In December 2017, President Donald Trump signed the Tax Cuts and Jobs Act (TCJA) into law. Among its many flaws, the act worsened a tax code double standard that tilts the scales against workers. Employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write off, or deduct, management and legal costs, such as those involved in resisting unionization campaigns and negotiating with unions. Meanwhile, workers, who are often represented by unions in these negotiations, cannot deduct the cost of the dues they pay to support their unions. In other words, workers cannot deduct an important cost of earning their income, while employers can deduct the costs of maximizing their profits at the expense of workers.

The 2017 tax law heavily favors corporations over workers

The TCJA is tilted in many ways toward the wealthy and corporations. Corporations receive large, permanent tax cuts, including steeply discounted tax rates on their past overseas profits. The law implemented a lower rate on U.S. companies’ current and future overseas profits relative to their domestic profits and included provisions that reduced companies’ tax bills if they have more of their physical assets overseas, potentially rewarding offshoring. Meanwhile, pass-through businesses—which do not pay corporate tax—received a special new tax deduction, overwhelmingly benefiting the wealthy owners of such entities. High-income Americans received larger tax cuts, even as a share of their income, than middle- and lower-income Americans. The law also reduced or eliminated many individual tax benefits, such as the itemized deduction for unreimbursed employee expenses, which includes union dues.1

In their efforts to pass the TCJA, President Donald Trump and officials in his administration claimed that its provisions—particularly its slashing of the corporate tax rate—would provide “rocket fuel” for the economy and increase the average household’s income by at least $4,000 annually.2 Yet the economic reasoning behind these claims was deeply flawed. Nearly two years after the law’s enactment, there is no indication that the corporate tax cuts are trickling down to workers3 or that workers have benefited broadly.4

The TCJA made a flawed union dues deduction worse

Even before the major provisions of the TCJA went into effect in 2018, the deduction of union dues was subject to limitations. In 2017, tax law only allowed union dues to be deducted as an unreimbursed business expense.5 This meant that (1) only the portion of union dues plus any other unreimbursed business expenses exceeding 2 percent of the taxpayer’s adjusted gross income (AGI) was deductible; and (2) taxpayers could claim that deduction only if they did not claim the standard deduction, which was $12,700 for a couple filing jointly in 2017.6 As a result, though union dues were deductible, only some workers actually deducted them. By contrast, the expenses that companies incur in setting worker pay—including negotiating with unions and even resisting unionization—have always been fully deductible.

Instead of balancing the playing field, then, the TCJA further tilted it against workers by eliminating the deduction for unreimbursed employee expenses, including union dues.

Unions play a critical role in the lives of workers

Historically, unions have helped to ensure that American workers have decent pay and benefits as well as a voice in the nation’s democracy. Union wages are about 12 percent higher for unionized workers than their nonunionized counterparts.7 And unions raise wages for all workers, including noncollege graduates, millennials, people of color, and women.8 By law, unions are required to represent the interests of all workers in a bargaining unit.9 More broadly, research shows that union advocacy aligns with the economic interests of working people. Unions also motivate their members to participate in U.S. democracy and support voter mobilization efforts; as a result, areas with higher unionization rates have higher voter turnout.10

Together, these facts suggest not only that unions are an important check on corporate power but also that they play a critical role in addressing inequality and boosting the prosperity of the middle class.

Over the past three to four decades, however, union membership has declined, workers’ wages have stagnated, and workers have not benefited much from the substantial increases in U.S. productivity. Many factors have contributed to this erosion in union membership and power, including changes in the economy, such as the decline in U.S. manufacturing; the trend toward increased concentration of corporations; recent laws that conservative policymakers have passed at the state level; and regulatory actions that the Trump administration has taken.11 Among many other anti-worker actions, the Trump administration has derailed a plan to extend overtime protection to 8.2 million workers, made it more difficult for businesses to be held liable for wage violations against contract and franchise workers, and awarded billions of dollars in federal contracts to companies that violate wage laws. The administration has also blocked workers’ access to courts, siding with corporate interests by letting companies force workers into mandatory arbitration agreements. The 60 million workers covered under these agreements are left without real access to the courts, as the agreements often prohibit them from bringing class and collective actions to resolve workplace disputes in judicial or arbitral forums.12 Furthermore, the administration has taken steps to revoke civil rights protections and implement policies that would threaten workers’ safety on the job.13

Unions are essential to holding corporations accountable for inequitable treatment of workers and wage disparities between workers and CEOs. Unfortunately, the TCJA’s elimination of the deduction for union dues is an additional blow that undermines workers’ ability to seek the basic rights of fair pay and benefits in this challenging time. Along with the changes to international tax law mentioned above, the TCJA’s elimination of the union dues deduction appears to be part of a concerted effort to put corporate interests above those of workers and undermine unionization.

A broadly available union dues deduction is good tax policy

Allowing an above-the-line deduction—one that could be taken regardless of whether a worker chooses the standard deduction or itemized deductions—for union dues would increase tax fairness for workers. The current tax treatment of union dues is not only fundamentally unfair but also inconsistent with basic income tax principles. An above-the-line deduction would follow two important principles of taxation: (1) that taxable income should not include the costs of earning that income; and (2) that income tax should be based on an individual’s ability to pay.

Costs of earning income should be deductible

A basic principle of income taxation is that taxpayers should be able to deduct the costs of earning their income.14 That is why corporations and other businesses are allowed to deduct the ordinary and necessary costs of earning revenue, including their inputs and other costs. Professionals or business owners who earn income through business entities or “Schedule C” self-employment income can deduct their costs, including items such as professional licenses and fees.

In recognition of the fact that every person’s work situation is different, the pre-TCJA tax code also allowed a deduction for unreimbursed business expenses. This ensured more equal treatment across taxpayers. In theory, an employee earning $40,000 should be treated the same as an employee earning $42,000 who has to spend $2,000 on expenses required for the job. The deduction for unreimbursed business expenses did not quite achieve that parity because of the 2 percent of AGI floor, but it did bring the tax treatment closer to parity. Many unreimbursed business expenses were allowed under the unreimbursed business expense deduction—not only union dues but also certain business travel costs, qualifying home office costs, and continuing education costs, as well as tools, supplies, and clothing needed for work.

The TCJA’s elimination of this deduction was inconsistent with the widely held view that expenses such as union dues are costs of producing income. In fact, the congressional Joint Committee on Taxation considers the deduction for employee business expenses to be part of the normal structure of the individual income tax, not a tax expenditure.15 Moreover, American Enterprise Institute tax expert Alan D. Viard and others have recognized that the TCJA’s elimination of the deduction was not an appropriate way to broaden the tax base.16

Income tax should be based on an individual’s ability to pay

An above-the-line deduction would be consistent with another fundamental principle of tax policy: that a taxpayer’s “ability to pay” should be taken into account in designing an income tax.17 An above-the-line deduction for union dues would allow the tax code to measure ability to pay more accurately, since it would treat a worker who contributes $1,000 in union dues in order to earn $31,000 in gross income the same as one who makes $30,000 in gross income without paying union dues.

An above-the-line deduction for union dues would be fairer than not only the current tax treatment, which allows no deduction for union dues, but also previous tax law, which limited the ability to deduct union dues to those who itemized deductions. Policymakers are beginning to recognize this. For instance, Sen. Bob Casey (D-PA) and Rep. Conor Lamb (D-PA) have introduced legislation in their respective chambers that would allow an above-the-line deduction for union dues.18

On balance, taxpayers who itemize tend to be those who make more income because they are more likely to own a home and thus have mortgage interest to deduct. They may also have higher state and local taxes or make deductible charitable donations. Together, these other deductions may exceed the standard deduction, enabling the taxpayer to itemize. In 2016, when union dues could be claimed as an itemized deduction, only a quarter of taxpayers with incomes between $40,000 and $50,000 itemized their deductions, while more than 90 percent of taxpayers making more than $200,000 itemized and could therefore potentially claim a union dues deduction.19 Yet because the TCJA increased the standard deduction significantly, the overall number of itemizers in 2018 is expected to decrease to 10.9 percent of taxpayers and skew even more toward the wealthy.20 Therefore, simply reinstating the pre-TCJA itemized deduction would only benefit those who need it least—those with more ability to pay taxes.

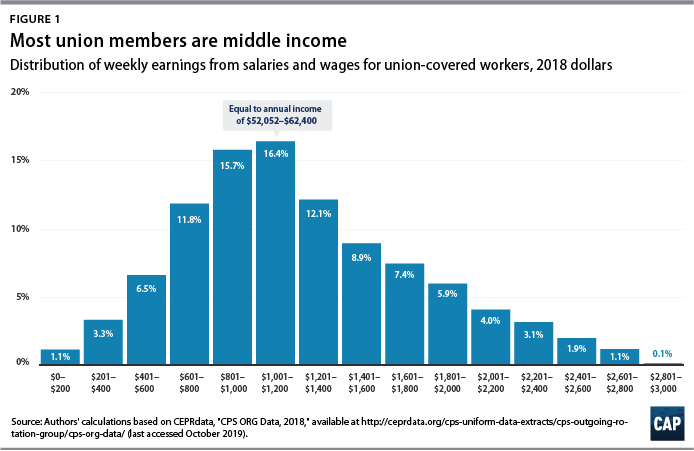

Figure 1 below shows the distribution of unionized workers’ incomes by weekly pay. For context, weekly pay of $1001 to $1200 is equal to an annual income of approximately $52,052 to $62,400.

An above-the-line deduction for union dues would benefit nearly all workers who pay union dues, regardless of whether they itemized. Even workers who normally receive a refund as a result of the earned income tax credit (EITC) and the child tax credit (CTC) could benefit from the deduction as long as they had some tax liability before the application of the refundable credits. For example, if a single parent had a tax liability of $1,000 before applying combined refundable tax credits of $4,926 from the EITC and CTC, that individual would receive a refund of $3,926. But if that person paid union dues of $600, an above-the-line deduction would reduce their taxable income by $600. Assuming that they fell in the 10 percent tax bracket, their tax liability would be $60 less, increasing their tax refund to $3,986.

Unions and the workers they represent should not have to wait for this eminently fair tax treatment. If an above-the-line deduction for union dues were enacted now on a permanent basis, workers and unions would not be caught up in the decision that Congress will face in 2026—whether or not to allow the law to automatically revert to pre-TCJA law for a range of individual income tax provisions.21

An above-the-line union dues deduction could also increase the fairness of state income taxes. Forty-one states and the District of Columbia have an individual income tax.22 While states differ in how much they follow federal tax policy, most require taxpayers to begin their state tax return by entering their federal AGI.23 And since an above-the-line federal deduction would already be incorporated in the federal AGI, these states likely would automatically allow the deduction—unless they proactively disallowed it.

A rough CAP estimate finds that in 2018, the cost of an above-the-line federal tax deduction for union dues would have been $1 billion, a tiny amount compared with the massive tax giveaways in the 2017 tax law.24 Congress could raise the $1 billion needed to offset the cost of an above-the-line union dues deduction just by raising the corporate tax rate by a small fraction of 1 percent.25 While it is not known exactly how much federal revenue is lost to employer deductions related to fighting unions, that cost may be much larger. Employers spend—and therefore likely deduct—roughly $340 million each year just on consultants who help them stave off union elections.26 Other union-related deductions that employers may claim include legal expenses for resisting worker grievances and union wage negotiations—not to mention the costs they likely deduct for a wide range of illegal anti-union activities.27

An above-the-line deduction for union dues would complement critical reforms to labor laws

Congress has advanced numerous proposals that would reform labor laws to protect workers going forward. Federal legislation, such as the Protecting the Right to Organize Act,28 the Public Service Freedom to Negotiate Act,29 and the Workplace Democracy Act,30 include reforms to ensure that more workers are covered by federal collective bargaining laws; protected against employer retaliation or forced attendance at anti-union meetings; and able to bargain with corporations, which have the power to improve workplace conditions. Lawmakers should advance these policies, as well as reforms to improve the collective bargaining system for workers, by promoting bargaining across industries and instituting policies to ensure that the government is on the side of strong unions and worker organizations.31 Allowing all workers to deduct union dues would provide a small but important complement to the letter and spirit of these critical reforms.

Conclusion

Without a strong collective voice, it is difficult for workers to ensure that they share in the profits they help to generate. Unions are a proven mechanism for workers to stand together and negotiate for the pay and benefits they deserve. Moreover, because each union can tailor their negotiations to the specific group of workers they represent, union representation may be a more efficient means of addressing sector-specific issues as well as the widespread and persistent problem of stagnant wage growth. Union dues are an essential expense for workers in their pursuit of fair wages and job security, and all workers should be able to deduct them on their tax returns.

Alexandra Thornton is the senior director of Tax Policy for Economic Policy at the Center for American Progress.

The author wishes to thank Curtis Nguyen and Galen Hendricks for their contributions to the graphics and data, as well as Karla Walter, David Madland, Seth Hanlon, Mia Dell, Dáaiyah Bilal-Threats, and Jennifer Abruzzo for their helpful comments on earlier drafts.