This report contains an update.

Introduction and summary

Today, the United States finds itself at the crossroads of many economic, social, and global challenges. The past several decades have seen real wages for rank-and-file workers stagnate; income and wealth inequality rise; undue political power concentrate in the hands of the few; and the pace of productivity growth and overall economic growth slow. Moreover, despite the United States being among the wealthiest countries in the world, millions of Americans lack affordable health care or child care, nearly one-third of its children live in poverty or on the brink of poverty, economic mobility has declined, and many communities face persistently high unemployment and economic distress.1 At the same time, scientists warn that the world must take dramatic action to reduce carbon emissions over the next decade to prevent irreversible harm to the planet, our economy, and our communities due to climate change.2

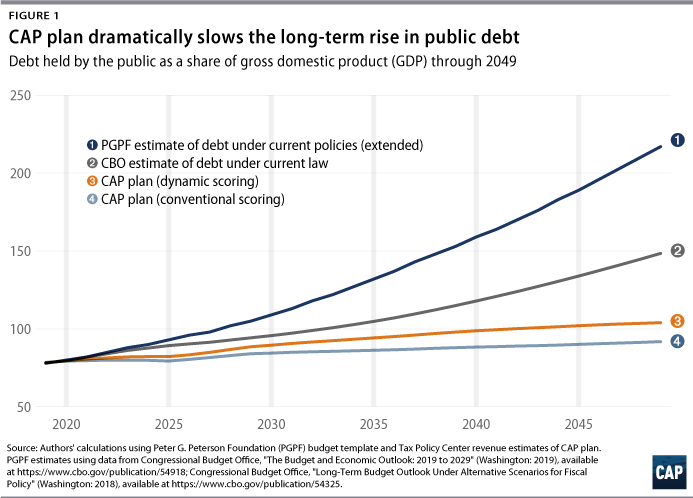

The United States also faces long-term fiscal challenges. The evidence suggests that the debt is not an immediate problem: Since 2008, the public debt has doubled as a share of gross domestic product (GDP) from about 40 percent to 80 percent with no discernable consequences. Over the last 10 years, real interest rates have declined to historically low levels and debt service is still a relatively small share of the federal budget.3 But over the long term, if we maintain our current revenue and spending policies, annual deficits will grow and the public debt as a share of GDP will rise from about 80 percent today to as high as 200 percent of GDP by mid-century.4 High and rising debt will increase the share of the federal budget dedicated to debt service and could potentially slow economic growth.5 For these reasons, the projected rise in public debt should be viewed as a long-term risk that must be weighed against other risks and opportunities.

The long-term budget proposal presented by the Center for American Progress in this report—CAP’s Fiscal Solutions plan—is premised on the recognition that the United States faces a multitude of critical challenges that must be addressed concurrently. Crucially, it is based on the conviction that we, as a country, can do big things.6 We can—and we must—dramatically increase investment in our people, our economy, and our future, as these investments are essential to sustaining a strong economy over the long term. Accordingly, this report proposes an approach that meets critical national challenges head on, including the rising inequality that undermines our economy and democracy; underinvestment in children and the future; and the daunting threat of climate change, while keeping federal debt to manageable levels.

Briefly, CAP’s Fiscal Solutions plan proposes investments and policies to ensure:

- Every American has quality, affordable health care

- Every family has access to quality, affordable child care and comprehensive paid family and medical leave

- The United States takes bold action to address climate change, including major new investments in climate science, research and development, resilience, and the transition to a clean energy economy

- The nation improves the well-being of today’s children and enhances their future prospects by providing a universal child allowance along with other investments, including modernizing school facilities and boosting teacher pay in high-poverty schools

- The United States makes major productivity-enhancing investments in infrastructure, schools, and science and establishes a targeted job guarantee that strengthens our economy and extends opportunity to workers and communities that have been left behind

- Fundamental tax reform is implemented to dramatically reduce income and wealth inequality and provide that all income—whether from work, investment, or inheritance—is taxed under the same progressive rate schedule

- Social Security is protected for decades to come without any benefit cuts or other harmful changes

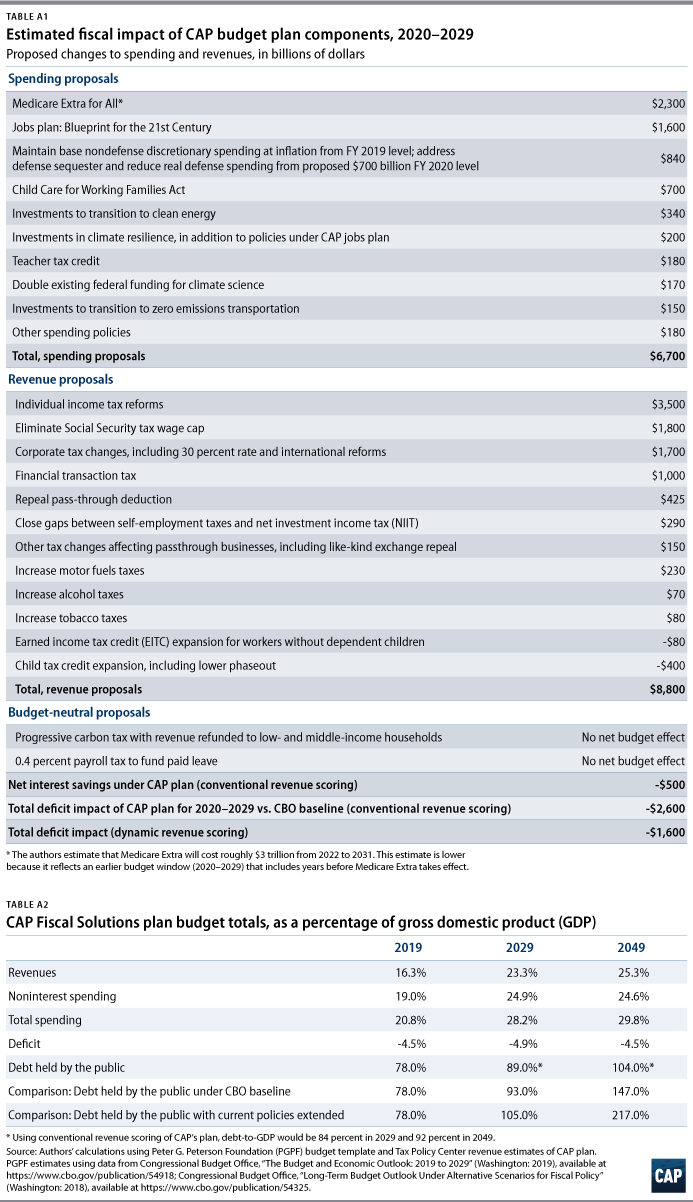

CAP’s Fiscal Solutions plan makes these investments while substantially improving the country’s long-term fiscal outlook. Specifically, the plan slows the rise in the public debt so that, three decades from now, the debt would be roughly 92 percent of GDP when scored using conventional revenue estimates or 104 percent using dynamic scoring (incorporating feedback from estimated macroeconomic effects).7 The level of public debt under the plan three decades from now is only modestly higher than today’s level—about 80 percent—and much lower than projected levels, which come to about 150 percent of GDP under Congressional Budget Office’s (CBO) long-term budget outlook and potentially higher than 200 percent if current policies are extended indefinitely.8

Importantly, CAP’s plan shows that we can make the investments we need in a stronger economy—all while holding the nation’s debt to manageable levels and avoiding putting the burden on low- and middle-income Americans—illustrating that the United States has ample fiscal capacity if we, as a country, are willing to raise revenue in a progressive manner.

Components of CAP’s fiscal solutions plan

Investing in the economy and the American people

The budget plan is based on the recognition that, while the public debt level can pose long-term risks, government borrowing is often necessary to finance needed public investments. As a recent CAP survey of the economic literature on debt and deficits concluded, “[T]he government can incur debt to lay the foundation for widely shared prosperity, yet America cannot afford wasteful trillion dollar giveaways to the wealthy.”9 Yet the recent runup in public debt has been caused largely by successive tax cuts favoring high-income Americans, the damage from the financial crisis, and foreign wars. It would be a mistake to respond to the resulting deficits by sacrificing public investments in areas such as infrastructure, education, health care, child care, science, and clean energy, where those investments could bolster long-term growth and ensure that its benefits are broadly shared. In fact, as former International Monetary Fund (IMF) chief economist Olivier Blanchard underscored in a recent address, when real interest rates are persistently low, as they are now, the fiscal and welfare costs of public debt are lower.10 That implies that the cost of failing to make critical public investments is higher.

Accordingly, CAP’s budget plan remedies the past failure to make needed investments in the economy and the American people, focused on several broad areas:

- Guaranteeing affordable quality health care for all Americans

- Investing in innovation and the transition to a clean energy economy to ensure that the effects of climate change do not devastate future generations

- Investing in jobs, infrastructure, and the middle class

- Investing in children and families

In addition to the new investments described below, CAP’s plan maintains general nondefense discretionary spending at its real fiscal year 2019 levels, relieving the harmful effects of the budget sequester and allowing for further investments not specified in this report. Nondefense discretionary spending funds core government functions and critical areas, such as education, public health, environmental protection, and veterans’ services.

Guaranteeing affordable, quality health care for all Americans

Unlike all other developed countries, the United States fails to provide universal health coverage to its citizens. While the United States has seen significant coverage gains in recent years—particularly under the Affordable Care Act (ACA)—efforts to improve health care remain under attack. The Trump administration, with help from its allies in Congress, has worked tirelessly to dismantle the ACA and undermine access to Medicaid. As a result, in one of the wealthiest nations on earth, 30 million individuals remain uninsured—and this number continues to grow.11 In order to address these challenges, it is time to build upon the historic success of the ACA and finally guarantee affordable, quality health care for all Americans.12

This budget plan incorporates Medicare Extra for All, the health care plan CAP originally outlined in 2018. Medicare Extra is a universal coverage plan that would eliminate underinsurance. All Americans—regardless of income, health status, age, or insurance status—would have the right to enroll in the same high-quality health plan modeled after Medicare. Newborns, individuals enrolled in Medicaid, and those currently purchasing insurance in the individual marketplace would automatically be enrolled in the new program. While individuals receiving coverage through their work could retain private insurance, they would also have the option to switch to Medicare Extra. Employers would also have the option to sponsor Medicare Extra for their employees.

Medicare Extra would provide comprehensive coverage and include important enhancements to the current Medicare program: an out-of-pocket limit, coverage of dental care and hearing aids, and integrated drug benefits. The plan would offer free preventive care, free treatment for chronic disease, and free generic drugs. Cost sharing and premiums would be limited and scaled by income. Individuals with incomes below the federal poverty level, including most individuals currently enrolled in Medicaid, would have no cost-sharing requirements or premiums.

Benefits under Medicare Extra would include:

- Primary and preventive services

- Hospital services, including emergency services

- Ambulatory services

- Prescription drugs and medical devices

- Laboratory services

- Maternity, newborn, and reproductive health care

- Mental health and substance use disorder services

- Habilitative and rehabilitative services

- Dental, vision, and hearing services

- Early and periodic screening, diagnostic, and treatment services for children

Medicare Extra would significantly reduce health care costs for individuals and families and slow the growth of U.S. national health expenditures. Payment rates for medical providers would reference current Medicare rates—and employer plans would be able to take advantage of these savings. Medicare Extra would negotiate prescription drug prices by giving preference to drugs whose prices reflect value and innovation. Medicare Extra would also implement long-overdue reforms to the payment and delivery system and take advantage of Medicare’s administrative efficiencies. In sum, Medicare Extra provides guaranteed, affordable health coverage to every American while bending the health care cost curve over time.

CAP anticipates that Medicare Extra will have a net cost of about $3 trillion over 10 years (2022–2031), and we have incorporated that target cost into this budget plan. That cost estimate is net of savings achieved within health programs, premiums, and increased tax revenue generated indirectly from changes in employer-sponsored health insurance. The remainder of the cost would be financed by progressive tax revenues.

Taking bold action to address climate change

When it comes to implementing policies today that will leave a better world for future generations, no issue is more important than climate change. Scientists have warned that the world must take dramatic action to reduce carbon emissions over the next decade to prevent irreversible harm to the planet, our economy, and our communities.13 The United States must lead the way. But, regrettably, the current administration withdrew the United States from the landmark agreement reached in Paris in 2015 to combat climate change. President Donald Trump’s withdrawal from the Paris agreement undermined America’s leadership and credibility and undermines the strength of our economy. Already, more than 4 million workers are now employed in clean energy industries.14 The failure to make the needed policy choices and investments to promote a clean energy economy threatens the development of these growing industries and will impede U.S. economic growth over the long term.

Climate change is also a critical fiscal issue. The Office of Management and Budget estimates that the annual costs of unmitigated climate change range from $34 billion to $112 billion by the mid to late century.15 What’s more, that estimate does not consider the significant resources the nation would need in order to address the effects of climate change on areas such as health care, national security, and infrastructure—all of which could add untold costs.

To reduce carbon emissions, CAP’s plan proposes a progressive, budget-neutral carbon tax. Set at the social cost of carbon emissions, or roughly $52 per metric ton, the carbon tax would shift public and private investment away from carbon-intensive energy sources and toward renewable and lower-carbon energy sources.16 Because low- and moderate-income households spend a higher share of their incomes on energy costs and other forms of consumption, a carbon tax can have a regressive distributional effect, including increasing hardship for those with low incomes. The CAP plan therefore proposes to rebate all of the net revenue from the carbon tax to middle- and low-income Americans. Such a progressive rebate system can be implemented in a number of ways, including through the combination of lump sum rebates and tax cuts on labor income, which CAP proposed in 2016.17

Establishing a price on carbon emissions is an important step toward confronting climate change—but given the urgency and magnitude of the challenge, it is not sufficient. There’s also a need for substantial public investments. U.S. investment in climate science and clean energy research and development are critical to both domestic and global efforts to understand and combat climate change. To strengthen these critical foundations, the plan doubles federal spending on climate science; clean energy research and development; and programs supporting advanced manufacturing.

The budget plan would dramatically accelerate the transition to a 100 percent clean energy electricity sector through direct investments that will improve equity and assist low-income and rural communities. This includes updating outdated transmission infrastructure to better integrate renewables and storage technologies; repairing and replacing outdated natural gas distribution pipelines to reduce methane leakage; improving energy efficiency and reducing costs for low-income households through an expanded Weatherization Assistance Program (WAP); and updating energy systems in municipal buildings, schools, universities, and hospitals by funding the U.S. Department of Energy’s State Energy Program for the next 10 years at the levels from the American Recovery and Reinvestment Act (ARRA) of 2009.18 For the 56 percent of the United States landmass served by rural electric co-ops, CAP’s plan vastly expands funding available through the Rural Utilities Service to both forgive outstanding debts on fossil fuel assets owned and operated by rural co-ops and to replace them with zero-emitting electric generation.19

The plan also includes CAP’s proposal for a $240 billion, 10-year job-creation program called the Future-Ready Communities Corps. The program—which would help some of the most vulnerable communities by retrofitting them with energy efficient and solar ready homes and even relocating those who are situated on flood plains—is estimated to avoid $60 billion per year in extreme weather-related costs. It would also employ 290,000 people and save households about $7 billion per year on their energy bills.20

The CAP budget plan also makes significant investments in zero emissions transportation, including installing electric vehicle (EV) charging stations in public spaces and federal workplaces. The federal government would also facilitate the replacement of half the buses operated by transit agencies and one-quarter of all school buses with EV alternatives through the expansion of the successful Low or No Emission Vehicle Program. To help more Americans transition to cleaner vehicles, the plan calls for the government to implement a program to encourage trade-ins of fuel inefficient vehicles for hybrid and EV alternatives. The plan also extends tax credits for wind and solar energy and for electric vehicles.

In addition, the plan proposes an annual National Disaster Resilience Competition to fund major resilient infrastructure in communities affected by or at risk for natural disasters. In order to help states pay for resilient infrastructure, clean energy, and clean transportation, CAP proposes the establishment of State Future Funds—federally supported revolving loan funds that support innovative and resilient transportation and energy infrastructure and flood protections in areas that need them the most, including low-income areas and communities of color.21 Additional funding for conservation and restoration would be provided to the FEMA Pre-Disaster Mitigation Grant Program, the Land and Water Conservation Fund, the U.S. Forest Service, and the National Oceanographic and Atmospheric Administration (NOAA). We would also provide funding to relocate the Alaska Native communities who are at risk from sea level rise to areas that are safer and culturally appropriate.

Investing in infrastructure, jobs, and the middle-class

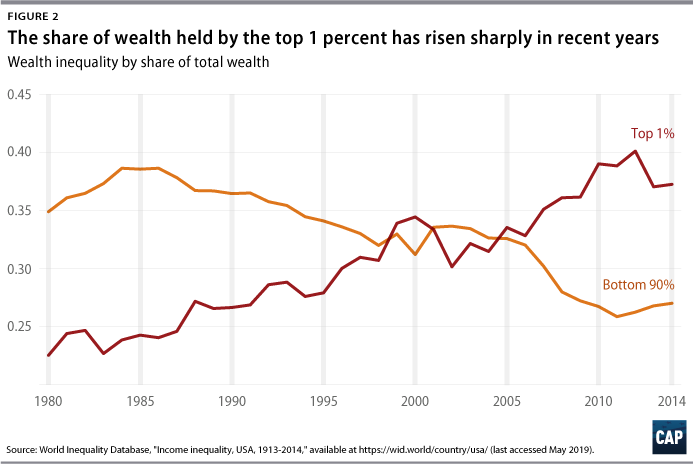

Millions of families in the middle- and working-class are not fully sharing in the gains or opportunities from economic growth. Median wages have been essentially stagnant for decades for many groups of workers, inequality has shot upward, and millions of families continue to live in poverty. Together with the rising costs of significant expenses such as health care, higher education, child care, and rent, these factors have contributed to a widening chasm in economic security and opportunity. In 2016, the top 1 percent of earners received nearly one-quarter of U.S. income while the bottom half received only 14 percent. Wealth inequality is even more stark. The wealthiest 1 percent have 39 percent of the nations’ wealth while the bottom 90 percent have just 23 percent.22

The plan addresses these significant economic challenges that middle- and working-class Americans now face through a series of targeted investments, including rebuilding and reinvesting in America’s infrastructure; providing long term supports and services that allow more people with disabilities and seniors to thrive in their communities; and establishing a federal jobs guarantee program that revitalizes communities that have been left behind.23 Taken together, these investments would generate growth while creating millions of jobs, increasing worker power, raising wages, and reinvesting in the nation’s physical and human capital.

Rebuilding and reinvesting in America’s infrastructure

Failing to invest in America’s infrastructure puts a significant drag on the economy. Repeated underinvestment in infrastructure has led to deteriorating facilities, broken roads, and crumbling bridges, which increase costs and reduce productivity.24 CAP’s plan would immediately work to reduce this gap by investing an additional $42 billion above baseline per year over the next decade. Funding would go to the nation’s transportation and water infrastructure, rebuilding roads, rails, and bridges, and ensuring access to safe, clean water. This level of investment would generate—through direct and indirect effects—350,000 jobs in the first 10-years.25 By reducing congestion and increasing mobility, which, in turn, would cut unnecessary costs for households and businesses, these investments would ultimately increase overall national competitiveness and growth.

Providing long-term supports and services

Too many seniors and people with disabilities lack access to critical home- and community-based support services and long-term care. As the U.S. population continues to age, this problem will only compound, forcing more and more people eligible for services onto waitlists without care. As it stands now, there are more than 700,000 people with disabilities who qualify for Medicaid but remain on support service waitlists.26 In addition, only 30 percent of seniors who require care and are not institutionalized receive paid support.27 Moreover, wages for caregivers in this sector—such as personal care or home health aides—are very low, with median wages of just $10 to $12 per hour.28 It is clear that more investment is needed in this area. Therefore, the CAP plan earmarks $44 billion annually to support the generation of 1 million home health aide and personal care aide jobs as well as the creation of pathways for the federal government to work with those in the industry and community to develop training programs that provide care workers with specialized skills. This investment would address a long, unmet need and boost economic security for seniors, people with disabilities, and their families while allowing them to thrive in their communities.

Lifting communities left behind with a federal job guarantee

The gains of economic growth have not been shared evenly across income groups or regions, and many communities have been left significantly behind due to a variety of economic and social factors, including automation, offshoring, concentration in certain markets, and structural racism. Although the significant investments outlined throughout this report will undoubtedly help many families and workers facing these situations find jobs and increase their economic security, a more targeted approach is necessary to ensure the hardest hit communities see real positive gains. As a result of this need, CAP’s budget plan appropriates the funds required to pay for the jobs guarantee program—as outlined in the previously published “Jobs Blueprint”—for a full 30 years.29 The jobs guarantee would afford long-term residents in the nation’s most economically distressed counties—comprising roughly 10 percent of the U.S. population—a living wage job in their local labor market.

Investing in children and families

To expand opportunity; reduce poverty and hardship; and help families make ends meet, CAP’s budget plan proposes significant investments in families and children, including a major investment in high-quality child care to ensure that no low- or middle-income family spends more than 7 percent of its income on child care. The plan also invests in a comprehensive program of paid family and medical leave for American workers; a new initiative to increase the pay of teachers serving in high-poverty schools; and a major new funding commitment to K-12 school modernization.

Child care

For families, child care can frequently be among their largest household expense.30 The average cost of center-based child care is more than $10,000 per year, and high-quality centers can cost dramatically more.31 Unaffordable or inconsistent child care can reduce parents’ ability to fully participate in the labor market. In fact, breakdowns in child care cost U.S. businesses an estimated $4.4 billion per year and cost families even more in lost wages—$28.9 billion a year.32 In the long run, expanded access to child care and early childhood education provides children with the basis for future mobility and success, resulting in long-term growth and economic stability.33

CAP’s plan incorporates the Child Care for Working Families Act, introduced by Sen. Patty Murray (D-WA) and Rep. Bobby Scott (D-VA), which would more than double the eligibility for child care assistance; improve the quality of care itself as well as positions in the sector; and dramatically reduce child care costs for families. 34 This plan does so by providing universal access to preschool programs for children ages 3 and 4 and expanding child care subsidies to all low- and middle-income families composed of anyone earning less than 150 percent of the median income in their state. These subsidies would ensure that no low- or middle-income family pays more than 7 percent of their earnings on child care and provide all families under 75 percent of the state median income with access to free child care.

Comprehensive paid family and medical leave

CAP would also ensure that all families have access to paid leave by budgeting for the enactment of the Family And Medical Insurance Leave (FAMILY) Act.35 Workers should not have to sacrifice their economic security when they need to take time off to care for their family or chosen family. Under this plan, all workers are afforded 12 weeks of paid leave, during which they can earn two-thirds of their monthly wages up to a monthly maximum of $4,000. The legislation fully finances paid leave through a small 0.4 percent payroll tax, evenly split between employers and employees.

Teacher pay

The CAP plan includes a fully refundable tax credit for teachers of high-poverty schools, which would increase teacher pay by as much as $10,000 per year.36 On average, teachers earn just 60 percent of what their counterparts in other professions earn—even when controlling for education and experience. Even more troubling, in 30 states, the average salary for teachers is below the family living wage.37 This proposed investment would begin to close the large pay gap that too many teachers in America face.

School modernization

CAP’s budget plan would invest $46 billion annually for 10 years in rebuilding the nation’s K-12 schools.38 This investment would cover the gap left by years of underinvestment in our public schools that has led to far too many schools, especially those serving low-income communities, to fall into disrepair.

Universal child allowance

The plan also expands the Child Tax Credit (CTC) to help provide economic security for many working- and middle-class families.39 The Tax Cuts and Jobs Act (TCJA) of 2017 doubled the CTC to $2,000 per child, but the increase was both temporary and poorly targeted, with many of the hardest-pressed families receiving only a partial benefit and, in some cases, little or no benefit. CAP’s plan ensures that all low- and middle-income families receive the full benefit of the CTC by making the entire $2,000 per-child credit refundable with no income phase-in and by permanently indexing the amount to inflation.

Additionally, since child rearing costs are the highest for the youngest children, the plan provides a fully refundable young-child tax credit of $125 per month ($1,500 per year) for families with children under age 3.

Taken together, these policies would tremendously reduce child poverty and substantially boost the incomes of many working- and middle-class families. They would also dramatically improve the well-being and prospects of children, especially those in their first years of life—the most critical stage of development. Research has shown that boosting the incomes of low-income families improves children’s health and increases educational attainment and earnings later in life.40 Quite simply, there is no investment we can make as a society that promises a higher return.

Raising progressive revenue and achieving tax fairness

Tax cuts over recent decades—culminating in the deeply misguided TCJA—have undermined the country’s revenue base while providing their largest benefits to the highest-income Americans. The 2017 tax cuts will drain $1.9 trillion in revenue over the next decade. Over the subsequent decade, roughly $3 trillion will be drained if the major temporary provisions are extended.41 More important than the increase in debt itself was the wasted opportunity to make productive investments. Despite the outlandish promises made about the TCJA, it is appearing to have little economic impact aside from further increasing inequality.42 Rolling back the 2017 tax cuts for corporations and the wealthy is an obvious first step in the direction of a better, more responsible fiscal policy and a stronger and more equitable economy.

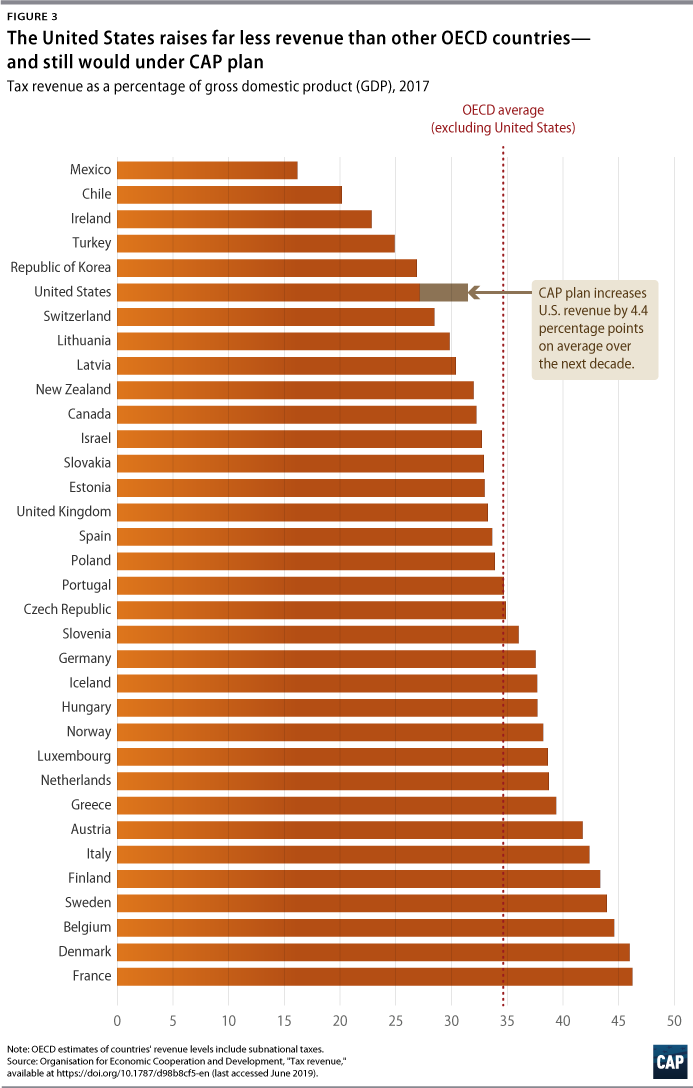

However, America’s tax code also needs more fundamental reform. Given our aging population and the need for additional investment, the country needs substantially more revenue. In 2017, the countries comprising the Organisation for Economic Co-operation and Development (OECD), excluding the United States, collected revenue equal to 34.7 percent of their GDP, on average. By comparison, the United States collected revenue equal to only 27.1 percent of GDP.43 (Both figures include tax revenue collected by all levels of government.)

Accordingly, CAP’s budget plan proposes comprehensive tax reform. While the existing tax code favors wealth over work, the CAP tax plan is based on the principle that all income—whether it derives from work, investment, or inheritance—should be taxed according to the same progressive rate schedule.

Taxation of income from wealth

The existing tax code taxes income from wealth—including dividends, capital gains, and business profits from pass-through entities—at preferential rates. It also frequently allows massive accumulations of wealth to go entirely untaxed, since wealthy individuals have many avenues for deferring or avoiding the recognition of capital gains, including the step-up in basis loophole that allows gains to go untaxed if held for a person’s lifetime.44 CAP’s plan remedies this unfairness by closing loopholes and taxing all income—whether from work, investment, or inheritance—according to the same progressive rate schedule.

The plan taxes capital gains and dividends as ordinary income and addresses capital gains tax avoidance by implementing a mark-to-market system for very wealthy taxpayers. Under current law, the gain on capital assets is only taxed when that asset is realized. Under the new regime, the gain in value of publicly traded assets would be taxed annually—whether realized or not—at ordinary rates. Assets that are nonpublicly traded would be subject to a deemed interest charge upon disposition in order to approximate what the tax treatment would be if the gain had been taxed annually. CAP’s plan also closes the infamous carried interest loophole that allows Wall Street fund managers to pay special, low rates on much of their income. The plan also prevents wealthy real estate investors from avoiding tax on their gains by ending tax-free “like-kind exchanges.”45

The plan replaces the estate tax by taxing large inheritances (above a $1.5 million lifetime exemption) under the income tax system at ordinary rates. Under this inheritance tax, those who are born into great wealth would pay income taxes on their inheritances—just as if they had won the lottery.46

Potential capital gains tax reforms: Addressing step-up in basis and mark-to-market taxation

The existing income tax code allows taxes on the appreciation of assets to be deferred because such capital gains are only taxed when realized or, in other words, when they are sold. Worse, the existing tax code often allows large accumulations of wealth to go permanently untaxed because of a provision known as step-up in basis.

Generally, a person’s capital gain is taxed when she sells an asset, with the gain measured as the sale proceeds minus her basis in the asset. Basis is essentially the original cost of the asset, potentially with adjustments. For example, if a person buys a stock for $1 million and later sells it for $3 million, she would have $2 million in gain: $3 million minus the basis of $1 million. However, when a person bequeaths assets to heirs, no capital gains tax applies. Moreover, the heir inherits the asset with a stepped-up basis equal to the fair market value when transferred. In this example, while the original owner had a basis of $1 million in the stock, her heir would have a basis of $3 million. Therefore, if the heir then sells the stock for $3 million, she would have zero gain and no tax would apply.

There are several ways to address this structural flaw in the tax code. Some have proposed that gains should continue not to be taxed at death; instead, heirs should inherit the asset with a carryover basis—in other words, the original owner’s basis rather than a stepped-up basis. Others, including President Barack Obama, proposed that gains above certain exemption levels should be subject to capital gains taxes when transferred by bequest.

A further, more comprehensive reform is to introduce a mark-to-market regime. While the existing tax code generally taxes gains on assets only when sold, a mark-to-market system would tax gains on assets on a year-to-year basis, even if the owner continues to hold the asset. Such an approach addresses the ability of asset owners to defer capital gains taxes.47

Tax reform for workers and families

The CAP plan repeals major provisions of the TCJA and introduces a more sensible and equitable tax framework for families. The plan restores personal exemptions—which are temporarily repealed under TCJA—at $5,000 per taxpayer, spouse, or dependent, higher than their pre-TCJA level.

The plan reforms tax expenditures to make them more equitable and efficient and replaces the existing system under which taxpayers choose between the standard deduction and itemized deductions. Whereas the current charitable deduction provides large benefits to high-income donors but no benefits for the vast majority of Americans who give to charity, the CAP plan allows all taxpayers a 15 percent nonrefundable tax credit for charitable donations exceeding 2 percent of their income. Similarly, the CAP plan allows all taxpayers to claim a nonrefundable tax credit for 15 percent of state and local taxes (SALT) or a flat amount of $2,000 for singles or $4,000 for couples, whichever is higher. The plan also restores miscellaneous itemized deductions, including those for unreimbursed employee expenses and union dues. The mortgage interest deduction is gradually reduced for 10 years until fully repealed. The standard deduction is repealed in the CAP plan, but the other features—including the higher personal exemption and the option for the SALT credit—protect low- and middle-income taxpayers.

CAP’s plan also makes retirement tax incentives—which are currently skewed to people with high incomes—more progressive. It makes the saver’s credit refundable, extending a tax benefit of up to $1,000 for low- and moderate-income savers. On the high end, the plan limits total contributions to tax-qualified retirement plans to twice the elective deferral limit ($38,000 per year using the 2019 deferral limit), which is more than enough for middle- and upper-middle class Americans to maintain their tax-preferred retirement savings while reducing the use of such tax-preferred accounts as another tax avoidance vehicle for the wealthy.

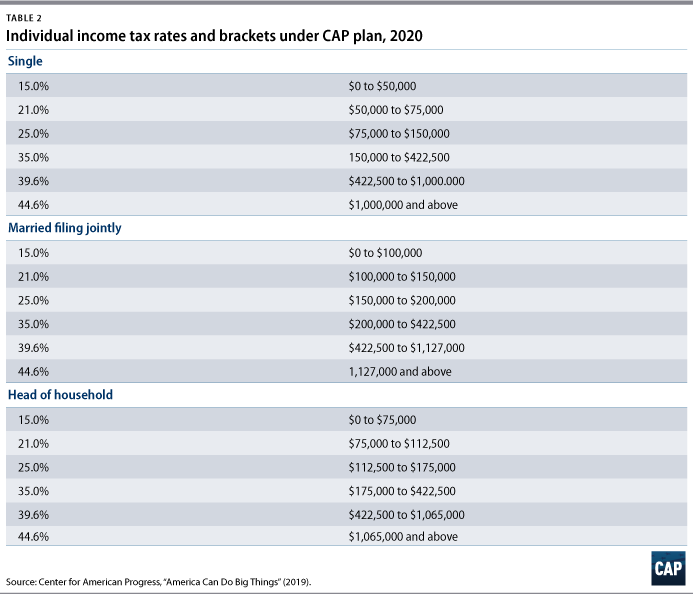

CAP’s plan taxes income according to progressive rates, ranging from 15 percent to 39.6 percent—and with a new 44.6 percent tax bracket for income above $1 million. The temporary, TCJA-enacted changes to the alternative minimum tax, which overwhelmingly benefit people with high incomes, are repealed under the plan.

In addition to the substantial increases in the CTC described above, the CAP plan increases the Earned Income Tax Credit (EITC) for workers without dependent children, who currently receive very little benefit from the EITC. Under the plan, the maximum credit for workers without dependent children would more than double, and it would extend to workers between the ages of 18 and 66, as opposed to between 25 and 64 under current law. To address the financial stresses that frequently lead families to turn to predatory payday loans, the plan allows all EITC recipients to claim up to $500 of their tax credit in advance after July 1 of each year.48

Corporate and business tax reforms

CAP’s plan rolls back the TCJA’s unjustified tax cuts for corporations and business owners, including setting the corporate rate at 30 percent—applying to both domestic and foreign profits—thereby ending the tax incentive for U.S. corporations to shift jobs and profits overseas.49 CAP’s plan eliminates several unjustified tax loopholes, including those for fossil fuels, and implements a fee on large, leveraged Wall Street banks.

The plan also repeals the special, new deduction that the TCJA extended to owners of pass-through business. Tax experts have labeled the pass-through deduction (Section 199A) as “the worst provision ever even to be seriously proposed in the history of the federal income tax.50” Since ownership of pass-through entities is highly concentrated—and since the deduction gives its largest benefit to those in high tax brackets—more than 60 percent of the benefit of the pass-through deduction goes to the richest 1 percent.51

Payroll tax reforms

The CAP plan eliminates the taxable maximum for the Social Security tax—a reform that the trustees estimate will keep Social Security solvent through 2074. The elimination of the taxable maximum would only affect individuals with earnings above the maximum: $132,900 in 2019. Whereas the current tax code allows many high-income individuals to avoid Medicare taxes on their business income (including, in some cases, labor income that is mischaracterized as business profits), CAP’s plan ensures that the income of high-income individuals does not fall into the gaps between the Medicare payroll and self-employment taxes and the net investment income tax. As mentioned above, CAP’s plan also introduces a 0.4 percent payroll tax—split between employers and employees—to fund comprehensive paid family and medical leave.

Excise taxes

CAP’s plan implements a small financial transaction tax (10 basis points, or 0.1 percent, on equity trades) to raise revenue and reduce speculative and high-frequency trading. In order to fill existing gaps in the Highway Trust Fund for highways and transit, the motor-fuel excise tax is increased by $0.15 per gallon and indexed for inflation. Over time, the motor-fuel excise tax would be replaced by a vehicle miles traveled fee so that the trust fund remains solvent as the economy transitions away from nonrenewable fuels. The CAP plan also raises revenue by modernizing alcohol and tobacco taxes.

The tax reforms described above would be complemented by additional resources for tax enforcement to ensure that well-heeled taxpayers cannot cheat the system and that the United States collects the revenue it is owed.

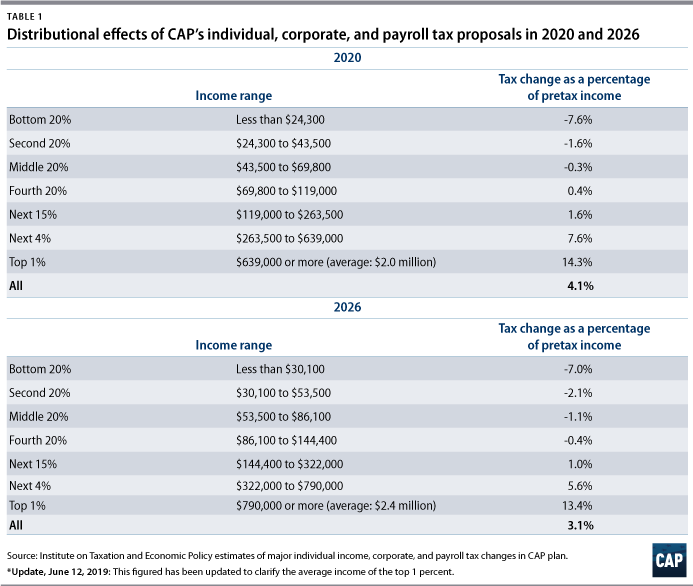

Overall, the CAP tax plan increases revenue substantially—and does so in a highly progressive manner. Federal revenue as a share of GDP would average 22.1 percent of GDP over the next 10 years compared to 17.7 percent under the CBO baseline. Notably, even with a 4 percent to 5 percent increase in revenue as a share of GDP, the United States would still be well below the OECD average, suggesting that the United States has the capacity to raise additional revenue, beyond what CAP has proposed, for investments or deficit reduction.

The CAP plan raises this revenue without significantly increasing taxes on low- and middle-income Americans. In fact, on average, the plan would cut taxes for the bottom 60 percent of Americans relative to the existing tax code in 2020 (with the TCJA’s temporary provisions in place) as well as for the bottom 80 percent of Americans relative to the existing tax code in 2026 (when the TCJA’s provisions expire). The overwhelming share of the revenue increases comes from those with very high incomes.

Conclusion

CAP’s Fiscal Solutions plan advances bold yet balanced proposals for addressing America’s long-term challenges, including, but not limited to, long-term debt.

The plan outlined here would substantially reduce economic inequality; guarantee quality affordable health care; help families balance work and family life; and revitalize communities that have been left behind. It would improve the lives and future prospects of America’s children while protecting and strengthening Medicare and Social Security. It would also take bold action to address the most urgent, long-term threat: climate change. CAP’s plan accomplishes all of these things while substantially improving the United States’ long-term fiscal outlook.

This plan outlines a potential path for the U.S. budget that is far better than the path it is on now. And beyond the specifics it outlines, the plan illustrates that the United States has ample fiscal capacity to make critical investments in our future.

About the authors

Seth Hanlon is a senior fellow, Alexandra Thornton is senior director of tax policy, Sara Estep is a research assistant, and Galen Hendricks is a special assistant on the Economic Policy team at the Center for American Progress.

The budget plan described in this report was developed as part of the Peter G. Peterson Foundation’s 2019 Fiscal Solutions Initiative.

The Peterson Foundation convened organizations with a variety of perspectives to develop plans addressing our nation’s fiscal challenges. The American Action Forum, American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, Economic Policy Institute, Manhattan Institute, and Progressive Policy Institute each received grants. All organizations had discretion and independence to develop their own goals and propose comprehensive solutions. The Peterson Foundation’s involvement with this project does not represent the endorsement of any plan. The final plans developed by all seven organizations were presented as part of the Peterson Foundation’s Fiscal Summit on June 11, 2019.

Appendix: CAP’s Fiscal Solutions plan summary

Health care:

- Incorporates CAP Medicare Extra for All plan

Other mandatory:

- Incorporates Child Care for Working Families Act

- Incorporates comprehensive paid family and medical leave under FAMILY Act, funded by 0.4 percent payroll tax split between employers and employees

Nondefense discretionary spending:

- Incorporates CAP’s 2018 Blueprint for the 21st Century, with public investments in long-term care, K-12 school construction, transportation and water infrastructure, and climate resilience

- Permanently doubles federal spending for climate science and clean energy research and development

- Invests $850 billion over 10 years in clean energy transition, zero emissions transportation, and resilience

- Provides $15 billion per year to fund a $10,000 tax credit for 2 million teachers

- Increases Internal Revenue Service tax enforcement budget by 35 percent

- Maintains funding for all other nondefense programs at inflation-adjusted fiscal year 2019 levels through 2030; projects growth in nondefense discretionary spending after 2030 at inflation plus 1 percentage point

Defense discretionary spending:

- Restrains defense spending through increasing by less than inflation over next 10 years from initial level of $700 billion. Projects growth in defense spending beyond 2030 at inflation plus 1 percentage point

- Defense spending is held to 2.3 percent of GDP by 2029 and 2 percent of GDP by 2049. In real (inflation-adjusted) terms, defense spending would be about equal to the post-9/11 base defense budget and roughly equal to the mid-1980s level

Social Security:

- Eliminates taxable maximum wage amount

- Strengthens minimum benefit, survivorship benefit, and divorce benefit

Individual taxation:

- Taxes earnings, investment income, and inheritances according to the same progressive rate schedule

- Restores personal and dependent exemptions of $5,000, indexed for inflation after 2020

- Exemptions phased out above $200,000 of adjusted gross income (AGI) for singles and $250,000 for couples

- Eliminates standard deduction

- Provides 15 percent nonrefundable credit for charitable contributions above 2 percent of AGI

- Provides 15 percent nonrefundable credit for state and local income and property taxes, or flat nonrefundable credit of $2,000 for singles, $3,000 for heads of households, and $4,000 for couples—whichever is greater

- Mortgage interest deduction phased out

- Restores deductions for miscellaneous itemized expenses and moving expenses

- Transforms CTC into a fully refundable child allowance with no phase in. Credit amount of $2,000 indexed for inflation after 2025. Additional fully refundable young-child credit of $125 per month ($1,500 per year) for children under 3. CTC phaseout begins at $100,000 for single and head of household filers and $150,000 for couples

- Expands EITC for workers without dependent children per H.R. 822, 115th Congress (Rep. Neal). Allows $500 of EITC as advanceable credit

- Replaces estate tax with inheritance tax; inheritances exceeding a lifetime $1.5 million exemption treated as ordinary income

- Implements mark-to-market system for publicly traded assets; gains on nonpublicly traded assets are taxed at death or other disposition with interest charge

- Repeals TCJA changes to the AMT

- Saver’s credit made refundable

- Reduces overall annual contribution limit for defined contribution retirement plans to twice the elective deferral limit; limits stretch IRAs; limits total accrual within defined contribution plans; restores income limit for Roth” conversions

- Student loan discharges and entire amount of Pell Grants excludable from income

- Repeals health flexible spending accounts (FSAs); disallows new contributions to health savings accounts, medical savings accounts, or 529 plans for K-12 private schools

Corporate and business taxation:

- Corporate rate increased to 30 percent

- Pass-through deduction (Section 199A) repealed

- Taxes foreign profits equal to domestic profits by eliminating the 50 percent global low-taxed intangible income (GILTI) exclusion; eliminating the exemption for 10 percent of fixed assets; and applying tax on a per-country basis. Deduction for foreign-derived intangible income (FDII) eliminated. Includes anti-inversion provisions per H.R. 1711 (Rep. Lloyd Doggett, 116th Congress) / S. 780 (Sen. Sheldon Whitehouse, 116th Congress)

- Carried interest taxed as compensation under income and payroll tax

- Certain business preferences repealed, including fossil fuel preferences, last-in-first-out and lower-cost-or-market accounting methods, like-kind exchanges for real estate, and exceptions from interest deduction limits for real estate and floor inventory debt

- Extends wind production tax credit, solar investment tax credit, and electric vehicle credit through 2029

Other revenue proposals:

- Budget-neutral carbon tax starting at $52 per metric ton of CO2e, with all revenue refunded to low- and middle-income households

- Financial transactions tax (10 basis points)

- Increases tobacco taxes (President Obama fiscal year 2017 budget proposal)

- Restructure alcohol taxes to flat $16 per proof gallon

- Increases motor fuels tax rates by 15 cents per gallon, indexes rate for inflation; motor fuels tax revenue would be replaced over time by a vehicle-miles traveled tax

- Fee on large financial institutions, per President Obama’s fiscal year 2017 budget proposal

- Closes gaps between Medicare payroll and self-employment taxes and the net investment income tax, per President Obama’s fiscal year 2017 budget proposal