See also: “Toward a Robust Competition Policy” by Marc Jarsulic, Ethan Gurwitz, and Andrew Schwartz

Market competition is faltering in some parts of the U.S. economy. Across many sectors, and across several decades, a significant share of corporations has been earning returns above competitive levels.

The expected response—entry of new firms that want to earn a share of those higher returns in those markets—has not happened. As a result, firm owners earn more, workers’ wages are lower, and incumbent firms have less pressure to innovate on their own.

These findings of returns that exceed competitive levels are an indication of entry barriers, and a new CAP report, “Toward a Robust Competition Policy,” tries to identify the sources of barriers.1 They include increased market concentration; the increased use of intellectual property protection in the form of patents; the rise of business models dependent on network externalities; and the rising importance of digital data as an input in production.

The report also identifies policies that can help to reduce barriers, including restricting acquisitions by firms protected by barriers; limiting the ability of such firms to enter adjacent markets; requiring the standardization and sharing of important data; and allowing users to communicate across digital platforms.

However, some markets may remain uncompetitive despite these policies. So this CAP report also advocates a monopoly tax designed to discourage the construction of entry barriers and to reduce the economic power that flows to individual companies from the presence of those barriers.

Significant numbers of corporations are earning monopoly-like profits

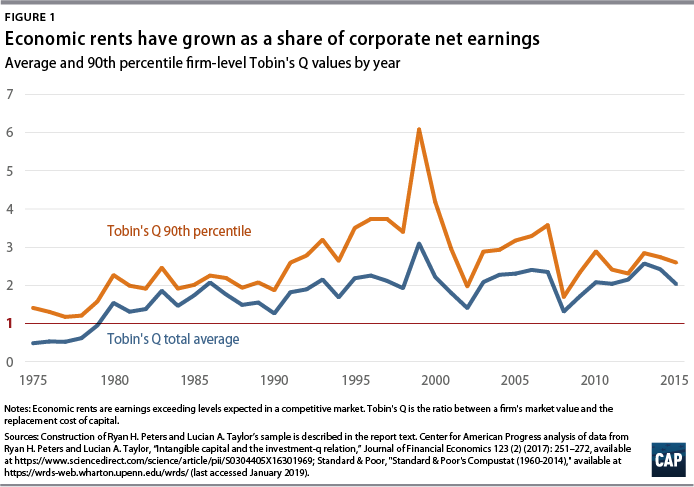

Measures commonly used by economists to evaluate firm-level economic performance now indicate that many firms have market power and are earning profits above competitive levels. For a significant number of firms, the ratio of market value to the replacement cost of its capital has risen well above one. In other words, investors are signaling that the expected returns of these firms exceed the current value of their combined assets. This is a recognized indicator that firms are able to extract economic rent—in other words, to earn returns beyond expected profits in a competitive market.

Figure 1 presents results from a large sample of publicly traded nonfinancial corporations showing that, for a significant fraction of firms, the ratio of market value to the replacement cost of firm capital has been above one and increasing since the late 1970s—an indication of monopoly-like profits.2

Sustained levels of monopoly-like profits are evidence of uncompetitive markets

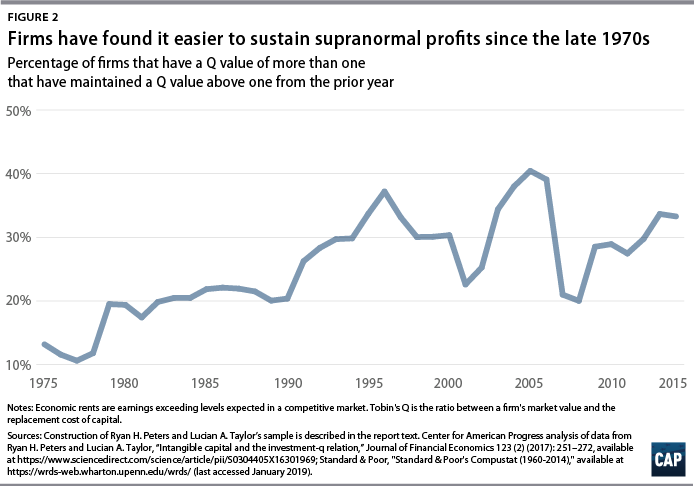

Companies creating new breakthrough products or implementing more efficient processes that lowers costs or increases revenues should expect increasing profits. Under competitive markets, other companies seek to emulate or supplant competitors’ innovations. As a result, supply would increase, forcing down prices, and pushing down the innovating firm’s profits. Therefore, high profit levels should be temporary. Instead, corporations who have achieved excess profits in a given year are increasingly likely to maintain them in the subsequent year, as shown in Figure 2.

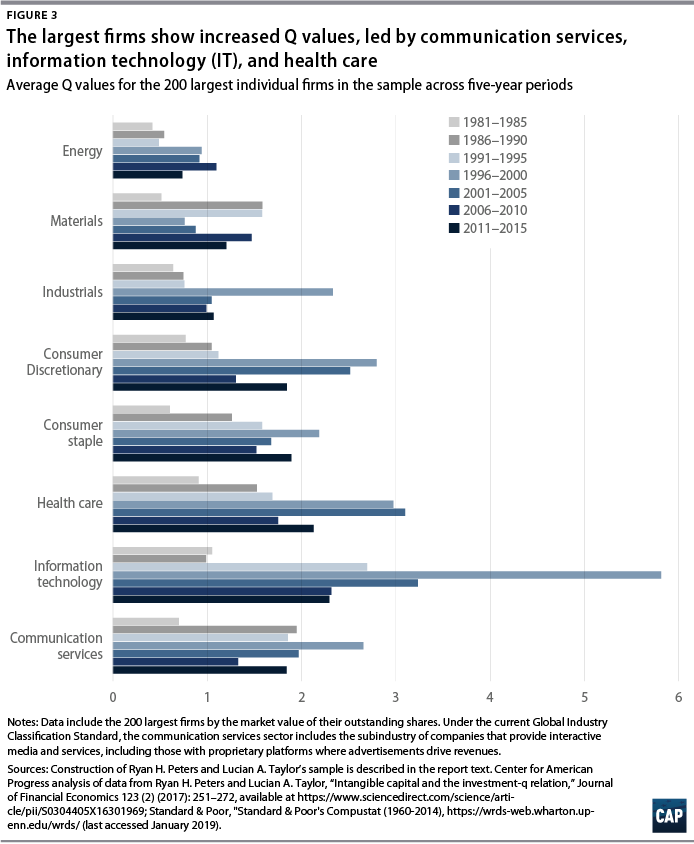

Monopoly-like profits are evident in many sectors of the U.S. economy, especially communications services, health care, and information technology

An analysis of the 200-largest companies in the sample across five-year periods going back to 1980, seen in Figure 3, indicates that the decades-long trend of increasing Q values occurs across sectors.

Additional indicators of reduced competition

- The 90-50 ratio for corporate returns—the accounting return on invested capital for the 90th percentile of firms to the 50th percentile—has increased from around two in 1980 to around 10 in 2014.3

- Corporate profits are concentrated in a declining number of firms. 4

- Overall market concentration has increased over the past several decades.5

- Rate of entry of new firms has been declining since the late 1970s.6

- Rising concentration among employers is associated with job lock and weak wage growth.7

Barriers to entry limit the threat of new competitors

All of these indicators are compelling evidence suggesting that a significant number of firms have market power. This means that they have some ability to set the price for a good or service above competitive levels.

There are several factors—some old and some new—that help create, maintain, and enhance market power:

- Mergers and acquisitions. Evidence shows that the increase in concentration following mergers reviewed by the antitrust agencies is too often accompanied by increased prices. Moreover, incumbent firms with market power have been allowed to use acquisitions to fend off potential competition.

- Intellectual property protection. Tools such as patents are state-sanctioned monopolies intended to incentivize innovation. However, in recent decades, private actors have been able to earn patent rights based at least in part on discoveries from publicly funded research. In some industries, so-called patent thickets discourage new entrants.

- Network effects. Some products—for instance, the telephone or social media platforms—become more valuable as more individuals use it. The benefits from this effect may be mitigated if consumers cannot easily switch to a competitor. Incompatibility among similar services leads to a lock-in effect and makes customers dependent on their current service.

- Access to data. Companies across the digital economy have realized the value of data on the behavior and interests of users and customers. Firms with access to large amounts of data on individuals know more about their behavior and preferences and are better positioned to develop new machine learning and artificial intelligence tools. New entrants lack crucial inputs and are less likely to be able to compete in markets where these data are crucial.

Recommendations to decrease barriers to entry

- Increase antitrust enforcement. Restrict acquisitions, particularly where existing entry barriers protect dominant companies. Limit operation in adjacent markets when entry could add to already significant barriers.

- Change intellectual property policy. Shorten patents durations. Treat government as an early investor that can earn financial benefits when public investment is key to a profitable innovation. Increase public research budgets.

- Formalize policies around data. Require data sharing and establish sharing requirements. Require that users can communicate across digital platforms. Require competition regulators to conduct merger reviews focusing on data and their impact.

- Tax monopoly profits. When other policies cannot establish competitive market outcomes, establish a surtax on monopolistic profits. This can be accomplished without loss in efficiency.