Introduction and summary

America’s capital markets—made up of the stock, bond, and related financial markets—enable millions of investors to allocate capital every day to what they hope are the best economic uses in the coming years. When those markets are fair, efficient, and competitive, those investments play a central role in contributing to a vibrant economy and society. Growing companies produce the goods and services that the public needs, workers obtain employment, and investors earn returns on their investments. But capital markets are far from self-regulating; when they are insufficiently transparent or accountable, significant problems arise. Investors can be defrauded; good companies and their workers can fail to obtain the capital they need; and the public can suffer from worsening inequality, environmental damage, financial crises, and more.

America has some of the most robust capital markets in the world, but significant weaknesses in the functioning of the private markets expose American investors and the public to risks, harms, and lost opportunities. Indeed, a good deal of evidence suggests that today’s markets are too short-termist and fail to align the interests of corporate stakeholders to drive shared, long-term success.

An earlier Center of American Progress report—“Long-Termism or Lemons: The Role of Public Policy in Promoting Long-Term Investments”— explored how an excessive corporate focus on short-term results appears to be reducing business investments.1 This trade-off likely means lower growth rates, reducing total output by 6 percent over a century.2 The 2015 report offered a range of ideas to increase the long-term focus of the markets.

But “Long-Termism or Lemons” did not address the question of whether investors, markets, and key corporate stakeholders are sufficiently informed—and from that information, empowered—to do the basic work of the capital markets: drive smart capital decisions for the long term. This report asserts that the answer to that question is “no.” Shareholders and stakeholders of all types and sizes do not have access to the long-term-oriented information they need—in particular, environmental, social, and governance (ESG) information—in a consistent, comparable, and reliable manner.3

Public oversight of the nation’s stock markets is premised on the need for government to mandate corporate transparency. Corporations are understandably unwilling to voluntarily share information that might not be flattering but that investors and the public need to distinguish between good and bad investments. Moreover, information must be shared in a consistent, comparable, and reliable manner for it to be useful to investors and the public—and hence to enable efficient markets.

The Securities and Exchange Commission (SEC) was created during the Great Depression to address market failures and ensure this very transparency.4 Over the years, as investors, the economy, and the public interest have evolved, the SEC has had to update its requirements. When it has failed to do so, the consequences to investors of all types and to the public interest have been severe.5 Today, the SEC is behind the curve on mandating the disclosure of sufficient long-term-oriented information, especially ESG information. Its reliance to date on the private market to execute this public regulatory function has not worked.

The informational asymmetries created by these gaps in disclosure undermine the alignment of interests that the capital markets need to drive shared long-term success—what might be termed corporate long-termism. Investors lack the information needed to make smart front-end allocation of capital to long-term, socially beneficial uses. Management lacks the incentives needed to enable them to focus on the long term—whether that involves maximizing opportunities or minimizing risks. And the public, including policymakers, lacks the information needed to make intelligent long-term decisions about the economy and policy overall.

Unfortunately, the economic and societal consequences of this major roadblock to corporate long-termism are significant. Similarly, economies and societies are being roiled by popular dissatisfaction with globalization, rapid technological change, growing market concentration, and extraordinary levels of inequality.6 Even as the stock market is driven forward on the back of massive tax cuts and buybacks, collapsing middle- and working-class wealth poses significant long-term economic risks.7 Even more concretely, a study by The Economist found that by 2100, climate risks alone could imperil $4 trillion to $14 trillion in private sector assets and $43 trillion when public sector assets are included.8

Given the capital markets’ propensity to fads, booms, and busts, the market failure to provide sufficient ESG information to investors and other key market participants and corporate stakeholders may represent one of the most underappreciated systemic vulnerabilities of the U.S. financial system—and hence to U.S. economic growth.9 Furthermore, in an era where information and misinformation are often given equal footing in the public square, defending the quality of information in the capital markets is critical to protecting reliable economic growth.10

More long-term-oriented companies and capital markets cannot solve all the world’s problems, but they can make a meaningful difference in a lot of areas. Companies both affect and are affected by a wide range of ESG issues: employee and board diversity; worker benefits and training; environmental risks; financial stability; human rights; corporate political influence; tax evasion; monopoly power; and more. Indeed, investors and the public have already said so: The SEC’s 2016 Concept Release on Regulation S-K—the principal SEC regulation that governs corporate disclosure—garnered more than 26,500 comments from investors and the public. An analysis of these commenters showed that the comments overwhelmingly and persuasively favored ESG disclosures across a wide range of issues.11

That’s in no small part because ESG matters are increasingly important to the long-term performance of companies themselves, especially their management of risk. And investors have been taking notice, in no small part because the perception of a trade-off between performance and social responsibility is increasingly being disproved by the numbers. Whether it’s a 2015 Harvard Business School study of 2,300 firms, a growing body of research on how resource-efficient companies outperform their peers, or its own analyses of how higher gender diversity yields better stock performance and lower volatility, Morgan Stanley’s Institute for Sustainable Investing confidently summed it up: “We believe sustainability creates business value.”12

Another institutional investment adviser put it like this:

“[W]e have been collecting studies from financial institutions and academic institutions that link ESG performance with financial performance since 2000, and to date we have collected 356 studies, all of which show that more sustainable companies or funds have financial performance that is comparable with, or better than, those of less sustainable peers. … In sum, there is ample evidence that environmental, social and governance factors are relevant to financial performance; if these factors were all immaterial, it would be difficult to explain how there could be so many studies showing correlations of financial and ESG performance over the past decade and a half.”13

Companies and management, too, have begun to take notice, but they face conflicts and collective action challenges that limit their ability to respond. For example, the number of companies issuing sustainability reports has increased, private standard-setters have offered new models for those disclosure, and investors are successfully engaging with companies on ESG matters.14 Yet, despite these interventions, some of which are costly, ESG information is still incomplete, inconsistent, often low-quality, and weakly unverified.15 That doesn’t even count the legislative, regulatory, and other political efforts that have sought to reduce transparency further.16 The cost-benefit calculus from regulatory inaction is increasingly high.17

Ultimately, much remains to be done to better align investors, managers, and other stakeholders for mutually beneficial long-term results. This report examines the role that improved corporate disclosure could play in boosting long-termism, focused especially on ESG information. As case study examples, the authors focus on inadequacies in the SEC’s approach to worker training and to climate-related disclosures, but, as noted, the same analysis could be applied easily to a wide range of ESG matters.

This report recommends that the SEC update its disclosure regime and related tools to better align interests of investors, management, and the public toward long-term economic success and the public interest. Specifically, the SEC should:

- Require high-quality, consistent ESG disclosure on both marketwide and sectoral bases.

- Look to expert, nongovernmental standards or standard-setters for ESG disclosure standards.

- Defend an investor-oriented, public-interest approach to the disclosure mandate.

- Update audit and data tagging standards to boost the availability and reliability of information.

- Empower SEC staff to be the voice of long-termism on behalf of investors and the public.

- Bring clear, bold enforcement actions and support similar actions by states and private investors.

- Boost board attention to corporate long-termism and sustainability.

- Boost shareholder voice in favor of ESG and long-termism.

In his inaugural speech, SEC Chairman Jay Clayton stated that the SEC’s analysis “starts and ends with the long-term interests of the Main Street investors … Mr. and Ms. 401(k).”18 The world has changed since 1982, when the SEC last meaningfully addressed the ESG information that those Main Street investors can reliably access.19 It’s time for the SEC to ensure that investors and the public get the information they need to better link corporate performance and risk management with long-term results for the American economy.

ESG information promotes corporate long-termism

Publicly listed corporations are essential components of the U.S. economy. They employ millions of Americans, contribute to productivity growth, and provide essential goods and services upon which Americans depend.20 However, in recent years, a sizable amount of evidence has emerged indicating that these corporations have become too focused on meeting short-term earnings, stock price targets, and market pressures for stock buybacks.21 Short-term pressures arise, for example, when executive compensation is too closely linked to short-term stock prices. Similarly, so-called activist investors—those who buy a large number of a company’s shares with the goal of creating some sort of corporate change—can pressure companies to engage in excessive levels of buybacks of their shares, or otherwise engage in business strategies that maximize short-term gain for investors but undermine the company’s long-term economic performance, stability, and social responsibility.22 The secular decline in business investment in the United States since 2001 appears, in part, to reflect these pressures.23 Short-termist pressures also have played a role in the decline of American manufacturing.24

The debate around how to respond to short-termism has mostly centered, to date, around two concerns: whether and how to limit stock buybacks,25 and whether to insulate boards and management from investors’ influence, activist or otherwise.26 In “Long-Termism or Lemons,” CAP analyzed some of these short-termism market pressures and recommended boosting corporate long-termism by deploying long-term executive compensation plans, limiting share buybacks, and enhancing long-term investors’ influence over the company’s board of directors.

What has not been as central to the debate as it should be is whether corporate long-termism can be promoted through disclosure. Building on the growing chorus of investors seeking this information for long-term performance and risk management purposes, this report argues that disclosure of the broad range of ESG information can play an important role in aligning the interests of all corporate stakeholders toward long-term, commonly shared interests.

ESG information and its growing impact on public markets

The effectiveness of capital markets in allocating investments, as well as in protecting investors from fraud and undo risks, depends first and foremost upon having a wide availability of information. Today, investors and the public lack critical ESG information that they need to make better long-term-oriented decisions. And as a result, corporate management does not receive sufficient ESG-related signals from the capital markets, which in turn discourages it from taking a long-term-oriented approach.

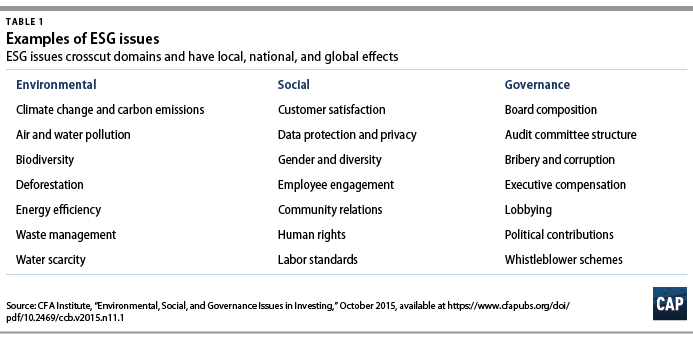

ESG issues cover a wide range of topics and facets of society that affect, and are affected by, the private sector. Whereas ordinary financial information seeks to present snapshots of the financial condition of the company on topics such as revenues, costs, cash flow, and more, ESG information seeks to present a snapshot of the company’s interaction with the physical environment, human beings, and institutional structures. The CFA Institute, which administers the chartered financial analyst (CFA) certification and supports professional standards for the investment industry, lays out a useful sampling of ESG topics.27

Greater provision of ESG information would empower investors and the public to further and better incorporate long-term-oriented factors into their capital market decision-making, which, in turn, would affect how companies address those ESG and other long-termism matters.

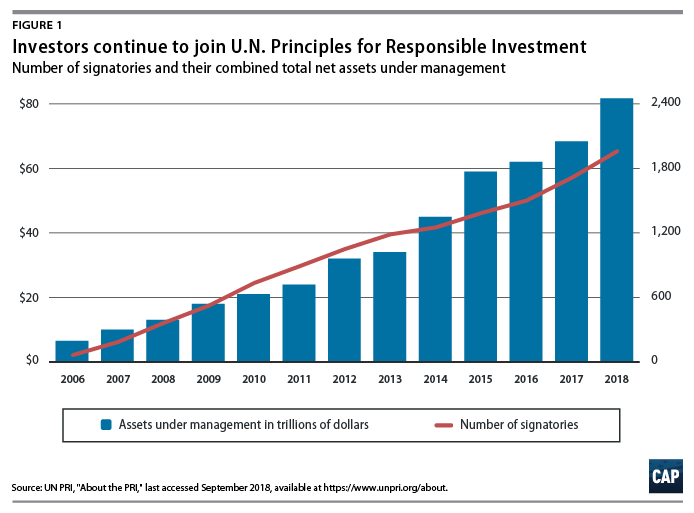

That’s exactly what investors and the public are demanding. Investors of all types increasingly recognize that ESG information is an essential part of evaluating potential investments. A recent study found that 82 percent of mainstream, or non-ESG focused, investors considered ESG information when making investment decisions.28 Moreover, at more than $8.72 trillion in total assets under management as of 2014, investing that takes into account ESG criteria is no longer a niche investment category.29 The extraordinary increase in the number of signatories to the Principles for Responsible Investment (PRI) makes this clear. The PRI is a network of investors focused on promoting responsible investment through understanding and incorporating ESG factors into investment decision-making. Since its launch by the United Nations in 2006 with just 100 members, the PRI now has more than 1,800 signatories who manage more than $80 trillion in assets.30

Pension plans, which particularly require long-term investment, are increasingly using ESG information in their investment process.31 Indeed, in response to that demand, the U.S. Department of Labor provided helpful flexibility by clarifying in 2015 that its regulations would not impede investment decisions to use ESG factors as part of the “primary analysis of the economic merits of competing investment choices.”32

Thousands of asset managers with trillions of dollars in assets under management are not just factoring ESG information into their decisions because they want to do the right thing. It’s because ESG information is important for long-term investment success and in particular the management of risk—two core aspects of efficient capital allocation and investor protection. Several reviews of the academic literature, including one survey of 2,000 other academic studies, find a correlation between ESG criteria and corporate financial performance.33 A range of academic evidence also points to lower costs of capital and other benefits to companies and investors that consider ESG factors in their decision-making.34

Expanding ESG disclosure appears to have significant benefits and limited costs, consistent with the experience of disclosure more broadly. Evidence points to companies with strong disclosure practices having positive shareholder returns.35 These companies also have better stock returns than those with poor disclosure practices.36 Moreover, as discussed in detail below, with many companies already engaged in various types of information collection and partial disclosure, the additional costs of marketwide and consistent disclosure are limited.

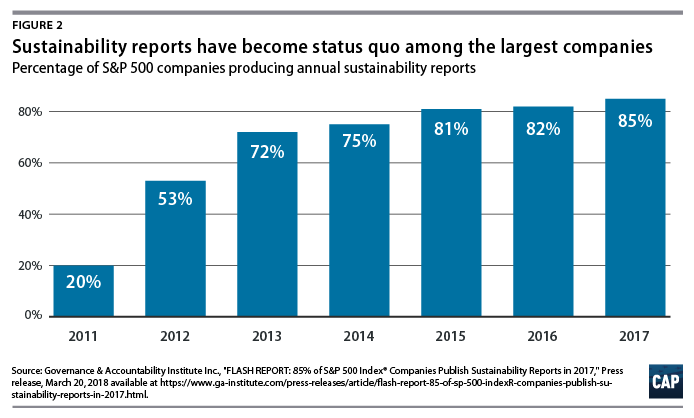

Companies themselves are recognizing the low costs and high benefits of transparency. Despite limited formal regulatory requirements, more companies than ever are making sustainability disclosures. According to the Governance and Accountability Institute, the number of S&P 500 companies making “sustainability reports” increased from less than 20 percent in 2011 to more than 85 percent in 2017.37

Companies are also providing discrete disclosures in response to investor pressure and questioning. For example, many are disclosing that they are using an internal price on carbon to guide decision-making.38

The limits of market-driven progress

Demand for, and availability of, ESG information has blossomed in recent years. Yet today’s information marketplace is far from working well on its own. The ESG information being voluntarily made available today is not complete, specific, comparable, widely available, or well-verified.39 Disclosures in SEC filings, which provide the highest standard for reliability, are often weak. Generic and boilerplate disclosures are ubiquitous.40 Needless to say, all of this limits the information’s utility for investors, especially on a marketwide basis.

One study by the Sustainability Accounting Standards Board (SASB) focusing on climate-related disclosures alone found that as of October 2016, almost 30 percent of recent 10-K filings for the 10 largest companies by revenue in each industry do not identify any climate risks.41 Forty percent of companies have boilerplate disclosures.42 And even where disclosures have improved, comparisons of companies across a given industry are difficult, if not impossible, without the standardization of metrics and greater requirements for qualitative descriptions.

Ultimately, investors themselves have been overwhelmingly clear about the need for expanded disclosure on worker pay, training, benefits, and diversity; on environmental matters such as climate; on financial stability matters such as derivatives exposures; on human rights risks; on political spending; on tax strategies and risks; and more.43 Each of these areas makes a persuasive case for how additional disclosure would boost the long-term alignment of interests among investors, companies, and the public.

The two case studies below illustrate the benefits of additional ESG disclosure for corporate long-termism, as well as the significant weaknesses in the disclosures available today.

Worker training

America’s working class have been under tremendous economic pressure in the past 15 years. The middle 60 percent of households have seen their incomes stagnate, and since 2000, workers without college degrees have seen their wages decline by 2 percent, while those with college degrees have seen a 3 percent increase.44 Meanwhile, there are 4 million fewer Americans with jobs than there were in 2000, as demonstrated by the prime-age labor force participation rate.45 On top of that, the financial crisis helped wipe out nearly 50 percent of the net wealth of the average middle-class household—comparing 2010 with 2001—and it has yet to fully recover.46 In some regional economies and some demographics, the pain has been even more acute.47

As worker training can be seen partially as a worker benefit, it should, perhaps, not be surprising that between 2001 and 2009, employer-provided training declined by more than 27 percent, the largest portion of which took place before the 2008 financial crisis and Great Recession.48 That parallels the collapse in business investment that has also occurred since 2000, cited as key evidence of corporate short-termism.49 And in fact, they are both disturbing: A range of studies shows how on-the-job training is important for boosting productivity for workers, firms, and the entire economy.50

Short-term financial market pressures to reduce costs are not the only reason companies are under pressure to reduce workforce training investment.51 Factors such as declining employee tenure, declining compensation, and other structural factors matter a great deal, but capital markets pressures are real. Because human capital investments are not broken out from other general and administrative expenses, companies that make those investments look less efficient than others. With markets placing maximum pressure for—indeed, excessively valuing—buybacks and dividends today over investments that are likely profitable in the future, the impact of lumping workforce training into general and administrative expenses is likely magnified.52

The good news is that there is a ready model for how disclosure can help reduce this conflict. Prior to the 1970s, spending on research and development (R&D) was specifically disclosed and appeared in various ways, ranging from general and administrative expenses to capitalization.53 Since the Financial Accounting Standards Board mandated specific disclosure in 1974, R&D investment has become an important financial statement disclosure that investors look at to determine whether a company is innovative and investing for the future.54 And unlike workforce training, R&D investment by U.S. companies has risen, with R&D investments now exceeding capital asset investments.55

CAP has argued that a stand-alone disclosure requirement for workforce training would improve how financial markets view worker training. In 2017, the Human Capital Management Coalition, a group of institutional investors representing $2.8 trillion in assets, agreed and petitioned the SEC to significantly expand disclosures on workforce training and other workforce issues.56

Corporate disclosure of workforce training investment and other worker issues is only one piece of a larger series of policy changes that are needed to improve economic outcomes for American working families.57 But they present an achievable opportunity to better align long-term interests among investors, companies, and the public.

Climate

Climate change is a central example of where greater ESG disclosure could better protect investors and achieve better capital allocation in the public interest. Climate change poses enormous risks and opportunities for the corporate sector, ranging from oil industry asset valuation to negative impacts on crops, coastal property, supply chains, and more.58 Yet, corporate disclosure available today is insufficient, not comparable, and unreliable.59 This limits the effectiveness of the capital markets in doing their basic job of allocating capital to the best available private market uses.

Climate change presents risks to both investors and the broader economy. A 2015 estimate of value-at-risk (VaR) associated with climate change by The Economist found that expected losses to the private sector from a warming planet could amount to $4.2 trillion by 2100, discounted in present value terms.60 As the publication notes, this is approximately the same size as Japan’s entire annual gross domestic product (GDP) or as the total value of all the world’s listed oil and gas companies.61 The Economist also analyzes the risk of a 5-degree or 6-degree warming scenario and finds private sector losses ranging from $7 trillion to nearly $14 trillion, respectively.62 Public sector costs would add an additional $43 trillion in estimated losses over the next 80-plus years.63 Focusing specifically on U.S. publicly listed companies, climate risks to corporate America are widespread.64 One estimate finds that the overall market cap of affected assets is $27.5 trillion, which is 93 percent of the U.S. equity market value.65

With the U.S. government engaged in wide-ranging environmental and other forms of deregulation, investors and the public recognize that the capital markets now play an outsized role in countering some of those impacts.66 This would be primed to occur through the basic functioning of the capital markets: pricing and managing risks. But widespread and consistent disclosure is important, because climate disruption poses marketwide and even systemic risks to the financial system and economy.67 Failure to accurately price investments has caused financial crises in the past and preventing such mispricing is one of the SEC’s most fundamental mandates dating back to its founding legislation in 1934.68 ESG disclosure for climate would also help the capital markets better seize opportunities to deploy capital that can achieve both economic and social returns.69

Investors need to consider climate across a diverse portfolio, but the issue is important to the entire economy, and the public would benefit from the transparency provided by the capital markets. Jobs, livelihoods, and entire communities will feel the effects of whether America’s largest corporations effectively respond to climate disruption or not.

The SEC’s 50-year struggle with corporate ESG disclosure

Investors and the public have long sought information about what are now considered ESG matters. Nearly 50 years ago, the National Resources Defense Council and several other public interest groups petitioned the SEC to adopt rules requiring various environmental disclosures and disclosures regarding equal employment opportunities.70 This kicked off nearly a decade of rule-making and judicial processes, ultimately leading to new disclosure obligations—although many fewer than were originally sought. The process was unprecedented at the time, and, as the appellate court that reviewed the case noted, the public’s engagement was considerable. For example, in the summer of 1975, the SEC held weeks of hearings, wherein it heard more than 50 oral presentations and in a simultaneous comment period, received more than 350 additional comment letters, creating a record of more than 10,000 pages.71

Clearly, these issues were important to participants on all sides, yet out of this process, the SEC only added modest disclose requirements regarding material compliance with environmental laws and litigation. The effort to secure disclosure regarding equal employment opportunities were not successful.72

Fast forward to 2016, when the SEC issued a concept release to revamp its corporate disclosure framework, it received more than 26,500 comments from investors and the public.73 An analysis of these commenters showed that the comments overwhelmingly and persuasively felt that ESG disclosures were significantly lacking across a wide range of issues.74 All of that is on top of a succession of efforts by investors and the public to push for greater disclosure on a range of specific topics, such as political spending where more than 1.2 million commenters registered their views with the SEC.75

To understand why these overwhelming ESG gaps remain today, it is important to step back and understand the overall framework for corporate disclosure by the SEC.

Background on the SEC corporate disclosure framework

In the aftermath of the stock market crash of 1929, Congress established regulatory oversight of the capital markets, in particular mandating that the companies who offered securities for sale to the public provide wide-ranging transparency regarding their businesses. That was accomplished through the mandates of the Securities Act of 1933 and the Securities Exchange Act of 1934, as well as the newly created SEC.76

The federal securities laws and the SEC have essentially adopted two approaches for requiring corporate disclosures necessary to protect investors and promote the public interest. First, the federal securities laws and SEC regulations set out specific, required disclosures covering many aspects of the company’s business, including its risks and its ownership structure. These requirements are also tailored to address various contexts, such as when a company offers shares to the public or when it provides ongoing reports of its operations and financials.77 Second, the federal securities laws establish an overarching anti-fraud principle requiring a company’s disclosure to be materially accurate and complete. To ensure these disclosure obligations are met, the federal securities laws empower the SEC to oversee corporate filings and, through regulatory tools, act as gatekeepers between companies and the capital markets. In addition, both the SEC and harmed investors can recover in court for violations and harms.78

Since 1982, the SEC’s Regulation S-K has been the primary source of specific disclosure requirements for public companies.79 It forms the backbone of what companies disclose in their most important public filings, in particular their annual Form 10-K filing with the SEC.80 This cornerstone securities regulation is divided into several subparts, each of which covers a specific topic.81

Let’s take climate disclosure as the example to illustrate how the existing disclosure framework works with respect to an ESG topic. There currently are no climate-specific disclosure mandates, but climate disclosures may be triggered by more general disclosure requirements in Regulation S-K. These requirements arise principally in items 101, 103, 303, and 503 of Regulation S-K.

Item 101 requires companies to disclose basic general information about their businesses. Paragraph (c)(xii) of Item 101 specifically calls for companies to disclose “the material effects that compliance with [environmental laws] may have upon the capital expenditures, earnings and competitive position” of the company, as well “any material estimated capital expenditures for environmental control facilities.”82

Item 103 requires companies to disclose “any material pending legal proceedings.”83 The instructions specifically direct companies to disclose environmental proceedings if any one of three conditions are met, one of which is that a government is bringing an action that the company “reasonably believes” could result in sanctions of $100,000 or more.84

Item 303 requires disclosures that are intended to “communicate to shareholders management’s view of the company’s financial condition and prospects.”85 These disclosures comprise the Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) portion of SEC filings. Climate change issues may be disclosed here to the extent that they may be of interest for companies’ management, such as potentially affecting earnings, cash flows, or broader strategy.

Lastly, Item 503 requires disclosure of the most significant factors that make an investment in the company “speculative or risky,” commonly called “risk factors.”86 Again, to the extent that climate change or regulations related to it may have uniquely significant impacts on the company, they should, at least theoretically, be disclosed here.

Each of these disclosure obligations are highly dependent on management’s judgement about the magnitude of these issues’ impact on companies’ operations or financial position or likelihood of occurrence. MD&A sections, in particular, are not audited and, given the generality of the overarching requirement, are difficult to enforce. Risk factor disclosures, moreover, are often overwhelmingly boilerplate with little decision-useful information, and instead take a laundry-list approach to potential risks.

Investors and the public are left, absent other SEC or court intervention, largely at the mercy of whether a company’s management determines to disclose or not. And indeed, that is exactly the implication of a principles-based approach disclosure, which has increasingly characterized the SEC’s approach to disclosure.87

Slow and stalled progress toward ESG disclosure requirements

The SEC’s disclosure regime outlined above has been mostly frozen on ESG matters—and indeed on most substantive matters—since the 1980s.88 But that is not for a lack of trying by investors and public interest groups. For decades, they have pressed the SEC to update its expectations, yet little progress has been made.

Climate change, the subject of some of the most persistent and creative investor efforts, is again a good example of the limits of what has been achieved to date, in part because it has seen more progress at the SEC than have other areas. However, the SEC’s analysis and approach to climate-related matters are equally applicable to other ESG matters.

In 2010, after years of efforts and a petition from more than two dozen organizations,89 the SEC issued an interpretative release that advised companies of several distinct areas in which climate change risks may need to be disclosed.90 The guidance offered four areas in which climate change-related issues could give rise to disclosure obligations:

- Impact of legislation and regulation

- International accords or treaties

- Indirect consequences of regulation or business trends

- Physical impacts.

This guidance did not revise the specific disclosure elements of items of Regulation S-K. Instead, it offered scenarios in which companies “may” or “could” have a disclosure obligation under the above-referenced framework due to the impacts of certain climate or climate-related regulatory risks on the companies’ financials, operations, and more.91 This quintessentially soft-touch approach barely moves the needle on disclosure obligations and once again relies heavily on management’s judgment and company-by-company oversight by the SEC.

Nevertheless, things were promising starting out. Following the 2010 release, the SEC began sending interpretive letters and other correspondence to companies and asset managers for various climate change-related issues. But without improvements in quality, the SEC’s focus nevertheless waned: The commission sent 38 comment letters in 2010, 11 in 2011, three in 2012, and none in 2013.92 Moreover, enforcement has not played a role in the SEC’s efforts on this front. A recent Government Accountability Office (GAO) report on the topic noted that senior SEC staff “did not expect changes in companies’ climate-related disclosures as a result of the 2010 Guidance since SEC did not adopt any new disclosure requirements”—a somewhat stunning admission regarding the guidance’s impact.93

Separately, in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Congress stepped in to mandate a number of other ESG disclosures, including the ratio between CEO pay and that of the median worker; information about conflict minerals; information on mine safety; and information on resource extraction-related payments.94 These disclosure mandates have been criticized as serving political or special interest ends that would otherwise not be appropriate to the federal securities law.95 While some of those provisions were both overly prescriptive in certain details and insufficiently broad to cover the real range of ESG issues related to worker safety, human rights, and such, the provisions nevertheless reflect an effort by Congress to advance investor protection values related to ESG disclosures.

For example, the pay ratio, which compares the salary of the median employee with that of the CEO, sheds important new light on employee compensation. Because pay is both a complex and sensitive topic, the ratio offers a sensible, cost-efficient approach that is helping investors cast informed votes on matters related to executive pay and human capital management.96 In particular, it provides an important window into whether companies are investing and retaining their workers in a manner sufficient to motivate employee productivity.97 In short, being incomplete does not negate the fundamental value of the disclosures for boosting the long-term alignment among investors, management, and the public interest.

Moreover, Congress seemingly rejected the critique of political or special interest disclosures when, with little controversy, it mandated disclosures of Iran-related business activities in the Iran Threat-Reduction and Syria Human Rights Act of 2012.98

Investors and the public resort to private market self-help

Faced with little movement by the SEC, shareholders and others have engaged in a range of private market strategies to improve ESG disclosures and boost corporate long-termism. They may directly engage companies, often through investor calls or direct outreach to management.99 They may put forth proposals under the SEC’s Rule 14a-8, which enables shareholders to vote on certain topics.100 They may seek to change the composition of a company’s board of directors to better reflect their concerns. Or they may vote with their investment dollars and divest or otherwise change their capital allocation.101

Each of these unilateral efforts by investors has its appropriate role in corporate long-termism, as well as investor protection.102 Sometimes they have achieved surprising success at driving marketwide change.103 Ultimately, though, they have not been able to replace the direct regulatory action needed to achieve broad-based and consistent disclosure and accountability. Below are a few of the more notable efforts by investors and other stakeholders to fill the corporate long-termism void left by inadequate ESG disclosure requirements under Regulation S-K.

Shareholder proposals and engagement

The SEC’s Rule 14a-8 enables shareholders to petition to have specific proposals included in the company’s proxy, which allows all shareholders to express their views to the board and management. The rule, which dates back to 1942, has grown in significance since the 1980s.104 It has become an important tool for investors to help companies manage new and emerging risks, especially in ESG areas on which management is often not well-attuned.105 Shareholder proposals also drive engagement with management, as those who pursue these initiatives regularly work with management to obtain a responsible, productivity-enhancing result without a vote.106

Shareholder proposals have achieved notable successes in the ESG area. Together with the engagement they have driven, proposals have helped push companies toward what is now the standard practice of having independent directors constitute a majority of the board.107 More recently, shareholder proposals were essential in pushing what is now a substantial majority of companies to have sexual orientation nondiscrimination policies.108 In the area of political spending, shareholder proposals have secured the cooperation of 160 companies and more than half of the S&P 100 in disclosing and instituting board oversight over political spending.109

This represents extraordinarily important progress, but it has limits. In particular, the company-by-company approach—and, commonly, resistance by management—constrain its ability to set out consistent, comparable, and reliable disclosures marketwide.110 In addition, while some asset managers are leaders in pushing for corporate long-termism, not all are.111 And some asset managers do not support shareholder-led proposals on any issue.112

Exchange listing standards

In part at the urging of the PRI as part of its implementation of the United Nations’ Sustainable Development Goals, stock exchanges around the world have encouraged more disclosure of ESG issues.113 Exchanges have long played a role in setting regulatory requirements, including disclosure requirements, across their listings. Working with the U.N. Sustainable Stock Exchanges Initiative, Ceres, and others and soliciting the input of institutional investors around the world, the World Federation of Exchanges issued guidance in 2015 on how each exchange could approach implementing its own ESG reporting requirements.114

As of 2018, more than 40 stock exchanges around the world have either published or are committed to publishing ESG disclosure guidance, including the leading stock exchanges in Australia, China, Hong Kong, India, Sweden, and the United Kingdom and, as of 2017, the Nasdaq Stock Market in the United States.115 In addition, a new effort is underway in the United States to create a “Long-Term Stock Exchange” that would adjust investor rights and disclosure toward a longer-term approach.116

The particulars may vary, but the efforts represent meaningful consensus that progress is important and possible. They remain, however, largely voluntary and are not necessarily consistent across exchanges, including within the United States.117 Investors and other stakeholders continue to urge more progress, but the economics underlying for-profit competition among exchanges undermine their ability to play market-setting regulatory roles.118

Global leadership on ESG

Internationally, European policymakers are working to expand ESG disclosures. EU Directive 2014/95/EU sets ESG reporting requirements for large public companies.119 Companies must provide nonfinancial information in corporate reports or separate filings on a variety of topics. The directive has the force of law, and EU members are responsible for transposing the directive into law and ensuring compliance.120 Individual countries are also moving toward requiring disclosures by investors about how they factor in ESG issues into their investment decisions.121

Sustainability reports and investor-led questionnaires

As mentioned above, more companies are publishing sustainability reports than ever before. The wide adoption of sustainability reporting represents progress in companies providing investors and the public with important ESG information. However, standardization, detail, completeness, and reliability remain challenges.

The most widely used standards for sustainability reporting are set out by the Global Reporting Initiative (GRI), an international organization comprising investors, companies, and governments.122 The GRI has done important work to improve sustainability reporting, and nearly 9,600 organizations worldwide have integrated the GRI framework, and many prominent U.S. companies use GRI guidelines in their corporate sustainability reports. 123 GRI guidelines cover a wide variety of business indicators, including procurement practices, biodiversity impacts, and labor-management relations.124

As noted above, however, sustainability reporting has significant limitations. These stand-alone reports differ from basic SEC-mandated corporate disclosures in that they are not standardized, are not verified by outside auditors to the same degree, and are not accountable to the same degree. They often look more like public relations documents than rigorous disclosure documents. Also, sustainability reports rarely contain detailed quantitative information and even more rarely disclose information that does not project a positive image of the company—a practice occasionally labeled “greenwashing.”125 Companies with even the highest-quality sustainability reports failed to include 90 percent of their known negative events.126 Because information is not audited to a high standard, reliability is weak. A 2013 study of more than 4,000 sustainability reports uncovered omissions, inaccurate data, and unsupported claims.127

Nevertheless, as noted above, sustainability reports signal that companies acknowledge the importance of this information to investors and the general public and that they can and do produce a wide range of worthwhile information.

Information compilation and rankings

To the extent that sustainability reporting seeks to present solely a positive public image, it will be limited in its utility. Investors and public interest groups have sought to counter this is by instead directly creating a marketwide expectation of disclosure.

The innovative work of CDP—formerly the Carbon Disclosure Project—represents one of the most effective efforts of this type. Since 2003, it has requested specific quantitative and qualitative environmental disclosure via direction questionnaires sent on behalf of investors. CDP then compiles and makes the information available to investors.128 Today, more than 6,300 public and private companies worldwide respond to its questionnaires, which cover governance; targets and initiatives; emissions; and methodology around climate change, water, forest practices, and more—giving those with access to the CDP platform an impressive array of information.129

Efforts are also underway to review and rank companies based on independently available information. The Center for Political Accountability’s (CPA) CPA-Zicklin Index benchmarks and ranks companies for their political disclosure and accountability practices.130 In 2017, JUST Capital made publicly available information and rankings of companies on ESG criteria, such as worker pay, benefits, environmental protection, and consumer privacy protection.131 The Asset Owners Disclosure Project engages in similar rankings for asset managers and investors such as pension funds and insurance companies, putting pressure on companies through the practices of their investors.132 A range of private ratings firms also offer ESG ratings on companies.133

These and other efforts to compile information directly from companies or from external sources provide investors and the public useful information and ultimately add to the pressure on companies to take a long-term approach. Yet, the costs of these divergent approaches add up, and there are limits to what each of them can do on their own.

Standard-setting

One of the most important self-help approaches to date takes the form of private standard-setting. The activities of GRI and CDP, mentioned above, are some the earlier standard-setting activities associated with the development, respectively, of sustainability reports and questionnaires. In both cases, their work focused on facilitating disclosure through nonmandatory reporting channels. More recently, though, private associations of investors, market participants, academics, and others have established frameworks for what ought to be disclosed through existing mandatory regulatory reporting channels.

Of particular importance is the SASB, which has promulgated sector-by-sector standards for companies to disclose ESG information in their SEC regulatory filings. The SASB’s framework seeks to apply existing—and hence, in theory, mandatory—minimum standards under current law.134 Its requirements arise from looking at ESG items that would be material to companies in a particular sector, taking the approach to materiality that the Supreme Court has set forth in an enforcement context—see discussion of materiality below.135 Although some have critiqued its approach to materiality as being too permissive for a disclosure standard-setter and the structure too focused on MD&A, the SASB’s effort nonetheless represents a highly practical step forward in bringing standardization, quality, and accountability to information. Additionally, the SASB’s sectoral approach has important strengths, as ESG risks can vary by industry; it has set out disclosure standards for nearly 80 industries.136 The SASB’s work has attracted the interest of investors, companies, market professionals, and regulators, but ensuring uniform takeup across companies will require regulatory and enforcement teeth.

Taking a somewhat different approach, Integrated Reporting <IR> is a set of standards, available since 2013, which builds ESG matters directly into companies’ businesses and accounting frameworks by measuring six types of capital within a corporation—financial, manufactured, intellectual, social and relationship, human, and natural.137 it attempts to change the way companies and markets value what they do, and valuation lies at the heart of financial reporting and thus corporate disclosure.138 It is mandatory in South Africa and has been adopted voluntarily by some companies around the world.139 Challenges remain in the United States, however, with respect to its takeup and the completeness of disclosure.140

Litigation

Investors and public interest advocates, including state attorneys general, have begun to resort to litigation to advance companies’ ESG disclosures.141 Perhaps the most important of these efforts have proceeded under the auspices of fraud investigations led by the New York attorney general, who has a broad ability under the Martin Act to investigate potential financial fraud.142 In particular, in 2007 it began investigating several major international energy corporations for failure to disclose climate change risks to investors, and in January of this year sued five of the world’s largest publicly listed oil companies.143 The SEC opened and then recently shut an investigation into at least one of these companies.144

Private litigation, which is important for both deterrence and recovery, is also available. Some of these private litigation efforts have been able to tackle false or misleading statements in corporate sustainability reports, including, to some extent, omissions.145 However, given the expense, risk, and practical litigation challenges—especially in a world of heightened pleading requirements—private plaintiffs are also unlikely to be able to shoulder the burden of testing and reforming today’s ESG disclosure regime.

Recommendations

Rather than relying on a patchwork of voluntary initiatives, the ESG disclosure that investors and the public need demands direct regulatory action at the SEC. This falls squarely within SEC core competencies and mandates, and no new statutory authority is required for almost everything outlined below. However, should the SEC continue to fail to act, Congress should step in to force the SEC’s hand with clear, strong, and broad mandates.

Here, specifically, is what needs to be done.

Require high-quality, consistent ESG disclosure on marketwide and sectoral bases

For the promise of corporate long-termism to work, the SEC must commit to ESG transparency. That commitment must extend to enhancing both marketwide and sectoral-specific information.

First, the SEC should establish explicit disclosure requirements for ESG matters that are generally applicable to all corporate filers. Called line-item disclosures, these would need to be updated from time to time, but a good starting place for what should be required are the ESG items for which investors and the public have already requested additional disclosure—most recently in the 2016 Concept Release on Regulation S-K. As noted above, that list would presumably include employee pay, training, benefits, and diversity; climate- and weather-related risks and impacts; financial stability matters; human rights-related risks; political spending; and tax strategies and risks.146 The SEC may also look to what other disclosure platforms and standard-setters—such as the GRI, CDP, SASB, and <IR>—have proscribed as being reasonable indicia of investor demand.

It would be important, however, for the SEC to remain flexible, monitor market developments, and make adjustments as appropriate—all with the goal to enhance the alignment of interests among investors, the long-term performance of companies, and the public. With other short-term pressures still present in the marketplace, careful attention to practical outcomes, as well as the interplay of disclosure, board stewardship, asset manager engagement, and shareholder voice—discussed below—will be important to achieve the desired goal of corporate long-termism.147

Flexibility would be aided were the SEC to experiment with a petition system whereby it would consider the appropriateness of a new disclosure topic based on a certain threshold of investor or other stakeholder interest. Doing so would encourage investors and other corporate stakeholders to weigh in with the SEC and may provide the SEC with better information on the gaps between what investors want and what companies give. These petitions could result in analysis and investor testing by SEC offices such as the Division of Economic and Risk Analysis and the Office of Investor Advocate, so as to prepare the ground for broader agency action.

The SEC should also enhance sectoral disclosure by updating its industry guides for relevant ESG matters. Additionally, the SEC should review disclosures that companies are required to make available through other government agencies and take steps to make them more accessible to investors.148 This could potentially be achieved by directing companies to incorporate the disclosures in their SEC filings.

A balance must also be struck between specificity, which can yield information that is more comparable across companies, and flexible approaches that elicit useful information across a range of circumstances. As such, the SEC should also adopt a catch-all mandate for ESG disclosure that, for example, could mandate that companies make quantitative and qualitative disclosures regarding factors that influence or threaten their long-term sustainability.149

In adopting line-item standards, the SEC should especially consider systemic impacts. This means expanding its focus from simply those items that have an impact upon a given company. Some topics may require looking at marketwide impacts, even if one company’s impacts may be relatively modest. This broader approach is important not only to align incentives marketwide, but also for investor protection. Today, investors are diversified and must attempt to evaluate systemic risks. Whether the issue is climate change, inequality, or diversity, there is a wide range of matters increasingly being recognized as systemic risks.

Ultimately, the cost to investors from attempting to collect this information in today’s environment is high; the costs to investors from failures to manage those risks is also high. The SEC should also remember that the cost to companies from disclosing activities or data that may have some impact upon ESG matters within their purview is relatively low.150 In addition, to support a marketwide approach, it may be time for the SEC to consider applying new ESG disclosure mandates to companies not yet publicly listed but which otherwise have reached a certain size, scope, or number of shareholders.151 This would address the rapidly growing universe of nonpublicly listed, but otherwise large and economically important, companies152 and would also be consistent with the SEC’s consideration of expanding access to nonpublicly listed companies to a greater range of potential shareholders.153

Look to expert, nongovernmental standards or standard-setters for ESG disclosure standards

The SEC has long retained direct control over its line-item corporate disclosure requirements. In certain areas, however, it has looked to external organizations for detailed regulatory expertise that it was not well-positioned to provide. The SEC has long relied on external accounting expertise to establish the accounting principles that form the backbone of financial disclosures.154 Over the years, Congress and the SEC have increased regulatory oversight of accounting standard-setting and boosted its independence from industry. 155 Yet, private-public-mixed standard-setting continues to function adequately and fills expertise gaps that would not necessarily be better met wholly within the SEC.

In 2003, the SEC again looked to this model with respect to standards for internal controls when it pointed to the framework set by the Committee of Sponsoring Organizations of the Treadway Commission, a private standard-setting initiative focused on reducing corporate fraud.156 As that private sector standard became increasingly recognized as high quality, the SEC, in adopting its own requirements to crack down on corporate fraud, required companies to use “a suitable, recognized control framework that is established by a body or group that has followed due-process procedures, including the broad distribution of the framework for public comment.”157

ESG information may offer a similar case for looking to an external standard-setting entity, subject to SEC oversight. ESG information extends beyond the areas of corporate financial reporting that the SEC has tended to know best. A public-private standard-setter may also be more flexible in integrating a range of viewpoints, including investors, management, other corporate stakeholders such as workers, and the public interest, especially if the entity is empowered with sufficient investigative authority. Such an entity might also be better able to navigate the evolving nature of companies and ESG concepts themselves, as innovative businesses create, and long-termism-focused investors identify, new ESG areas that need to be addressed.

The SEC might consider a step-by-step or mixed approach. For example, it could look to the SASB to apply its disclosure framework within the MD&A and/or as supplements to the SEC’s industry guides, even while the SEC itself directly set out line-item mandates applicable marketwide. It could also initiate a pilot project to apply <IR> to certain sectors or subsets of companies.

The SEC could also move companies to adopt these standards through the comment letter process or through enforcement—both further discussed below. The SASB and others assert that current law already requires the disclosure of ESG matters.158

Regardless, the SEC would need to set out both substantive requirements and process protections that it would expect a new standard-setter to cover. Moreover, it would need to be attentive to the risks of capture.159 Properly designed governance structures can help ensure a more responsive, public interest-oriented process.160 In particular, corporate and professional service providers that work for them should not wield an effective veto power over what investors and the public determine should be disclosed. Public accountability and transparency, such as through regular testimony before the SEC’s Investor Advisory Committee, are important protections against capture, as are stable funding sources free from special interest interference.161

Defend an investor-oriented, public-interest approach to the disclosure mandate

Materiality is frequently called the touchstone for what companies should be required to share under the federal securities laws, but the SEC’s disclosure authority is actually much broader.162, cited by U.S. Securities and Exchange Commission, “Comments on Concept Release,” p. 23 (“The Securities Act and the Exchange Act authorize the Commission to promulgate rules for registrant disclosure as necessary or appropriate in the public interest or for the protection of investors. The Commission has used this authority to require disclosure of information it believes is important to investors in both registration statements for public offerings and in ongoing reports.”); see also Williams, “The Securities and Exchange Commission and Corporate Social Transparency.” ] Yet, an unfortunate trend has been afoot not only to ignore the SEC’s broader disclosure authority, but also to twist materiality into being a disclosure standard that looks to a matter’s significance to the company financially, or otherwise provides the company overwhelming discretion regarding what to disclose.163 A troubling trend in disclosure requirements has been to insert a requirement that a matter need be found—for all practical purposes by management—to be “material” before being disclosed, with little transparency into how the company reached that materiality determination at all.164 That is unfortunate because the purpose of materiality as a disclosure standard is totally different: It is to examine whether information is important to a “reasonable investor.”165

Moreover, overreliance on management determinations of materiality makes the sufficiency of disclosure, as a practical matter, extraordinarily hard to review. As the GAO pointed out in its recent report, SEC staff reviewers, absent an enforcement action, are not well-positioned to have access to the information that management uses when it makes these sorts of determinations.166 Private investors are even less well-positioned.

It is important to recall the purposes of both that standard and the broader authorities of the federal securities laws. They exist because most investors, especially ordinary retail investors, would not otherwise be able to obtain the information they need to make good decisions to invest or manage their investments. Remembering this most basic purpose should help make clear why the SEC needs to resist twisting materiality into being something that it is not: a way of limiting disclosure on behalf of companies, to the detriment of marketwide comparability, rather than a way of examining whether disclosure is important to investors and the broader public interest, to the benefit of greater information availability.

Measuring or determining materiality is sometimes difficult. It is not a purely economic concept solely relating to the present-day or market-moving value of the firm’s securities.167 It is—and has long been—what investors and the public deem important in decisions that they may make, such as buying or selling stock; voting proxies; engaging the company; and working with stakeholders such as workers or communities.168 As a practical matter, this means that when the demand for information by investors and the public reaches a threshold, the issue becomes material for the purposes of disclosure.

Take corporate political spending; more than 1.2 million comments have been submitted to the SEC in support of requiring corporate political spending disclosure, including from retail and prominent institutional investors, workers and other corporate stakeholders, public interest groups, and many members of the general public.169 Also, investors have been winning numerous shareholder proposals on the topic, despite significant obstacles in their way.170 Yet, it is frequently critiqued as not material, owing to what is often portrayed as small amounts of spending for a large company.

But these investors are onto something. The lobbying behind the 2017 tax bill suggests that relatively small amounts of money for a company can make meaningful differences to a company’s and its executives’ pocketbooks.171 Not only does the SEC regularly requires disclosure regarding financial amounts or other information that is numerically small compared with the size of the company, but the SEC has even “long recognized that investors may well have an interest in matters beyond the issue’s direct relevance to the company’s profits and losses.”172 In short, materiality points to what investors want to know—for their own reasons, including simply in the public interest—and should not be used as a means for management, regulators, and courts to second-guess investors.

That does not mean, however, that management should have to guess what should be disclosed.173 Indeed, the SEC and the line item disclosures embedded in the original Securities Act of 1933 were put in place precisely to solve that problem: to stand in the place of investors and force the asking of clear, specific questions, via disclosure, that investors would ask of companies if they could do so themselves.

Update audit and data tagging standards to boost the availability and reliability of information

Auditing, whereby independent auditors check and opine on the reliability of management’s numbers, protects investors and markets by ensuring high-quality information. Currently, standards for auditing ESG information are less demanding than those for financial reporting, as they still operate under industry-set standards adopted on an interim basis by the PCAOB upon its creation in 2003.174 The PCAOB, with the encouragement of the SEC, needs to update its audit standards for ESG information and should take new steps toward enforcing it vigorously.

Through its oversight of board audit committees, the SEC should push audit committees to engage in the same level of oversight for ESG matters as for that of ordinary financial information. It should also require the adoption and disclosure of policies and procedures with respect thereto, as well as appropriate policies regarding committee composition—see also discussion regarding ESG and board membership below.175

The SEC should also require that data for all corporate filings, including ESG information, be provided to investors in a machine-readable—or “structured data”—format embedded directly in the disclosure document, known as Inline eXtensible Business Reporting Language (Inline XBRL) and subject to the same level of audit and accountability as any filing.176 This would be an extension of the SEC’s rule, finalized in 2018, that requires financial information be provided via Inline XBRL.177 Utilizing an Inline XBRL format reduces the cost to investors of accessing data and increases its reliability, as it promises to reduce the incidence of errors compared to when structured data is provided as a separate attachment.178

Empower SEC staff to be the voice of long-termism on behalf of investors and the public

Every day, the SEC staff are on the front lines of investor protection and corporate long-termism, and SEC Chairman Clayton was right to identify this as a key principle of the SEC’s work.179 One of the most important tools that could boost corporate long-termism are comment letters issued by the Division of Corporate Finance to companies on their disclosure filings. The division does this to boost the consistency and quality of corporate reporting and compliance with Regulation S-K, short of having to bring an enforcement action. The practice of issuing comment letters has waxed and waned, especially on particular matters, and the drop-off in comment letters on climate disclosure has been blamed, in part, for the ineffectiveness of the SEC’s 2010 climate guide.180 A more consistent application of comment letters with respect to ESG would help minimize uncertainty for companies on how to comply with current legal requirements for disclosure and would be a cost-efficient, targeted approach to enhance long-term-oriented disclosure.

To help the division do this, the SEC should boost staff training on ESG and other long-termism matters and expand the use of externally sourced technical experts. Given the availability of technical expertise across the federal government, it seems hard to understand why the SEC does not already have a robust program for staff training and the utilization of technical expertise on a range of topics.

Bring clear, bold enforcement actions and support similar actions by states and private investors

Enforcement is the foundation of compliance with the federal securities laws and accountability to the public. By failing to bring any meaningful enforcement cases on ESG disclosures, the SEC has been sending a signal for years that ESG disclosures and the corporate long-termism they drive are not regulatory priorities.

This is something that the SEC can change right now. The SEC should bring targeted enforcement cases using its current authority to support the states and private investors that, as discussed above, have already begun to act.

Moreover, it is critical that the role of private enforcement of the securities laws be respected and supported, as the health and reliability of capital markets depends upon them. To ensure that public interest attorneys and individual plaintiffs can continue to play a constructive role in enhancing disclosure, the SEC should resist efforts at the federal or state level to curtail or undermine investor access to courts or to class actions.181 Moreover, the SEC and courts should vigorously resist the inappropriate use of freedom of speech arguments to shut off legitimate investigations and enforcement actions related to companies’ failure to disclose known risks.182

Boost board attention to corporate long-termism and sustainability

The thesis of this report is that mandatory ESG disclosure can enable private market forces to help align the interests of corporate management with the long-term interests of investors and the public. But as prominent lawyer Martin Lipton has argued for years and most recently set out for the World Economic Forum, corporate boards are places where the rubber can meet the road in establishing a corporate long-termism culture and supporting that with the appropriate incentives.183 To make that happen, boards should boost expertise, attention, and accountability to long-termism generally and ESG specifically.

Research has shown that board attention yields results, finding for example that a higher level of independent directors and other forms of board focus result in less fraud and more voluntary disclosure.184 Research has also noted that independent directors have been associated with greater focus on shareholder interests, as opposed to other corporate priorities.185 Attention and composition thus both matter.

Board membership is a useful starting place for boosting board attention to ESG. Investors have for years sought to boost board diversity, both itself an ESG goal as well as a tool for advancing long-termism more broadly. Led by the New York City comptroller, investors have been calling for disclosure to help them evaluate board diversity.186 A bipartisan Senate bill also called for specific disclosure regarding cybersecurity expertise on the board.187 Sen. Elizabeth Warren (D-MA) recently put forward a bill to make corporate governance accountable to stakeholder interests and to require that worker representatives make up at least 40 percent of board membership.188 More broadly, the benefit corporation movement, by adding a public purpose to the company charter, has deployed state fiduciary duty law to encourage boards be more attentive to the long-term public interest.189

The SEC should advance long-termism by building upon these proposals. It should mandate disclosure of the expertise, experiences, and attributes of board members across a wide cross section of ESG issues. In addition to the disclosure of the gender, racial, and ethnic diversity of the board members and candidates, it should also require disclosure of their ESG-relevant skills and expertise. The board should also be charged with explaining how it is incorporating the views of workers, communities, and other major stakeholders, including both retail and long-term investors, in the corporation’s governance, as well as how it is achieving its long-term-oriented goals. The SEC should explore ways to promote best practices on board attention to ESG-related matters and stakeholders—including, as noted above, with respect to audit committee oversight.

Such a proposal, in part, would not be so different from the direction the United Kingdom is going in its corporate governance code. Following a spate of corporate scandals in the last year, the United Kingdom’s revised corporate governance code, effective January 2019, directs boards to explain their approach to the long-term interests of the company as mandated in the code.190 Other U.K. actions underway may include the implementation of parliamentary and regulatory recommendations calling for companies to appoint more diverse boards, including workers, and to convene stakeholder advisory councils.191

It’s worth noting that the shareholder proposal process under Rule 14a-8, described above, has long been a useful tool to get management and boards to focus on long-termism and ESG matters, in particular from a risk management perspective. The SEC issued a staff bulletin in 2017 that increases board involvement in the process. Thus, when a board requests the SEC to permit the company to exclude a proposal from the proxy, the board must explain its views on the matter. Boards will have to be attentive to the range of long-term-oriented proposals that ESG-oriented shareholders put forward and maintain policies, procedures, and processes for thinking through them appropriately.192 This should be a priority for SEC engagement with companies and, as appropriate, enforcement. At the same time, it highlights the importance of countering the series of one-sided attacks on shareholder voice, discussed below, on the ability of investors to offer Rule 14a-8 proposals,193 and on how and with whom investors freely choose to consult for those and other votes, which are discussed next.194

Boost shareholder voice in favor of ESG and long-termism

If there is one concept that unifies the diverse voices at the SEC, it is that shareholders are the core pillars of the corporation and hence the capital markets.195 And indeed, the thesis of this paper is that shareholders bear the primary risks that insufficient ESG disclosure has created. Both federal securities law and state corporate law, of course, reserve pre-eminent roles for shareholders in the exercise of corporate governance. While much of this paper seeks to look beyond the debate about how corporate governance changes could promote corporate long-termism, it cannot completely ignore the role that shareholders play in being able to advance their own interests in ESG disclosure.

It is essential that shareholders retain robust rights to utilize shareholder proposals and to obtain the independent governance advice of their own choosing. Efforts to shut down or significantly constrain those tools would thwart the private market give-and-take between shareholders and management embodied in so-called shareholder democracy that, to date, has enabled important advances on a wide range of ESG issues—not the least of which is the “G” for governance.196 To the extent that corporate executives feel frustrated by the time and attention they have to spend on proxy matters, they would be well-served to remember the even greater cost associated with financial and reputational losses that can be prevented by shareholder engagement.197 Moreover, in a world that increasingly values crowdsourcing and more radical approaches to transparency, more rather than less reliance on diverse shareholder data points may well be a wiser approach to risk management and the identification of new opportunities.198

But shareholder voice, especially at the retail level, is today overwhelmingly mediated by the mutual funds in which more than 100 million Americans, or 45 percent of U.S. households, put their money, and the asset managers that advise those funds.199 To that end, millions of working Americans are “forced capitalists,” locked into the market in a small selection of 401(k)s or a pension fund for the long run.200 Fortunately, asset managers are fiduciaries to their funds and, ultimately, to its investors. Asset managers, as such, are positioned to take a longer-term view. What that exactly means, though, may vary greatly. Some funds are focused on particular sectors with sustainability mandates or have become widely known to engage on ESG matters.201 As noted above, engagement refers to where an investor works with management to address concerns, rather than selling a stock or taking some other formal action. Other asset managers do not engage on ESG matters or simply follow companies’ management for important shareholder votes.202

This should change. In 2003, the SEC required mutual funds to disclose how they vote their proxies after the fact.203 Now, the SEC should require mutual funds to disclose their policies and approach to ESG matters more broadly, including describing how they approach voting and engagement.204 Moreover, any mutual fund handling long-term investments, such as college savings or retirement funds, should disclose how their voting and engagement are calibrated toward the long-term horizons of their owners.205 Similar attention should also be paid to whether boosting ESG disclosure could support greater long-term orientation for private funds—hedge funds and private equity funds.

The SEC should also explore ways to better align asset managers’ proxy votes with the views of their underlying mutual fund investors that desire greater long-termism. One tool may be to address the problem of abstentions being counted as votes against an ESG resolution.206 Another option may be to provide mutual fund investors with greater choice in having their asset manager vote a proportional amount of the funds’ proxies along ESG lines.207

Broadly speaking, an increasing amount of attention is being paid to the impact that asset managers, especially index funds, are having on companies, their governance, and broader impacts. Some scholars have questioned the ability and incentives of asset managers to fully and properly conduct engagement initiatives across the public markets.208 Others disagree and point to how index funds, through engagement and other means, compete meaningfully with actively managed funds.209 In a separate debate, some have highlighted the correlation—although not yet causation—between index fund ownership and monopoly power in concentrated sectors.210 The point relevant here is that long-term oriented engagement by asset managers with substantial shareholder heft is a welcome addition to the markets and to corporate governance generally—and should be encouraged.211

Ultimately, shareholder voice and engagement are still concepts and practices in flux, and SEC Chairman Clayton is right to highlight the range of real policy tensions that exist in these areas and to convene a roundtable to explore these questions, among others.212

Conclusion

From worker training to climate change-related information and beyond, insufficient transparency in the capital markets is failing investors, companies, and the public’s long-term interests. As environmental, social, and governance (ESG) issues continue to have more frequent and significant impacts on businesses, the economy, and society, it becomes imperative that the required disclosures of publicly listed companies give an honest assessment about the risks and opportunities that corporations and markets face. Ultimately, by improving the transparency, consistency, and quality of ESG information and company engagement with ESG matters overall, the SEC can better meet its mission of ensuring investors are better protected, markets are fair, capital is effectively allocated, and the public interest is served.

Acknowledgments

The authors wish to acknowledge Carl Chancellor, Gregg Gelzinis, Galen Hendricks, Irene Hong, and Shanée Simhoni for their contributions to this report, and especially Tyler Gellasch for contributing early drafting support. The authors also wish to acknowledge helpful feedback from a wide range of experts.

About the authors