After years of hysterical warnings about budget deficits under former President Barack Obama, Republican congressional leaders suddenly seem to have shed their concern for the deficit. In The Atlantic, Russell Berman questions whether “deficits still matter to Republicans” under President Donald Trump.1

While this changing approach to budget deficits is certainly hypocritical, it continues a consistent pattern of selectively using fiscal hysteria as a weapon to attack programs for low- and middle-income Americans. A recent article by this author for Harvard Law and Policy Review defines fiscal hysteria as “exaggerating the impacts of deficits and debt, thereby underestimating the extent to which the United States can afford to solve problems facing the American people.”2 While fiscal hysteria does not actually lead to sustainable fiscal policy—since it tends to be deployed selectively for political gain—it does lead to policies that enrich those at the top at the expense of everyone else.3

The upcoming debate over the budget resolution for fiscal year 2018 will test whether hypocritical fiscal hysteria works to sell an unpopular agenda to lawmakers, the media, and the public. While this budget will likely include false claims that a looming fiscal crisis forces Congress to cut programs for working families, another motivation for passing this budget appears to be tax cuts for the wealthiest Americans.4

The empty rhetoric of hypocritical fiscal hysteria can be debunked by exposing the reality of the policy agenda behind that rhetoric. But even when fiscal hysteria is expressed consistently instead of hypocritically, it still exaggerates fiscal problems in ways that enable those who would use fiscal hysteria hypocritically as a political weapon. Instead of indulging fiscal hysteria, the federal budget should be assessed with a clear-eyed understanding of the underlying fiscal strength of the United States.

The sudden disappearance of fiscal hysteria

The House Republican budget warned of a “looming fiscal crisis” when Obama was president, but now Speaker of the House Paul Ryan (R-WI) will not even commit to preventing further increases in the budget deficit as a result of passing his party’s agenda.5 After years of insisting on balanced budgets, the congressional majority made no attempt to balance the budget in the budget resolution they ultimately passed for FY 2017, which laid the procedural groundwork for repeal of the Affordable Care Act (ACA).6 Instead, the budget adopts the spending and revenue levels projected under current law—the same projections that were supposed to lead to a fiscal crisis under President Obama.

In 2015, when Obama was president, the Republican-controlled Congress passed a budget resolution that created a fiscal rule against legislation that increases deficits.7 But the FY 2017 budget resolution waives that rule for ACA repeal.8 Sen. Rand Paul (R-KY) voted against the FY 2017 budget resolution due to its deficits, but it still passed with the support of every other Republican senator.9

Tax cuts for the wealthy are—by far—the biggest budget busters on the agenda. According to the nonpartisan Tax Policy Center, the tax plans proposed by President Trump and House Republican leaders would both cost several trillion dollars over a 10-year period and disproportionately benefit the highest-earning 1 percent of Americans.10 The House Republican plan is particularly skewed towards the wealthy, with the top 1 percent receiving an eye-popping 99.6 percent of the benefit once it is fully implemented in 2025.11

Fiscal hysteria is a political weapon

While Congress may not care about budget deficits when it comes to cutting taxes for the wealthy, this does not mean that fiscal hysteria is gone forever. After Congress finishes debating whether to take health insurance from tens of millions of Americans, expect fiscal hysteria to come roaring back as Congress looks to cut the budgets of everything else, such as Social Security, student loans, nutrition assistance, and affordable housing.12

The first version of the FY 2017 House Republican budget—written before the final version that was only passed to repeal the ACA—advocated trillions of dollars in spending cuts.13 The budget did not raise any new revenue from the wealthy or corporations, and 62 percent of its cuts hit programs for low- and moderate-income Americans.14 This budget advocated turning Medicare into a voucher program and making especially large cuts to Medicaid and nutrition assistance.

Fiscal hysteria was the tool to sell these unpopular cuts to the American people. The phrase “fiscal crisis” appears several times in the House Budget Committee’s paper advocating these cuts.15 The paper whips up fear of a fiscal crisis because the policies it advocates are extremely unpopular. A 2012 survey found that only 19 percent of the public supported similar cuts in an earlier budget authored by Rep. Ryan.16 In 2011, President Trump said the Ryan budget was “political suicide for the Republican Party.”17

House Republican leaders appear poised to revive their plans for massive program cuts in an upcoming budget resolution for FY 2018.18 The only way to sell these cuts to the American people will be to use fiscal hysteria to claim that massive cuts are the only way to avoid a crisis.

Spotting phony fiscal hysteria

The FY 2018 budget resolution should be evaluated based on the actual policies it is enabling—and who benefits and suffers from those policies—rather than taking the rhetoric that will be used to sell the budget at face value. Even though the FY 2018 budget resolution will likely be full of fiscal hysteria when it comes to cutting programs for working families, it appears that this budget will also pave the way for deficit-increasing tax cuts for the wealthy.19 To pass a tax bill along party lines with 50 votes in the Senate—instead of the typical 60 vote threshold—Congress must first pass a budget resolution with reconciliation instructions for that tax bill.

Speaker Ryan and other congressional leaders claim that they support a revenue-neutral tax reform that repeals tax breaks to pay for lower tax rates, but their other statements make clear that this is a nearly meaningless commitment.20 These lawmakers are using egregious budget gimmicks to falsely claim that their massive tax cuts are revenue neutral.21

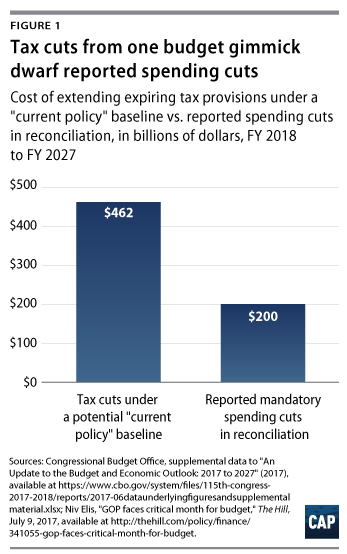

One major gimmick in the House Republican tax plan is the so-called “current policy” baseline, which they are using to claim that cutting taxes by more than $400 billion over 10 years is still revenue neutral.22 This current policy baseline assumes that lawmakers will permanently extend tax breaks scheduled to expire under current law, which reduces the overall level of revenues that a tax plan would need to raise to be considered revenue neutral under this new baseline. By comparison, House Republican leaders are currently considering reconciliation instructions to cut programs for working families by $200 billion over 10 years, which is less than half the amount that the current policy budget gimmick will enable in tax cuts.23

The FY 2018 budget resolution could pave the way for much larger cuts to programs for working families, but these will be used to cut taxes for the wealthy rather than to reduce deficits. Rather than including a reconciliation instruction for revenue-neutral tax reform, the reconciliation instruction could instead say deficit-neutral tax reform. While a revenue-neutral reconciliation instruction means that tax cuts must be financed by other provisions that increase tax revenues—such as closing tax loopholes—deficit-neutral means that spending cuts could be used to finance tax cuts. A deficit-neutral reconciliation instruction opens the door to potentially unlimited spending cuts to pay for tax cuts.

In January 2017, Howard Gleckman of the Tax Policy Center speculated that Congress will eventually give up on the hard choices of tax reform, and instead simply pass tax cuts.24 Indeed, Rep. Mark Meadows (R-NC), chairman of the ultraconservative House Freedom Caucus, is pushing for deficit-increasing tax cuts.25

There appears to be increasing support within the Trump administration and among congressional Republicans for using a particularly egregious budget gimmick to pass tax cuts that are technically temporary but last for 20 years or more.26 The rules for reconciliation prohibit increasing deficits in years that are outside the period covered by the budget resolution.27 The gimmick is to sunset the entire package after the budget resolution ends, and then after passing the tax cuts, push to make them permanent to prevent a tax increase when they expire as scheduled.

Congress passed tax cuts under former President George W. Bush using the same budget gimmick, but this would be even more egregious. While the Bush tax cuts were originally scheduled to expire after 10 years—which is currently the normal period for a budget resolution—Sen. Pat Toomey (R-PA) and others advocate lengthening the budget resolution to cover a longer period such as 20 years to make the temporary nature of their tax cuts even more of a fiction.28

And in the end, Congress may even ignore its own budget to pass tax cuts for the wealthy. The House of Representatives did this in an attempt to repeal the estate tax in 2015. First, the House passed a budget that called for maintaining federal revenues at the same levels as current law.29 The report for this budget stressed that it was a balanced budget—an accomplishment which it grandly described as a “vision of governing, and of America itself.”30 But this vision was immediately discarded when the House passed estate tax repeal legislation that cost $269 billion over 10 years, thus reducing revenues below the levels in the House budget resolution.31

Speaker Ryan is a master at co-opting anti-deficit rhetoric to advance his agenda without being held accountable for the fiscal reality of the policies he supports. When George W. Bush was president, Rep. Ryan voted for tax cuts in 2001 and 2003, wars in Iraq and Afghanistan, and a Medicare prescription drug benefit.32 Lawmakers did not pay for any of these policies. During the Bush administration, large budget surpluses turned into deficits.33 Despite this history, the conventional wisdom has been that Speaker Ryan is a “budget hawk,” and that was how the Ryan budget was marketed to the American people.34

Fiscal hysteria is wrong on the facts

Even when fiscal hysteria is expressed consistently and sincerely, it exaggerates the nation’s fiscal challenges in ways that play into the hands of President Trump and his allies in Congress. As economist Jared Bernstein says, “Deficit hysteria — often promulgated by those who are happy to cut taxes without making up the revenue loss — has become a stalking horse for shrinking government under the guise of fiscal rectitude.”35 Fiscal hysteria obscures the fact that the United States can support and expand its commitments and investments in working families, if lawmakers choose to do so.

Despite claims to the contrary during the Obama administration, the United States is not “broke.”36 Investors would not accept the current low interest rates on U.S. Treasury bonds if they were at all concerned about a looming fiscal crisis.37

The United States has more than enough economic capacity to support existing programs such as Social Security and make new investments to strengthen and grow the middle class. In 2015, the Center for American Progress proposed a budget that would expand Social Security, invest $1 trillion in infrastructure, provide paid family leave, and support affordable college for all students.38 The plan did all this and more while significantly reducing the national debt as a share of the economy over the long term, primarily by ensuring that the wealthiest Americans pay their fair share of taxes and building on the successful work of the ACA to control health care costs.

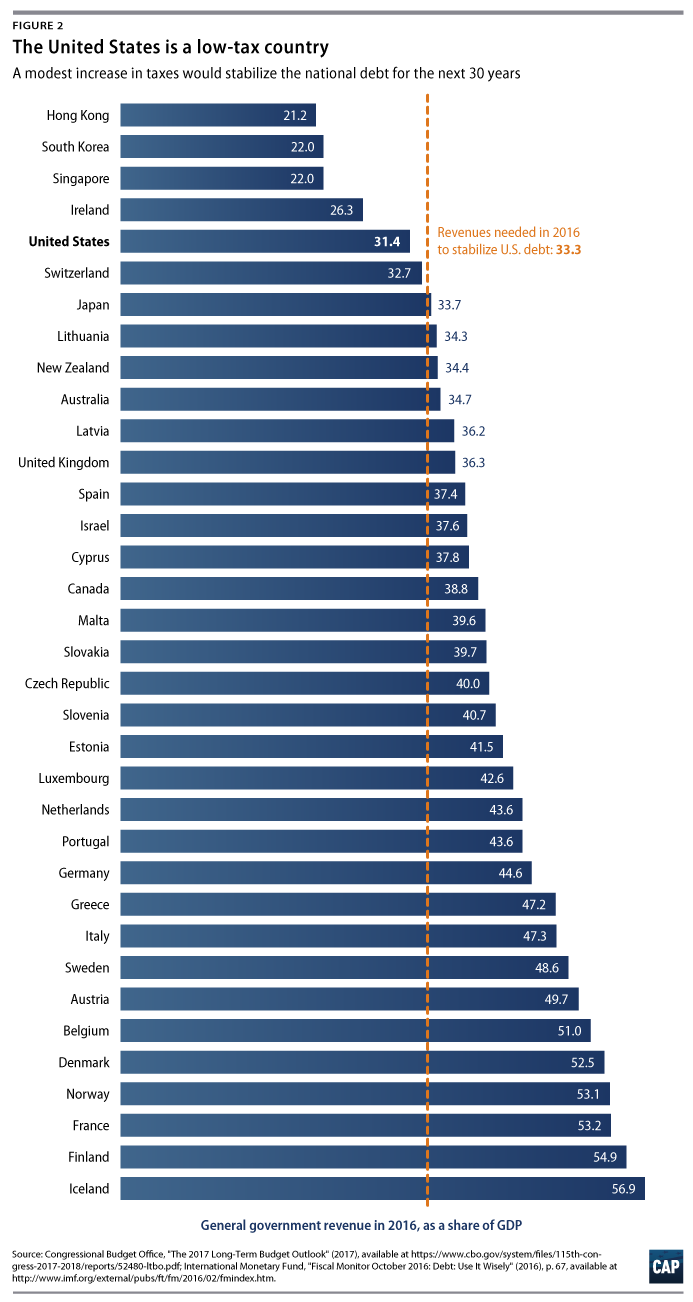

According to the International Monetary Fund, the United States currently has the fifth-lowest tax burden among 35 advanced economies.39 This includes federal, state, and local taxes. Even if the federal government stabilized the debt as a share of the economy over the long term using only tax increases, the United States would still have the sixth-lowest tax burden among advanced economies.40 There is no fiscal imperative that forces lawmakers to dramatically scale back Social Security, Medicare, Medicaid, or other programs for low- and middle-income Americans.

Conclusion

The FY 2018 budget resolution will not be about deficit reduction, despite the likely rhetoric about a looming fiscal crisis. That rhetoric will only be used to justify cuts to programs that the authors of the budget resolution want to cut anyway. Hypocritical fiscal hysteria will not stand in the way of tax cuts for the wealthy.

If the authors of the FY 2018 congressional budget resolution claim that a fiscal crisis compels them to propose massive cuts to programs that provide health care, disability benefits, and nutrition assistance to working families, then they should be asked whether this alleged fiscal crisis also requires any new revenues from the wealthiest Americans or the largest corporations. If lawmakers really believe that there is a looming fiscal crisis, then why are tax cuts for the wealthy and corporations even on the table? Instead of repeating the empty rhetoric of the budget resolution, the focus should be on the actual policies it enables using reconciliation—and any budget gimmicks that smooth the way for those policies.

At the core of the budget debate—and tax reform—is the question of who wins and who loses. Fiscal hysteria avoids that debate with false claims about a looming debt crisis, and it obscures an agenda that takes resources away from low- and middle-income Americans and gives them to those at the top.

Politicians use fiscal hysteria because it works. Until fiscal hysteria stops working, it will continue to help the rich get richer at everyone else’s expense.

Harry Stein is the director of fiscal policy at the Center for American Progress.