This report contains a correction.

Introduction and summary

During his campaign, Donald Trump promised a near-dismantling of the Dodd-Frank Act, the core piece of financial reform legislation enacted following the 2007-2008 financial crisis.1 He doubled down on that promise once in office, vowing to both “do a big number” on and give “a very major haircut” to Dodd-Frank.2 In early February, he took the first step in fulfilling this dangerous promise by signing an executive order directing U.S. Secretary of the Treasury Steve Mnuchin to conduct a review of Dodd-Frank.3 Per the executive order, Secretary Mnuchin will present the findings in early June.4 While the country waits for President Trump’s plan, it is useful to analyze one prominent way Trump and Congress might choose to gut financial reform—through the Financial CHOICE Act, or FCA.5

Introduced in the last Congress by U.S. House of Representatives Financial Services Committee Chairman Jeb Hensarling (R-TX) and expected to be reintroduced in the coming weeks, the Financial CHOICE Act offers a blueprint for how Trump might view these issues. During the presidential campaign, Rep. Hensarling briefed Trump on his ideas regarding financial deregulation and was reportedly on Trump’s short list for treasury secretary.6 The FCA would deregulate the financial industry and put the U.S. economy in the same perilous position it was in right before the 2007–2008 financial crisis. The precrisis regime of weak regulation and little oversight created an environment of unchecked financial sector risk and widespread predatory consumer practices, which precipitated the Great Recession and brought the U.S. economy to the brink of collapse. And the argument repeated by President Trump and other advocates of financial deregulatory proposals—that bank lending has been crushed under the weight of financial regulations over the past six years—has been thoroughly debunked by bank lending data.7

Before delving into the specifics of the Financial CHOICE Act, it is helpful to put Rep. Hensarling’s deregulatory efforts in context. To justify dismantling financial reform, President Trump and his congressional allies know that they must outline a problem. President Trump argues that the main problem with financial reform is bank lending. He believes that banks are not making enough loans due to the burdens of Dodd-Frank. What is his evidence? Nothing more than anecdotal remarks that his friends cannot get loans.8 As Figure 1 demonstrates, a lack of loans is simply not the case. Overall lending and business lending in particular, has increased significantly since the financial crisis and the passage of Dodd-Frank. Moreover, credit card lending, auto lending, and mortgage lending have increased since 2010, when Dodd-Frank was passed.9 Bank profits are also higher than ever.10

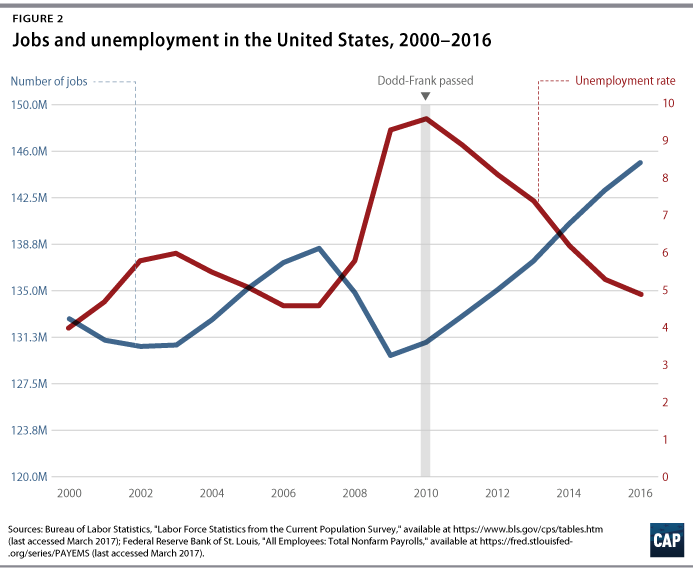

Chairman Hensarling makes similar arguments about the perceived unavailability of credit, adding that financial reform has not encouraged economic growth and has hurt community banks.11 Again, the data contradict these charges. Figure 2 highlights the steady economic growth the country experienced under President Barack Obama. And while the scars of the devastating Great Recession remain, the financial reforms put in place to prevent the recurrence of exactly that kind of economic catastrophe have not damaged growth. Indeed, since the end of the financial crisis and the passage of Dodd-Frank, community bank lending and profitability are both up.12 It is fair to say that the number of community banks has declined over time. This trend, however, started in the 1980s and is caused by economies of scale, technology, and long-running trends toward banking deregulation, as well as other factors—not the 2010 passage of the Dodd-Frank Act.13

Hensarling presents his approach as a moderate adjustment to Dodd-Frank, but in reality it is a thorough demolition of financial reform. This report analyzes how Hensarling’s approach erodes the financial stability safeguards that the real economy needs to thrive, from mitigation of systemic risk to financial sector accountability and consumer protection. It also explains how the bill further concentrates—and makes even more unaccountable—economic power in the hands of those that will serve their own interests at the expense of the real economy. Finally, this report details how the FCA eliminates the consumer and investor protections that guard against the predatory financial practices that wreaked havoc on consumers and investors prior to the financial crisis.

It is necessary to note that just about every provision in this report could fit under the rubric of financial stability safeguards. For example, consumer financial protection protects ordinary consumers from abuses and the broader financial system from the proliferation of dangerous consumer loans that can bring down entire firms and markets. Similarly, the Volcker Rule is a key bulwark against the high-risk bets that brought down major firms in 2008, and yet it also aims to reorient large bank trading toward real economy-serving purposes. That this report discusses certain provisions under one section rather than another should not be taken as a substantive comment on the merit or usefulness of the provision to financial stability. The report’s different sections reflect an effort to highlight how the Dodd-Frank Act and financial reform yield a broad array of public benefits. Similarly, this report highlights examples of broader themes in the FCA rather than focusing on minute details: Failure to discuss any particular provision should not be read as a substantive judgment regarding its relative merits.

This report is based on the version of the Financial CHOICE Act released in September 2016, as well as a memo outlining this year’s planned changes to that version.14 A new version, which may have some further modifications, is expected to be released in the coming weeks.

Financial reform enacted through the Dodd-Frank Act has made a lot of necessary progress since the crisis. U.S. banks have more substantial loss-absorbing capital cushions, increasingly rely on stable sources of funding, undergo rigorous stress testing, and plan for their orderly failure. President Trump’s intent to dismantle these reforms only helps Wall Street’s bottom line—ignoring the memory of every family who lost their home, every worker who lost his or her job, and every consumer who was peddled a toxic financial product.15

The question remains: What is the problem President Trump and his allies in Congress are trying to solve? Lending is up. Bank profits are up. Consumer credit costs are down. The economy is steadily improving. Yes, much more needs to be done to make the economy work for hard-working Americans, but financial deregulation is not the path to that end.16 In fact, it is a path toward exactly the opposite: booms and busts that leave taxpayers holding the bag for Wall Street’s excesses, greater concentration of economic power and less accountability for wrongdoing that harms ordinary consumers and investors, and major changes to financial regulation and monetary policy that would damage the real economy. Now that is a problem.

A return to financial instability that threatens the economy

Chairman Hensarling’s Financial CHOICE Act would take a sledgehammer to the vital financial stability reforms established by the Dodd-Frank Wall Street Reform and Consumer Protection Act.17 Enacted in 2010 following the financial crisis, this law represents the most significant financial sector regulatory reform effort since the Great Depression. Each prong of Dodd-Frank’s financial stability reforms is directly related to clear and unmistakable lessons learned in the financial crisis. The desire to roll back these reforms demonstrates a willful ignorance of those very lessons at best and a malicious disregard at worst. It is clear, however, what the end result of the FCA’s deregulatory efforts would be: returning the financial sector to its boom-and-bust ways at the expense of middle- and lower-class families and workers, as well as the financial stability that the U.S. economy needs to function. It is essential to remember that the financial crisis of 2007 and 2008 single-handedly destroyed 8.7 million jobs, sent the national unemployment rate to 10 percent, and eliminated 49 percent of the average middle class family’s wealth compared with 2001 levels.18

The Financial CHOICE Act prescribes a wide range of steps that would jeopardize U.S. financial stability, including:

- Bank deregulation: The FCA allows banks of all sizes to opt out of the vital enhanced prudential standards mandated by the Dodd-Frank Act, such as living wills, liquidity standards, and stress testing, as long as they maintain a 10 percent leverage ratio, a far from sufficient level of capital to justify such drastic deregulation.

- Systemic risk deregulation: The bill repeals the Financial Stability Oversight Council’s, or FSOC’s, ability to plug the holes in financial regulation that invariably emerge over time as companies and markets evolve. The FCA eliminates the process for designating nonbank financial companies—such as American International Group Inc., or AIG—as systemically important, eviscerates FSOC’s budget, ties up its processes, and prevents it from breaking up financial institutions that pose a grave threat to financial stability.

- Fewer orderly shutdowns and more bailouts: The bill also repeals the Orderly Liquidation Authority, or OLA, the legal authority that allows regulators to shut down large, complex banks in an orderly manner, without resorting to a taxpayer bailout.

- Derivatives deregulation: The bill repeals FSOC’s authority to designate financial market utilities as systemically important.

- Willful blindness on insurance: The FCA also merges the Federal Insurance Office with FSOC’s Office of the Independent Member with Insurance Expertise to create a severely weakened insurance office.

Cost of the crisis

Thanks to the reckless practices and lax oversight of Wall Street’s largest financial firms, the American people lost 8.7 million jobs, households lost at least $19 trillion in wealth, and almost 10 million households lost their homes as a direct result of the financial crisis.19 Additionally, the real wealth of the average middle class family collapsed between 2007 and 2010, falling nearly $100,000, or 52 percent.20 America’s families were not bailed out. They suffered.

The same cannot be said about Wall Street. Many of the massive financial institutions that caused the crisis were bailed out with trillions of dollars in loans, stock purchases, and guarantees from the federal government.21

Bank deregulation

Under the FCA, even the largest of banks can choose to opt out of some of the most important provisions in the Dodd-Frank Act, namely the enhanced prudential standards mandated by Section 165. If the bank maintains a 10 percent quarterly leverage ratio—which is only a modest increase from the 6 percent to 8 percent leverage ratios the big banks maintain today—then it can choose to opt out of: 1) risk-based capital requirements; 2) liquidity requirements; 3) risk management standards that improve banks’ own internal risk frameworks; 4) resolution plans, also known as living wills, that outline how the bank can be wound down without a bailout if it fails; 5) credit-exposure reporting requirements that help regulators understand how interconnected firms are with the broader financial sector; 6) concentration limits to prevent a bank from becoming too connected to other financial companies; 7) contingent capital requirements that enable the conversion of debt to equity during financial stress to help avoid bailouts; 8) short-term debt limits to prevent banks from loading up on debt that could run during a time of stress; and 9) enhanced public disclosures that help the market better evaluate the health of firms and the competence of management.22

While some financial reformers have argued vigorously for a more aggressive leverage ratio—that is, a higher level of loss-absorbing common equity, as opposed to debt, relative to the total size of the bank—the FCA’s approach is unfortunately a sham. The big banks currently maintain equity funding that puts them within striking distance of a 10 percent leverage ratio. But research suggests that the socially optimal leverage ratio—the amount of loss-absorbing equity that a bank would need to be able to withstand losses without shutting down lending, getting a bailout, or engaging in other socially problematic outcomes—is significantly higher than that.23 It is also unclear how exactly the FCA’s leverage ratio will be calculated—leaving open the possibility that Trump-appointed regulators will use more lenient measures that do not adequately account for many of the off-balance sheet exposures that tore down the financial system during the last financial crisis. Moreover, if an institution that opted out of these vital safety and soundness requirements fell below the 10 percent quarterly leverage ratio, it would have a full year to raise its quarterly leverage ratio back to 10 percent. It would be quite easy for a bank to fluctuate above and below the threshold, restarting the twelve-month clock over and over—gaming the system as they so choose.

But even if bank capital was closer to what they would really need in a crisis, there are other important anti-bailout protections in this important suite of tools. Giving Wall Street the choice to exempt themselves from these enhanced standards would leave multitrillion dollar banks without a solid first line of defense against real world shocks and financial sector mistakes that inevitably will arise. In doing so, the bill puts Main Street jobs and economic growth squarely at risk and puts taxpayers squarely back on the first line of defense.

For example, scrapping risk-based capital in favor of a modest leverage ratio incentivizes banks to load up on riskier assets to maximize profit, as they would no longer be constrained by the risk weighting approach of the Basel III international regulatory framework. Banks would also be exempt from important liquidity rules such as the Liquidity Coverage Ratio and the Net Stable Funding Ratio.24 The former ensures that big banks hold enough liquid assets, such as Treasuries, that they can turn into cash quickly to meet their obligations for a full month during a time of market stress, and the latter makes sure that banks are not relying too heavily on short-term debt, which is less stable and can run during a crisis.

Eliminating these crucial rules disregards some of the most important lessons learned during the financial crisis. Indeed, banks with decent capital positions could be holding risky illiquid assets funded by short-term debt. If the market seizes up and the banks’ short term creditors do not roll over the debt, the bank may all of a sudden be unable to keep itself afloat as it struggles to turn its risky assets into cash to meet its obligations. Struggling to turn the illiquid assets into cash, banks may take massive write-downs as they sell the assets at “fire sale” prices, those well below their real worth, which in turn forces others holding the same assets to take a loss on those assets.25 This type of fire sale was one of the most dangerous negative feedback loops that turned 2008 from a U.S. mortgage and foreclosure crisis into a global financial near-meltdown.

Another first line of defense that the FCA puts on the chopping block is the stress testing that regulators apply to the largest banks every year.26 Regulators test the balance sheets of big banks to make sure they can withstand a severe market downturn without failing and potentially sparking a financial crisis. If a big bank does not pass stress testing, it may be restricted in how much it can return to its shareholders in dividends. The stress tests are particularly useful because they both allow and force regulators to adapt to evolving market conditions and to prevent banks from using window dressing or financial engineering to disguise risk.27 This makes them an important line of defense in addition to capital levels, which are set by regulation.

As if the opt-out were not enough, banks that do not opt out of the Dodd-Frank regulations would undergo severely watered down stress testing.28 Wall Street would love these changes because banks would be able to pay more dividends to their shareholders every year. But those payouts would not take into account whether the money was coming directly at the expense of U.S. financial stability.

Systemic risk deregulation

The FCA also eviscerates the authority and funding of the Financial Stability Oversight Council, a core innovation of financial reform.29 A key lesson from the financial crisis was that there were distinct regulatory blind spots. Regulators did not adequately communicate with one another, and no one regulatory body was tasked with looking at systemic risk across the financial system. FSOC was created to fill in this regulatory gap that had proven so costly during the crisis. It not only serves as a forum for all of the financial regulators to meet, share information across jurisdictions, and discuss risks to U.S. financial stability, but importantly, it has tools to close regulatory gaps in coverage.

In its investigative capacity, FSOC has done excellent work to examine potential systemic risk posed by the asset management industry broadly, as well as hedge funds specifically.30 It has also made significant progress as a practical tool for getting the diverse regulatory agencies to work together. If anything, policymakers should consider strengthening FSOC’s ability to coordinate among regulators and ensure rulemakings are fully implemented.

In order to give FSOC the data and research capacity necessary to successfully execute this much-needed role, Dodd-Frank created the Office of Financial Research, or OFR.31 The OFR uses a data-driven approach to help FSOC analyze and evaluate potential risks to financial stability. Like FSOC, the OFR brings together thinking and analytics from across markets, enabling it to bridge analytic gaps. The OFR has also played an important role domestically and internationally in bringing regulators into the data age, pushing the use of uniform legal entity identifiers for corporations and other uniform product and transaction identifiers. Data-driven standardization was sorely lacking prior to the financial crisis, meaning that both regulators and market participants were unable to spot the build-up of dangerous risks across or even within complex financial firms. The FCA eliminates the OFR without even attempting to justify the action.

Critically, FSOC was designed not to just be a convening mechanism but also to have the authority to actually plug holes in regulation. The most important of these tools is its ability to designate for Federal Reserve Board supervision those nonbank financial companies, such as insurance companies or hedge funds, that may threaten U.S. financial stability. Once designated, these institutions are subjected to the appropriate enhanced regulation. FSOC has used this authority to ensure strong regulatory oversight over large insurance companies such as AIG, which was a key culprit during the financial crisis; it received the largest government bailout in U.S. history at more than $180 billion.32 The case of AIG and other nonbank financial companies demonstrated that large threats to financial stability can also build up outside of the traditional banking sector. It is vital to have a regulatory body such as FSOC monitor these risks that build in the insurance or asset management sectors and take necessary action accordingly. The CHOICE Act, however, strips FSOC of this crucial authority. FSOC would no longer be able to subject companies such as AIG to enhanced oversight and prudential regulation. The FCA also takes away FSOC’s power to break up a financial institution that poses a grave threat to financial stability—sending precisely the wrong signal about how regulators should monitor and combat systemic risk. This is what the Financial CHOICE Act means for ordinary Americans: less regulation of the biggest threats to the economy, less accountability, and more bailouts.

Fewer orderly shutdowns and more bailouts

In September 2008, regulators faced two awful choices: let a large, complex financial institution fail and exacerbate the crisis or use taxpayer money to bail out the company.33 The government chose to let Lehman Brothers Holdings Inc. fail and go through bankruptcy, severely worsening the financial crisis. The next day taxpayer money was used to bail out AIG.

Dodd-Frank created a third option, the Orderly Liquidation Authority, in which the Federal Deposit Insurance Corporation can quickly wind down a failing financial institution and charge the financial industry for any costs incurred during the resolution process, taking taxpayers off the hook.34 The CHOICE Act, however, eliminates this third option and replaces it with an insufficient tweak to the bankruptcy code, which would bring the country back to Lehman Brothers-style catastrophes and AIG-style bailouts.

Former Chairman of the Federal Reserve Ben Bernanke recently outlined the reasons why modifications to the bankruptcy code fall short during a crisis and underscored the need to preserve the OLA.35 He argues that financial regulators are better equipped to manage the failure of a complex financial firm during a crisis, compared with a bankruptcy judge that does not have the necessary expertise or familiarity with the financial firm. Moreover, winding down massive financial institutions with sprawling international business lines and legal entities requires coordination between regulators across international jurisdictions—a role that a bankruptcy judge is not situated to fulfill. Bernanke also points out that it is unlikely that during a crisis, a complex financial firm would have access to private financing while in bankruptcy, making OLA’s liquidity role—with the financial industry on the hook for any losses—so important.

At this point, it should be clear that the FCA is the height of folly. It strips regulators of the tools necessary to fight financial crises once they have developed and to wind down failing institutions in an orderly manner to avoid government bailouts.

Derivatives deregulation

Taking the financial regulatory system back to its precrisis condition is a common theme in Hensarling’s Financial CHOICE Act. This theme holds true when analyzing the FCA’s impact on the regulation of financial market utilities, which is a vital component of derivatives regulation. Derivatives, such as futures that are traded on regulated exchanges, and swaps, which prior to Dodd-Frank were unregulated, are both financial contracts that derive their price from an underlying asset. During the financial crisis, unregulated swaps exemplified the reckless, unchecked risk in the financial sector. When used appropriately and under strong regulatory oversight, swaps and futures can help companies hedge against risks such as drought, fuel price changes, and currency fluctuations. When used aggressively in the shadows, however, these financial instruments can help tear down the financial sector.

AIG and derivatives during the financial crisis

In the run-up to the financial crisis, AIG sold large amounts of credit default swaps, or CDS, against the supposedly very safe super-senior tranches of subprime collateralized debt obligations, or CDOs.36 In essence, AIG used these derivatives to insure against the default risk of these subprime mortgage CDOs that were considered extremely unlikely to actually default. AIG loaded up on these derivatives because it was a way for them to earn premiums insuring a risk they never thought would require payouts. The collapse of the subprime mortgage market triggered the defaults on the CDOs, including the super senior tranches, which in turn triggered the CDS and required AIG to make the payouts they never thought would be necessary. The magnitude of these payouts and subsequent collateral calls following AIG’s own credit downgrade threatened the solvency of the company and the open CDS contracts.37 Because banks and other firms trading these swaps were linked together in a daisy chain of risk, the Federal Reserve concluded that major banks—which relied on the CDS contracts with AIG to protect against subprime CDO defaults—would fail unless the CDS contracts were made good, thus leading the U.S. government to bail out AIG.38This is just one example of why swaps need to be subject to regulations, such as those in Title VII of the Dodd-Frank Act that ensure transparency and market stability.

Dodd-Frank brought many more derivatives out of the shadows and into transparent markets. A large swath of swaps is now also subject to clearing, which means that a third party institution must ensure that the two sides of the swaps contract put up the necessary collateral to cover potential losses. This also serves as mutual insurance among the exchange participants since the exchange provides some limited protection against member losses with its own capital. The risk management standards at these third party institutions, called financial market utilities, are highly regulated because they are critical to preventing swaps contracts from tearing down the financial system during a crisis. Changes by Dodd-Frank brought swaps out of the shadows and have made sure that companies can cover the risks that they pose.

The FCA eliminates the enhanced oversight of these financial market utilities. As these institutions handle transactions or ownership management functions in the trillions of dollars, weak standards at these institutions could spell disaster for the U.S. economy and every single American who owns a stock or bond or has a pension. The CHOICE Act repeals Title VIII of the Dodd-Frank Act, which gives FSOC the authority to subject financial market utilities to appropriate regulatory oversight, including but not limited to new requirements for governance standards, credit risk management, liquidity risk management, collateral and margin frameworks, and recovery and wind-down plans. These are basic, commonsense requirements for institutions essential to the plumbing of the markets. Without them, U.S. financial stability would once again be at grave risk.39

Willful blindness on insurance

While primarily impacting the banking and securities sectors, the financial crisis also put severe stress on the insurance industry.40 The international insurance giant AIG was on the brink of collapse and required the largest taxpayer bailout in American history.41 Because insurance is largely regulated at the state level, in the lead up to and during the financial crisis, the federal government possessed little insurance expertise.42 This proved to be an unmistakable regulatory blind spot.43 In addition to the FSOC designation authority noted above, the Dodd-Frank Act created the Federal Insurance Office within the U.S. Department of the Treasury to address the insurance expertise void.44 The Federal Insurance Office supports FSOC in monitoring systemic risks related to insurance companies. The Federal Insurance Office also monitors and reports on consumer issues across the insurance industry and represents the United States, along with the Fed, at international standard-setting bodies.45

The FCA merges the Federal Insurance Office with FSOC’s independent member with insurance expertise—a voting position created in part to give someone with state-based insurance experience a voice in FSOC’s deliberations—to create the severely weakened Office of the Independent Insurance Advocate. For example, the FCA eliminates the insurance office’s authority to study and report on low- and moderate-income households’ and traditionally underserved communities’ access to affordable insurance products across the country. Moreover, the new office would not be allowed to recommend to FSOC that it should designate an insurance company for heightened oversight or subpoena insurance companies for data or information. In short, the new merged office would be severely limited in its ability to look out for consumers, to advise FSOC on potential systemic risks, and to access the data and information it needs to analyze risks across the insurance industry.

Concentration, accountability, and the real economy

Financial firms with hundreds of billions and even trillions of dollars in assets are the real winners in the Financial CHOICE Act, while accountability and the real economy end up the losers. Firms would get even bigger and even more powerful. Massive banks would be able to gamble and bet once again against their customers—such as middle-class retirees with pension funds and 401(k)s—and would be allowed to grow in both size and complexity, unchecked by regulators. All financial firms would be less accountable, as many U.S. Securities and Exchange Commission, or SEC, oversight tools would be gutted. And monetary policy would be undermined at the expense of full employment. These dramatic changes are direct threats to jobs on Main Street and the real economy.

The CHOICE Act takes a wide range of steps to further concentrate economic power, undermine accountability, and damage the real economy, including:

- Reopening the Wall Street casino: The FCA repeals the Volcker rule, allowing banks to engage in risky proprietary trading, as well as sponsor and invest in private equity and hedge funds for their own profit.

- Concentration limits and a return to mega-mergers: The FCA rolls back Dodd-Frank Act provisions ensuring that regulators consider financial stability and concentration when reviewing mergers and acquisitions of financial institutions.

- Bringing the SEC to heel: The FCA shifts SEC enforcement of complex cases away from administrative hearings and toward federal court proceedings, removing an important tool for overseeing regulated industries, and eliminates for certain asset classes provisions of Dodd-Frank meant to realign perverse securitization incentives that contributed to the financial crisis.

- Removing transparency in private equity: The bill eliminates registration and reporting requirements for private equity firms, preventing regulators from having access to important data on hundreds of billions of dollars in assets and leaving investors in these funds to once again fend for themselves.

- Excessively compensating the wealthy and powerful: The FCA also eliminates regulators’ authority to curb risky compensation practices that created perverse incentives for CEOs and eliminates the requirement that companies disclose the pay ratio comparing the median employee compensation with the CEO’s compensation.

- Undermining the goals of monetary policy: The FCA turns monetary policymaking into a highly political process, a grave departure from past precedent.

Reopening the Wall Street casino

Broadly speaking, the Financial CHOICE Act would reconcentrate power in the hands of a wealthy few, reduce accountability, and undermine the financial system’s obligations to serve the real economy. Its attempt to repeal the Volcker rule in its entirety is a distinct example of this.

The Volcker rule, named for former Chairman of the Federal Reserve Paul Volcker, was put in place to ban proprietary trading—when banks make bets to increase their own profits rather than on behalf of their clients—by banks and their affiliates.46 It also establishes limits on their investments in private equity and hedge funds—the practical equivalent of proprietary trading.47 Eliminating the Volcker rule would return the country to the precrisis financial engineering that allowed banks and other massive financial institutions to pursue speculative activity in the market and sponsor hedge funds and private equity funds that engaged in unsound, risky strategies. These high-risk activities were at the heart of the banks’ losses and bailouts.48 Effectively, Republicans in Congress want to let banks gamble with government-insured money, thus reopening the Wall Street casino and increasing the likelihood of failure and bailouts.

As was demonstrated as recently as 2012 by the massive trading loss at J.P. Morgan known as the “London Whale,” large proprietary trading positions can be excessively risky, instantaneously exposing banks to potentially enormous losses.49 Such behavior grows even more serious when you consider that many of these same institutions are of systemic importance. And for anyone who touts this as a net benefit for economic growth, proprietary trading does nothing to support manufacturing, construction, or service jobs.

Once again legitimizing “speculative, impersonal, short-term trading activities” in lieu of more modest and safer commercial banking and customer-serving market-making, as Volcker has put it, would have deeply pernicious cultural repercussions within firms.50 Indeed, it would set the financial sector back on a path toward even more severely concentrating power in the hands of a small number of banks that are actively in the business of betting against their customers and clients, who are retirees, savers, and other investors in American capital markets and farmers and commodity users in American derivatives markets, among others.

Banking should be boring, as others have noted.51 Banks should be in the business of serving the real economy, not gambling on the markets for their own profits, and the ups and downs of the capital and derivatives markets should be established by the diverse opinions of millions of market participants—not by the traders at a small handful of banks. The FCA’s termination of the Volcker rule is a clear example of the bill choosing banks’ immediate profits over the long-term economic success of ordinary Americans.

Concentration limits and a return to mega-mergers

For a bill that claims to be against bailouts, the Financial CHOICE Act seems awfully comfortable with mega-institutions. Why else would the FCA exempt banks from regulatory oversight of mergers and acquisitions that could result in firms being “too big to fail”?52 The FCA is giving the green light for firms to consolidate. And consolidation could mean fewer community banks serving local small businesses. Or worse, it could mean the creation of more institutions that are perceived to be too big to fail.

Supporters of the FCA may ascribe such a move to the value of simplification and a belief that as long as these institutions, regardless of their size, have a quarterly leverage ratio of at least 10 percent, that will prove enough. But this belief is insufficient. The U.S. banking sector, and the real economy in general, needs more competition and less concentration.53 As the Office of Financial Research noted in its 2016 report, eight of the largest U.S. banks hold almost three-fourths of all assets of U.S. bank holding companies, and “the potential impact of a large bank failure remains substantial.”54 There are also concerns that merging one firm with another while not creating observable aggregate concentration could lead to substantial concentration within particular types of markets, a significant financial stability risk. Moreover, there is not clear evidence that mid- to large-size banks experience increasing returns to scale.55 Hence, mergers that concentrate assets in larger banks do not necessarily raise efficiency and lower costs for consumers. In fact, the well-documented increase in financial sector concentration has done nothing to lower costs of intermediation.56

The concentration of the financial sector increases systemic risk and threatens financial stability without offering clear efficiency gains. It also transfers important decision-making over who gets loans in the real economy to a smaller and smaller set of large firms. The Dodd-Frank Act ensured that the Federal Reserve would review mergers and acquisitions of financial institutions to specifically consider financial stability risks and concentration.57 Rolling back such oversight is akin to calling for more concentration of economic wealth and, ultimately, another destructive financial crisis. This is deeply troubling for those who believe that a diverse financial sector is the foundation for a diverse and competitive real economy.

Bringing the SEC to heel

The Financial CHOICE Act further contributes to the concentration of economic power and reduced accountability by letting financial institutions play by a different set of rules than everyone else. It guts the authority of the Securities and Exchange Commission to hold repeat offender firms accountable for their repeated violations and thereby protect investors on a going-forward basis. This is not simply an authority that the SEC has; it has long been the standing requirement of the law to automatically disqualify from certain privileges under federal securities law—privileges such as expediting securities offerings or selling securities without registering with the SEC—anyone that violates the federal securities laws or certain other financial regulatory laws, especially if the violation is criminal. Prior to the arrival of Commissioner Kara Stein at the SEC, the commission regularly waived that disqualification for the largest firms. But since the beginning of her tenure, the SEC has started to curtail that practice and has begun, albeit slowly and incompletely, to hold firms of all sizes equally accountable.58 Eliminating automatic disqualification would give repeat offenders a competitive advantage over better managed competitors. And by undermining trust in the markets—something sorely tested in the repeated criminal behavior of some of the largest firms—it puts the diversity and vibrancy of U.S. capital markets at risk and concentrates market power in the worst offending firms.59

Supporters of the bill may insist that it significantly increases the SEC’s civil and criminal penalty authority. In reality, though, it would undermine SEC enforcement by taking away the important tool of administrative hearings and moving toward using federal court proceedings, a venue that is generally far more expensive and cumbersome, making enforcement less likely.60

In addition to a series of other steps, the FCA also eliminates the requirement that banks have some skin in the game for asset-backed securities other than residential mortgages. Prior to the financial crisis, banks and lenders had created a structure that allowed them to profit from the origination and securitization of loans but absolved them of the risk of loans going bad.61 In late 2014, rules were finalized that reformed the system by requiring banks to retain at least a 5 percent interest in any security transaction that they sponsor.62 The goal was to ensure that the incentives of the institutions that package these deals matched up with those of investors, reinstituting the checks that originally governed the financial system.63 The FCA would no longer require compliance for particular assets, once again permitting dangerous incentive structures that helped cause the financial crisis and further disadvantaging those that do business the fair way while concentrating power in those institutions that could mislead and manipulate the system.

The bill also ties the hands of the SEC, and other financial regulators, by adding a series of procedural hurdles to its ability to act, as well as by granting Congress the authority to veto any “major” financial regulation simply by doing nothing.64 By tying the hands of regulators, the FCA cedes power to a sector that packs overwhelming lobbying firepower. This should be deeply troubling to anyone who believes that the markets should not police themselves.

Removing transparency in private equity

It was evident during the financial crisis that regulators did not have sufficient oversight tools to address challenges arising in growing segments of Wall Street that rested outside the traditional banking sector. One such area was the alternative asset management industry, including hedge funds and private equity firms. Some of the largest private equity firms and hedge funds manage hundreds of billions of dollars in assets, making it crucial for regulators to have quality data on and appropriate oversight of this industry. During the 2007–2008 financial crisis, hedge funds played a key role in major losses and even failures of some of the biggest financial firms, including, most notably, Bear Stearns Companies Inc.65 And it was only a decade prior to this crisis when the giant hedge fund Long-Term Capital Management had to be bailed out by an orchestrated series of big bank investments under the auspices of the Federal Reserve Bank of New York.66 Morgan Stanley’s private equity business also incurred serious losses during the financial crisis, contributing to the stress on the institution.67

Dodd-Frank required these firms, for the first time, to register with the SEC, submit themselves to examinations, and report on their activities. Utilizing these new tools, the SEC has already found a series of investor protection failings at these firms, imposing millions of fines and leveling the playing field toward more transparency and investor empowerment.68 More recently, the Financial Stability Oversight Council has also identified a series of possible systemic risks arising from hedge funds specifically. The FCA is quite consistent on private funds: Regulators should not have access to information on or oversight of this industry. The FCA removes SEC registration and reporting requirements for private equity firms. It also eliminates the ability of the SEC to require certain records for the purposes of monitoring systemic risk. But taking the cop off the beat would return power to the hands of the fund managers that take advantage of investors, such as teachers and firefighters who trust these firms with their retirement funds. It would also disadvantage those that are doing the right thing, as well as expose taxpayers once again to financial stability risks.

Excessively compensating the wealthy and powerful

The concentration of wealth and power and a reduction in accountability are main themes in this bill, so it is not surprising that it eliminates Dodd-Frank’s restrictions on incentive-based compensation packages and executive compensation disclosure requirements. Before the financial crisis, Wall Street compensation packages often created perverse incentives for bank employees to take excessive risks for huge bonuses tied to short-term gains and little downside if massive losses were incurred.69 Such activities occurred at regional banks such as Washington Mutual Inc. that make and securitize high-risk loans just as much as at top Wall Street trading firms, and compensation structures incentivized employees at all levels, not just CEOs.70 This mindset of encouraging excessive risk-taking to maximize profit while letting taxpayers foot the bill if the bets did not pay off was at the heart of the crisis. Dodd-Frank gave regulators the authority to curb risky incentive-based compensation practices, but the FCA erases those rules and enables Wall Street to put those precrisis compensation practices back in place.

The Financial CHOICE Act’s approach to concentrating power extends to the real economy as well. Rules requiring companies to disclose the pay ratio comparing the median employee compensation with the CEO’s compensation would also be eliminated by the FCA.

Securitization’s perverse incentives

During the financial crisis, Americans who had borrowed to purchase a home or car were often the victims of predatory lending. On their backs, as well as those of investors, banks and originators made historic profits. They did this by lowering underwriting standards and trapping Americans in home, credit, and auto loans they would never be able to pay off.71 Instead of having a stake in the success of such loans, however, lenders and banks sold most of these loans to investors through private securitization markets. In many cases, in fact, banks made money when these assets lost value.72 Dodd-Frank sought to ensure that incentives were better aligned between lenders and consumers by requiring banks to keep a representative and meaningful stake of the securitized loans in their portfolios and by prohibiting banks from engaging in any conflict of interest with their investors.73 The Financial CHOICE Act severely erodes these requirements and makes toxic loans and malfeasance likely again, to the detriment of consumers, investors, and financial stability.

Undermining the goals of monetary policy

The Financial CHOICE Act does not simply gut financial regulation. It also deforms monetary policy in two important ways. First, it introduces continual pressure on the Federal Reserve to make its interest rate policy conform to the statute’s version of the Taylor rule, which economists have used as a stand in for the judgement of a central banker for research purposes, even when doing so could cause needless economic harm.74 The FCA would require the Federal Reserve to calculate an interest rate target according to a version of the Taylor rule and then justify any deviation between that value and the interest rate target actually chosen, creating a pathway for Congress to politicize meetings that the Federal Open Market Committee holds every six weeks.

The adoption of this standard is ridiculous on its face. Staff at the Minneapolis Federal Reserve Bank estimate that if the Taylor rule had been in effect over the past five years, 2.5 million more Americans would be out of work today due to inappropriately high interest rates hurting employment.75

Nonetheless, putting this requirement into statute would have the effect of deterring the Federal Reserve from exercising its expertise and judgment when setting monetary policy. Members of the Federal Open Market Committee would be looking over their shoulders, anticipating the political pressure the committee would experience when taking action that is necessary to support the Federal Reserve’s dual mandate but that is inconsistent with the statutory formula.

This concern has been expressed by Republican and Democratic Fed chairs, with former Chair Ben Bernanke noting the problematic nature of more abstract proposals and current Chair Janet Yellen advising the House of Representatives directly on these provisions when they were considered as a stand-alone bill.76 Since stepping down as chair, Bernanke has commented, “The principal effect of the bill would be to make meeting-by-meeting monetary policy decisions subject to Congressional review and, potentially, Congressional pressure.”77

The Financial CHOICE Act further diverts monetary policy from the dual mandate by making it more likely that the Fed will be forced to use monetary policy to deal with financial instability. With fewer regulatory and supervisory tools available to constrain excessive risk-taking by banks and other financial market actors, the Fed will need to conduct monetary policy with an eye towards reducing speculative bubbles. Bubbles can be deflated by raising interest rates, but this means lower real output and employment. Taking regulatory and supervisory tools off the table may be a win for the financial sector, but it also deflects the Federal Reserve’s focus from full employment and stable prices.

Consumer protection

The CHOICE Act also rejects the painful lessons about toxic financial products from the financial crisis and Great Recession in which 10 million families lost their homes and Americans collectively lost $19 trillion in wealth. Instead of continuing post-crisis reforms that have ensured the availability of safe and affordable financial products, it would give a free pass to financial institutions to once again sell harmful products that wreck family balance sheets, as well as entire communities, without fear of getting caught.

The CHOICE Act includes the following key provisions that would gut consumer financial protections across the board:

- Crippling the Consumer Financial Protection Bureau, or CFPB: The FCA takes away the CFPB’s independence by politicizing its director and replacing direct funding from the Federal Reserve with annual congressional appropriations; it also shrinks the agency’s ability to identify and address financial wrongdoing by ending its supervision authority, consumer complaint database, and research and education functions, as well as greatly limiting its regulation and enforcement authority.

- Reopening the door to known predatory practices: The bill also allows a creditor of any size to once again make most mortgages without regard to a consumer’s ability to repay the loan as long as the creditor holds the mortgage in its portfolio; guts protections against overcharging consumers on title insurance through affiliated companies; strips consumer protections from manufactured home borrowers; enables recklessness by removing the CFPB’s ability to pursue financial actors engaged in unfair, deceptive, or abusive practices and scaling back enforcement powers to exclude cash compensation to victims; blocks the U.S. Department of Labor’s fiduciary rule governing retirement investment advice; and prohibits both the CFPB and the Securities and Exchange Commission from taking steps to limit the use of mandatory consumer arbitration.

Crippling the CFPB and other financial regulators

The FCA would make numerous changes to the highly effective and independent Consumer Financial Protection Bureau. While it would not replace the agency with a weakened and conflicted Consumer Financial Opportunity Commission, as proposed in last year’s bill, it would instead crush the agency’s ability to defend consumers from predatory practices through other means.78 The bill would replace independent funding—something every other bank regulator has—with annual appropriations subject to congressional approval, enabling members of Congress to defund the agency or pick and choose the types of predatory actors subject to its jurisdiction. It would politicize the CFPB by making its director removable by the president for any reason, subjecting it to the risks of constant special interest lobbying in ways from which every other financial regulatory agency is currently immune.

The agency would be unable to ultimately fulfill its mission—protecting consumers from financial harm—with many of its most significant legal tools taken away. For example, the FCA would end the CFPB’s authority to supervise financial institutions for their consumer practices, which allows examiners to look under the hood and identify small problems before they become large ones. It would eliminate the ability of the agency to regulate a product for being unfair, deceptive, or abusive.79 It would also end its research and education functions, which shed light on troubling market practices and help consumers across the country better navigate the financial system. And it would repeal its ability to maintain a consumer complaint database. Combined with other technical administrative requirements, such as cost-benefit analyses that may understate the benefits of regulation, these changes would radically change the nature of the agency, rendering it a toothless sham.

There is no doubt that the CFPB has been under attack because of—not in spite of—its strong track record defending working families. In its short history, the CFPB has returned nearly $12 billion to 29 million wronged consumers.80 For every dollar of its funding, it has returned approximately $5 to victims.81 It has processed more than 1 million complaints on behalf of consumers, enabling CFPB staff to identify patterns and to ensure that policy decisions made by bank leadership correspond with the actions of individual officials with whom consumers interact.82 As noted above, this complaint system, a cornerstone of public accountability, would be dismantled by the bill.

To date, the CFPB’s enforcement actions have addressed unfair or deceptive practices including overcharging on student loans, illegally threatening service members to collect on debts, and providing inaccurate information to credit reporting companies.83 Its enforcement actions addressing discriminatory lending practices alone returned more than $450 million to approximately 1 million victims of fair lending violations.84 Its rulemaking has rooted out abusive practices in the mortgage market, recently provided long-awaited clarity and consistency to prepaid cards, and is expected to address predatory payday and auto title lending.85 Yet all of these regulatory and enforcement activities would be largely halted from moving forward under the FCA. The CFPB’s newly limited enforcement authority would not include the ability to return cash to victims for predatory practices, only allowing the agency to issue cease-and-desist letters once the damage had already been done. And by ending the CFPB’s ability to make rules and take enforcement actions against firms engaged in unfair, deceptive, or abusive acts or practices—beyond specific violations of pre-existing consumer finance laws—the FCA would freeze the CFPB in its tracks, while giving a free pass to the worst financial predators and putting good financial actors at significant competitive disadvantage.

All of these efforts rely on an agency that is independent from capture by special interests and conflicting mandates. Since the founding during the Civil War of America’s first financial regulator, the Office of the Comptroller of the Currency, policymakers have recognized that a sound financial system must be insulated from political whims intended to weaken it. The existing structure of the CFPB is sound and specifically designed for the agency to be independent, effective, and accountable.86 Making the CFPB director subject to the whims of the president would be a first of its kind action to centralize banking regulatory power solely in the hands of the president and would eliminate the independence long established by Congress.

The FCA also shreds the independence of other regulatory agencies, such as the Federal Housing Finance Agency.87

At its core, the FCA is about helping the worst financial firms escape accountability rather than making an agency more accountable. The CFPB already is accountable, with its officials testifying before Congress 63 times to date, and it is audited once a year by the Government Accountability Office.88 Opponents in Congress just want to pick and choose which kinds of shady companies get a free pass.

CFPB: An independent watchdog for the financial marketplace

The Consumer Financial Protection Bureau has held financial institutions accountable when consumers have been seriously wronged, returning, on average, more than $400 to victims.89 Among other actions, last fall, the CFPB announced a settlement with Wells Fargo for opening as many as 2 million fraudulent, unauthorized customer accounts to meet sales quotas, while leaving consumers to unknowingly foot the bill.90

By crippling the CFPB, the FCA would let predatory practices continue to ravage communities, unchecked by regulation. The story of Naya Burks, a St. Louis-area parent, is instructive: She took out a $1,000 loan from a payday lender to cover bills and deal with an unpredictable work schedule only to see the 240 percent-interest loan balloon to $40,000 after she fell behind on payments.91 The lender dropped a lawsuit against Burks due to public pressure, but a rulemaking currently being finalized by the CFPB would potentially end these debt traps that cost families across the country $8 billion each year in fees.92 The Financial CHOICE Act would shred the CFPB’s authority to address these practices, whether through processing consumer complaints to ensure that banks hear their customers’ voices as problems arise, regulation designed to prevent future consumer harm, or enforcement to make victims whole after the fact.

Reopening the door to known predatory practices

In the lead up to the housing crisis, unscrupulous lenders pushed predatory loans on homebuyers and existing homeowners. Before the Dodd-Frank mortgage protections were in place, lenders often received additional compensation for steering borrowers into higher-cost mortgages.93

As a result, lenders often peddled mortgage products, such as home purchase loans and refinance loans, that appeared attractive to consumers but included terms and fees that would later push many of them into foreclosure. These terms included teaser interest rates that increased to an unaffordable rate over time, prepayment penalties that made it difficult for a borrower to refinance the mortgage, and negatively amortizing payment schedules that allowed a consumer’s debt to grow each month.94

To prevent a return to this predatory mortgage lending, the Dodd-Frank Act put common sense rules in place to ensure that lenders evaluate a borrower’s ability to repay a loan and to provide consumers with additional protections against being pushed and locked into a loan designed to blow up on them.

The Financial CHOICE Act would turn back the clock to a time when mortgages were risky to consumers and for the banking system. Creditors of any size could once again make most mortgages without regard to a consumer’s ability to repay the loan as long as the creditor holds the mortgage in its portfolio. While supporters of this proposal argue that a creditor is unlikely to originate an unsustainable loan if it is held on portfolio, Americans learned otherwise during the housing crisis. Some of the nation’s most predatory lenders, including Washington Mutual, held some of the most explosive and predatory loans in their portfolios.95

The FCA also guts protections against overcharging consumers on title insurance through affiliated companies, which are companies that are often under the same corporate umbrella as the lender. Abuses related to affiliates abounded during the run-up to the crisis, with upselling rampant throughout the system. The points and fees cap for the Dodd-Frank qualified mortgage definition exempts bona fide third party charges but does not exempt charges for affiliate companies, removing the incentive for these harmful arrangements. The FCA would make it easy, once again, for lenders to enrich themselves at the expense of homeowners by steering borrowers into high-cost insurance plans.

Finally, the FCA strips consumer protections from manufactured home borrowers, many of whom are rural, lower-income, and seniors. For example, it raises the interest-rate trigger for the enhanced consumer protections Congress put in place for borrowers receiving high-cost loans. As a result, manufactured housing residents could be made to pay much higher interest rates before receiving the same protections that residents of site-built homes enjoy.

These are among many reversals in the bill that would harm family finances. As noted above, the FCA would largely strip the CFPB’s authority to regulate predatory practices by excluding those not already covered by specific federal laws. This includes blocking the agency from taking action against high-cost payday loans and indirect auto lending, two areas where insufficient oversight has repeatedly led to consumer harm.96 The FCA would also block the Department of Labor’s conflict of interest rule, or fiduciary rule, until the SEC finalizes its own rule at some point in the future. The department’s fiduciary rule, finalized last year and scheduled to be in place this year, requires that all retirement financial advisers act in the best interest of their clients, closes a 40-year-old loophole, and is expected to save retirees $17 billion annually.97 Separate from the legislation, the Trump administration has also requested that the implementation of this rule be delayed, leaving these key protections for savers and retirees in limbo.98

What’s more, the Financial CHOICE Act would also undermine access to justice for wronged consumers and investors. Specifically, it prohibits both the CFPB and the SEC from taking on the abuses of mandatory consumer arbitration clauses by financial firms. As the Wells Fargo and other cases have shown, arbitration clauses largely eliminate consumers’ ability to obtain redress for consumer harm through the legal system. The abuses of this system—and incredible unfairness, since these very same firms avail themselves of the federal courts all the time when it pleases them—have been increasingly scrutinized by federal agencies in recent years.99 Limiting agencies’ ability to constrain unfair arbitration is a one-two punch to weaken enforcement and deterrence both within public agencies and among private attorneys and the class action system.100

Conclusion

The fact that President Donald Trump and House Financial Services Committee Chairman Jeb Hensarling are well on their way to choosing Wall Street over Main Street and letting Wall Street choose its own rules is not surprising, but the lack of subtlety is striking. The provisions in the Financial CHOICE Act show a malicious disregard for the lessons learned in the financial crisis. Erasing the progress made on financial stability, consumer protection, and the concentration of economic power on Wall Street would make the real economy far more vulnerable to the daily ravages of the worst financial practices, as well as to another serious financial crisis and ensuing recession. Lack of accountability would grow worse, not better, devastating the societal fabric of trust that deeply needs to be rebuilt. Too many workers lost their jobs, too many families lost their homes and wealth, and too many consumers were wronged for the United States to go back to those precrisis ways.

About the authors

Gregg Gelzinis is a Special Assistant for the Economic Policy team at the Center for American Progress. Before joining the Center, Gelzinis interned for seven months at the U.S. Department of the Treasury while completing graduate school. During his undergraduate career, he held internships at Swiss Re, the Federal Home Loan Bank of Atlanta, and the Office of U.S. Sen. Jack Reed (D-RI). He graduated summa cum laude from Georgetown University, where he received a bachelor’s degree in government and a master’s degree in American government and was elected to the Phi Beta Kappa Society.

Ethan Gurwitz is a Research Associate with the Economic Policy team at the Center. His research focuses on competition policy and antitrust enforcement. He is a 2012 graduate of Northwestern University.

Sarah Edelman is the Director of Housing Policy at the Center. Prior to working at CAP, Edelman worked in the areas of community development, community organizing, and consumer protection at Public Citizen, Community Legal Services, the office of Sen. Sherrod Brown (D-OH), and the Federal Deposit Insurance Corporation Division of Consumer Protection. Edelman holds a master’s degree from the University of Maryland School of Public Policy and a bachelor’s degree from The George Washington University.

Joe Valenti is the Director of Consumer Finance at the Center, where he focuses on consumer protection and financial security. Prior to joining CAP, he held various research and policy roles at the U.S. Treasury Department, New York City Department of Consumer Affairs, and the Aspen Institute and was a graduate intern for the U.S. Senate Committee on Banking, Housing, and Urban Affairs under Chairman Christopher J. Dodd (D-CT). He holds a Bachelor of Arts from Columbia University and a master’s degree in public policy from Georgetown University and is a graduate of the Sorensen Institute for Political Leadership at the University of Virginia.