The United States faces a growing backlog of infrastructure repair and expansion projects. Many of the assets that propelled rapid economic growth and household wealth formation following the end of World War II have come to the end of their useful lives. In order to remain economically productive in the 21st century, government at all levels must increase infrastructure investment. The American Society of Civil Engineers estimates that, across all sectors, the United States needs to invest more than $3 trillion in the coming years. In the absence of a sustained commitment to rebuilding and expanding critical facilities, the United States will face an infrastructure drag that reduces economic productivity and access to opportunity for millions of Americans.

Historically, state and local governments have carried out public infrastructure finance through the issuance of municipal bonds. In recent years, a less traditional actor has entered the picture: Wall Street. Specifically, investment managers have opened up funds dedicated to investing private capital in U.S. infrastructure projects through public-private partnerships, or P3s. Public-private partnerships are an alternative form of infrastructure procurement that may include equity financing and a long-term maintenance and operations contract for the private concessionaire.

Liquidity

Public-private partnership supporters make two fundamental assertions about infrastructure finance in the United States that deserve scrutiny. The first is that one of the reasons why governments have been unable to invest sufficiently across sectors is a lack of liquidity. The term liquidity has several meanings. In the context of infrastructure finance, liquidity simply refers to access to financial capital. When lamenting the current state of infrastructure disrepair and promoting P3s as the solution, financiers frequently talk about the vast amount of private equity capital ‘sitting on the sidelines’ waiting to be invested in infrastructure. The implication is that if only state and local governments would undertake more P3 projects, this money would flow into the system and solve the infrastructure backlog.

Yet there is a reason why P3s with an equity component have been slow to emerge in the United States: Equity capital is a substantially more expensive source of project financing than municipal bonds. The cost of funds for equity capital can exceed highly rated municipal debt by a factor of five. Currently, there is more than $3.7 trillion in outstanding municipal debt. While not all of this debt was issued to build infrastructure, the volume of debt indicates that nonfederal borrowers have no problem accessing project financing; the municipal bond market is robust.

The single most important factor constraining overall government investment in infrastructure is not access to credit but rather insufficient government revenues. The problem is fundamentally political: The public has a finite willingness to pay the taxes and fees necessary to service project debts.

The borrowing behavior of state and local governments over the past 15 years demonstrates that tax revenues constrain indebtedness not a lack of investor demand. Between 2000 and 2008, total outstanding municipal debt increased by more than $2 trillion, or 138 percent. This number is significant for two reasons. First, the growth in municipal debt outpaced overall economic growth as measured by gross domestic product, or GDP. This reveals the tendency of governments to leverage even modest upward trends in tax revenues to borrow more through the bond market.

Second, the economy experienced a brief recession in 2001, losing 0.6 percent in economic output before returning to growth. Because the downturn was relatively short-lived, state and local governments chose to borrow money through the bond market to cover operating and capital needs as opposed to eliminating projects and substantially reducing services or raising taxes. From 2003 to 2004, total municipal indebtedness increased by $921 billion. In other words, the shallowness of the downturn combined with the expectation that growth and tax revenues would soon rebound fueled borrowing.

By comparison, the Great Recession demonstrated that a steep decline in tax revenues combined with indications that the recovery would be slow produced a significantly different borrowing behavior. Again, the issue was a dramatic drop in tax revenue as opposed to a shortage of market liquidity. The Great Recession resulted in a GDP contraction that was more than seven times greater than the downturn in 2001. According to research from the Pew Charitable Trusts, state tax revenues declined by 13 percent in 2009 compared with baseline collections prior to the start of the Great Recession. As a result, between 2008 and 2015, total municipal debt increased by only $198 billion, or 6 percent. State and local governments understood that they would not have the revenues necessary to support another major round of borrowing and therefore held off on significantly increasing their overall indebtedness.

Importantly, investor demand for municipal debt held strong through both cycles. In fact, the demand for low-risk public debt continues to be so overwhelming that real interest rates on securities from the U.S. Department of the Treasury are currently negative over a seven-year period and less than 1 percent over a 30-year period; investors are paying the federal government to hold their money. The municipal bond market—as well as the Treasury securities market—does not have a liquidity problem.

This is not a claim about the soundness of buying and selling municipal debt as an investment strategy. The salient point is that the governments that build infrastructure projects have no trouble accessing capital markets. The reason that some observers see equity capital as sitting on the sidelines is that governments do not need equity debt to build their projects. What they need is revenue.

Understanding finance terminology

The claims that P3 supporters makes about liquidity raise an important point about terminology. Specifically, what does it mean to say that private capital is sitting on the sidelines ready to invest? For starters, this statement implies that traditional project financing involves something other than private capital. In reality, every dollar used to purchase municipal debt tied to a project is private capital being put to use to build America’s infrastructure.

This is not to say that municipal debt and equity are the same. In the finance world, the term equity typically refers to ownership in a company. When it comes to infrastructure, the government project sponsor retains ownership of the completed facility. Instead, project equity refers to a legal claim on a stream of revenues. For example, in the case of a toll highway project, an equity investor would have the right to a share of the stream of toll revenues over and above what is needed to repay senior project debts. Large infrastructure projects almost always involve multiple sources of debt financing. These may include debt from the TIFIA loan program, private activity bonds, or traditional municipal bonds. Once these senior debt holders have been repaid, the equity investors receive their share of toll revenues.

Equity investments are different from municipal bonds in three ways. First, project equity is not listed on a public exchange. By comparison, a municipal bond is a type of tradable fixed-income security. Second, the return that equity investors receive over time is subject to federal taxation. And third, the rate of return on equity can be variable, depending on the structure of the P3. In the case of a toll highway where the concessionaire assumes revenue risk, the ultimate rate of return on equity will depend on travel demand and overall toll revenues. Thus, while municipal bonds and equity investments have different characteristics, the important point is that both are private dollars financing infrastructure projects.

Simply stated: There are no sidelines.

Public pensions

The second assertion that P3 supporters make is that public-private partnerships have the potential to advance two disparate policy goals: strengthening workers’ retirement and building needed infrastructure projects. In reality, the low-volume of P3 transactions with an equity component means that infrastructure deals will not provide meaningful relief to public pensions.

Public pension funds face two significant challenges. First, pension funds are obligated to provide benefits to future retirees, a requirement for which they lack adequate funding. Second, due to the unique tax status of pension funds, investing in municipal debt is simply unattractive.

Unlike individuals and private corporations, pension funds are tax-exempt investors, meaning they have no federal income tax liability. The interest income from municipal bonds is not subject to federal income taxation. As a result of this favorable treatment, municipal bonds offer a lower interest rate than taxable corporate debt. Yet because this tax treatment provides no benefit to pension funds, the low rate of return on municipal debt makes this an untenable asset class.

By comparison, the equity component of a P3 infrastructure project provides a substantially higher return and therefore presents a more attractive vehicle for large institutional investors. While the return on equity varies by project and phase of development, the Federal Highway Administration cites a rate that ranges from 8 percent to 14 percent annually. Simply put, this rate of return dwarfs what is available through municipal bonds. Currently, AAA-rated bonds offer only 2.4 percent annually over a 30-year period.

As for unfunded liabilities, the numbers are daunting. As just one example, the California Public Employees’ Retirement System, or CalPERS, is a state agency that manages a large-scale pension fund on behalf of participating state and local public employees. Currently, CalPERS pays an average monthly benefit of $2,627 to 611,000 retirees and manages the contributions of another 1.2 million active and inactive employees.

The total value of the CalPERS fund stands at $293 billion—making it the largest public pension fund in the United States. While impressive, CalPERS faces a significant shortfall. The agency’s most recent financial statement reveals a total unfunded liability—the difference between the value of the fund’s assets and the assets necessary to meet future benefits payments—of $93 billion. To put that in perspective, the shortfall is greater than the individual GDP of 15 states, including Mississippi, New Mexico, West Virginia, and New Hampshire.

CalPERS is not the only public pension facing a shortfall. For instance, the California State Teachers’ Retirement System, or CalSTRS, estimates its unfunded liability at $72.7 billion. And the Colorado Public Employees’ Retirement Association, or Colorado PERA, estimates its unfunded liability at $25.9 billion. The Pew Charitable Trusts estimates that total unfunded public pension liabilities exceed $1 trillion nationally.

Given the magnitude of the shortfall facing public pensions, infrastructure investments—if they are to attract the interest of pension funds—must not only offer an attractive rate of return but also a sufficient volume of transactions to make meaningful progress in addressing outstanding liabilities. Public-private partnerships pass the first test but fail the second. For starters, not all P3 deals involve private equity financing. Second, when equity is used as part of project financing, it tends to account for only a small share of the total because it is so expensive relative to other forms of financing—namely, municipal bond debt and low-cost loans from the federal government.

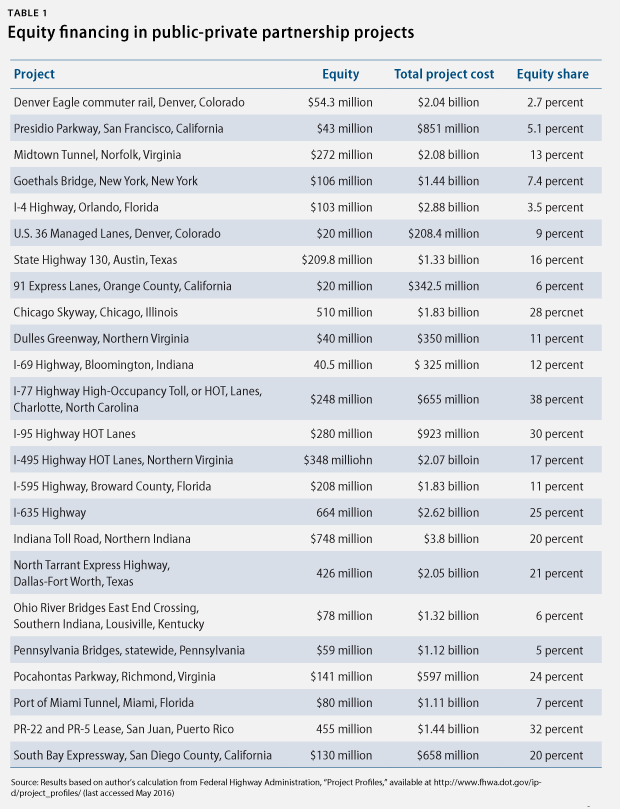

A review of projects financed through the Transportation Infrastructure Finance and Innovation Act, or TIFIA, loan program at the U.S. Department of Transportation demonstrates the limited role of equity. Congress established the TIFIA loan program in 1998. Since its inception, the program has helped finance only 24 public-private partnership projects involving an equity component. Excluding the Chicago Skyway and Indiana Toll Road projects, which were lease transactions of existing facilities as opposed to new construction or reconstruction, the average equity investment is $183 million as part of a project with a total cost of $1.28 billion.

Using these averages, it is possible to develop an estimate of how many major P3 projects a pension fund such as CalPERS would need to invest in to reduce its unfunded liability by just 5 percent. As with any model, this relies on a number of assumptions, including:

- The extent to which CalPERS would expose itself to the downside risk that an infrastructure project would fail to perform financially

- The annual rate of return on the equity investment

- The length of the concession

- The discount rate used to calculate a net present value of the anticipated cash flow over time

First, CalPERS would almost certainly try to reduce portfolio risk by taking a limited share of equity in any given project. For example, assume that CalPERS would be willing to take a 20 percent position. Based on the average equity investment of $183 million derived from the TIFIA project list, a 20 percent share would translate to an investment of approximately $36.6 million. Second, investors expect an annual return of between 8 percent and 14 percent on infrastructure projects. Third, P3 concession contracts vary greatly, with some lease agreements stretching as long as 99 years. Assuming a more traditional 30-year term and a 12 percent rate of return, CalPERS would receive a return of $131.7 million. After applying a discount rate of 7.5 percent—which is the long-run rate of return that CalPERS assumes when projecting fund performance and calculating unfunded liabilities—CalPERS would receive a stream of payments with a net present value of $51.8 million. The net present value number is important because the $93 billion unfunded liability CalPERS reports is the amount of additional fund capital in 2016 dollars needed to meet future obligations.

In order for CalPERS to reduce its unfunded liability by just 5 percent, or $4.85 billion, the fund would need to invest in 90 infrastructure projects that offered terms equivalent to those assumed in the hypothetical case. In other words, CalPERS would need an enormous volume of P3 projects in which to invest and then have to take a significant position in every one of them in order to reduce its liabilities by even a small amount. If CalSTRS and Colorado PERA and others attempted to reduce their unfunded liabilities by an equivalent amount, the number of P3 projects would need to grow substantially. In fact, in order to reduce total unfunded public pension liabilities by 5 percent, pension funds—assuming they were able to collectively take a 100 percent position equivalent to the $183 million average equity share on every project—would need 193 projects with a total cost of $246.7 billion. This seems exceedingly unlikely, as TIFIA has provided financing assistance to only 24 P3 projects with an equity component in the past 18 years. While the TIFIA list is by no means exhaustive of the infrastructure sector, it provides a useful measure of the overall pipeline. According to research by Squire Patton Boggs—a global law firm that provides legal and other services to the infrastructure sector—only five P3 projects closed in 2014. Of this total, four were surface transportation projects.

Public-private partnerships are best suited to very large, complex projects for which it is more likely to be cost-beneficial for the state to pay the premium associated with risk transference. Yet, the very nature of infrastructure investment is that most projects do not meet the size and complexity threshold. In order words, the number of P3 projects will remain relatively low not due to regulatory barriers but the fact that the vast majority of small and medium-size projects don’t lend themselves to a P3 procurement model.

Beyond financing

Underlying everything from the smallest repair project to the largest new build is the unglamorous world of procurement—the process by which government buys goods and services. Traditionally, state and local governments have procured transportation facilities such as highways and bridges through a process referred to as design-bid-build. Under this approach, the state separates the procurement process into three distinct phases:

- Design and engineering

- Construction

- Operations and maintenance

The traditional design-bid-build process involves two independent phases of project development that are carried out by separate private firms. First, one firm completes the design and engineering work and then hands this product off to the state. Next, that state uses these specifications to develop a request for proposals for the construction phase. Finally, following construction, the state assumes complete responsibility for the operation and maintenance of the facility. This includes everything from snow removal to reconstruction of deteriorated segments. In this way, a design-bid-build procurement model allows the state to retain control over each stage in the process.

A public-private partnership is an alternative approach to infrastructure procurement for large-scale, complex projects. Under this approach, the private firm exercises greater control and decisionmaking authority since the procurement stages are bundled together into one contract. From the government’s perspective, one of the key benefits of using a P3 approach is the ability to transfer risk. The nature of P3 contracts allows the public sector to transfer some or all of the project development, design, construction, operational, and revenue risk to a private entity. This is not a small benefit. After all, large infrastructure projects frequently take longer and cost more to complete than initially estimated. This benefit does not come cheaply. In exchange for accepting delivery or revenue risk over time, the private entity will require additional compensation.

In order to determine if the additional cost of transferring risk and working through the complexities of a P3 transaction are economical, state and local governments must engage in value-for-money analyses. For those projects that pencil out, P3s are a valuable alternative procurement strategy.

Conclusion

Public-private partnerships have been fundamentally miscast as a solution to a growing government funding deficit. In reality, P3s are an alternative form of procurement that offers government a way to manage risk. This may be especially appealing if a state or local government is attempting to develop a complex facility for which it has little experience letting contracts and overseeing delivery. Moreover, a long-term concession that locks in a private entity to providing a specified level of service or repair may help insulate a critical infrastructure asset from the vagaries of state budgets and recession. Provided that governments have the skill to negotiate effectively with their private sector counterparts in order to extract maximum value, P3s have a place in the U.S. infrastructure landscape. This will still leave, however, the politically challenging task of building support for the taxes and fees necessary to repay project debts, regardless of their source.

Kevin DeGood is the Director of Infrastructure Policy at the Center for American Progress.