By all rights, Millennials—people born between 1981 and 1997—should be the highest-paid generation in American history. They are, after all, the most likely to hold a college degree and are working in a period of unsurpassed productivity. Unfortunately, more education and a more productive economy have not paid off for working Millennials.

Median compensation—wages plus the value of benefits from employers such as health care premiums and 401(k) contributions—for a 30-year-old in 2014 was below that of a 30-year-old 10 years earlier. Indeed, 30-year-olds today make around the same amount of money as 30-year-olds in 1984, despite the facts that they are 50 percent more likely to have finished college and that they work in an economy that is 70 percent more productive.

This issue brief argues that a labor market where the deck is stacked in favor of employers at the expense of employees is a primary cause of this poor median compensation growth. Millennials have spent almost their entire working lives in a labor market that is loose—with too many job seekers and too few jobs—and where private-sector labor unions are almost entirely absent. Certainly, monetary policy that promotes employment while making it easier for workers to form unions would help Millennials make up lost ground.

But there also exists an opportunity for Millennials not only to catch up but also to leap ahead: Family-friendly policies such as guaranteed access to paid family and medical leave and subsidized child care would provide a real financial boost. With these family- and worker-affirming policies in place, Millennial women—who are increasingly becoming mothers—would suffer a smaller motherhood earnings penalty than previous generations of female workers. These policies would reduce the motherhood penalty and—coupled with a restoration of workers’ bargaining power—go a long way toward helping Millennials enjoy healthy wage growth.

Stellar education and productivity but mediocre pay

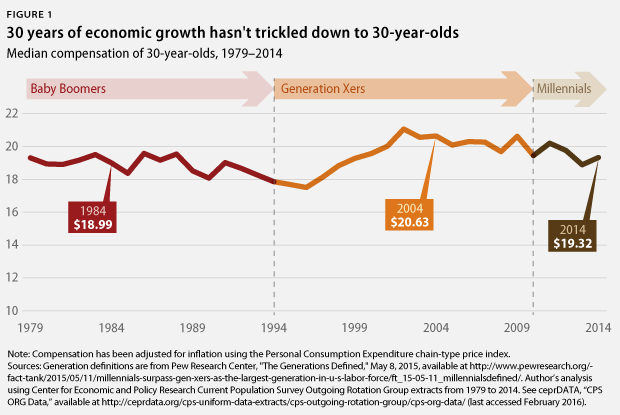

Figure 1 below displays the median compensation for 30-year-olds from 1979 to 2014 by each generation. Rather than looking at the compensation of all workers in the 17-year-old to 33-year-old age range—the age range of Millennials in 2014—the analysis focuses on the compensation of 30-year-olds to prevent changes in college attendance rates from affecting wage trends.

Thirty-year-olds experienced slow and even negative real pay growth from 1979 to 1996, a large jump from 1996 to 2002, and then a renewed downward march from 2002 to 2014. The result is that the median 30-year-old in 2014 made the same as the median 30-year-old in 1979.

To facilitate comparison, the rest of the analysis compares the compensation of 30-year-olds in 2014—Millennials—with those of 30-year-olds in 1984—members of the Baby Boom generation—and 2004—members of Generation X. This brief refers to each group of 30-year-olds by the generation to which they belong.

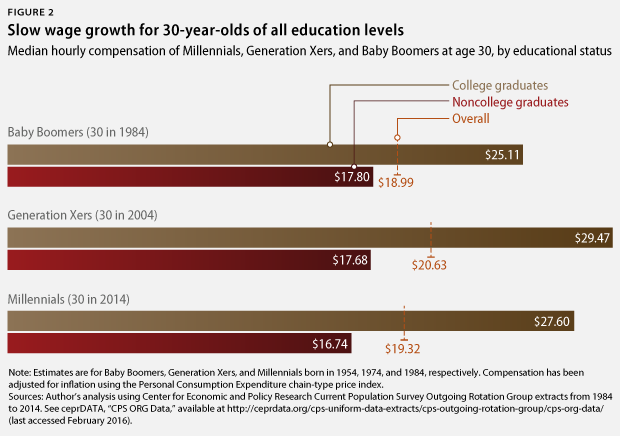

In 2014, the median compensation for a 30-year-old was $19.30 an hour—practically the same as it was for Baby Boomers in 1984 when adjusted for inflation and more than $1 less than it was for Generation X workers in 2004. Indeed, the pay of Millennials with a college degree is no higher than that of Generation Xers with a college degree even though the real cost of college has grown, as has the average college graduate’s debt. Moreover, the story for Millennials who lack a college degree is far worse.

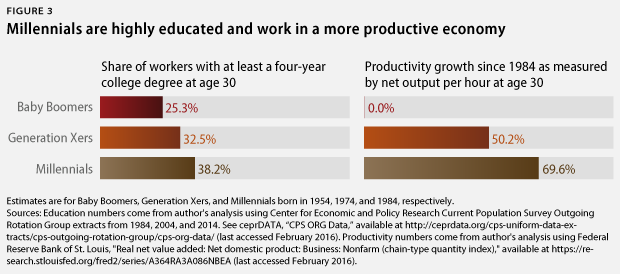

The above data are as striking as they are disturbing, particularly when it seems reasonable that Millennials should benefit from their higher levels of education and a more productive economy—two traditional remedies for sluggish wage growth. The share of 30-year-old Millennials holding a college degree, for example, is 51 percent higher than the share of Baby Boomers with a college degree when they were the same age and 18 percent higher than the share of Generation Xers. The same pattern holds true for productivity; while directly measuring the productivity of each generation is not possible, what is known is that Millennials are working in an economy that is 70 percent more productive than when Baby Boomers were the same age.

That the median compensation for Millennial workers is practically the same as it was for less-educated Baby Boomers working in a less productive economy 30 years ago strongly suggests that more education and higher productivity are not by themselves the solution to raising the pay of Millennials.

The challenge: Restoring workers’ ability to bargain

Perhaps the most important reason why Millennials’ compensation did not grow as expected is that they entered a labor market where the deck is stacked against workers.

The first challenge to Millennial workers’ bargaining power is an incomplete labor market recovery. No matter how many books on salary negotiation that today’s workers—Millennials or otherwise—read, negotiating a raise in 2016 will be difficult without a healthy labor market. Employers do not raise wages because they feel generous—they raise wages because they have no other option in order to hire and retain qualified workers. When there are a dozen workers willing to do a job, it becomes that much harder to bargain for a higher wage. Study after study shows that tighter labor markets—where employers compete for qualified workers—produce higher wages.

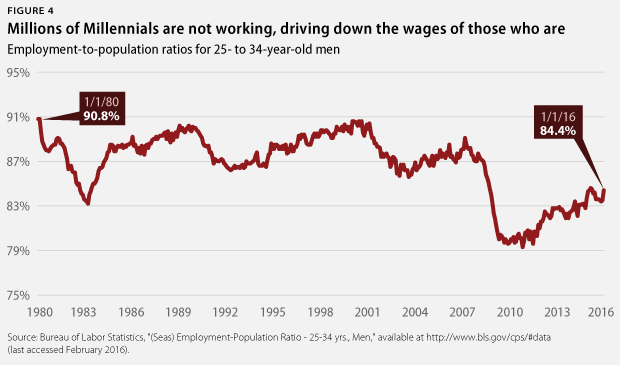

Despite substantial recent progress, there remains a great deal of slack in the Millennial labor market—as displayed in Figure 4 below, which shows the share of 25-year-old to 34-year-old men with a job since 1980. The graph focuses on just men to control for women’s much lower labor participation rates at the beginning of the 1980s, which reflects labor supply decisions by women and demand for female workers relative to male workers rather than aggregate demand.

Despite a record 71 months of private-sector job growth, the share of 25-year-old to 34-year-old men with a job is 2.6 percentage points below its prerecession level and a striking 6 percentage points below its level in 2000. Between 1980 and the Great Recession, there were only eight months—the first quarter of January 1983—when the share of 25- to 34-year-old men with a job was lower than it is today. The current U.S. labor market is still one where Millennials compete for jobs instead of employers competing for Millennials by offering them higher wages.

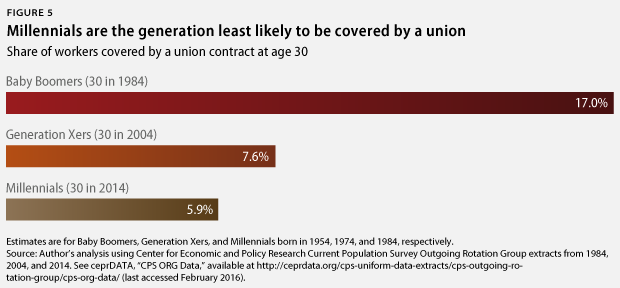

The second challenge to Millennials’ bargaining power is the decline of labor unions. Unions traditionally have helped balance power at the bargaining table by letting employees band together to negotiate for higher wages, better benefits, and additional job security. While union wages are not immune to the disempowering effect of weak labor markets, their growth rates are less cyclical than nonunion wages.

Unfortunately for Millennials, they are the least likely generation to belong to a union: Just 5.9 percent of private-sector workers belonged to unions at age 30 in 2014, compared with 17 percent of 30-year-olds in 1984 and 7.7 percent of 30-year-olds in 2004. Not only have Millennials faced a prolonged weak labor market, but they also are almost entirely unable to join the institution that could help rebalance power—namely, unions.

Raising the wages of Millennials will require leveling the playing field between workers and employers. The first step is for the Federal Reserve to pursue an empirically driven monetary policy that recognizes that further interest rate hikes make no sense in a period of low employment rates, practically nonexistent inflation, and negative interest rates in other advanced economies. Overall real wage growth began to creep above 1 percent in 2015 for the first time in five years;there is little reason for the Fed to stamp out the beginning of real wage growth when markets predict that inflation will average 1 percent over the next five years. The second step is to reverse the decades-long decline in union coverage by making it easier for workers to join together and bargain collectively.

The opportunity: Reducing—or ending—the motherhood penalty

The Millennial wage story is no longer just about trying to land that first full-time job, particularly when considering that the oldest group of Millennials will turn age 35 this year. As Millennial workers begin to raise children, they will have to balance work and family in an economy where two incomes are more necessary than ever.

The good news is that parenthood can increase wages. Research by University of Massachusetts sociologists Michelle J. Budig and Melissa J. Hodges shows that men’s earnings rise a staggering 14 percent when they have a child. Notably, this fatherhood bonus is not explained by an increase in work hours or a reduction in spouses’ work hours. The most convincing explanation—backed by experimental evidence—is that employers prefer employing fathers, seeing them as more committed than childless men and paying them more based on this perceived stability.

Unfortunately, Budig and Hodges’ research also finds that women see their wages decline 7 percent for each child they have, and about half of that drop is unexplained, likely reflecting employer discrimination against mothers—the so-called motherhood penalty. But the other half of the decline—the portion explained by mothers losing work experience and seniority while becoming more likely to take on part-time and seasonal jobs—presents an opportunity for public policy.

The United States is the only advanced economy where parents are not guaranteed access to paid maternity leave and has fallen behind its global competitors in making child care affordable. The lack of such policies makes it difficult for some women to work full time even if they want to. Indeed, Budig and Hodge find a motherhood bonus for women in the top 10 percent of earners, who are the women most likely to have access to paid leave and be able to afford child care.

Enacting paid family and medical leave and subsidized child care laws—as the Center for American Progress has proposed—would not only help squeezed Millennial families cope in the short term with lost wages and high child care costs but also permanently raise Millennial mothers’ wages, as they would need to take less time off from work to care for their families and would find it easier to hold full-time jobs.

Conclusion

The U.S. economy has not rewarded young workers for achieving the highest educational attainment of any generation and working in a more productive economy; today’s 30-year-old workers barely make more than workers that age did 30 years ago. Monetary policy and changes to labor law that make it easier for workers to bargain for raises, combined with family-friendly policies that reduce the motherhood earnings penalty, would help Millennials not just catch up with the gains of previous generations but also leap ahead.

Appendix

The compensation numbers are based on the author’s analysis of hourly wage data from the Bureau of the Census’ Current Population Survey, or CPS, Outgoing Rotation Group using extracts from the Center for Economic and Policy Research. The compensation numbers include workers who are employed, not self-employed, and do not work in the public or agricultural sectors. Focusing on private-sector, nonagricultural workers provides a group of workers that is comparable to the industries that the Bureau of Labor Statistics uses to measure productivity—nonfarm business.

The author calculated net productivity—output per hour minus depreciation—using data on gross output per hour from the Bureau of Labor Statistics Major Sector Productivity and Cost database and net output from the Federal Reserve Economic Data of the Federal Reserve Bank of St. Louis.

The author adjusted the wage numbers for inflation using the Personal Consumption Expenditures chain-type price index, or PCE. There exists an important debate about the correct inflation index to use for adjusting wages and incomes for inflation. The other main inflation index—the Consumer Price Index research series using current methods, or CPI-U-RS—shows more inflation than the PCE. Using the CPI-U-RS would depress Millennial wages further relative to previous generations.

What matters to employers is not just wages but also the cost of an employee—which also includes the cost of benefits such as employers’ health insurance premiums. These benefits have been taking up an increasing share of compensation, so looking at wages alone would tend to understate the growth of compensation. Unfortunately, the CPS data we used do not report compensation. We resolved this as others have: by taking the ratio of compensation to wages reported in the Bureau of Economic Analysis’ National Income and Product Accounts, or NIPA, tables and multiplying it by median wages. While this ratio is not necessarily the ratio of compensation to wages of the median hour worked, evidence suggests that the distribution of nonwage benefits is more unequal than that of wages and that the share of compensation coming from benefits rises with wages. Using the NIPA ratio thus would tend to overstate the median Millennial worker’s compensation relative to the median Gen Xer’s.

Brendan V. Duke is the Associate Director for Economic Policy at the Center for American Progress. He recently turned 30 years old.