The U.S. middle class is stuck in a rut: The U.S. Census Bureau recently revealed that real median household income failed to grow between 2013 and 2014—the fifth consecutive year in which it either shrank or did not grow. But this is not just the story of a weak recovery; it is also the story of a weak 2001–2007 expansion. Despite six years of economic growth, the share of prime-age workers with a job fell, and real median household income did not grow past its 2000 level during that expansion.

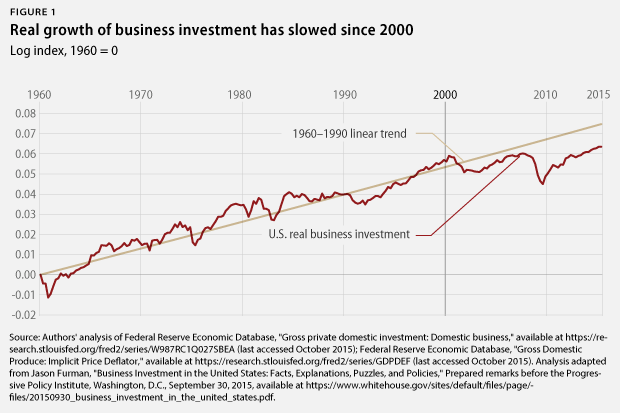

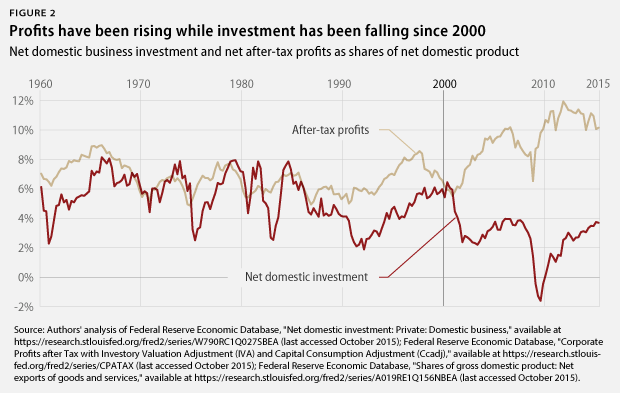

One of the primary reasons for anemic middle-class income growth in both post-2001 recoveries is a retreat in business investment, which has remained well below its historic trend. (see Figure 1) This is especially perplexing because corporate profits are robust and borrowing costs are historically low. (see Figure 2)

Slow business investment growth predates the Great Recession and presents a major challenge to both the demand and supply sides of the U.S. economy. For the demand side, lower investment means that companies are purchasing fewer goods and services, which in turn reduces employment and wages. For the supply side, less investment means slower productivity growth.

As White House Council of Economic Advisers Chairman Jason Furman has shown, lack of investment is the primary driver behind the recent productivity growth slowdown. While the failure of middle-class compensation to keep up with economy-wide productivity demonstrates that higher productivity does not automatically translate into middle-class income growth, economists and policymakers almost universally acknowledge that it is still necessary for long-term growth in living standards.

Some policymakers and analysts have argued that the key to increasing investment is cutting taxes on capital since that would boost the incentive to save and invest in new capital goods. This argument misses that higher after-tax returns also allow investors to do just as well in the future while saving and investing at a lower rate. Moreover, tax cuts themselves can lead to higher deficits, which reduce national saving. The balance of research on tax policy changes over the past four decades suggests that lower taxes on capital do not increase investment. Unfortunately, the nation’s decades-long experiment with tax cuts for the wealthy has produced only lackluster economic results at an exorbitant fiscal cost.

There are several public investments the country could make that would actually boost future productivity. A robust public investment agenda would include spending $100 billion per year on infrastructure investment, making college debt free, and increasing families’ access to high-quality child care, as the Center for American Progress previously proposed. These are important physical and human capital investments that would pay dividends down the road.

But another challenge is motivating the private sector to invest when the cost of borrowing money has never been lower. One possible explanation for the 15-year business investment drought is that managers and investors have become so focused on short-term profits that they are not making long-term investments that will increase the value of their companies. BlackRock CEO Larry Fink recently wrote a letter to the CEOs of the Standard & Poor’s 500 index companies arguing that this so-called short-termism has become a real problem:

As I am sure you recognize, the effects of the short-termist phenomenon are troubling both to those seeking to save for long-term goals such as retirement and for our broader economy. In the face of these pressures, more and more corporate leaders have responded with actions that can deliver immediate returns to shareholders, such as buybacks or dividend increases, while underinvesting in innovation, skilled workforces or essential capital expenditures necessary to sustain long-term growth.

This report examines the evidence of short-termism among publicly traded firms, finding that Fink’s worries are well founded. It next examines the role of three important players in modern equity markets—managers, short-term traders, and institutional investors—in the growth of short-termism.

The threat that short-termism poses to inclusive prosperity is a form of the “lemons market”—or asymmetric information—problem described by Nobel Prize winner George Akerlof. In a market, sellers know a product’s quality and try to fool buyers into paying full price for low-quality “lemons.” Savvy buyers refuse to pay top dollar because doing so no longer guarantees top-quality products. This generates a cascading effect in which sellers who cannot get top dollar stop selling their high-quality products until only the low-quality lemons remain on the market. Similarly, managers of public companies know more than investors do. Since higher short-term earnings signal higher long-run value, some managers may attempt to fool investors by engaging in short-termism to raise current earnings. This poses the danger that investors will believe the stock market is a lemons market, forcing even long-termist managers into short-termism in order to appear as profitable as short-termist firms. Taken to its logical extreme, this dynamic could cause growing firms to forgo or even exit public markets entirely.

Properly functioning markets are a powerful agent for inclusive prosperity, but properly functioning markets do not simply fall from the sky and cannot be taken for granted. The Center for American Progress proposes a policy agenda that would nudge financial markets toward a focus on the long term while paying dividends for managers, shareholders, and the middle class.

Marc Jarsulic is the Vice President for Economic Policy at the Center for American Progress. Brendan V. Duke is a Policy Analyst for the Center’s Middle-Out Economics project. Michael Madowitz is an Economist at the Center.