At the heart of Pay for Success, or PFS—also called social impact bonds—is a government contract in which the government agrees to pay for specific outcomes. It is the fact that the government only pays when social outcomes are achieved that makes the concept especially appealing in tight budgetary times. Likewise, it is the government’s promise to pay when the contracted outcomes are achieved that attracts investors to provide capital to programs that they believe can achieve those outcomes.

Two questions that have proven particularly important for every PFS arrangement are: What is the right price for an outcome? And how should government calculate that price? This issue brief provides guidance for government agencies on how to value outcomes.

Initially in the United States, governments have tried to establish a price by calculating so-called cashable savings—the number of dollars the government will save if and when the outcome is achieved. For example, a decline in crime would lead to a reduction in future incarceration costs. While this may be the right calculation sometimes, this methodology undervalues the true benefit of the outcome to government in many cases. Thus, it unnecessarily narrows the circumstances to which PFS can be applied.

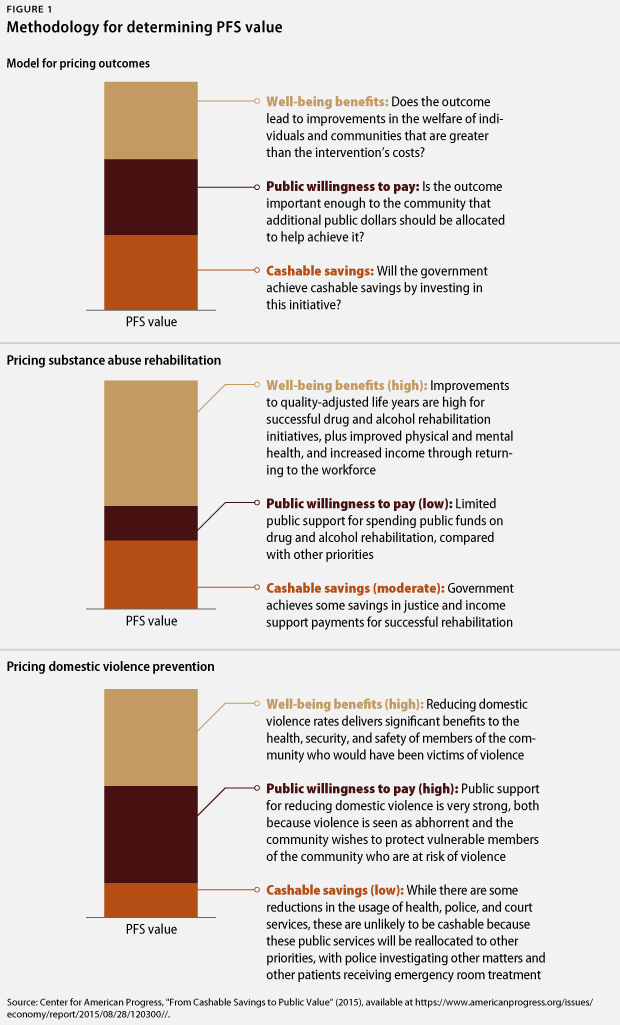

Given that PFS is still in its infancy, many governments are finding that setting the right price is a particular challenge and the cashable savings concept can constrain their ability to deploy PFS successfully. As PFS financing moves forward, it is important that governments adopt a broader set of considerations for deciding how much they are willing to pay for outcomes. Specifically, governments should take into account three factors in deciding the value of an outcome:

- Well-being benefits: the improvements that accrue to individuals and communities when the outcome is achieved

- Public’s willingness to pay: the outcome is deemed to be worth the investment

- Cashable savings: the savings that accrue to governments when the outcome is achieved

Taking this more holistic perspective on funding outcomes can dramatically reshape the PFS field and better target society’s finances to produce the greatest social impact.

Governments make most financing decisions based on more than simply cashable savings

When Pay for Success financing was introduced, it was presented as a tool that could deliver savings to governments that outweigh the costs of an intervention. The first PFS arrangement internationally was in the United Kingdom and focused on reducing recidivism for inmates leaving the HM Prison Peterborough, a penitentiary some 90 miles north of London. The British government estimated how much it would save as a result of a reduction in recidivism and promised to pay a proportion of those savings to an external organization if it was successful in reducing recidivism rates. Savings were calculated by looking at how much the prison system in the United Kingdom would likely save as a result of a recidivism reduction. Based on the calculated savings, the British government set a price for the outcome—about $13 million for a 10 percent reduction in recidivism rates for each cohort.

The initial PFS arrangements in the United States have followed the same methodology used in the original Peterborough arrangement. From reducing recidivism for people held in New York City’s jails to increasing early childhood educational attainment in Utah and improving outcomes for at-risk youth in Massachusetts, the contracting governments have focused on how much less they would spend on public services if the particular outcome was achieved—also known as the cashable savings. The term is meant to capture the actual money government saves and can therefore spend on other things.

Despite the term, some PFS initiatives are based on savings that are not easy to quantify because they are calculated based on average unit costs, which can include facilities and centralized costs, rather than marginal costs, which are the hours and materials used to provide the last unit of service. For example, the average annual cost of an inmate in North Carolina is roughly $30,000, but that includes the costs to operate the facility, statewide administration, and promised payments to retirees. Every additional prisoner costs $4,000 of incremental time, clothing, food, and other resources dedicated to each inmate. So reducing the number of prisoners by 1 percent does not release 1 percent of the costs. However, as the number of prisoners declines further, some of those more centralized costs can be unlocked—for example, by closing down parts of prisons.

Finally, there is the difficulty of cost savings that accrue to another agency or another level of government than the one directly undertaking the contract. In all of these examples, few or none of the savings can easily be converted to cash to pay for the program.

Even setting aside these practical considerations, while a focus on cashable savings might make intuitive sense and seem politically expedient, it does not ensure that governments will make the necessary investments to achieve long-term gains. Rather, it could lead to systematic underinvestment in PFS arrangements.

Imagine if all public spending had to pass the cashable savings test. Every social program would need to show that it saves the government more money than it costs. In other sectors of the economy, the government looks at a broader set of issues. For a road investment in the United Kingdom, for example, the government examines the benefits to society as a whole, including the time savings to each individual who uses the road, access to transportation for those getting to work, and the safety benefits associated with the new road. Government officials try to estimate the value that society places on these benefits. If that value exceeds the costs of building the road, then the investment is deemed appropriate.

Consider a social program that seeks to reduce domestic violence. If the program is successful, there are likely to be some cashable savings for the government. Reducing domestic violence saves on policing costs, as well as on incarceration and health care costs. But governments do not determine how much to invest by looking at these savings alone. They also consider how important stopping domestic violence is to society, based on the strong social belief that domestic violence is abhorrent. Even if it did not save the government money, policymakers would probably want to invest in reducing domestic violence for the simple reason that it is wrong. Consequently, public perceptions about the importance of tackling an issue are also an significant determinant of how much money governments should allocate.

Education provides another worthy example. Governments all around the world invest in education for children. They do so in part because they believe that education gives every child a chance to succeed. Governments also believe that giving every child a strong educational foundation is essential for a successful economy and society. Of course, educated members of society become productive workers and pay more taxes as a result of their higher wages. But when determining how much to invest in education, governments do not just calculate the projected value of tax collections; they also consider the lifelong benefits of education to individuals and to society as a whole.

In none of these examples does a government base its spending decisions solely on a calculation of the amount of savings to taxpayers as a direct result of the program. If they did, they would systematically underinvest in essential public services. Using cashable savings as the only way to determine outcome payments limits the value of the outcome and thus the instances in which a government can deploy PFS to produce better, more efficient outcomes.

Beyond cashable savings

Governments should think beyond cashable savings when deciding how much funding to attach to a Pay for Success arrangement. Indeed, some have already done so. For example, the state of New York’s request for proposals, or RFPs, for PFS projects require that interventions produce “quantifiable social value and budget savings.” Nonetheless, most jurisdictions that have looked to PFS financing to date have determined the price they pay for PFS outcomes by considering the magnitude of cashable savings achieved. It is time for a better articulation of how government should value outcomes in order to determine whether a PFS transaction should go forward.

As noted above, the authors propose that governments consider three factors in determining how much funding to commit for a PFS initiative:

- Well-being benefits: Does the outcome lead to improvements for individuals and communities that are greater than the intervention’s costs?

Social spending should only be undertaken if it improves the lives of the individuals and communities. Where benefits can be quantified and measured, outcome payments should reflect the value of these benefits.

The Washington State Institute for Public Policy’s, or WSIPP’s, approach is an example of the way evidence can be used to put a value on the well-being benefits that interventions achieve. WSIPP uses an economic model to value the benefits and costs of an intervention over time. For example, when analyzing a crime intervention, it not only looks at the savings to government as a result of a reduction in future crime—such as lower incarceration and policing costs—but also examines wider benefits to potential victims of crime. Most people do not think of the real harm from crime as the cost of incarceration or policing, but instead they think of the economic and social harm to victims.

- Public willingness to pay: Is the outcome important enough to the community that additional public dollars should be allocated to achieving it?

The public’s view about the importance of an issue is at the heart of most government spending decisions. This should also inform whether governments commit to paying for outcomes through a PFS initiative. The public’s values, such as preventing domestic violence; concern about contemporary problems, such as containing the spread of Ebola; and moral obligations, such as a commitment to support veterans, are three reasons that the price of an outcome could be higher than the measureable benefits to individuals and governments. Of course, this measure is likely to be the most difficult to calculate and also may vary over time.

Public willingness to pay is likely to be influenced by contextual factors. After a major storm, for example, public willingness to pay for storm defenses may be much higher than it was previously. Often, the easiest proxy for public willingness to pay is whether legislatures or executive branch leaders are willing to pay for an outcome—more often than not, that willingness reflects the political priorities of their constituents.

- Cashable savings: Will government achieve cashable savings by investing in this initiative?

Some interventions produce outcomes that reduce real government spending in the future by preventing more expensive problems. For example, reducing recidivism results in lower prison costs. The amount that government is likely to save should be an important factor in determining the price government is willing to pay for outcomes in a PFS arrangement. If the savings that a specific intervention will produce are calculated accurately and they exceed the cost of delivering the service, PFS can even enable government to launch new preventive programs without new expenditures because funding for outcomes can come directly from the savings. Moreover, PFS allows governments to implement programs and pay only after the results are confirmed.

Governments should determine the level of payment they are willing to promise for a PFS arrangement by looking at these three considerations together.

The framework depicted below demonstrates the importance of considering all three criteria. Governments could asses project’s value as too low if they look at only one of the criteria—for example, the public willingness to pay or cashable savings. But by looking at all three factors together, it is possible to develop a much better sense of the actual value to government—and, therefore, the right price to set.

No single consideration is essential to an initiative’s viability: Programs that have limited cashable savings but higher public support and well-being benefits might generate enough value to support a PFS contract. This is not a mathematical formula for determining outcome payments nor does it assume that governments will have enough funds to pay for every initiative in which benefits outweigh costs. Rather, the aim is to present key factors that responsible governments can consider in pricing outcomes for PFS contracts.

Whether a government actually enters into a PFS contract, the process of disaggregating the values as outlined here will strengthen any program. It also creates a framework to measure and evaluate existing programs or contracts.

When should governments use Pay for Success instead of traditional program funding?

Pay for Success financing, at least at this early stage, is complicated and takes quite a bit of effort to implement. However, when governments and policymakers want to achieve specific benefits, particularly those listed below, they should seriously consider PFS as a model for allocating resources.

- Creating accountability for—and thus improving—outcomes: PFS helps those who run, fund, and oversee programs to improve their results through tracking and managing outcomes in a focused manner.

- Paying only for success and sharing the risk of failure: PFS arrangements normally stipulate that funding will only be used if the outcome is achieved. In general, government currently pays for social services whether they achieve their desired outcomes or not—and the result can be unclear. PFS allows governments to share or completely shift the risk of failure to the upfront investor.

- Integrating funding streams to achieve results: PFS can bring upfront investments to achieve outcomes that have challenged governments due to their inter- and/or cross-governmental nature.

- Incentivizing private investors to help government and service providers achieve important societal outcomes: The first PFS transactions in the United States have brought about a new form of private-public partnership to address social issues. At a time when budgets are tight for social programming, this partnership can be of enormous value. And because the government only pays when outcomes are achieved, it can be easier for governments to innovate.

- Delaying payment for preventive programs: It is often difficult to find funding to implement preventive programs on a large scale because resources are tied up remediating the existing problems. PFS allows government to implement programs and pay after the results are confirmed.

PFS initiatives must also meet specific requirements: the government must be able to identify discrete outcomes and collect the right data; there must be evidence-supported interventions that improve those outcomes; and the interventions must be able to be implemented effectively at scale. If these requirements are met, PFS can be a valuable tool for governments and the communities they serve.

The future of Pay for Success

Pay for Success has been grown rapidly in just a few years from one project in the United Kingdom to dozens of projects in the United States and around the world. The idea has rapidly gained bipartisan support in the United States at the national, state, and local levels. The authors of this brief believe that PFS has the potential to improve the accountability of social spending and improve the lives of individuals and communities. However, it is critical that governments get the pricing right to enable PFS to realize its full potential.

Jitinder Kohli is a Senior Fellow at the Center for American Progress. Megan Golden is a senior fellow at the Institute for Child Success. Joe Coletti is the deputy director of the North Carolina Government Efficiency and Reform, or NC GEAR, initiative in the North Carolina Office of State Management and Budget. Luke Bo’sher is a Fulbright scholar at New York University’s Wagner School of Public Service and previously served in the Australian federal government.

The authors also wish to thank Sonal Shah and Marta Urquilla of Georgetown University’s Beeck Center for Social Impact and Innovation, Kathy Stack of the Laura and John Arnold Foundation, Erin Matteson from the North Carolina Office of State Budget and Management, Roxane White from Nurse-Family Partnership, and Tracy Palandjian and Jake Segal from Social Finance for providing valuable feedback on earlier drafts of this article.