The United States has the largest and safest aviation system in the world. On any given day, the Federal Aviation Administration, or FAA, must successfully handle 65,000 flights. Each year, commercial airlines carry approximately 740 million passengers—more than 2 million people per day. The backbone of this system is the 14,800 air traffic controllers who, along with 5,000 supervisors and managers, ensure a safe national airspace 24 hours per day. The vast majority of controllers are federal employees, while a small percentage are contract workers paid through the FAA budget.

In September, the current authorization for FAA programs, the FAA Modernization and Reform Act of 2012, will expire. Perhaps the largest and most complicated question before Congress is whether to privatize air traffic control operations, system maintenance, and procurement responsibilities for the air traffic control modernization program known as NextGen.

The current system of air traffic control relies on ground-based radar. When radar technology first came to the civilian aviation sector in the 1950s, it was cutting edge. Today, the limitations of radar hamper the FAA’s ability to manage heavy air travel demand—especially in the Northeast and other major metropolitan regions—and to efficiently reroute planes in response to severe weather. NextGen is an effort to transition to a more efficient satellite-based system.

The term privatization is politically fraught, for good reason: Privatization often means turning over government assets that serve as nonmarket-based public goods to a private entity with a profit motive. Fights over privatization are especially contentious when the private sector takes over infrastructure that functions as a public utility, with all the monopolistic advantages that can entail.

In this case, however, Congress is not contemplating turning over air traffic operations to a for-profit company seeking to earn a return on investment. Instead, privatization likely would take the form of a congressionally chartered, not-for-profit government corporation that would operate independently of the FAA. Another possibility is the formation of a hybrid public-private partnership. The goal for aviation stakeholders, to the extent that there is any unanimity, is to create an Air Navigation Service Provider, or ANSP, that is governed with substantial input from industry, is budgetarily self-sufficient, and operates independently of Congress.

The prospect of privatizing air traffic operations—and possibly, the procurement responsibilities for NextGen air traffic control modernization—raises many questions. Below are four of the most pressing.

1. If the current system of air traffic control governance works well, why privatize it?

The idea of privatizing air traffic control operations is not new. In fact, debates over air traffic control governance date back more than 30 years. For much of this time, however, the discussion has been largely academic, with little serious effort made to undertake such a dramatic overhaul.

The most often-cited reasons for privatization are budgetary stability and certainty. The rolling uncertainty over both appropriations and the authorization of aviation programs makes it difficult for the FAA, airports, manufacturers, air carriers, and others to engage in long-term planning or to operate a hugely complex air traffic control system smoothly and safely.

In theory, a privatized ANSP would be financially self-sufficient, allowing the entity to be independent from both Congress and the annual appropriations cycle. In short, no more service disruptions would result from political brinksmanship—not a small benefit. The prospects for privatization have become far more real as a result of two recent, politically driven disruptions to the National Airspace System.

First, in 2011, the authorization for FAA programs lapsed for two weeks due to a fight over the Essential Air Service program. The shutdown was the outgrowth of a contentious dispute regarding the size of federal subsidies to air carriers that serve rural airports, among other issues. The partial shutdown meant that the federal government did not collect approximately $30 million per day in airline ticket taxes. In addition, more than 4,000 workers were furloughed, shutting down numerous construction projects and delaying certain safety inspections. In the end, Congress would enact 23 short-term extensions before finally passing the FAA Modernization and Reform Act of 2012.

Second, in 2013, the budget deal known as the sequester—which forced automatic spending cuts to programs that receive money from the general fund of the U.S. Treasury—disrupted aviation manufacturing, construction, aircraft registry and certification, and some aspects of safety oversight. Initially, the FAA intended to shutter almost 200 contract towers that provide air traffic control services at smaller airports and to require all employees, including air traffic personnel, to take one furlough day every two weeks.

Congress eventually stepped in and prevented the worst impacts by providing the FAA with some budgetary flexibility to move funds from capital to operating accounts. While this avoided potentially major flight delays, it did little to stop disruptions to aviation manufacturers and their customers. Under federal law, for example, all planes must be registered with the FAA before they can enter service. As a result of the budget cuts, the registry was forced to close for a time, preventing air carriers from taking delivery of new aircraft.

To be clear, these events caused substantial disruptions to large sectors of the aviation industry. Of all the questions that arise when considering privatization, identifying the benefits is relatively simple. Unfortunately, privatization raises other, more challenging questions.

2. Who would pay?

Funding for FAA programs comes from two sources: annual appropriations and the Airport and Airway Trust Fund, or AATF. Appropriations cover approximately 30 percent of the FAA’s annual budget of $16 billion, with the trust fund covering the rest. Congress has always provided appropriations funding for aviation programs under the theory that a robust aviation sector provides substantial benefits to the nation, including to taxpayers who do not fly.

The FAA budget is broken into four major accounts: air traffic operations, facilities and equipment, research, and grants-in-aid to airports. For many years, Congress has directed appropriations funding exclusively to the operations account. In total, the $4.5 billion in annual appropriations funding represents a little less than half of the overall operations account; the remaining operations budget and all of the other accounts are covered by the AATF.

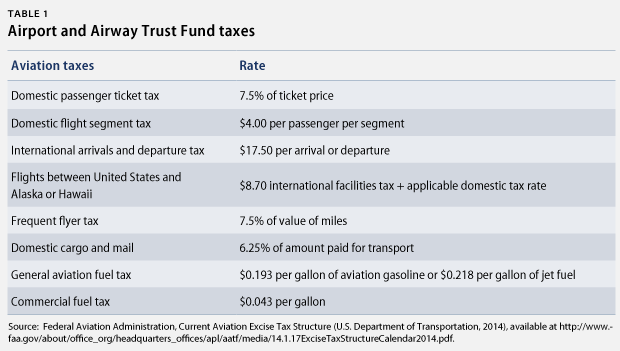

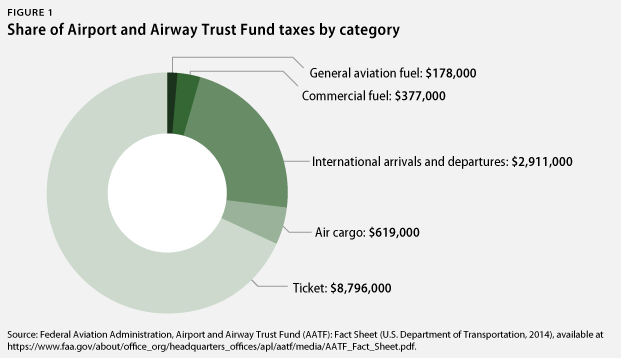

As shown in Table 1, the AATF is capitalized by taxes on aviation fuels, tickets, and air freight. The overwhelming majority of trust fund revenues are derived from ticket taxes, with only a modest share attributable to fuel and air freight.

Infrastructure policy debates are often a thinly veiled fight over taxes. This is especially the case with air traffic control privatization. In order to achieve true independence from Congress, the new ANSP must have a steady stream of tax revenue to cover operational costs and—depending on the extent of reform—procurement of NextGen air traffic control infrastructure.

Proponents of privatization would like to redirect the flow of trust fund revenues so that air traffic operations and procurement are fully funded by aviation taxes, with the remaining accounts supported through annual appropriations. This restructuring would provide the new ANSP with budgetary independence and long-term funding certainty, while leaving airport construction grants, research programs, and certifications to contend with the vagaries of the annual appropriations cycle.

Privatization represents a bold attempt by the aviation industry to carve out operations and procurement activities along with most or all of AATF funding, while dumping responsibility for remaining FAA functions onto taxpayers. This cherry picking comes at a time when aviation taxes have failed to keep pace with rising costs: In the past eight years, appropriations funding as a share of the total FAA budget has risen from 18 percent to 29 percent. Redirecting AATF revenues to fund the new ANSP and related procurement would fundamentally change the political dynamic around aviation taxes. In the future, taxpayers would be forced to cover the increasingly expensive remaining FAA functions that industry taxes partially cover today. In short, privatization would provide the aviation industry with the operational control it wants while also offloading a major funding responsibility.

While privatization would clearly constitute a win for the industry, it is less clear that this would benefit the public. Proponents of privatization often state that the new ANSP would be substantially more efficient and better able to handle the complex task of NextGen implementation. Given the FAA’s impressive safety record in the face of increased air traffic demand, the assumption of improved efficiency may be unjustified.

The stronger argument in favor of privatization rests with improved procurement. Yet even this potential benefit comes with additional questions about taxation. A review of the major aviation associations and other stakeholders reveals an industry that is, to say the least, not in hurry to pay more in taxes. For example, Airlines for America, or A4A—a trade group that represents the largest commercial air carriers in the United States—released a blog post prior to Halloween protesting that, “The aviation industry and its customers are charged 17 different taxes and fees. With all those taxes, even Frankenstein is scared.”

The general aviation community has perhaps even less tolerance for raising taxes. The Aircraft Owners and Pilots Association, or AOPA, which represents more than 400,000 general aviation members, has repeatedly attacked attempts to establish aviation user fees. For several years, the Obama administration has proposed increasing general aviation fuel taxes, as well as levying a $100 user fee on every general aviation flight. This proposal stems from the fact that while general aviation users are responsible for 15 percent of air traffic control costs, they contribute less than 3 percent of AATF revenues.

The head of AOPA described the user fee proposal as “a serious assault on general aviation.” In the past, AOPA has supported very modest increases in aviation fuel taxes. However, these would not provide enough revenue to cover the costs that general aviation currently imposes on the system, let alone enough to advance NextGen infrastructure modernization.

Current estimates place the cost of NextGen implementation at approximately $40 billion. Even if an independent ANSP is more efficient at system procurement than the FAA, it will not be $40 billion more efficient. Given that the aviation industry is loathed to accept higher taxation, it is very unlikely that the new ANSP would impose taxes that are high enough to cover the cost of NextGen. This means that if modernization responsibilities were privatized, it would require substantial appropriations funding from Congress. And yet advocates of privatization would like the new ANSP to control the procurement process—ostensibly privatizing efficiency gains from NextGen while socializing modernization costs. Because it will provide enormous financial benefits to air carriers, the financial burden of modernization should be shared.

3. How would privatization affect NextGen implementation?

Transitioning from a ground-based radar system of navigation and control to one based on satellites is a major undertaking. The task is complicated, in part, because upgrading is not as simple as purchasing existing systems and then scheduling installation. NextGen involves funding primary and applied research to advance the science and technology required to make the envisioned system a reality. And the upgrades extend beyond infrastructure owned by the government. As part of the transition, aviation users—from the smallest private planes to the largest commercial carriers—will have to upgrade their on-board avionics.

As recently as 2009, the Government Accountability Office, or GAO, listed the NextGen modernization program as having a high risk for “waste, fraud, abuse, and mismanagement or in need of broad-based transformation.” More recently, the GAO praised the FAA for improved management, but implementation remains a difficult process.

The incentives to get NextGen right are enormous. An economic analysis by the FAA found that NextGen would return $2 in benefit for every $1 invested:

Implementing and maintaining them [NextGen upgrades] is expected to cost the FAA and aircraft operators $37 billion through the year 2030, while generating $106 billion in total benefits over that same time period. Applying a 7 percent discount rate, and taking the difference between the present value of benefits and costs, we find that NextGen mid-term improvements have a Net Present Value (NPV) of $23 billion. This translates to $2 in benefits for every $1 invested.

The principal benefit from NextGen implementation is avoided delay—more flights taking off and landing on time. The FAA estimates a total benefit over the next 15 years of $106 billion, with $77 billion resulting from avoided delay and the remaining $29 billion resulting from more direct routes that burn less fuel, reduced carbon dioxide emissions, safety improvements, and other operational cost savings. NextGen offers a highly efficient technological solution to the problem of aviation congestion—a problem that will only grow worse as the United States adds another 100 million people by 2060.

Two things are certain: NextGen offers tremendous benefits, and the FAA could do a much better job of implementing this complex suite of technologies. Turning over such a large procurement process to a privatized ANSP, however, comes with its own challenges.

For starters, NextGen is not the only procurement underway within the FAA. And the FAA has a responsibility to ensure that NextGen integrates smoothly with existing systems. In fiscal year 2013, Congress appropriated $2.7 billion for the Facilities and Equipment account, or F&E. Annual NextGen funding has held constant at around $1 billion, principally within the F&E account. The remaining funds support numerous activities, including tower facilities, lighting, telecommunications, landing and navigation aids, and weather equipment, among many other categories. Splitting off NextGen from the bulk of facilities and equipment planning and procurement—as some proponents of privatization would like to see—increases the possibility that the two will become out of step, causing technological conflict or reducing the efficacy of the investment.

Technology integration is not the only possible sticking point. In the past decade, the aviation industry has undergone substantial consolidation. As a result, major carriers increasingly dominate certain geographic areas, pushing up prices even as fuel costs fall. Privatization raises the possibility that procurement could become a new form of rent seeking by major carriers looking for a competitive advantage. The rollout of NextGen technology and the redesign of airspace around major metroplexes will not be uniform. Would Delta Air Lines agree to upgrades at a major American Airlines hub? Would either major carrier approve a system deployment that might benefit a new regional carrier competing for their established market share? At the very least, these questions deserve consideration when debating alternative forms of air traffic control governance.

Finally, the highly cyclical nature of the aviation industry could negatively impact NextGen implementation. Unlike essentials such as rent and food, air travel is quickly reduced or eliminated during hard economic times. Research by the U.S. Travel Association reveals that 72 percent of domestic air trips are for leisure purposes. As a result, the economic health of the aviation industry is closely tied to the overall health of the U.S. economy.

A recent FAA report wistfully states that, “Going into the next decade, there is cautious optimism that the industry has been transformed from that of a boom-to-bust cycle to one of sustainable profits.” Perhaps. Under the current system, Congress sets all aviation tax rates. In theory, privatization would give the new ANSP the authority to set rates. The history of boom and bust raises the possibility that the aviation industry might use its seat at the ANSP governance table to try to roll back taxes and fees during a downturn. Cutting aviation taxes to respond to economic conditions could dramatically slow the pace of air traffic control modernization—if ANSP-controlled taxes are directed toward the modernization at all.

Congress, by comparison, is not bound by economic cycles and can deficit spend to stimulate aggregate demand, including on critical assets such as aviation infrastructure. The Great Recession offers a prime example. The American Recovery and Reinvestment Act of 2009 included a total of $1.3 billion for aviation programs, including $1.1 billion for grants to airports and $200 million for facilities and equipment.

4. How would privatization affect aviation policy?

Public policy, system management, and infrastructure planning and procurement are deeply intertwined. Privatizing air traffic operations and NextGen procurement would reduce the extent to which important aspects of aviation policy remained under the control of Congress and the FAA. For example, Congress has consistently promoted safety as a fundamental goal of federal aviation policy. This policy goal finds expression in the thousands of decisions and rules that collectively govern aviation manufacturing, personnel training, and daily air traffic control operations. Privatizing air traffic operations and NextGen procurement would mean relinquishing control over many of these collective decisions and rules.

How long is an air traffic control shift? How many hours of rest must a controller have before a new shift may begin? How much automation should air traffic operations allow? How many years of experience should a controller have before working at the busiest airports? Answering these questions is only a small aspect of what it takes to safely operate the National Airspace System. And while it may be tempting to argue that they are somewhat of a red herring—since Congress would continue to set standards across the board—the history of the federal regulation of private entities suggests that the policy shift involved with privatization would be profound.

Other modes of transportation offer a window into what the new dynamic might look like. Private freight railroads, for example, raise their own revenue, plan and build their own infrastructure, and control daily operations. The Federal Railroad Administration, or FRA, has little ability to affect the direction of rail infrastructure development and is confined to engaging in safety oversight—largely reacting to accidents. The rail industry often bristles at FRA’s attempts to regulate, claiming that federal involvement in its business affairs results in clunky rules that harm the industry. Would a privatized ANSP develop a similarly contentious relationship with the FAA?

Highways offer another example. The Federal Highway Administration provides states with substantial grant support each year. Yet the overarching request on the part of state departments of transportation—which own the infrastructure, plan and build new projects, and maintain operational control—is for more money and less oversight. Would a financially self-sufficient ANSP that also controlled system procurement chafe at FAA oversight?

Budgetary and personnel numbers illustrate the scale of the potential impact of privatization on the FAA. Air traffic control and NextGen procurement account for a little more than 50 percent of the entire FAA budget. Of the FAA’s more than 45,500 full-time employees, air traffic control operations account for more than 31,000, or 69 percent, with another 195 employees dedicated to NextGen implementation. Privatization would effectively split the agency in half: The new ANSP would control operations and NextGen procurement, while the FAA would retain critical oversight functions and certification of aircraft, systems, and certain industry personnel such as pilots and mechanics. In other words, privatization represents a major restructuring of personnel and decision-making authority.

Conclusion

While the motivations for privatization—namely, budgetary certainty and more efficient procurement—may be simple, the effects of such a massive transformation in aviation governance are anything but. Privatization could be the right policy answer: After all, just because something has been done one way for a long time does not mean it should continue to be done that way as conditions change. Yet the level of policy intervention should be commensurate with the level of the problem. Given the complexity and uncertainty surrounding privatization and the successful track record of the FAA, advocates have a high bar to clear to demonstrate that the current system is so broken that a major change in governance is warranted.

Kevin DeGood is the Director of Infrastructure Policy at the Center for American Progress.