In recent years, a growing number of philanthropic foundations, policymakers, social service providers, and researchers have come to recognize that the social sector is changing. Shrinking public-sector budgets have limited traditional government grant programs. An increasing number of private funders have created financial models that pay for performance and emphasize the importance of and need for evidence. And complex social challenges such as criminal recidivism, poor school performance, homelessness, and chronic health conditions, with their panoply of causes and effects, seem to resist nearly every attempt to solve them. These issues have given rise to the creation of new models of partnership between the public, nonprofit, and private sectors that focus on achieving results.

The status quo in the social sector simply cannot hold. One in five American children lives in poverty. More than 600,000 people were homeless on one night in January 2012 when the Department of Housing and Urban Development last conducted its census for the Annual Homeless Assessment Report. Nearly 100,000 of those people were chronically homeless, meaning they had been continuously homeless for at least a year or had been homeless at least four times in the past three years. Many long-term homeless individuals are single adults, but homelessness among families is a growing problem in some localities or municipalities. For instance, 1 in 100 children in New York City today does not have a permanent home. There are approximately 133 million Americans suffering from a chronic illness, including 7.1 million children with asthma. Up to 73 percent of low-income children with asthma do not receive proper treatment.

These numbers demonstrate the scale of challenges facing those who want to improve their socioeconomic conditions or receive better treatment for what ails them. They also represent enormous cost to the public. In response, a new suite of tools has been developed in an attempt to affect positive change in the social sector. These new mechanisms fall under a broad umbrella of what is referred to as “social finance,” where evidence, evaluation, and scale capital are brought to bear on intractable social issues. While these tools are still fairly new and far from mainstream, we can nevertheless take valuable lessons from how—and why—they were developed.

There are essentially three avenues for social finance today: new methods of grant making, such as the Social Innovation Fund; innovative public-private partnerships, such as social impact bonds and Pay for Success contracts; and new strategies and behaviors in the capital markets, such as impact investing.

This brief offers a primer on each of these tools, explaining what they are, how they are being used, and where policy changes can help them reach their full potential. It is important to understand innovation funds, social impact bonds, and impact investing as “tools” or “mechanisms.” They are the means by which we can hope to reach a range of very important ends—improved educational attainment, economic security, and stable, healthy lives for some of our poorest and most vulnerable citizens—and build on the impact of ambitious, large-scale public and philanthropic efforts. When all is said and done, impact—real, measurable, verifiable impact—is the bottom line.

Innovation funds

Even the most effective social service organizations face challenges when it comes to evaluating their impact and scaling their interventions to reach more people. Because of the way grant programs are structured, it can be difficult for nonprofit organizations to secure sufficient philanthropic or public funding for more than a year or two at a time. And restrictions on how public funds can be used—as well as private-donor preferences—can make it harder still to secure money to fund the rigorous impact evaluations required to take a social intervention from “promising” to “proven.”

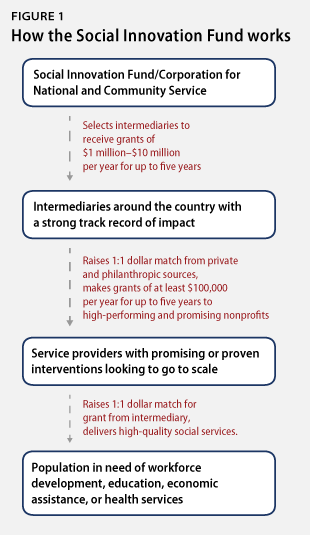

The Social Innovation Fund, created in 2009 and housed at the Corporation for National and Community Service, or CNCS, seeks to change that. The Social Innovation Fund invites applications from external organizations—sometimes called intermediaries—with strong track records of finding and funding effective social service organizations. Through a competitive process, the Social Innovation Fund makes grants from $1 million to $10 million per year for up to five years to these intermediary organizations. The Social Innovation Fund therefore makes two critical levels of investment: first, by investing in intermediaries who can—and do—find the best, most innovative social service programs throughout the country; and second, by investing in scaling those programs that are already working.

These federal grants then leverage private and philanthropic dollars twice: first, the intermediaries must match the federal grant they receive dollar for dollar with nonfederal sources; then, the grantees who receive funds from the intermediaries must likewise match that award 1-to-1 with other donations. This funding arrangement means that the $137.7 million awarded by the Social Innovation Fund since 2010 has leveraged $350 million in commitments from nonfederal sources.

The funds are used to scale effective social services so they can reach more people. Unlike many other grant programs, however, Social Innovation Fund dollars can also be used to finance rigorous evaluations. The program offers technical assistance to support evaluation as well.

The projects and programs assisted financially through the Social Innovation Fund are geographically and programmatically diverse. The fund supports early childhood programs in the Twin Cities—Minneapolis and St. Paul, in Detroit, and several cities and towns in Colorado. It awards funds that provide nonacademic support to help 4,400 college students stay in school in Chicago, Miami, New York City, and San Francisco. The Social Innovation Fund supports workforce development programs in Atlanta and Baltimore and is helping to reduce homelessness in Chicago. All told, since 2010, 20 intermediary organizations have received grants and raised additional dollars to finance service providers addressing issues of economic opportunity, health, and youth development.

The Social Innovation Fund is not alone in the federal government. The Investing in Innovation, or i3, fund at the Department of Education, which was originally funded through the 2009 Recovery Act, provides development, research, and scaling funds for evidence-based programs for K-12 education. To date, the i3 fund has awarded 92 grants totaling more than $900 million.

The vast majority of i3 grants have been relatively small awards to support the development and testing of innovative and promising new educational approaches. A smaller number of more generous grants are so-called “validation” grants, which fund the delivery of services and more rigorous evaluation of interventions that have a more developed evidence base, but still need work to demonstrate their effectiveness and impact. Four grants in 2010 and one grant in 2011 went to so-called “scale-up grants,” which expand programs already proven with rigorous evidence in an effort to reach more people and communities. Much like the principles behind the Social Innovation Fund, i3 grantees are required to raise matching donations from private or philanthropic sources.

The Department of Labor, meanwhile, is home to the Workforce Innovation Fund, which seeks to identify and evaluate promising approaches to workforce development. The fund made 26 grants totaling some $147 million in 2012, and in 2013 became one of the only federal programs supporting Pay for Success financing, which is discussed in the next section.

Many foundations and high-quality service providers have embraced the relatively new innovation fund model. In the Stanford Social Innovation Review, Carla Javits of REDF and Lisa Jackson of New Profit, Inc.—both of which are venture philanthropy organizations—noted in 2011 that they were “pleased that the CNCS and its evaluation consultants understand the importance of evaluating in a developmentally appropriate fashion,” and that some nonprofit subgrantees were allowed to take the time they needed to determine the best questions to evaluate impact later on, rather than being required to immediately conduct outcome evaluations. This flexibility gives promising programs time to build the right data-collection methods early in the Social Innovation Fund cycle. The Social Innovation Fund has changed the way the philanthropic marketplace thinks about scale, impact, and evidence.

Policy recommendations

As the innovation fund model continues to develop, there are a number of formal and informal policy options available to improve on the approach.

Scale the innovation fund model to other agencies

First, the Obama administration should consider expanding the innovation fund model to additional agencies and programs, blending lessons from the Social Innovation Fund, the i3 fund, and Workforce Innovation Fund. The two-tiered funding model of the Social Innovation Fund—where the intermediaries and the service providers both raise matching funds—is beneficial because it leverages considerably more nongovernmental resources. The Social Innovation Fund model of investing in intermediaries has given those organizations greater reach, allowing them to find the best programs to fund around the country. The i3 fund’s formal division into different levels of funding for innovative new programs, promising but unproven approaches, and proven interventions needing to go to scale allows a wider range of applicants and contributes to building a broader evidence continuum. The Workforce Innovation Fund benefits from the flexibility to support innovative new financing models.

Publish and use impact evaluation data

In existing innovation fund programs, agencies should make impact data for supported programs more transparent and available. Agency leaders should seek ways to ensure that the data and evidence gathered by innovation fund grantees is shared inside and outside of the government and that lessons learned through the innovation funds are applied to traditional government grant programs when appropriate.

Impact bonds and Pay for Success

Imagine a tool that allows the public sector to pay only for programs that delivered results and only after those results had been achieved. That is the central premise behind social impact bonds and their younger sibling, development impact bonds, which both fall in the category of what the Obama administration terms “Pay for Success” financing.

It is important to state up front that an impact bond is not a “bond” in the sense of a traditional, fixed-rate-and-term security such as a municipal bond, but is better understood as a rigorous outcomes-based contract between multiple parties.

Despite the confusing nomenclature, the impact bond model is simple in the abstract. At the outset of an impact bond agreement, a public-sector agency takes the lead in determining a specific, measurable outcome they want to see improved for a discrete population over a period of time. The outcome may be something like reducing recidivism for a certain category of prisoners in a system, reducing the rate of a specific chronic-health emergency, or reducing the infant-mortality rate. In many cases, the desired outcome is expected to save the public sector money in the future in addition to improving outcomes for individuals. Those anticipated future savings can be used to calculate the price the public sector is willing to pay for the improved outcome.

The public sector then contracts with an external organization that pledges to achieve the desired outcome with the understanding that the public-sector entity will pay the agreed-upon price only if they succeed. The external organization then may hire and manage nonprofit service organizations to provide interventions to achieve the improved outcome. But unlike in a traditional grant model—or even an innovation fund model—the public sector has yet to pay a penny to any of the organizations in the impact bond arrangement. The external organization turns to socially minded philanthropic or private investors to provide the working capital needed for the service providers to do their jobs.

If and when the outcome is achieved and verified by an independent evaluator, as spelled out under the terms of the contract, the public-sector entity releases the outcome payment, which the external organization then uses to repay the investors’ principal, plus a return for shouldering the financial risk of the impact bond. If the agreed-upon outcome is not achieved, the public sector does not pay out and—in the original impact bond model—the investors lose their principal.

But as we shall see, when it comes to using impact bonds, there is considerable opportunity for variation from this general model.

Social impact bonds

The impact bond concept originated in the United Kingdom, where the first social impact bond, to combat recidivism among short-term, nonviolent offenders at Peterborough Prison, was launched in 2010. Since then, the United Kingdom has built an impressive ecosystem of public and nonpublic organizations to facilitate social financing arrangements and social impact bonds. Big Society Capital, for instance, is a British investment bank dedicated to supporting the social investment market that was launched in 2012 and has up to £600 million in available capital raised largely from unclaimed assets in British financial institutions. In the government, the Cabinet Office hosts the Centre for Social Impact Bonds, which conducts outreach and education, as well as a £20 million fund to help partially finance outcomes for social impact bonds launched by local authorities in which some benefits accrue to the central government.

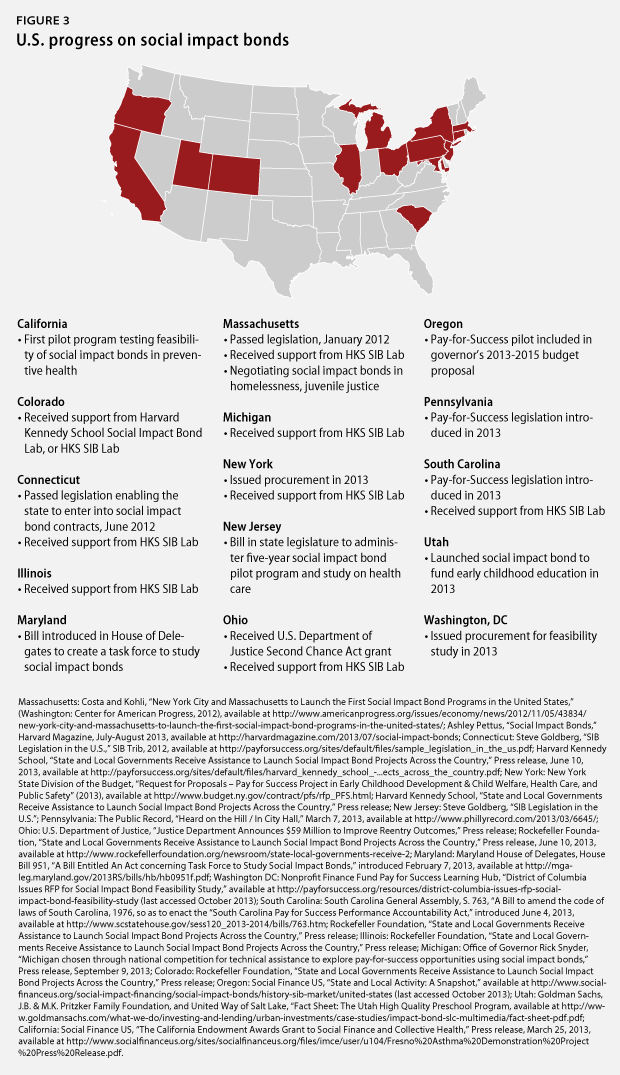

In the United States, the Center for American Progress released the first think-tank report on the social impact bond concept in 2011. Since fiscal year 2012, the White House has proposed using modest amounts of federal funding to support cities and states pursuing Pay for Success models in its budget, including social impact bonds. Congress, however, has not taken up any of the Obama administration’s Pay for Success proposals; as a result, these funds have not been appropriated.

But two federal programs—the Workforce Innovation Fund in the Department of Labor, described in the previous section, and the Second Chance Act in the Department of Justice, which funds programs to help prisoners reintegrate into society—were determined to have sufficient flexibility to help support Pay for Success without new appropriations. Last year, the Justice Department awarded about $10 million in research and implementation grants for Pay for Success projects. In September 2013, the Labor Department committed $24 million in Pay for Success grants to the state-level labor agencies in New York and Massachusetts, which the department “will release in installments based on whether the grant outcomes were met.”

Despite limited federal support, many states and municipalities are moving to explore and implement social impact bonds. The first social impact bond in the nation was announced in New York City in August, with the aim of reducing recidivism among 16- to 18-year-old males imprisoned in the Rikers Island prison complex by at least 10 percent over four years. At the same time, the state of Massachusetts announced the counterparts it had chosen to negotiate with on two social impact bonds, one in juvenile justice and one in chronic homelessness, following an open procurement process.

In Utah, an agreement to expand high-quality early childhood education to an additional 3,700 low-income 3- and 4-year-olds in two school districts was finalized in June. And in Fresno, California, where one in five children has asthma, a pilot program funded by the California Endowment, a private health foundation, seeks to demonstrate that a social impact bond could considerably reduce the rates of asthma-related emergencies among low-income children.

These four projects provide considerable insight into the potential for variation in the generic social impact bond model described earlier and demonstrate that there is no one approach to designing and negotiating a social impact bond. The Rikers Island social impact bond was financed primarily with $9.6 million from the investment-banking firm Goldman Sachs and guaranteed by a grant from Bloomberg Philanthropies for $7.2 million—some 75 percent of the total investment. The guarantee means that, if the outcome is not achieved and recidivism does not fall by at least 10 percent, the investor—Goldman Sachs—does not lose its entire principal.

Little information about the Rikers Island social impact bond was made public before the details of the deal were announced in their entirety in August 2012. But in Massachusetts, the state has taken a more open approach to exploring impact bonds and Pay for Success. Notably, around the same time that Massachusetts opened procurement for intermediaries and social service providers to bid on two sets of Pay for Success contracts, the state also became the first to pass legislation related to Pay for Success. In January 2012, Gov. Deval Patrick (D) signed legislation establishing a Social Innovation Financing Trust to hold outcome payments for the duration of social impact bond deals, thereby reassuring investors that, even if the administration in power changes, they will be paid for successful outcomes.

In the Utah social impact bond, Goldman Sachs is once again the lead investor, putting $4.6 million in to the deal. The venture capitalist J.B. Pritzker provided an additional $2.4 million as a subordinate loan, which reduces the risk for Goldman Sachs as the Pritzker money would only be repaid after the Goldman investment. This tiered-investment structure is arguably more replicable than the high-guarantee model used in the Rikers Island social impact bond deal, as philanthropic investors and others with a higher tolerance for risk can blend resources with more risk-averse institutional investors.

But not every intervention that seems like a good candidate for a social impact bond will be ready to be financed at scale right away. That is why the Fresno, California, demonstration project that aims to show the effectiveness of preventive care in reducing asthma-related emergencies by working with 200 children is such an exciting development for social impact bonds. Supported by the California Endowment, this grant-to-social impact bond model gives a promising candidate for full social impact bond financing time to collect data and work out any kinks in the delivery model before scaling up.

Other states and municipalities have also announced their intention to pursue social impact bond financing, including New York, South Carolina, Ohio, and Connecticut. These states are at various stages in developing social impact bonds—some are already negotiating details, while others are in the early stages of exploring promising issue areas. As more deals are finalized and announced, the community of private and philanthropic funders, intermediaries, and nonprofit service providers working with the social impact bond instrument will grow as well.

Just as not every program is a good candidate for being scaled through an innovation fund, there are considerable limitations to when social impact bonds should be used.

First, social impact bonds can only be used in instances where a specific, measurable outcome can be set. That means sufficient historical data must exist to set a realistic outcome. Given that everything in a social impact bond hinges on the outcome—from the plans of the service providers to the investors’ decision to put money into the deal to the eventual payment from the government—it is essential that all parties know the baseline from which they must work.

Next, social impact bonds should not be used in instances where cessation of services would result in harm to a population or used to finance critical public services such as primary and secondary education. If the intermediary organization begins to think it is unlikely that it will achieve the outcome, and, as a consequence, they will not be paid at the end of the deal, the intermediary has a strong incentive to stop providing services. While contracts can be written to require an orderly wind-down of services, it is unlikely that the government could force the intermediary to continue in a deal doomed to fail.

Finally, social impact bonds are difficult to negotiate and require a significant investment of time and resources from all parties. The state of Massachusetts, for instance, first announced their intention to pursue social impact bonds in May 2011. As of this publication, the details of the two impact bonds being negotiated in Massachusetts have yet to be announced. The Social Impact Bond Technical Assistance Lab at Harvard University’s Kennedy School of Government recently released a report that walks cities and states through the process of developing a social impact bond. The report comprises 36 discrete steps.

In general, as we previously wrote with the members of the Social Impact Bonds Working Group last year in our report “Frequently Asked Questions: Social Impact Bonds,” the best policy areas for social impact bonds today are:

- Program areas where outcomes can be well defined and administrative data are available

- Preventive interventions that cost significantly less to administer than remedial interventions and thus have the potential to save government money

- Areas where some proven interventions already exist, particularly those that are politically sensitive or politically unpopular

- Issues where political will for funding can be difficult to muster and/or sustain

Development impact bonds

Development impact bonds take the social impact bond model and apply it to another area that has seen a growing emphasis on measurement, evidence, and striving for improved outcomes: international development. The financing landscape for international development has changed considerably in recent years, shifting from a system dominated by official development assistance to one in which private-sector investment, philanthropic grant making, and domestic resource mobilization has vastly increased the amount of money available for development.

The development impact model closely mirrors social impact bonds. The details of a development impact bond flow from an agreed-upon, measurable outcome, and payment is contingent on success. Private investors provide the upfront financing, and it is likely that development impact bonds, like social impact bonds, will feature an intermediary organization that manages relationships between the other actors and monitors performance.

Since developing countries may not have sufficient domestic revenue, however, the development impact bond model allows for some or all of the outcome payments to be made by an external funder such as an international aid agency, a large philanthropy, or a consortium of organizations.

The applicability of development impact bonds, as is the case with social impact bonds, will be constrained considerably by the availability of good baseline data and the ability to set discrete, measurable outcomes. The timing, however, could not be better for development impact bonds. Not only is the impact bond becoming increasingly familiar in the United States, the United Kingdom, and other industrialized countries, but the United Nations is also in the midst of considering a global development agenda to succeed the Millennium Development Goals, which are set to expire at the end of 2015. Advocates for development impact bonds should see an opportunity in the recent U.N. High Level Panel on the Post-2015 Agenda report, which calls for a “data revolution” and includes an illustrative goal to “create a global enabling environment and catalyze long-term finance” for development.

Policy recommendations

Given that impact bonds are such young tools, there are many policy levers that could help better facilitate the negotiation of individual deals as well as the evolution of a true market for investors.

Federal government needs to play a larger role

More needs to be done at the federal level to support impact bonds and Pay for Success. Congress needs to act to ensure that the federal government can take a more active role in shaping the social impact bond market. Not only should Congress appropriate the discretionary funds—some $195 million requested by the Obama administration in the most recent budget—they should also take up the administration’s other proposal and create a $300 million Pay for Success incentive fund in the Department of the Treasury. The incentive fund, as envisioned in the president’s 2014 budget, would help solve several challenges facing the social impact bond market.

First, the fund would help backstop investments in Pay for Success deals, potentially broadening the pool of available investors in the impact bond market. Next, the incentive fund could help states negotiate social impact bond agreements and partially finance outcome payments in cases where some financial benefits are likely to accrue to the federal government and particularly to mandatory programs. Improved health outcomes, for instance, have both state and federal financial consequences, particularly for low-income people on Medicaid. And the standards used by the incentive fund to evaluate applicants would send strong signals to the market as to what comprises a “good” impact bond.

The Department of Labor’s decision to make its two Pay for Success grants available to partially finance outcome payments for social impact bonds being negotiated in New York and Massachusetts was an important first step for the federal government to help states pay for outcomes. But the long procurement process—the grant solicitation was announced in June 2012, and awards were not made until September 2013—further underscores the need for a central place in the federal government that can set standards for applications, establish best practices, provide technical assistance and aid for building state capacity to negotiate social impact bond contracts, and partially support outcome payments where appropriate.

Disclosure and transparency are key for the success of the market

Transparency is another critical challenge for impact bonds and Pay for Success. To date, the decentralized, state-by-state process of social impact bond negotiations in the United States has allowed for natural experimentation in how the deals are set up and financed, but it also means that too many jurisdictions new to impact bonds have had to start from scratch.

While many intermediaries and other organizations have engaged in public outreach and education efforts, more can be done. States should consider requiring social impact bond contracts be made public. Transparency in social impact bond transactions will go a long way toward helping the market grow more quickly and will help assuage concerns about using public dollars to repay investors for successful outcomes.

Start with pilots for development impact bonds

For development impact bonds, the recent report published by the Center for Global Development is a considerable contribution, but more work needs to be done to identify promising geographic and programmatic areas and to build institutional capacity both in the aid community and on the ground in developing countries. Data, particularly the historical baseline data needed to set a good outcome, will likely be even more challenging in the international development context than domestically.

The development community could take a lesson from the experience of the California Endowment and begin by seeking commitments from financial partners, most likely foundations, to support one or two promising pilots. The Center for Global Development report identifies several potential cases for development impact bonds—to reduce Rhodesian sleeping sickness in Uganda, for instance, and to expand low-cost private schools in Pakistan—that could hold promise as grant-to-development impact bond demonstration projects.

Consider how to appropriately share risks between parties

For both social and development impact bonds, issues around risk and risk-sharing promise to be problematic. A 2012 report by Godeke Consulting observed that government, service providers, and philanthropy have considerable overlap in their priorities for the Pay for Success market, while “the investors’ priorities are quite distinct and in a few cases at odds with the goals of the other stakeholders.” Notably, one of the attractions of the impact bond model for governments is that it transfers away the risk that public dollars will be spent on ineffective programs; however, until the true risks of the model are better known and more predictable, many private investors are likely to balk at the all-or-nothing nature of financial returns inherent to the model.

There are a range of investor types who could potentially work on a social impact bond deal, including philanthropic foundations, high net-worth individuals, socially minded financial organizations such as Community Development Financial Institutions, and private-sector institutional investors, all of which have different institutional missions and different levels of tolerance for risk. These investors should seek to build informal relationships with one another and with potential impact bond intermediaries to better facilitate multiple-investor transactions to balance risks appropriately among investor types.

Policymakers should also take an active role in facilitating social impact investments, including in social impact bonds. Beyond the standard-setting potential of a federal Pay for Success fund at the Treasury Department, the federal government could consider modifying the rules governing the Community Reinvestment Act, which requires banks to make a certain amount of investment in underserved areas, to encourage the use of Pay for Success instruments and impact bonds.

Impact investing

While both the Social Innovation Fund and impact bond/Pay for Success models involve active public-sector participation, impact investing primarily harnesses the capital markets to invest in businesses or assets that seek to achieve so-called “double-bottom-line” returns—returns that blend both financial and social benefit and an intent to make a positive impact. Currently, impact investing funds projects in a diverse range of areas, from for-profit enterprises and clean energy production to affordable housing and social services.

Impact investing has the potential to make a considerable positive impact in communities across the country and the world. Many approaches to impact investing have been tested in recent years, including program-related investments, or PRIs, at foundations, and equity investments in affordable housing and community development projects. Banks including J.P. Morgan Chase and Morgan Stanley have begun offering impact investing products to high net-worth customers who want to see some portion of their portfolios create broad social benefits as well as financial returns. Overall interest is clearly on the rise considering that socially responsible investment assets in the United States alone increased from $639 billion in 1995 to $2.71 trillion in 2007, according to the Global Impact Investing Ratings System, or GIIRS.

Impact investing vehicles take a variety of forms. Eleven states have passed laws to create a new class of private enterprises known as benefit corporations, or B Corps. These enterprises operate like traditional corporations but also attain a social accountability certification, much as new buildings can achieve LEED platinum certification for energy efficiency.

Other businesses build social impact explicitly into their customer pitch. Warby Parker, the online eyeglasses retailer, for instance, donates a pair of glasses for every pair sold. Revolution Foods created a successful model to offer healthy school lunches at competitive prices. Even large corporations such as Starbucks and Unilever and private companies such as Patagonia are using their business to implement more sustainable environmental, social, and employment practices.

Some foundations have taken the lead in driving socially responsible investing to the next level. The Omidyar Network has committed more than $600 million to for-profit and nonprofit organizations since 2004. Since 1995, more than 13,000 investors have bought in to the Calvert Foundation’s portfolio funding social enterprises and impactful nonprofit organizations to the tune of $800 million. The Rockefeller Foundation has made critical grants to build organizational capacity and seed the market for impact bonds and other social finance vehicles. And the F.B. Heron Foundation recently announced plans to move its entire $274 million endowment to impact investments over the next five years.

U.K. Prime Minister David Cameron prioritized impact investing at the 2013 Group of 8 meetings, convening a forum on the subject ahead of the leader’s meeting in June. At that time, the Obama administration announced several initiatives around impact investing. The Small Business Administration doubled its impact investing funds to $150 million. And the heads of the Overseas Private Investment Corporation, USAID, and the Small Business Administration announced the National Impact Initiative, a new framework to better align the Obama administration’s work on impact investing, social enterprise, and other impact initiatives.

This range of efforts from the private sector, philanthropy, and government demonstrate the high level of interest in finding ways to make socially impactful, responsible investment achieve its full potential to transform lives and communities. But more work remains to be done.

Policy recommendations

Better define impact investing

At its core, an impact business is one with the intent to build financial wealth and social value while also committing to measuring its progress against metrics for both financial and social returns. But these businesses can be difficult to identify, even with B Corp certifications, and more detailed taxonomy is needed to clarify different investment types.

Build more infrastructure

There needs to be investment in building the pipeline of impact investments and the infrastructure to support them. Many investors are interested in making later stage investments, but social enterprises and companies still need early investment to help them grow. Some companies may need financing while they build out their business models, and others are still building marketplaces and may need greater investment upfront in the form of grants, loans, or equity.

Investing upfront in intermediaries, both for-profit and nonprofit, will help build the pipeline for more impact investments. Other elements of a robust infrastructure for impact investment include business incubators and organizations such as the Global Impact Investing Network, which helps set standards for evaluating impact investments, and the B Lab, which certifies B Corps and facilitates knowledge sharing.

Adopt standard metrics for success

The sector needs more widespread adoption of common metrics to help determine what organizations count as impact businesses and whether intent matters. These metrics should be simple, concise, and easily understandable in order to make it attractive for new businesses to focus on impact. As the field grows and we gather more data, examples, and stories of successful results, we can be more honest about both challenges and guidelines needed for entrepreneurs and investors.

Create more financial products

The sector needs more banks, asset managers, and investors to develop products to allow for greater investment in businesses that can generate revenues and impact. Philanthropy and governments might also consider developing credit enhancements to create incentives for more capital market investments.

Determine the best methods for scaling impact investing

Identifying promising impact investments is a challenge, even with certification programs. The Omidyar Network believes that in order to scale impact investing, the sector should shift from a firm-based approach, where investors choose individual organizations or businesses to put their money into, to a sector-based approach, where they might put their money into pooled funds or other assets that fund a range of actors working in a certain issue area. The sector-based approach would not entirely replace the firm-based approach, since some investors will still prefer the latter, but expert-driven investment could help bring reluctant investors in to the fold and boost the overall impact of their investments.

Find ways to support a range of possible returns on investment

There needs to better research on rates of return in the impact investing sector. There are likely some sectors that already have the potential to produce outsized returns—clean technology, for instance, or housing—but other sectors need more maturity and still others may have lower rates of return. It is important for investors to be realistic about returns—and to make data-driven decisions. For instance, a recent study by the Case Foundation found that—contrary to conventional wisdom—impact investments made in small businesses in low- and moderate-income areas performed as well as their peers.

Philanthropy and investors should invest in research to get a better handle on the data and actual returns in the sector by asset class. Forthcoming research from the Center for the Advancement of Social Entrepreneurship at the Duke University Fuqua School of Business, InSight at Pacific Community Ventures, and ImpactAssets will lay out lessons learned from some of the highest-performing impact investing funds building on their 2012 report analyzing early trends in the emerging impact investing market. Continued research and analysis will be needed at every stage of market development.

Pursue appropriate government support

Policy also can play an important role in catalyzing impact investing vehicles that need longer to develop or may offer lower rates of return. The G-8 working group should look at the potential for Community Reinvestment Act rules to include impact investing, consider urging more widespread adoption of B Corp legislation, and offer possible changes to the rules for pension-fund investors. All of these policies could significantly increase the amount of money available for impact investing.

Conclusion

Innovation funds, impact bonds, and impact investing are all new and fairly complex tools, and considerable work must be done to make these mechanisms as useful and effective as they could be. But there is considerable momentum among, and great opportunities for, investors, foundations, service providers, and government leaders to bring these tools to bear on tackling a host of social challenges, making government work more efficiently, and harnessing the enormous profits of the private sector as forces of good.

Sonal Shah is a Senior Fellow at the Case Foundation and the Center for American Progress. Formerly, she served as the director of the White House Office of Social Innovation and Civic Participation. Kristina Costa is Speechwriter to the Chair and a Policy Analyst in economic policy at the Center.