The economic recovery is nothing if not resilient. The economy and the labor market in June continued on their path toward a self-sustaining recovery, despite the onset of adverse policy changes such as the end of a temporary payroll tax holiday in January 2013 and across-the-board spending cuts in April 2013. Economic growth and job creation would likely have been stronger under a different set of policies, but housing-market growth provided the economy a much-needed boost.

Despite housing gains, America’s middle class desperately needs stronger growth and faster job creation. Millions of families are still suffering from high unemployment, persistent long-term unemployment, and massive household-debt burdens.

It is not too late for policymakers to reverse course away from a sole focus on deficit reduction and toward a combination of tax and spending changes that will contribute to stronger economic growth and lower deficits. Indeed, recent research by the Center for American Progress has shown that the need for urgent deficit reduction has significantly abated over the past three years. With this context in mind, policymakers should heed the recommendations in CAP’s comprehensive agenda for economic progress to strengthen the American people and build the business environment necessary for sustainable long-term growth.

1. Economic growth picked up at the beginning of 2013. Gross domestic product, or GDP, increased in the first quarter of 2013 at an inflation-adjusted annual rate of 2.4 percent. Domestic consumption increased by an annual rate of 3.4 percent, housing spending grew by 12.1 percent, business investment accelerated moderately by 2.2 percent, and exports grew only by 0.8 percent in the first quarter. Government spending shrank again by 4.9 percent, slowing overall growth. Policy solutions should therefore aim to ease the strain of fiscal austerity on the economy and replace across-the-board spending cuts with a fiscal policy approach that can actually enhance rather than slow economic growth.

2. The moderate labor-market recovery continues in its fourth year. There were 5.1 million more jobs in May 2013 than in June 2009, when the economic recovery officially started. The private sector added 5.8 million jobs during this period. The loss of nearly 670,000 state and local government jobs explains the difference between the net gain of all jobs and the private-sector gain in this period. Budget cuts reduced the number of teachers, bus drivers, firefighters, and police officers, among others. Job creation should be a top policy priority since private-sector job growth is still too weak to quickly overcome other job losses and rapidly lower the unemployment rate. A reorientation of tax and spending policies to strengthen economic growth rather than a blind obsession with deficit reduction at all costs could create millions of jobs that America’s middle class desperately needs.

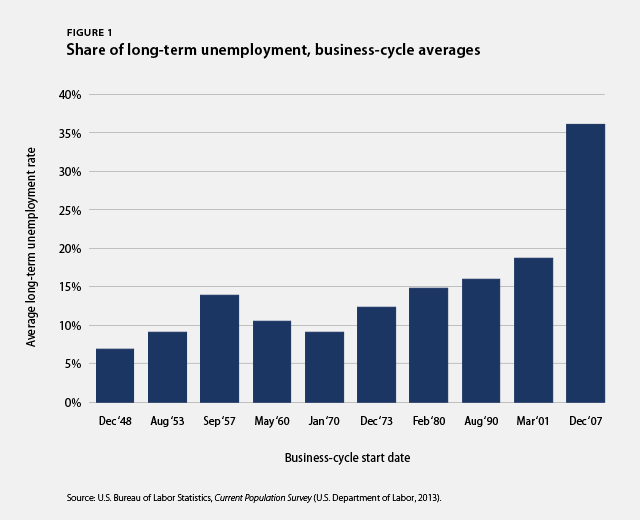

3. Long-term unemployment stays high, and some communities continue to struggle disproportionately from unemployment. The unemployment rate stood at 7.6 percent in May 2013, and 37.3 percent of the unemployed had been out of work for at least six months. Those out of a job for a long time struggle to regain employment because their skills atrophy. This is especially true for economically vulnerable groups. The African American unemployment rate was 13.5 percent in May 2013, the Hispanic unemployment rate was 9.1 percent, and the white unemployment rate was 6.7 percent. Meanwhile, youth unemployment stood at 24.5 percent. The unemployment rate for people without a high school diploma ticked down to 11.1 percent, compared to 7.4 percent for those with a high school degree, 6.5 percent for those with some college education, and 3.8 percent for those with a college degree. These population groups with higher unemployment rates have struggled disproportionately more amid the weak labor market than white workers, older workers, and workers with more education. This creates a greater need for progressive policy actions to strengthen job creation for everybody.

4. The rich continue to pull away from most Americans. Incomes of households in the 95th percentile—those with incomes of $186,000 in 2011, the most recent year for which data are available—were more than nine times the incomes of households in the 20th percentile, whose incomes were $20,262. This is the largest gap between the top 5 percent and the bottom 20 percent of households since the U.S. Census Bureau started keeping record in 1967. Median inflation-adjusted household income stood at $50,054 in 2011, its lowest level in inflation-adjusted dollars since 1995. And the poverty rate remains high, at 15 percent in 2011, as the economic slump continues to take a massive toll on the most vulnerable citizens.

5. Employer-sponsored benefits disappear. The share of people with employer-sponsored health insurance dropped from 59.8 percent in 2007 to 55.1 percent in 2011, the most recent year for which data are available. The share of private-sector workers who participated in a retirement plan at work fell to 39.2 percent in 2011, down from 42 percent in 2007. Families now have less economic security than in the past due to fewer employment-based benefits, which requires that they have more private savings to make up the difference.

6. Family wealth losses still linger. In March 2013 total family wealth was down $8.4 trillion (in 2013 dollars) from March 2007, its previous peak. Homeowners on average own only 49.2 percent of their homes—compared to the long-term average of 61 percent before the Great Recession—with the rest owed to banks. Homeowners’ massive debt slows household-spending growth, as households still have little collateral for banks to loosen their lending standards and households spend less than they otherwise would on new homes and other big-ticket items.

7. Household debt is still high. Household debt equaled 106.3 percent of after-tax income in March 2013, down from a peak of 126 percent in March 2007. Household debt grew again relative to after-tax income in the first quarter of 2013, up from a low of 104.8 percent—the first such increase since the fourth quarter of 2009. A return to debt growth outpacing income growth from already-high debt levels could eventually slow economic growth again if interest rates rise from historically low levels and crowd out household spending on other items.

8. The housing market continues to recover from historic lows. New home sales amounted to an annual rate of 454,000 in April 2013—a 29 percent increase from the 352,000 homes sold in April 2012 but well below the historical average of 698,000 homes sold before the Great Recession. The median new-home price in April 2013 was 14.9 percent higher than one year earlier. Existing-home sales were up by 9.7 percent in April 2013 from one year earlier, and the median price for existing homes was up by 11 percent during the same period. Home sales have to go a lot further, given that homeownership in the United States stood at 65 percent in the first quarter of 2013, down from 68.2 percent before the recession. The current homeownership rates are similar to those recorded in 1995, well before the most recent housing bubble started. Though the housing-market recovery started later than the wider economic recovery—and started out at a record low—lately the housing market has been growing rapidly and contributing a much-needed boost to economic progress. As such, there is still plenty of room for the housing market to provide more stimulation to the economy more broadly. The fledgling housing recovery could gain further strength if policymakers support economic growth and job creation at the same time.

9. Homeowners’ distress remains high. Even though mortgage troubles have gradually eased since March 2010, nearly one in nine mortgages is still delinquent or in foreclosure. In the first quarter of 2013, the share of mortgages that were delinquent was 7.3 percent, and the share of mortgages that were in foreclosure was 3.6 percent. Many families delayed and defaulted on mortgage payments amid high unemployment and massive wealth losses. This caused some banks to be nervous about extending new mortgages, which further prolonged the economic slump. Policymakers can accelerate economic growth by helping households lower their debt burdens through refinancing help and debt forgiveness.

10. Corporate profits stay high near pre-crisis peaks. Inflation-adjusted corporate profits were 83.1 percent larger in March 2013 than in June 2009, when the economic recovery started. The after-tax corporate profit rate—profits to total assets—stood at 3 percent in March 2013, nearing the previous peak after-tax profit rate of 3.2 percent that occurred prior to the Great Recession.

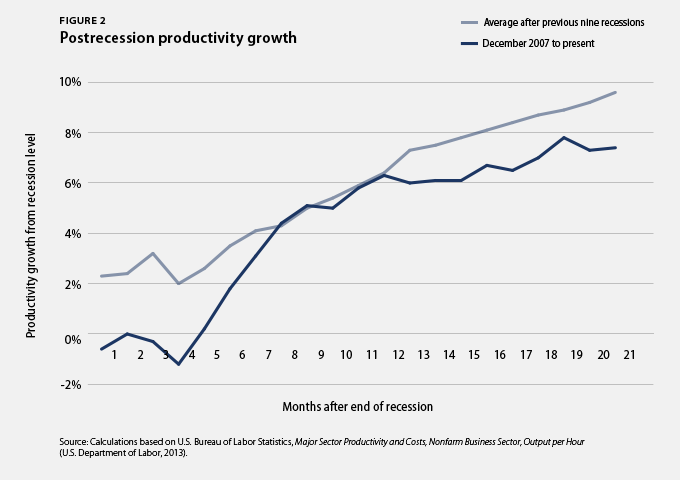

11. Slow productivity growth marks the U.S. economy. Productivity growth is the main ingredient in rising living standards. Wages, jobs, and profits depend on workers and companies figuring out how to make more and better things in the same amount of time. Output per hour, the main measure of productivity growth, has expanded by 7.4 percent from December 2007, when the Great Recession started, to March 2013, the last quarter for which data are available. This is substantially less than the average productivity growth of 9.6 percent during the same periods in previous business cycles of equal or greater length.

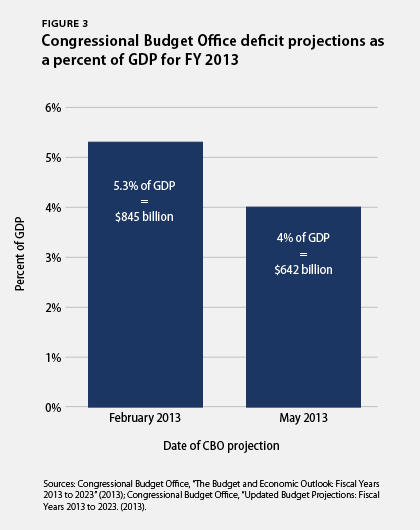

12. The outlook for budget deficits improves. The nonpartisan Congressional Budget Office, or CBO, estimated in May 2013 that the federal government will have a deficit—the difference between taxes and spending—of 4 percent of GDP for fiscal year 2013, which runs from October 1, 2012, to September 30, 2013. This deficit projection is down from 7 percent in FY 2012. This projected deficit for FY 2013 is better than what CBO predicted in February 2013, when it estimated a deficit of 5.3 percent of GDP for FY 2013. This improvement follows larger-than-expected tax collections, an improving economy, and slower health care inflation, among other factors. The estimated deficit for FY 2013 is much smaller than it was in previous years due to a number of measures that policymakers have already taken to slow spending growth and raise a little more revenue than was expected just last year. The improving fiscal outlook generates breathing room for policymakers to focus their attention on long-term growth and job creation in addition to long-term deficit reduction.

Christian E. Weller is a Senior Fellow at the Center for American Progress and a professor in the Department of Public Policy and Public Affairs at the McCormack Graduate School of Policy and Global Studies at the University of Massachusetts Boston. Sam Ungar is a Special Assistant at the Center.