Throughout his campaign and since taking office, President Donald Trump has promised to stand up for working people and families. But the most far-reaching bill he’s signed into law—the Tax Cuts and Jobs Act of 2017—was a handout for corporate America and the wealthy at the expense of working- and middle-class families. President Trump’s tax handout is estimated to cost $1.9 trillion between 2018 and 2027, according to the Congressional Budget Office (CBO). As a result of the law, large corporations are receiving a massive tax cut—even bigger than what was originally expected. And while the law is running up federal deficits, it is having little or no positive effect on the U.S. economy, according to new research from the Congressional Research Service.

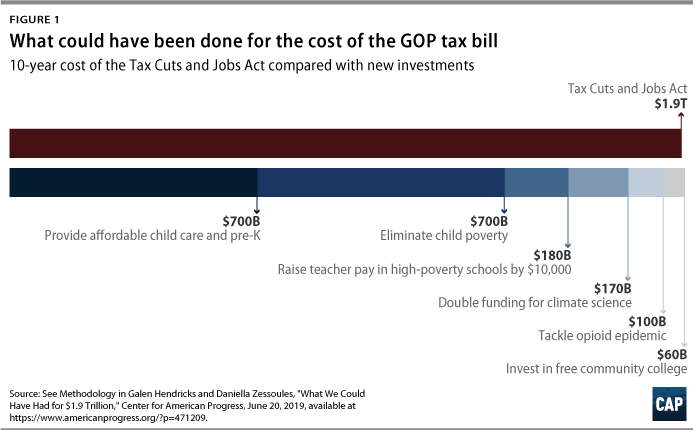

Working- and middle-class families deserve better. In fact, for the same $1.9 trillion cost of President Trump’s tax giveaway, the United States could afford to completely eliminate child poverty; double its federal investment in climate science; extend universal access to affordable child care and pre-K; provide a $10,000 raise for teachers in high-poverty schools; provide free community college; and take dramatic action to tackle the opioid epidemic. (see Methodology)

In reality, these investments are even less costly than President Trump’s tax giveaway. The $1.9 trillion price tag does not include the cost of extending certain tax cuts that were enacted as temporary, which would add another $650 billion to the 10-year cost.

Galen Hendricks and Daniella Zessoules are special assistants for Economic Policy at the Center for American Progress.

Methodology

The authors referred to the following resources when calculating the costs of investments toward which the $1.9 trillion tax handout could have been used.

- Eliminate child poverty: A 2017 TalkPoverty.org estimate found that bringing every family with children—along with each child who was not living with their family—above the poverty line would cost $69.4 billion in 2016.

- Double funding for climate science: According to a previous CAP estimate, doubling federal funding for climate science would cost $170 billion over 10 years.

- Extend universal access to affordable child care and pre-K: This assumes the cost of enacting the Child Care for Working Families Act introduced by Sen. Patty Murray (D-WA) and Rep. Bobby Scott (D-VA). According to CAP analysis, the bill would cost roughly $700 billion over 10 years after adjusting for gross domestic product (GDP) growth.

- Provide a $10,000 raise for teachers in high-poverty schools: This plan would cost around $15 billion per year or about $180 billion over the next 10 years if adjusting for GDP growth.

- Provide free community college: Former President Barack Obama proposed $60 billion over 10 years to provide two years of free community college.

- Take dramatic action to tackle the opioid epidemic: The Comprehensive Addiction Resources Emergency Act of 2018 would provide $100 billion in federal funding over 10 years to various states and local communities in need of resources in order to combat the opioid epidemic.