If there is truth in the old adage that “budgets are moral documents,” then President Donald Trump’s fiscal year 2020 budget, its first part released today, is morally bankrupt. It aims debilitating cuts at programs on which American families rely in order to pay for tax cuts, strips regulators’ ability to stop corporate wrongdoers and polluters, and launches yet another brutal attack on Americans’ health care. Every year, pundits declare the president’s budget “dead on arrival,” but Americans should make no mistake: Trump’s FY 2020 budget is a clear statement of his priorities, and its policies are those the president would enact if given the opportunity. And Trump’s priorities and policies reveal his sheer contempt for the “forgotten men and women” for whom he pledged to fight.

In fact, this year, Trump’s first ruse—even before his accounting gimmicks begin—is the budget rollout itself. The budget is already more than a month late thanks to Trump’s 35-day government shutdown, but it is being released in two parts: Today, Trump revealed a message-heavy budget overview. But Americans will have to wait another week before learning many of the specifics of his deep cuts; the complete budget is slated for March 18. While this ruse may obfuscate details of Trump’s devastating policies, it does not change the reality that the administration will be seeking drastic cuts to key priorities that the American people strongly support.

Trump’s budget reveals how middle- and working-class Americans will pay the price for his tax cuts

President Trump’s main legislative achievement in his first two years in office is a tax cut favoring rich Americans and wealthy corporations. The tax cut will add nearly $2 trillion to deficits over a decade—and potentially much more. The Trump administration achieved the tax cut by promising that average American families would receive a $4,000 increase in real wages—and that the tax cut would “pay for itself.” Both of these promises were false. The big winners of the tax cuts were wealthy corporations, which have seen their profits soar. And the tax cut is already bleeding revenue: In FY 2018, federal revenue was $200 billion—or 6 percent—below its pre-tax cut level, with corporate tax revenue $119 billion, or 37 percent, lower than projected. Corporate tax revenue plummeted by $92 billion, or 31 percent, from its actual FY 2017 level. These revenue losses were the biggest driver of growth in the federal deficit, which was up 77 percent in FY 2018.

Just as his past two budgets have done, Trump’s FY 2020 budget seeks to conceal the true costs of his tax cuts by “cooking the books,” including assuming economic growth rates about a percentage point higher in the coming years than those assumed by governmental and private-sector forecasts. But this fuzzy math should not distract from the budget’s main objective: cutting programs that ensure basic living standards for working- and middle-class Americans—such as food, housing, and Social Security—to pay for tax cuts.

New research shows that more than 51 million American households—43 percent—are unable to afford basics such as food, transportation, and health care. Yet the Trump budget contains a devastating $220 billion cut over the coming decade to the Supplemental Nutrition Assistance Program (SNAP), the nation’s largest nutrition assistance program, an approximately 33 percent reduction (compared to the baseline level estimated by the Congressional Budget Office). The entire program, whose modest benefits help more than 19 million American families put food on the table each month, costs less than Trump’s tax cuts for the richest 1 percent. On top of this, Trump is seeking to completely eliminate the Community Development Block Grant, which—among other things—provides federal funding for Meals on Wheels, a program that delivers meals to low-income seniors to help them get enough to eat and stay in their homes. In the midst of the nation’s growing affordable housing crisis, Trump wants to slash the budget of the U.S. Department of Housing and Urban Development by 16.4 percent—including eliminating the Public Housing Capital Fund and the HOME Investments Partnerships Program. Other eliminations include allocations to the National Housing Trust Fund, which supports rental housing for low-income renters such as seniors, veterans, people with disabilities, and households that have experienced homelessness.

Despite research showing that taking away food, housing, and health care from struggling workers doesn’t help them find steady work any faster, the Trump budget also lays out plans to impose so-called work requirements—which function as punitive time limits for unemployed and underemployed workers—across multiple programs that ensure basic living standards. In doing so, Trump is sidestepping Congress, which rejected Trump’s plans to impose these cuts legislatively, including in his failed attempts to repeal the Affordable Care Act (ACA) and gut Medicaid as well as harshen SNAP time limits in the 2018 Farm Bill. The Trump administration’s unprecedented policy encouraging states to impose these cruel time limits on Medicaid recipients already shows the devastating effects: In Arkansas, more than 18,000 workers have had their health insurance taken away since last June alone. And the administration is pursuing a cruel proposed rule that, by its own estimates, would take SNAP away from 755,000 struggling workers.

Breaking his widely noted campaign promise not to touch Social Security, the president’s newest budget would slash $84 billion over the coming decade from federal disability programs, including Social Security Disability Insurance (SSDI). The Trump budget threatens jobs and strips away resources from the very communities he has most vigorously promised to help, such as manufacturing workers, by eliminating the Manufacturing Extension Partnership, which helps small- and mid-size manufacturers compete.

Finally, like last year, the budget makes dozens of cuts worth hundreds of billions of dollars to national priorities in education, infrastructure, workforce development, energy and the environment, and much more.

The president’s budget also shortsightedly cuts investments in our future, including by slashing student aid for higher education by $207 billion over 10 years, and eliminating important education programs for teacher training (Supporting Effective Instruction State Grants) and after school (21st Century Learning Centers). The budget proposes deep cuts to science and research funding.

Trump continues his war on Americans’ health care to pay for his tax cuts

After repeatedly trying and failing to repeal the ACA legislatively, President Trump and congressional Republicans have resorted to attacking and weakening the law through executive action, federal waivers to the states to undermine Medicaid expansion, and budget proposals to gut funding levels.

Once again, Trump’s budget proposes massive cuts—$777 billion over 10 years—from repealing the ACA and slashing Medicaid. Like in his previous two budgets, Trump goes beyond these two measures to attack traditional Medicaid, seeking to restrict federal funding on a per-beneficiary basis or transition to block grant funding. Both of these things would lead to a significant decrease in federal funding and could cause millions of people to lose their health care coverage. Like in last year’s budget, he encourages states to take Medicaid away from jobless and underemployed Americans, including laid-off workers, people who are going to school, and those who are taking care of children or family members. Medicaid is a lifeline for millions of Americans—including children, veterans, people with disabilities, and individuals affected by the opioid crisis. Tearing down this vital program will make it more difficult for people to access the health care they need to find work, including by preventing people with disabilities from accessing the long-term services and supports they need to participate in the labor market.

After he repeatedly promised to protect Medicare as a candidate, Trump makes changes to Medicare that would shrink the program by $845 billion over the coming decade.

Trump’s budget enriches polluters and corporate wrongdoers by defunding key regulators

President Trump promised to clean up corruption, but his budget indicates that he will continue to seek to defund the agencies that protect Americans from pollution, financial scams, and unsafe working conditions. To complement his strategy of selecting the fox to guard the henhouse—such as tapping a coal lobbyist to lead the Environmental Protection Agency (EPA) and a pharmaceutical lobbyist and drug company executive to lead the U.S. Department of Health and Human Services (HHS)—Trump’s budget proposes dramatically defunding crucial regulating agencies.

For example, Trump proposes cutting funding for the EPA, whose job it is to safeguard clean air and water, by a shocking 31 percent. At the same time, his budget cuts funding for renewable energy research and innovation at the Department of Energy by 70 percent and eliminates tax incentives for renewable energy. His budget also appears to again propose to hamstring the Consumer Financial Protection Bureau (CFPB)—which helps keep financial scammers, big banks, and Wall Street special interests in check by investigating on behalf of consumer interests—by making its funding flow through Congress instead of the Federal Reserve. If Republicans regain control of the House of Representatives in 2020, this would give conservative lawmakers who are hostile to the CFPB power over its budget. The FY 2020 budget also likely freezes or cuts funding for the agencies that protect American workers’ safety and rights. It proposes slashing the U.S. Department of Labor’s overall budget by nearly 10 percent.

Trump is using the timing of his budget rollout to hide impractical and painful cuts

Although the Trump administration released its topline budget priorities and dramatic scale of cuts today, Americans cannot know exactly what harsh and absurd sacrifices the president is demanding to pay for his tax cuts until the detailed budget is released on March 18. But if prior years are any indication, the administration will be seeking drastic cuts to key priorities that the American people support. For example, Trump’s budget last year proposed to cut Head Start by $13 billion over 10 years, which would eliminate high-quality child care and early education for hundreds of thousands of low-income children.

Americans will have to wait until March 18 to find out whether, like Trump’s previous budgets, this budget eviscerates dozens of programs that, while modest in size, are tremendously important to the vulnerable communities they serve. For example, prior years’ budgets eliminated funding for the National Limb Loss Resource Center, the Paralysis Resource Center, and even the Special Olympics education fund. Trump would have completely wiped out the Legal Services Corporation, depriving nearly 2 million low-income people of critical legal representation each year, as well as the Low Income Home Energy Assistance Program (LIHEAP), which would have left an estimated 6.7 million low-income families—9 in 10 of which include a child, an elderly member, or a member with a disability—without the financial assistance they need to pay their energy bills.

The magnitude and number of the president’s still-undisclosed cuts show that his false promises were not limited to his campaign but continue to pile up throughout his presidency. In his 2019 State of the Union address, Trump said he would increase funding for pediatric cancer research by $500 million over 10 years, or a paltry $50 million per year, on average. The National Institute of Health’s (NIH) annual budget is $39 billion, which makes $50 million a drop in the bucket of health care research funding, and Trump’s budget appears to cut NIH by $6 billion (15 percent), though we will not know specifics on proposed NIH cuts for another week.

Trump’s budget would drastically shortchange national priorities—and things will get worse if he fails to reach a new deal with Congress

Unless Congress and the president reach a new budget deal, funding for both defense and nondefense programs would be cut substantially in FY 2020 because of caps imposed by the Budget Control Act (BCA) of 2011. Trump is expected to propose reversing all of the potential cuts to defense and adding an additional $34 billion to the Pentagon’s budget. But nondefense discretionary spending, which funds a broad range of critical government functions—including K-12 education, job training programs, transportation investments, and food safety inspections—faces a dire situation that Trump’s budget would worsen.

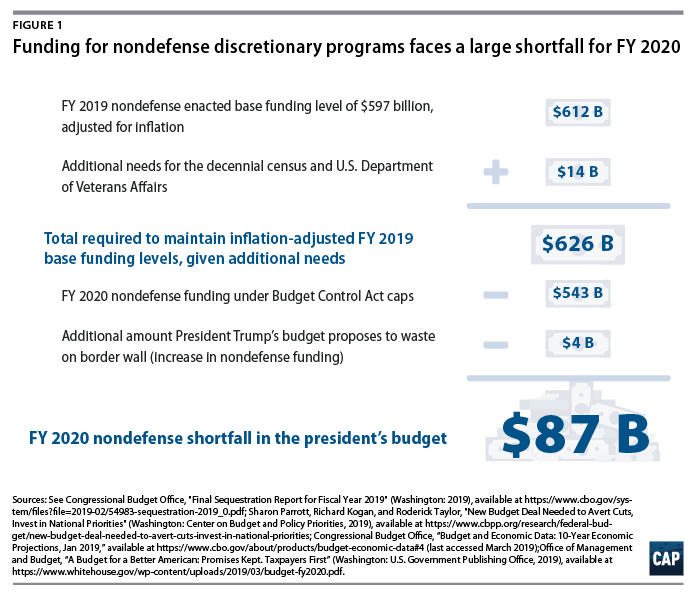

Under the BCA caps in effect for FY 2020, base funding for nondefense discretionary programs would fall from its FY 2019 authorized levels of $597 billion, or $612 billion when adjusted for inflation, to $543 billion—a reduction of 11 percent in inflation-adjusted terms. Moreover, an additional $14 billion is needed for FY 2020 in order to fund the 2020 decennial census and to meet veterans’ health care needs pursuant to the VA MISSION Act, which was enacted in June 2018. And Trump’s budget would waste $5 billion of the Department of Homeland Security’s budget on his irresponsible border wall. (The budget also requests $3.6 billion in FY 2020 defense funding for the wall.) Given these needs and the additional money wasted on the border wall, Trump’s budget includes a shortfall of $87 billion in funding for nondefense discretionary priorities in FY 2020. (see Figure 1)

The failure to fund nondefense programs adequately would worsen the United States’ disinvestment in the economy and vital programs in recent years. From 1969 to 2011, nondefense spending averaged 3.8 percent of gross domestic product (GDP), but it has been only 3.4 percent since FY 2012 and 3.2 percent every year from 2015 to 2019. The FY 2020 cap level of $543 billion is only 2.5 percent of GDP. In real terms, it is more than $200 billion less than the FY 2010 nondefense discretionary funding level.

The president’s budget also proposes massive cuts to nondefense discretionary spending in later years—slashing budget authority for nondefense discretionary spending by 21 percent over the next decade, with cuts that climb to an astounding 35 percent by 2029.

Conclusion

Despite his administration’s attempt to bury critical details with a two-part release, Trump’s budget already shows his true colors: To pay for his $2 trillion tax scam, he plans to slash programs that American families rely on and strongly support. Although Congress has never adopted a president’s budget wholesale, this year’s budget is especially important: With no deal in sight to address the budget caps, government programs are potentially subject to steep cuts—and Trump’s budget has just provided a road map to place these cuts squarely on the shoulders of struggling everyday Americans.

Seth Hanlon is a senior fellow at the Center for American Progress. Lily Roberts is the director of Economic Mobility at the Center. Rachel West is the director of research for the Poverty to Prosperity Program at the Center.