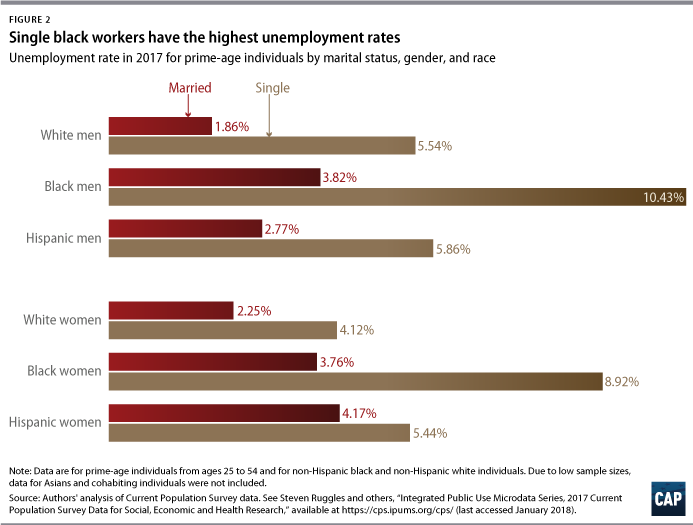

This Friday, the U.S. Bureau of Labor Statistics (BLS) will release employment data for January. This will be the last jobs day with Janet Yellen as chair of the Federal Reserve Board, as her term expires on February 3. The Federal Open Market Committee met just days before the job release and decided not to raise interest rates. This is good news for America’s most disadvantaged workers who benefit from a tight labor market. Hopefully, Jay Powell, the new Federal Reserve Board chair, will continue to keep rates low, as the country is already seeing the benefits of a tight labor market: Black unemployment hit a historic low last month—a record for which President Donald Trump dishonestly tried to take credit. Economists, however, have argued that Trump simply inherited a trend that was largely the result of beneficial Obama-era economic policies and low interest rates. This is an important reminder that economists and policymakers should be evaluating the health of the labor market based on how the most disadvantaged members of the population are doing— not solely on the overall numbers—when the BLS releases its monthly employment numbers. While black unemployment has hit a historic low, it is still almost twice the rate of white unemployment, and the unemployment rate for prime-age single black men is a staggering 10 percent, as shown in Figure 2.

Since Valentine’s Day is just weeks away, this column will focus on the labor market outcomes of an oft-overlooked demographic in economic policymaking: single individuals. In this column, single individuals are defined as individuals who have never married and who are not cohabiting. Single individuals tend to have lower economic security than married individuals. This is true largely because two adults typically have more opportunities than one and also because of selection; economies of scale; and legal and social privileges accorded to married people—especially married men. Overall, single individuals are younger, less educated, and have less wealth than married individuals. Due to the growing education gap in marital rates—highly educated individuals are more likely to get married than those with lower educational attainment—marriage is increasingly correlated with higher education and, thus, higher incomes. Additionally, single women still face a disproportionate care burden compared with single men, putting them at some of the greatest economic risk.

Finally, the share of the U.S. population that has never married is increasing, and people are spending a larger percentage of their lives unmarried due to later ages of first marriage, , increased economic independence of women, and growing rates of nonmarried partnerships—further emphasizing the pertinence of focusing on single and cohabiting individuals’ economic outcomes. Although the authors only cover married, cohabiting, and single individuals here, the labor market outcomes of divorced, widowed, and separated individuals should also be considered when evaluating the health of the labor market for all types of family compositions. A modern economy should work for all people, including those who want to live independently of spouses and partners.

Unemployment rates by marital status, gender, and race

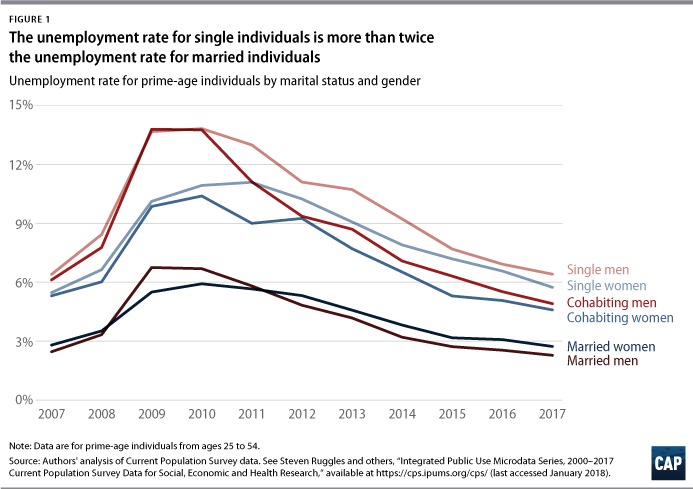

Overall, the unemployment rates of single individuals are much higher than those of married individuals and slightly higher than those of cohabiting individuals. Unemployment rates are highest for single men and lowest for married men, as shown in the Figure 1. Both single and cohabiting men have a slightly higher unemployment rate than women in these groups; for married individuals, though, women have a slightly higher unemployment rate. All data for single, cohabiting, and married individuals in this column are for prime-age individuals—ages 25 to 54 years old.

Individuals with lower levels of educational attainment tend to experience higher unemployment rates; they also marry at lower rates than those with a bachelor’s degree or higher. This overrepresentation of single individuals with lower educational attainment may help explain the high unemployment rates among this group. Additionally, 41 percent of adults who have never married, but would like to get married, cite a lack of financial stability as the reason for not yet having married, according to a Pew Research Center survey. This indicates that, for many, economic security may be a prerequisite for marriage.

Single black individuals have the highest unemployment rates by far compared with single and married individuals from other racial groups. Additionally, while the unemployment rate for single individuals ranges from 4.1 percent for white women to a staggering 10.4 percent for black men, the unemployment rate for married individuals ranges from just 1.9 percent for white men to 4.2 percent for Hispanic women. Asian and cohabiting individuals are excluded from this analysis due to low sample sizes.

The fact that single individuals are more likely to have lower levels of educational attainment; are younger; and are more ethnically and racially diverse than married people may help explain why single individuals have such high unemployment rates. Additionally, it is important to note that each demographic group has differing marital rates, with non-Hispanic black people having the lowest marital rates and non-Hispanic white people having the highest rates compared with other demographic groups.

Labor force participation rates by marital status and gender

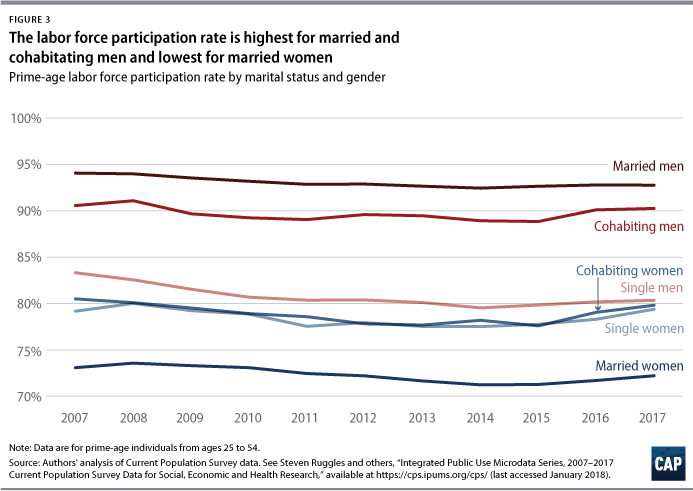

Prime-age married women have the lowest labor force participation rate, while prime-age married men have the highest. The large disparity in labor force participation rates between married men and women is striking, especially considering the minimal difference in rates between single men and women. There is also a gap in labor force participation rates between cohabiting men and women, but it is smaller than the gap for married men and women. Cohabiting men have a slightly lower rate than married men, while the rate for cohabiting women is much higher than for married women and closely aligns with the labor force participation rate for single women.

The low labor force participation rates for married women could be partly explained by the low labor force participation rates of mothers with children under 18. Although single women also have children, prime-age single mothers with children under 18 have almost identical labor force participation rates as prime-age single women without children under 18. However, the labor force participation rate of prime-age married women with children under 18 is lower than that of prime-age married women without children under 18. Additionally, Francine Blau and Lawrence Kahn found that a lack of family-friendly policies—including parental leave and part-time work entitlements—explains a portion of the low female labor force participation rates in the United States compared with other Organization for Economic Cooperation and Development countries.

Part-time employment rates by marital status and gender

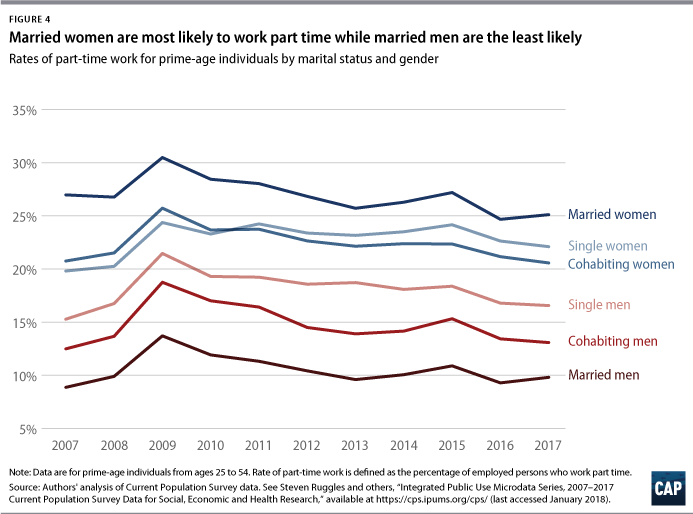

Although married women have the lowest labor force participation rate, they are the most likely to work part-time jobs, which are significantly less likely to offer benefits. These women also often face a pay penalty of lower wages when they work fewer than 40 hours per week. The low labor force participation rate and high rates of part-time work for married women indicate that married women are not fully engaged in the labor market, putting them in a precarious position if their spouse loses a job or if the marriage is dissolved. Because of this, women tend to face worse outcomes after divorce compared with men.

Additionally, similar to the trends in labor force participation rates, the gap in rates of part-time workers is largest between married men and women and smallest for single individuals, with the gap for cohabiting individuals falling in between.

Overall economy

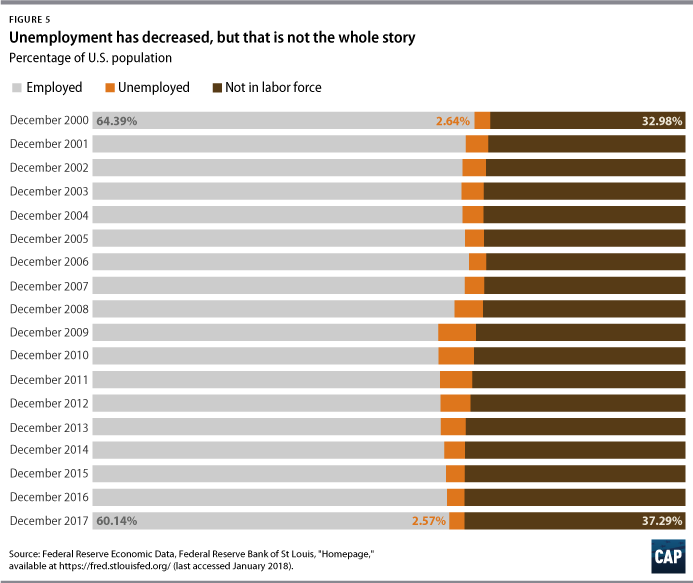

Overall, the economy is growing and unemployment is at pre-Great Recession levels. However, Figure 5 indicates that the employment rate remains below pre-Great Recession levels, meaning that a larger share of people falls outside the labor market now than in 2006. This likely indicates that many people have exited the labor market due to long-term unemployment and have not yet re-entered. Additionally, although the unemployment rate has returned to pre-Great Recession levels, certain demographics, such as youth and people of color, still face extremely high levels of unemployment and underemployment. The data presented in this column on the labor market experiences of single and cohabiting men and women clearly show that more work is needed to create a healthy labor market that engages all workers.

Conclusion

Overall, single workers, especially black and Hispanic workers, and cohabiting workers are struggling in the economy compared with married workers. This is another indication that the labor market is not at full employment and that more needs to be done to help these workers re-enter the labor market. When Friday’s employment data is released, it is important to look not only at the overall economic indicators, but at the demographic differences for each indicator as well. Although the economy is doing well in the aggregate, policymakers should focus on the economy’s more disadvantaged workers when evaluating the health of the labor market. An individual’s economic security should not be dependent on their family status—instead the government should take steps to ensure that high-quality jobs with sustainable wages and policies that enable workers to manage work and family responsibilities are available to all Americans. Such steps will help ensure financial insecurity is not a barrier for couples who want to be married and that people who are single are not struggling to make ends meet simply because of their marital status.

Annie McGrew is a research assistant for Economic Policy at the Center for American Progress. Galen Hendricks is a special assistant for Economic Policy at the Center. Kate Bahn is an economist for Economic Policy at the Center.