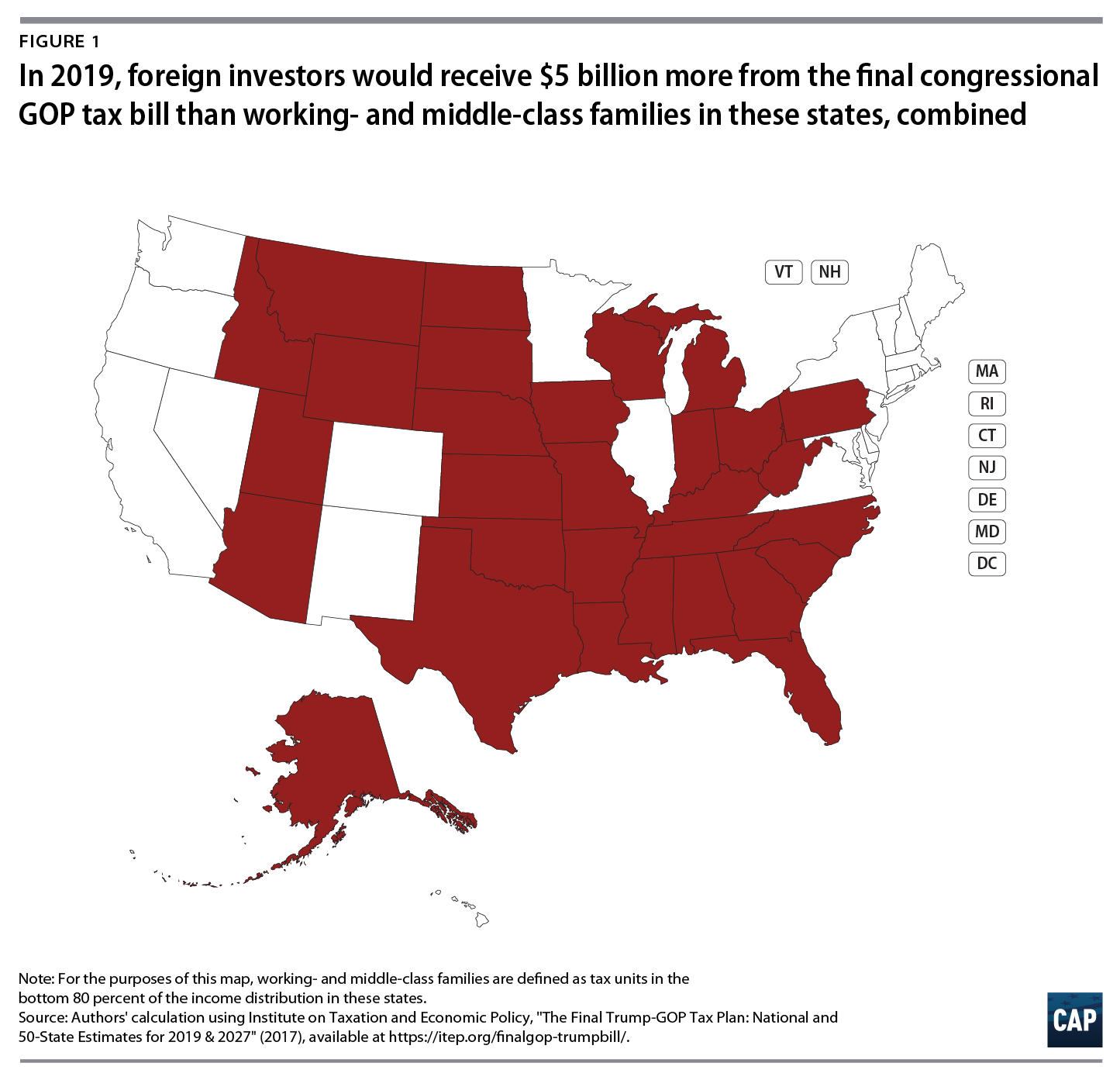

President Donald Trump claimed in a November speech promoting his tax plan that his focus “is on helping the folks who work in the mailrooms and the machine shops of America. … The people that like me best.” But in reality, the final tax bill that emerged late Friday from the conference committee focuses on corporations and the wealthy. According to the Tax Policy Center (TPC), the top 1 percent of families by income would receive a larger share of the bill’s cuts in the first year than the bottom 60 percent of families combined. And in fact, state-level data from the Institute on Taxation and Economic Policy (ITEP) show that in 2019, the bill would give $5 billion more to foreign investors who own corporate stock than the combined families in the bottom 80 percent of the income distribution in every state that voted for President Trump.

Foreign investors stand to win big due to the bill’s massive corporate tax cuts. In the near term, these tax cuts would accrue entirely to shareholders. According to research from the TPC’s Steven Rosenthal, about 35 percent of U.S. corporate stock is held by foreign investors. As such, these corporate tax cuts would help foreign investors more than the families that President Trump considers to be his base.

ITEP estimates that foreign investors stand to gain $48.4 billion in 2019. That same year, working- and middle-class taxpayers in the states that elected President Trump combined would gain roughly $5 billion less: $43.3 billion. In fact, these families would fare best in the initial years of the Trump plan, as their tax cuts in the individual code are temporary and expire after 2025. In contrast, corporations and their investor beneficiaries have been granted permanent tax cuts. These cuts would be funded over time by the repeal of a key tenet of the Affordable Care Act and long-term individual tax hikes from instituting a slower inflation measure—the Chained Consumer Price Index. In 2027, these corporate tax cuts would total $87.6 billion.

These permanent corporate tax cuts would benefit foreign investors in the long run as well. The government of Norway, for example, invests oil revenues on behalf of its citizens in a sovereign wealth fund (SWF), the Government Pension Fund Global. As such, every Norwegian is effectively a shareholder in U.S. corporations. In 2016, the Norway SWF held about 0.68 percent of outstanding U.S. corporate stock. Assuming this share holds constant and following TPC assumptions that corporate shareholders receive 60 percent of the benefits from corporate tax cuts in the long run, $355 million of the corporate tax cuts in 2027 would accrue to Norway’s SWF.* This is the equivalent of more than $61 per Norwegian. In contrast, ITEP finds that the average U.S. taxpayer in the middle 20 percent of the income distribution would pay $60 more in 2027.**

The final tax plan breaks many promises that President Trump and congressional Republicans made to the American people. Instead of siding with middle-class families, their plan would slash taxes for the wealthiest and give windfalls to investors. President Trump called for a “pro-worker, pro-family, and, yes, pro-American” tax plan. But in reality, his tax plan would help foreign investors more than the working- and middle-class families in the very states that elected him president.

Alex Rowell is a research associate on the Economic Policy team at the Center for American Progress. Seth Hanlon is a senior fellow at the Center.

*Author’s note: Corporate shareholders would also benefit from a portion of the 20 percent of corporate tax cuts that accrue to all capital, which is excluded from this analysis. This analysis also assumes that 2027 is the long term.

**Authors’ note: ITEP follows the Joint Committee on Taxation’s methodology in assigning 25 percent of corporate tax cuts to labor, slightly more than the TPC does.