Congressional Republicans’ tax plans in both chambers favor the wealthiest Americans over working- and middle-class families. For example, In 2027, the top 1 percent of America’s families, by income, would receive more than 60 percent of the Senate majority plan’s benefits, according to the Tax Policy Center (TPC). Under the House majority bill, the TPC estimates that the top 1 percent would receive nearly half of the benefits in 2027. In that same year, tens of millions of families earning less than $200,000 would see a tax increase under either bill.

The plan is so skewed to the wealthy because, at its core, it is a massive corporate tax cut. Corporate tax cuts predominantly benefit corporate shareholders, who are disproportionately wealthy. Both the Senate and House tax bills slash the corporate tax rate from 35 percent to 20 percent; move to a territorial tax system, where U.S. corporations’ future overseas income will be largely untaxed; and provide a special low tax rate for existing overseas earnings of U.S. corporations that have gone untaxed by the United States. Both bills include measures to reduce deductions and otherwise raise revenue from corporations, but on net, they represent a massive corporate tax cut.

In the near term, corporate tax cuts essentially provide a windfall for shareholders, many of whom are not even American. Research by the TPC’s Steven Rosenthal found that about 35 percent of stock in U.S. corporations is held by foreign investors. That means some of the major beneficiaries of the corporate tax cuts are foreigners.

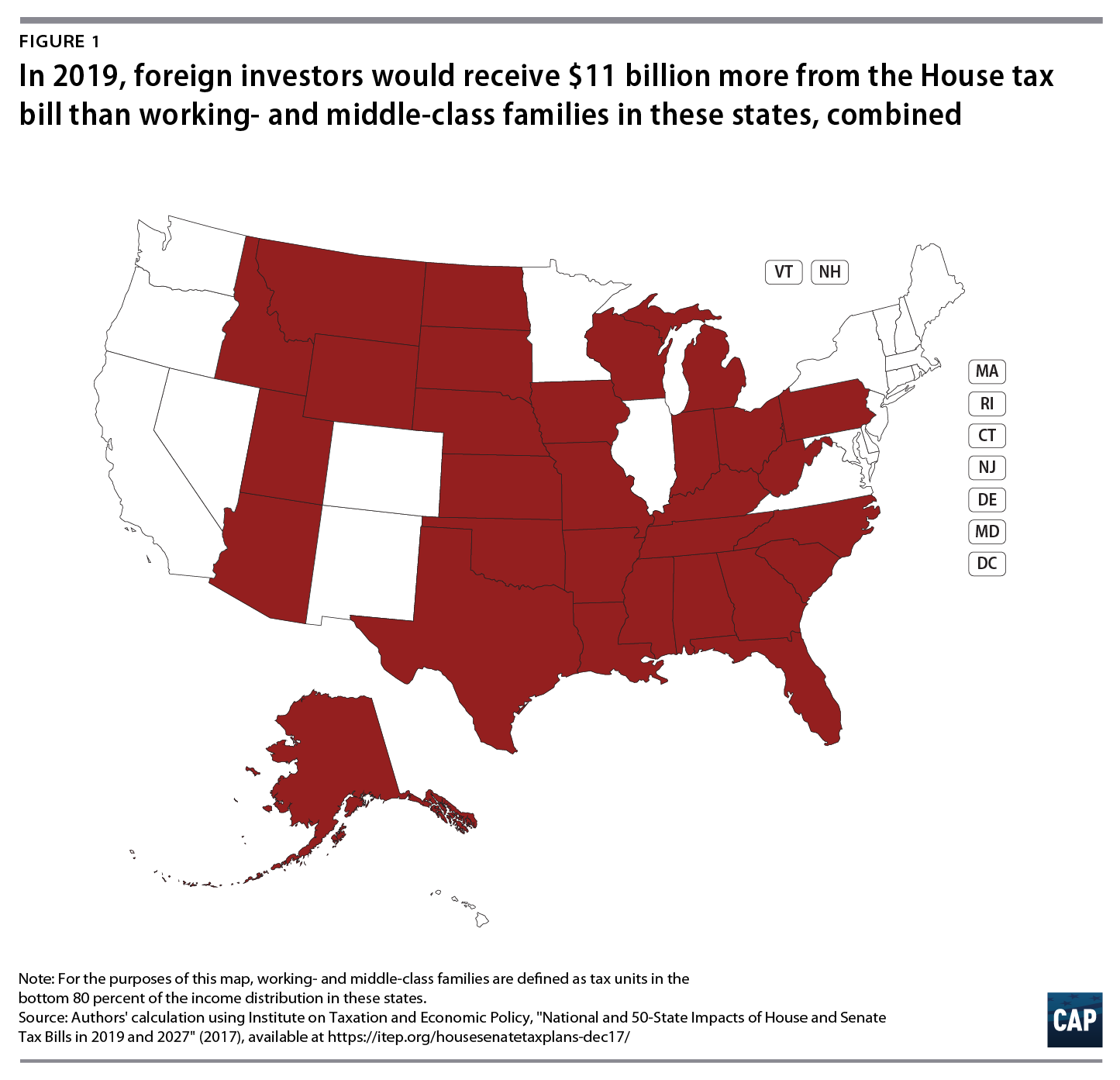

In fact, estimates by the Institute on Taxation and Economic Policy (ITEP) show that the Senate majority tax bill would give foreign investors a windfall of $31 billion in 2019—the first year that the corporate tax rate is slashed to 20 percent under the Senate bill. That same year, the House majority bill would be even more generous to foreign investors, benefiting them by $50.4 billion. Amazingly, ITEP estimates show that the House bill’s combined tax cut for families in the bottom 80 percent of the income distribution in the 30 states won by President Donald Trump is just $39.4 billion. This means that, as shown in Figure 1, foreign investors would receive a benefit from the House tax plan larger than the combined tax cuts to working- and middle-class taxpayers in every state that cast its electoral votes for President Trump. Likewise, the benefit to foreign investors in the Senate tax plan in 2019 is larger than the combined benefit to families in the bottom 80 percent in every Trump state, excluding Florida and Texas.

Foreign investors receive major tax cuts from the congressional tax plans over the long term as well. The mainstream consensus of tax analysts is that corporate shareholders and other owners of capital bear about three-quarters or fourth-fifths of the corporate tax over the long term. The TPC, for example, estimates that corporate shareholders bear 60 percent of the burden of the corporate tax over the long term; owners of all capital bear 20 percent; and workers bear the remaining 20 percent. The Senate bill cuts corporate taxes by $84 billion in 2027, according to ITEP. Assuming that 60 percent of that tax cut benefits shareholders—following the TPC’s methodology—then, conservatively, the portion of the corporate tax cut attributable to shareholders would be $51 billion.*

Some foreign countries invest in U.S. corporate equities on behalf of their citizens through sovereign wealth funds (SWFs). For example, Norway invests revenues from oil in stocks, bonds, and real estate held in the Government Pension Fund Global, Norway’s SWF. This means that all Norwegians effectively own U.S. corporate stock. In 2016, U.S. corporate stock held in Norway’s SWF was worth $206 billion—approximately 0.68 percent of outstanding U.S. corporate stock in 2016. Assuming that share holds constant, in 2027, an estimated $342 million of the assumed $51 billion in tax cuts for corporate shareholders from the Senate tax bill would accrue to Norway’s SWF —approximately $59 per Norwegian. That same year, Americans in the middle quintile of the income distribution would face a $60 tax hike—including the small share of corporate tax cuts that is imputed to them.**

President Trump has claimed to put “Americans first in tax relief.” However, both the House and Senate tax plans fail to do so, giving foreign investors larger benefits than millions of working- and middle-class American families.

*Note: Corporate shareholders would also benefit from a portion of the 20 percent of corporate tax cuts that accrue to all capital, which is excluded from our analysis. Our analysis also assumes that 2027 is the long term.

**Note: ITEP follows the Joint Committee on Taxation’s methodology in assigning 25 percent of corporate tax cuts to labor, slightly more than the TPC does.

Alex Rowell is a research associate on the Economic Policy team at the Center for American Progress. Seth Hanlon is a senior fellow at the Center.