On Friday, the U.S. Bureau of Labor Statistics will release its Employment Situation Summary for the month of September. Since the employment recovery began in February 2010, the U.S. economy has added more than 16 million jobs, and the steady tightening of the labor market has finally started to deliver some wage growth for workers, with wages increasing 2.5 percent over the past year. Unfortunately, President Donald Trump has not furthered this economic progress, as he has not pushed for any economic policies that would help workers or create jobs.

The recent U.S. Census Bureau data release showed that, despite a 3.2 percent increase in the median income for U.S. households in 2016, the current picture of income distribution is bleak. In 2016, the share of income going to the wealthiest 5 percent of U.S. households reached record high levels, while the share going to the middle 60 percent sunk to record lows. Unfortunately, the Trump administration is not pursuing policies that would raise incomes for most Americans. The administration has neither pushed for stronger labor laws that would empower workers nor has it set forth a plan, such as improved access to child care, that would raise disposable incomes and reduce barriers to the workforce. The Trump administration has also shown little interest in cracking down on monopolies that harm workers and consumers or in ensuring American workers have paid sick leave. These are the types of bold policy solutions necessary to shift the bleak reality of unequal income distribution in the United States. The economy must work for all Americans—currently, it simply is not.

The Federal Open Market Committee (FOMC) met in September and kept interest rates steady at 1 percent to 1.25 percent. However, the FOMC also announced that it will begin shrinking its balance sheet. While largely symbolic, this decision is another disappointment driven by the desire for monetary policy normalcy, despite continued low inflationary pressure. As the FOMC considers another interest hike before the end of the year, it is important to emphasize the persistent undershooting of the Federal Reserve’s 2 percent inflation target. With low interest rates and a low inflation target, the credibility of the Fed’s inflation target will be crucial to fighting future recessions. Unless the Fed adopts a new targeting framework, premature moves to tighten policy threaten its ability to react to future recessions. With the time to reappoint the Fed chair or choose a successor fast approaching, the Trump administration must ensure that the Fed is focused on growing the economy by improving opportunities for workers.

This column presents labor market indicators to watch in evaluating both the health of the U.S. economy and the effects of the Trump administration’s policy priorities. Although the headline unemployment rate—otherwise known as U-3—is the most frequently cited indicator of labor market health, other factors can provide a fuller picture of how the economy is performing. The employment rate, the number of people working part time for economic reasons, and the U-6 unemployment rate—all discussed below—are some of these factors. Additionally, it is important to note how each labor market indicator differs among demographics—for example, by race. Although the national unemployment rate may be low, this indicator can tell a different story for other demographic groups.

While employment in the service sector continues to expand, manufacturing and mining inch upward

President Trump has promised to bring back coal and manufacturing jobs to U.S. workers; however, these sectors have played a diminished role in the economy since 1980—especially in recent years. Since March 1980, goods-producing employment—the top-line category that includes construction, mining, manufacturing, and others—has decreased 20 percent and remains about 5 million below its 1980 level. Service employment, on the other hand, has grown by 90 percent since 1980 and from less than three times larger than goods-producing employment to more than six times larger today. As shown in Figure 1, service employment levels are much higher than goods-producing levels, meaning a percentage increase in service employment has a much larger effect on overall employment levels.

The unemployment rate is at prerecession levels, but other labor market health indicators have yet to recover fully

President Trump inherited a growing economy; however, there is still room for additional growth. Although the unemployment rate—the percentage of people actively looking for a job—is at prerecession levels, Figure 2 indicates that the employment rate—the percentage of the whole population that is employed—remains below prerecession rates, meaning that a larger percentage of people fall outside of the labor market now than in 2006. This likely indicates that many people have exited the labor market due to long-term unemployment and have not yet re-entered. It is good news that the number of long-term unemployed workers has continued to fall, but work remains to bring people back into the workforce. A recovery that reaches these workers is a key to long-term economic growth.

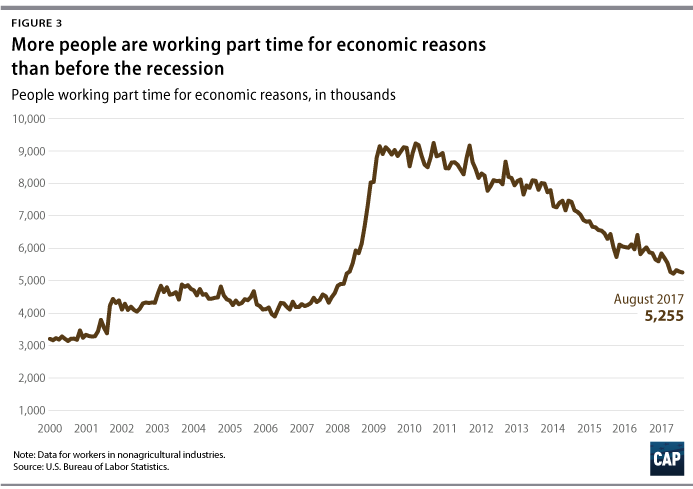

The number of people working only part time for economic reasons remains very high

The number of workers who are employed only part time for economic reasons—meaning that they are unable to find full-time work despite wanting it—remains high compared to prerecession levels. If workers are part-time because their hours are cut or because they cannot find a full-time job, that indicates a labor market that is less favorable for all workers. In August 2017, the number of involuntary part-time workers remained roughly the same at 5.2 million, which is still significantly higher than the precrisis low of 3.9 million in April 2006.

U-3 vs. U-6

The U-3 unemployment rate, the most common unemployment measure, can underestimate those who are unable to find jobs. For example, it does not capture the people who want jobs but have given up looking for work or the people who would like full-time work but can only find part-time positions. Perhaps the most comprehensive unemployment measure, U-6 alleviates this problem by including marginally attached workers—those who have recently looked for work but are not currently looking—and part-time workers who would prefer full-time work. A low U-6 indicates that people who face greater barriers in finding employment are being pulled back into the labor market due to greater economic opportunity. U-6 is always higher than U-3, but the gap grew much larger than usual during the recession and has remained above or near prerecession records over the course of the recovery.

The unemployment rate has not recovered to prerecession rates for all demographics

The gains from the recovery have not been experienced equally among different demographics and those with historically worse labor market conditions continue to face higher unemployment rates with long-term detrimental effects. While the overall unemployment rate fell from 9.5 percent to 4.4 percent between August 2010 and August 2017, the rate for African Americans only dropped from 15.9 percent to 7.7 percent during the same time frame. Focusing on the groups whose unemployment rates continue to have room for improvement should be a benchmark for the health of the U.S. labor market overall. Expanding their opportunities in the labor market can be a source of future economic growth.

Conclusion

This employment release will provide an updated snapshot of the real economy under the Trump administration. Since the Trump administration is only in its ninth month and there has been no progress on any employment-related policies during this period, it is unlikely that September’s data will show any drastic changes. However, as President Trump’s first term continues, the indicators highlighted above will be key in evaluating his policies. In order to maintain economic growth, the new administration must take these data seriously in its decision-making. Indicators such as the U-6 unemployment rate and the employment-to-population ratio show that there is still room to grow to meet previous eras of a strong labor market.

The Fed continues to be an important force in keeping the economy growing sustainably, but monetary policy is likely to be tested by economic uncertainty under the Trump administration. There is still room for the economy to grow, but it will require proactive labor market policy based on good data in order to improve the conditions that American workers face. The importance of sound economic data to guide and evaluate policy decisions cannot be understated. President Trump should embrace such data, such as the monthly jobs report, in the coming months and years to help shape his policy proposals.

Gregg Gelzinis is a special assistant for Economic Policy at the Center for American Progress. Michael Madowitz is an economist at the Center.