On Friday, the U.S. Bureau of Labor Statistics will release its “Employment Situation Summary” for the month of June. Over the first few months of the Trump administration, labor market trends that originated in the Obama years continued. Since the employment recovery began in February 2010, the U.S. economy has added more than 16 million jobs, and the steady tightening of the labor market has finally started to deliver some wage growth for workers, with wages increasing 2.5 percent over the past year. President Donald Trump has failed to take additional steps to build upon this steady progress. He campaigned on increasing employment yet has done nothing of substance to add jobs. His only real accomplishments have come at the expense of working families. And some of the policies his administration has endorsed, such as the House-passed Financial CHOICE Act, would threaten employment gains and economic growth by risking another financial crisis.

Meanwhile, the Federal Open Market Committee met in June and announced a 0.25 percent increase in interest rates. This was a disappointing decision by the Fed, as there are no clear signs of increased inflation. We may not know the full effect of this decision for some time, but it seems likely that it will needlessly slow the growth of wages and employment. With growing evidence that neutral interest rates have fallen and the lack of success developed economies have had in generating growth in aggregate demand, the Fed should reconsider its 2 percent inflation target.

This column presents labor market indicators to watch in evaluating both the health of the U.S. economy and the effects of the Trump administration’s policy priorities. Although the headline unemployment rate—otherwise known as U-3—is the most frequently cited indicator of labor market health, other factors can provide a fuller picture of how the economy is performing. The employment rate, the number of people working part time for economic reasons, and the U-6 unemployment rate—all discussed below—are some of these factors. Additionally, it is important to note how each labor market indicator differs among demographics—for example, by race. Although the national unemployment rate may be low, this indicator can tell a different story for other demographic groups.

Employment in the financial sector has recovered, but deregulatory efforts pose clear risks

The financial sector has recovered all of the more than 600,000 jobs lost during the 2007–2008 financial crisis. Not only has lending rebounded significantly since the financial crisis, but bank profits are also higher than ever. This improved health of the financial sector can be largely attributed to financial reform efforts. As a result of the Dodd-Frank Act, banks have increased their loss-absorbing capital by more than $700 billion—more than double their crisis levels. Banks hold more liquid assets, rely on more stable funding, and undergo thorough stress testing annually. A new systemic risk regulatory body brings financial regulators together to analyze emerging financial stability risks across the system. In addition, complex financial institutions now plan for their orderly failure and regulators have the tools necessary to wind down these firms without resorting to bailouts. Highly predatory abuses in the financial marketplace have been curbed, thanks in large part to the highly successful Consumer Financial Protection Bureau. This description of the financial sector paints a much-improved picture compared with the precrisis regime of weak oversight, unchecked risk, and consumer abuses. This progress, however, is under threat. The House of Representatives passed the Financial CHOICE Act in June—which eviscerates the Dodd-Frank Act—and a week later the Treasury Department released a Wall Street wish list report recommending dangerous rollbacks of financial reform. If financial reform is significantly curtailed, it would invite another catastrophic financial crisis—leading to a destructive impact on employment and economic growth.

The unemployment rate is at prerecession levels, but other labor market health indicators have yet to recover fully

President Trump inherited a growing economy; however, there is still room for additional growth. Although the unemployment rate—the percentage of people actively looking for a job—is at prerecession levels, Figure 2 indicates that the employment rate—the percentage of the whole population that is employed—remains below prerecession rates, meaning that a larger percentage of people fall outside of the labor market now than in 2006. This likely indicates that many people have exited the labor market due to long-term unemployment and have not yet re-entered. It is good news that the number of long-term unemployed workers has continued to fall, but work remains to bring people back into the workforce. A recovery that reaches these workers is a key to long-term economic growth.

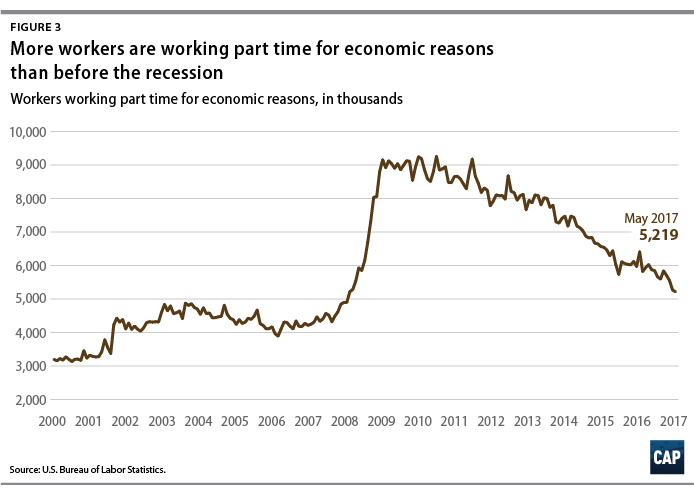

The number of people working only part time for economic reasons remains very high

The number of workers who are employed only part time for economic reasons—meaning that they are unable to find full-time work despite wanting it—remains high compared to prerecession levels. If workers are part-time because their hours are cut or because they cannot find a full-time job, that indicates a labor market that is less favorable for all workers. In May 2017, the number of involuntary part-time workers decreased slightly to 5.2 million, which is still significantly higher than the precrisis low of 3.9 million in April 2006.

U-3 vs. U-6

The U-3 unemployment rate, the most common unemployment measure, can underestimate those who are unable to find jobs. For example, it does not capture the people who want jobs but have given up looking for work or the people who would like full-time work but can only find part-time positions. Perhaps the most comprehensive unemployment measure, U-6 alleviates this problem by including marginally attached workers—those who have recently looked for work but are not currently looking—and part-time workers who would prefer full-time work. A low U-6 indicates that people who face greater barriers in finding employment are being pulled back into the labor market due to greater economic opportunity. U-6 is always higher than U-3, but the gap grew much larger than usual during the recession and has remained above or near prerecession records over the course of the recovery.

The unemployment rate has not recovered to prerecession rates for all demographics

The gains from the recovery have not been experienced equally among different demographics and those with historically worse labor market conditions continue to face higher unemployment rates with long-term detrimental effects. While the overall unemployment rate fell from 9.6 percent to 4.3 percent between May 2010 and May 2017, the rate for African Americans only dropped from 15.5 percent to 7.5 percent during the same time frame. Focusing on the groups whose unemployment rates continue to have room for improvement should be a benchmark for the health of the U.S. labor market overall. Expanding their opportunities in the labor market can be a source of future economic growth.

Conclusion

This employment release will provide an updated snapshot of the real economy under the Trump administration. Since the Trump administration is only in its sixth month and there has been no progress on any employment-related policies during this period, it is unlikely that June’s data will show any drastic changes. However, as President Trump’s first term continues, the indicators highlighted above will be key in evaluating his policies. In order to maintain economic growth, the new administration must take these data seriously in its decision-making. Indicators such as the U-6 unemployment rate and the employment-to-population ratio show that there is still room to grow to meet previous eras of a strong labor market.

The Fed continues to be an important force in keeping the economy growing sustainably, but monetary policy is likely to be tested by economic uncertainty under the Trump administration. There is still room for the economy to grow, but it will require proactive labor market policy based on good data in order to improve the conditions that American workers face. The importance of sound economic data to guide and evaluate policy decisions cannot be understated. President Trump should embrace such data, such as the monthly jobs report, in the coming months and years to help shape his policy proposals.

Gregg Gelzinis is a special assistant for the Economic Policy team at the Center for American Progress. Michael Madowitz is an economist at the Center.