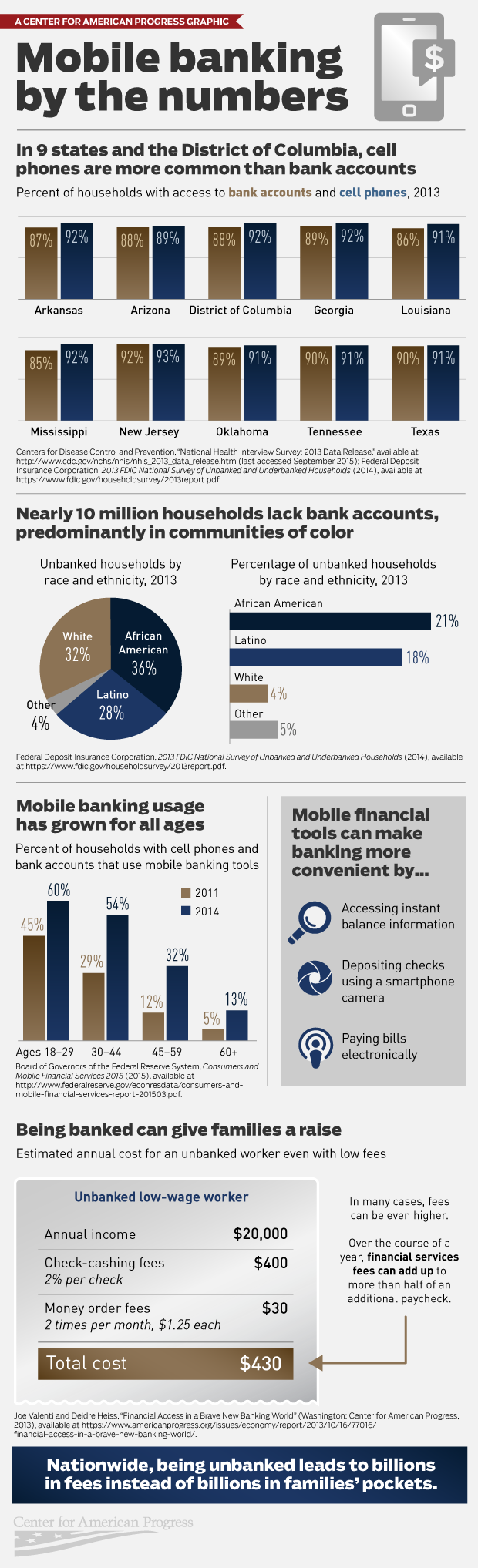

Approximately 17 million adults in the United States do not have bank accounts—a group known as the unbanked. As a result, they pay hundreds of dollars a year in fees and thousands of dollars across a lifetime just for basic financial services that others take for granted.

At the same time, access to cell phones is increasing rapidly: More households have access to cell phones than bank accounts in nine states and the District of Columbia. Mobile phones—especially smartphones—can overcome the limitations of traditional banking institutions by making it possible for people to manage their money anytime, anywhere. As mobile banking grows in popularity among all age groups, it presents a new opportunity to connect families to the financial mainstream by offering more convenient banking options—and collectively saving billions of dollars in the process.

Joe Valenti is the Director of Consumer Finance at American Progress. Pete Morelewicz is the Art Director at the Center.