The Retirement Savings Contribution Credit, more commonly known as the Saver’s Credit, is meant to help low- and moderate-income families save for retirement by offering a tax credit as high as 50 percent for up to $2,000 in retirement account contributions, or $4,000 for married taxpayers filing jointly. Yet only a small percentage of taxpayers claim it, partly because less than half of all workers have a retirement plan at work through which they can save and claim the credit.

The Saver’s Credit is a drop in the bucket among retirement tax subsidies, with an annual cost of about $1.2 billion, which reflects this lack of participation. By comparison, the total cost of other federal tax subsidies for retirement savings is more than $150 billion each year. Most of the financial benefits from retirement tax subsidies, such as deferred taxation for income saved in a retirement account, go to higher-income earners who would likely save anyway. The Saver’s Credit is an exception since it phases out at relatively low-income thresholds: $30,500 for single filers, $45,750 for head of household filers, and $61,000 for married taxpayers filing jointly.

The structure of the Saver’s Credit is partly to blame for its low usage rate because many tax filers who would be eligible to claim the credit receive no tax benefit from doing so. Making it refundable—the most important step—would require Congress to act. But in the meantime, the Internal Revenue Service, or IRS, could make it easier for households to claim the Saver’s Credit by directing a portion of their tax refund into retirement accounts—a step that is already legal and would simply require one additional line on the Saver’s Credit tax form and clear guidance from the IRS. This would give struggling families an immediate, tangible benefit from retirement savings around tax time, which is the very moment when they have resources to set money aside.

Helping Americans claim the Saver’s Credit with their tax refund and myRA

Here is how it would work: A hypothetical tax filer would be eligible to claim the Saver’s Credit at 50 percent if she contributes to a retirement account. She completes her tax return and expects a $500 refund. Under this proposal, she could direct a portion of her refund—let’s say $100—to a retirement account in order to claim the Saver’s Credit this year. That would increase her total refund to $550: $100 to the retirement account and $450 to her. Adding one new line on the Saver’s Credit form would enable taxpayers to specify their tax refund as a source of retirement account contributions. Tax preparers and software would do the math after the return is otherwise completed to suggest savings amounts for eligible filers. Tax preparation can already offer additional valued services, such as encouraging savings and identifying opportunities to reduce student loan payments.

While millions of taxpayers may not have an existing retirement account, this savings opportunity could be greatly strengthened by leveraging myRA—a portable, starter retirement account introduced by President Barack Obama last year—which is already eligible for the Saver’s Credit. The IRS should allow taxpayers to establish a myRA account on their tax return and fund it with proceeds from their tax refund. The combination of making instant savings and access to myRA available on the tax form would greatly simplify the process for working families who are struggling to save for retirement.

Why tax refunds are perfect opportunities to claim the Saver’s Credit

At tax time, workers would know exactly how the Saver’s Credit would benefit them and could make a clear, informed choice to save. The “found money” of a tax refund effectively gives otherwise cash-strapped households an opportunity to save. The IRS already permits contributions to an Individual Retirement Account, or IRA, to count toward the previous tax year until April 15—which may result in an immediate tax benefit. Under current law, these contributions may also qualify for the Saver’s Credit.

Yet low- and moderate-income households may lack cash on hand to make a contribution. Technically, taxpayers can already use proceeds from their tax refund to save for retirement and qualify for the relevant tax benefits as long as the funds are deposited in a retirement account by April 15. But current IRS forms and guidance are not optimized to facilitate this.

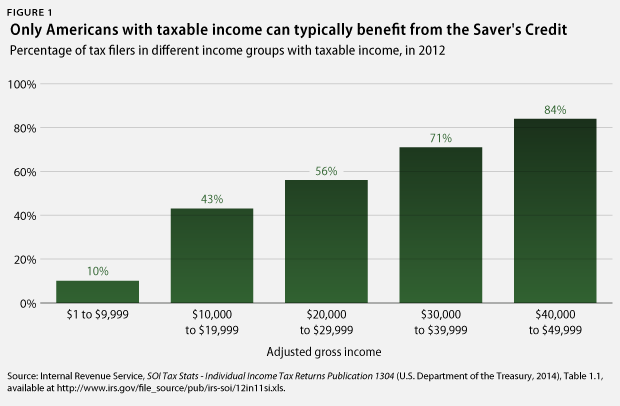

Meanwhile, since the Saver’s Credit is not refundable, it can only benefit taxpayers to the extent that they have income tax liability. However, many taxpayers with incomes below the threshold for claiming the Saver’s Credit have no income tax liability—although they still pay other taxes—meaning that the credit cannot benefit them. In 2012—the most recent year for which IRS data are available—out of the approximately 65 million tax returns reporting between $1 and $30,000 of adjusted gross income, only about 23 million resulted in any taxable income. As a result, it is imperative to help workers maximize the credit in years when they are eligible, given that workers eligible one year might not be eligible the next year if their financial situations change.

Technical steps and challenges

To facilitate instant tax refund savings for purposes of claiming the Saver’s Credit, the IRS would need to add a line to the Saver’s Credit tax form for tentative contributions made with anticipated tax refunds. The IRS would also need to publish clear guidance on the deadline by which taxpayers should file their return in order for their refund to be processed by April 15, the deadline for making a retirement contribution for the previous tax year. Since most refunds are distributed within three weeks after tax returns are filed, this deadline might occur in mid-March. Lastly, the IRS would need to establish clear procedures for processing tax returns when the anticipated refund is not available or does not arrive by April 15. These procedures could include automatically altering tax returns that claim a Saver’s Credit based on a tax refund that is delayed or reduced. This is necessary to protect taxpayers from inadvertently claiming a Saver’s Credit to which they are not entitled.

The IRS has the legal authority to make it easier for Americans to claim the Saver’s Credit with their tax refund, but it also requires adequate resources to carefully and effectively implement this new policy. Unfortunately, several rounds of budget cuts to the IRS make it difficult not just for the agency to collect revenue and prevent fraud, but also for the IRS to take low-cost, common-sense steps that actually improve economic outcomes for tax filers. Congress has already cut the IRS budget by 18 percent from inflation-adjusted 2010 levels, and it is considering even more cuts for 2016. As a result of these cuts, the IRS can barely answer its phones to help ordinary taxpayers. More funding for the IRS is needed both to address severe shortcomings in taxpayer service and to make it possible for the IRS to implement new policies to assist taxpayers.

Conclusion

When Congress finally does take action on tax reform, it should make savings count through progressive matches in the tax code, with a refundable Saver’s Credit as the first step. In the meantime, however, the IRS should take the small step of making instant savings easier for taxpayers of modest means. With myRA, small changes to tax forms, and clear guidance, the IRS could boost retirement savings for workers when a tax refund provides them with the resources to contribute. This would give them the opportunity to get tax benefits immediately instead of leaving them guessing about whether a credit is coming next year based on actions they take today.

Harry Stein is the Director of Fiscal Policy and Joe Valenti is the Director of Consumer Finance at the Center for American Progress.