Last month’s lackluster employment report served as a reminder that the economy still has a ways to go before reaching prerecession levels. After months of more accelerated progress, the unemployment rate in March remained at 5.5 percent, and the economy added just 126,000 jobs. Since the end of the Great Recession in 2009, about 10.2 million jobs have been added to the U.S. economy, and the national unemployment rate has fallen to nearly half of its 10 percent peak. While these gains are laudable, it is important to remain cognizant of the recovery’s fragility as policymakers move forward. Broader economic indicators continue to suggest that top-line numbers do not tell the full story of the labor market—one that details historically low growth in wages and considerable room for more employment growth. Here’s a look at some of the most important labor trends to watch this jobs day.

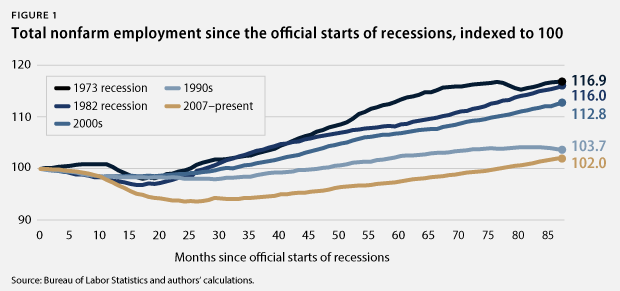

Job growth remains weak compared to previous recessions

During the economic expansion of the 1990s, the economy added at least 250,000 jobs per month 47 times. During the current expansion—which has now lasted roughly half as long—we have seen only 13 months of job growth greater than 250,000, which includes abnormal hiring involved with conducting the decennial census. Meanwhile, at the average rate of job growth over the past three years, The Hamilton Project estimates that the United States may not reach its former level of employment, when factoring in new labor-force entrants, until as late as mid-2017.*

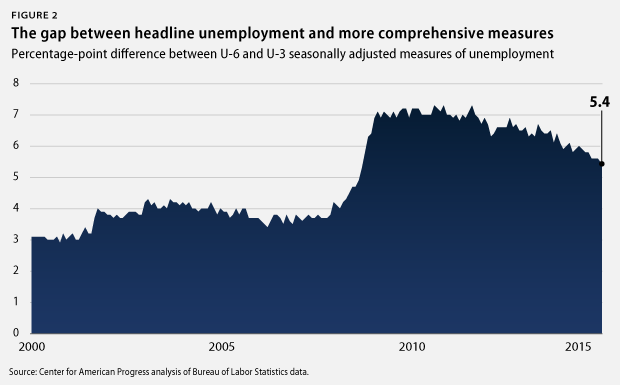

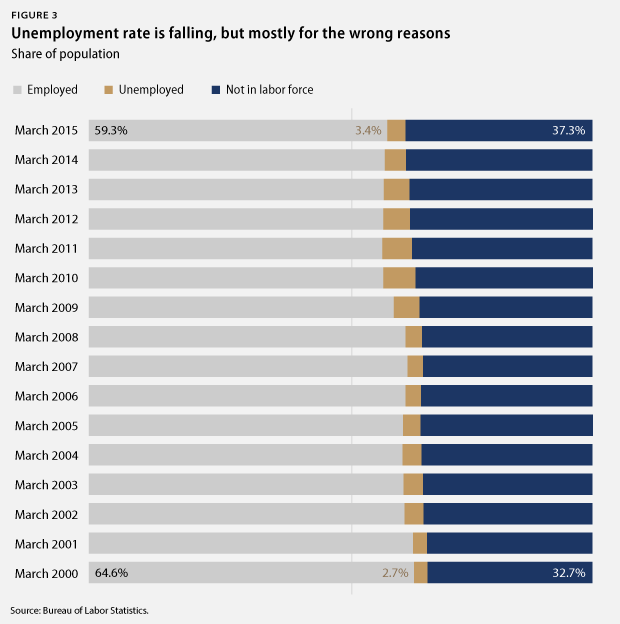

Many Americans who want jobs remain uncounted

In March 2015, the headline unemployment rate—otherwise known as U-3—fell to 5.4 percent, its lowest rate since the end of the Great Recession. While this does mark significant progress in the recovery, it is important to remember that there are much broader measures of unemployment that paint a clearer picture of the employment situation. U-3, the typical measure, is pretty restrictive: It counts the percentage of people who are actively looking for work but cannot find it. Among the important features U-3 does not capture are the millions of people who want jobs but have given up looking or who would like full-time work but cannot find it in this economy. Perhaps the most comprehensive unemployment measure, called U-6, alleviates this problem by including marginally attached workers—those who have recently looked for work but are not currently looking—and those working part time but who would prefer full-time work. U-6 is always higher than U-3, but it has gotten a lot higher since the recession, and the gap has hardly changed over the past year.

The labor-force participation rate also highlights these missing workers. When the economy is doing well, more people typically enter the labor market because there are more jobs available. So one should expect the labor-force participation rate to be increasing in the aftermath of the recession. It hasn’t been. Instead, it has declined steadily since the recession’s end and is as low today as it was in the late 1970s, when women entering the workforce became the norm. Even with the recent economic gains, labor-force participation is still stuck where it was at the end of 2013.

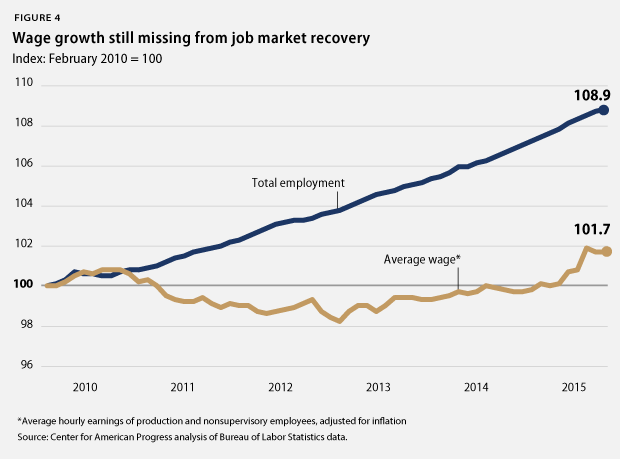

Americans are still waiting for a raise

Due to the slack caused by slow employment growth, real wage growth remains essentially stagnant. Employment levels have grown at a rate of only 7.8 percent in this recovery, well below the historical average of 14.1 percent. And as depicted above, even broader measures of unemployment show that employment levels have considerable room for improvement. While employment growth remains sluggish at best, it continues to outpace the dismal rate of wage growth. Continuing the trend of the past 30 years, corporate profit growth has been strong, while middle-class workers continue to grapple with the challenges of rising costs and slow wage growth.

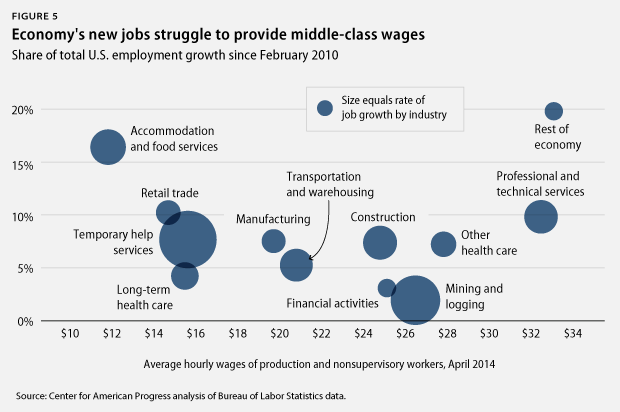

Part of the reason for this trend is that the recovery has come with stronger employment growth in low-wage industries, which makes securing a middle-class lifestyle a near-impossible feat. Jobs in low-wage industries—such as accommodation and food services, temporary help services, retail trade, and long-term health care—account for nearly 40 percent of all new jobs that were added in February 2015. While these workers make up a significant share of the growth this economy has had, their wages remain subpar, growing at rates well below their industry counterparts.

Conclusion

As the Federal Reserve considers raising interest rates, it’s important to remember that even though the Great Recession officially ended in June 2009, many Americans are still suffering from its effects. Identifying the exact cause of the considerable slack in the labor market is a challenge—maybe it’s the underperformance of the housing sector or of Congress—but the slack in the economy is real. Beyond employment gains, wages had stalled before the recession, and they have yet to accelerate in the recovery. On the jobs side, many people who want work are still missing from the labor force or are working fewer hours than they would like. These workers are the key to raising the nation’s potential economic output and future gross domestic product. It’s hard to predict what they will do as the economy picks up steam, but so far workers seem to be slowly coming off the sidelines, raising employment but tempering wage growth. However, this cannot happen forever, and as the expansion continues, it is important for economic modeling to reflect responses to and changes in the real world.

* Note: Authors’ calculations are based on data from the Bureau of Labor Statistics and The Hamilton Project’s Jobs Gap tool. See The Hamilton Project, “Closing the Jobs Gap,” available at http://www.hamiltonproject.org/jobs_gap/ (last accessed March 2015). The methodology for the authors’ estimates of labor-force dynamics is detailed in the following source: The Hamilton Project, “Understanding the ‘Jobs Gap’ and What it Says About America’s Evolving Workforce” (2012), available at http://www.hamiltonproject.org/papers/understanding_the_jobs_gap_and_what_it_says_about_americas_evolving_wo/. An explanation of an updated analysis can be found here: The Hamilton Project, “An Update to The Hamilton Project’s Jobs Gap Analysis” (2014), available at http://www.hamiltonproject.org/papers/an_update_to_the_hamilton_projects_jobs_gap_analysis/.

Jackie Odum is a Research Assistant for the Economic Policy team at Center for American Progress. Danielle Corley is a Special Assistant for the Economic Policy team at the Center. Michael Madowitz is an Economist at the Center.