This column was originally published on MarketWatch.

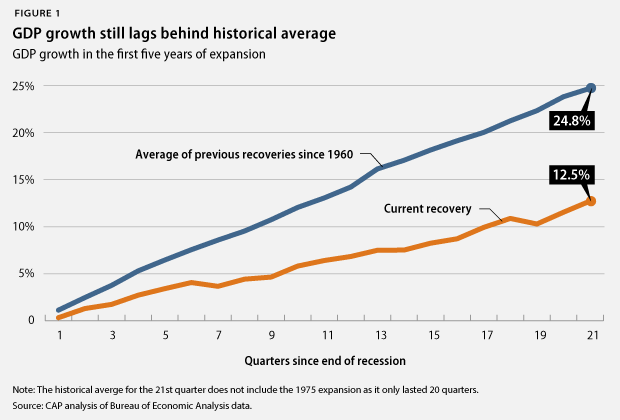

The Bureau of Economic Analysis data released yesterday showing the latest numbers for the country’s gross domestic product, or GDP, is another sign that we have settled into a new normal of economic growth. This new normal is much like the old normal in growth terms, but starting from a lower level means we’re increasingly resigned to end up with a smaller economy.

Before we get too wound up about this quarter’s GDP number—the sum total of goods and services produced by workers and capital in the United States—let’s keep in mind just how preliminary it is: Large GDP revisions are the rule rather than the exception. That said, yesterday’s reported 3.5 percent growth rate is what we have to go on, and it looks pretty solid. Unfortunately, we got started on growth late in this recovery, and we have never seen the kind of catch up growth that is necessary to make the hit of the Great Recession temporary.

As they have all year, consumers continued to drive the economy, although not terribly fast. According to yesterday’s data, personal consumption expenditures were up 1.2 percent in the first quarter, 2.5 percent in the second quarter, and 1.8 percent in the third quarter. Increasingly, this growth reflects big gains in durable goods pushed along by the strongest auto market since the recession.

It’s worth noting that credit is least partly fueling the auto market boom, which is one reason the auto sector continued to do well even as disposable personal income and nondurable consumption decelerated. That division is another indication that, although consumers are fueling the economy, they can only be counted on for so long without more wage growth. While the aggregate personal savings rate hit 5.5 percent in the third quarter, the increasing concentration of income and wealth in the United States means this isn’t the source of pent-up demand that it would have been a few decades ago.

Imports and exports data continue to be choppy; that is to say that while this quarter’s number boosted GDP growth significantly, there’s not much insight to be gained from it about the future. Moreover, volatility in commodity prices are likely to drive large fluctuations in net exports for at least the next quarter. Investment is always volatile, and while nonresidential investment improved slightly from the second quarter, improvements in residential investment have slowed somewhat. This isn’t shocking since the Federal Reserve, or Fed, has been tightening monetary policy, and we would therefore expect the housing sector to feel these effects first. The question is whether the Fed has slowed the housing market to a reasonable pace, or if simply ending the quantitative easing program was enough to seriously harm the housing recovery.

The true bright spot in 2014 has been the reversal of the drag on the economy from government spending. With the automatic across-the-board spending cuts known as the sequester in place, and local economies finally recovering, the federal and state governments have largely swapped places. The federal government contributed a lot to GDP growth this quarter, but defense spending entirely accounted for that growth.

According to yesterday’s number, state and local governments appear to be doing better at expanding the economy, contributing 0.38 percentage points to GDP growth in the second quarter and another 0.15 percentage points in the third. Interpreting the third quarter number—which is a seasonally adjusted annual rate of growth—is complicated by the fact that state and local governments have struggled mightily since the recession. The typical increases in spending that come with seasonal highway construction and school openings have been abnormally low for so many years in a row that the usual seasonal adjustment algorithms are more easily confused these days. Nonetheless, the best data we have suggest that roads are getting fixed and teachers are getting hired. Not exactly the stuff of a roaring economy, but a welcomed return to normal.

In sum, what we are seeing is an economy that’s chugging along fine, but this is good news that is muted by the fact that, for the most part, we remain blissfully unaware of how far behind we are after a lost half-decade of growth.

Michael Madowitz is an Economist at the Center for American Progress.