This column was originally published on MarketWatch.

Hiring in the United States slowed dramatically in August, according to new data released today by the Bureau of Labor Statistics, or BLS. This provides a sobering reminder that—despite 47 straight months of job gains—the labor market is not yet creating enough jobs for all who want work, nor quality jobs that lead to a middle-class livelihood.

Private employers added 134,000 jobs in August, while the public sector added another 8,000 jobs. Headline unemployment ticked down 0.1 percentage points to 6.1 percent, but this decrease was due to fewer people actively looking for work rather than an actual increase in employment.

Last month, 9.6 million people were counted as unemployed, 2.1 million were not counted as unemployed but are ready and willing to work, and another 7.3 million were employed in part-time work. These numbers indicate that private employers’ demand for workers is not creating enough opportunities for all those who want to work. Disproportionately higher than the rate for the overall population, the unemployment rate for African Americans held constant at 11.4 percent in August, while the rate for Latinos fell 0.3 percentage points to 7.5 percent.

In the longer term, the pace of job creation is improving, averaging 207,000 new jobs per month over the past 12 months, up steadily from the average of 198,000 and 183,000 per month in the two prior 12-month periods, according to BLS data. In comparison to past recoveries, however, this is not strong job growth. In the 1990s growth period, U.S. employers added more than 250,000 new per month in more than 47 months. Notably, the U.S. population at that time was four-fifths the size it is today.

Unless hiring can break out from this slow-but-steady trend, simple arithmetic indicates that it will be a while before the economy reaches full employment on its own. The share of the overall U.S. population that is employed—the broadest measure of employment—held flat at 59 percent in August and has barely budged since the job market began expanding in February 2010, according to BLS data. Before the Great Recession, more than 63 percent of Americans were employed.

Indicators of employers’ future hiring plans and workers’ confidence in the strength of the labor market also waned in the August data. Typically, employers will employ people for more hours before hiring new permanent workers. However, the average work week remained unchanged at 34.5 hours for the sixth straight month, signaling that employers are not moving toward greater expansion of payrolls. Unemployment is not always a bad thing—for example, people may leave one job confident in the prospects of getting a better, new one. But the number of people voluntarily leaving jobs and the number re-entering the labor force in search of work have remained basically unchanged since May, suggesting that people are not growing more confident in job market conditions.

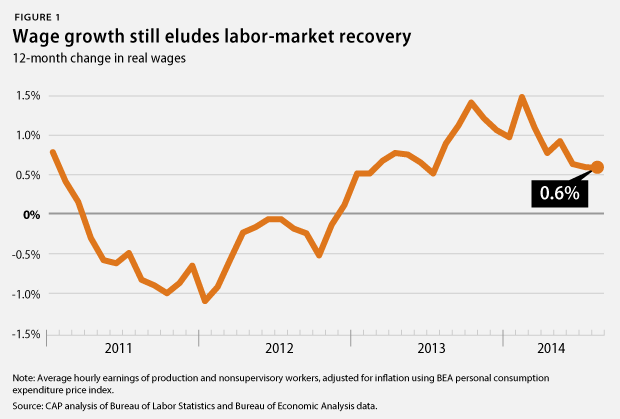

While the number of employed workers keeps rising, the quality of their jobs is not. Average hourly earnings—or wages—have yet to match employment growth in the jobs recovery. (see Figure 1) Wages for non-managerial workers—an indicator that closely tracks to the economy’s median wage and the average wage for the bottom 90 percent of wage earners—increased just 0.6 percent in the previous 12 months, after adjusting for inflation. This slight wage growth is an improvement over the real wage losses that workers experienced in 2011 and 2012, but it is no wonder that polls show that half the country believes the U.S. economy is still in recession.

Just one day after fast-food workers nationwide walked out on strike for fairer wages and working conditions, the BLS report shows that employment in the food-services industry accounted for 16 percent of overall private-sector employment gains. Combined with the jobs added in big-box retailers, long-term care, home health care, and temporary help, these low-wage industries accounted for 37 percent of new private-sector employment in August.

Stagnant wages stem as much from the still-high level of unemployment as from short-sighted business practices and political obstruction that have both restrained workers’ wage growth and squeezed fiscal resources out of public investments in education, science, and infrastructure. Higher wages and public investments are both key to making our economy more productive and prosperous overall.

Adam S. Hersh is a Senior Economist at the Center for American Progress.