Some members of Congress are threatening a government shutdown on October 1 unless a new round of spending cuts is enacted—cuts that ignore the nation’s true, improved fiscal and economic outlook. Federal budget deficits have actually shrunk dramatically in recent years. The national debt is no longer on the brink of exploding. But our economy continues to struggle; the Census Bureau recently reported that income inequality is growing while middle-class wages are stagnant. The 15 charts in this column illustrate how much the fiscal picture has changed, and why—in order to get the economy back on track—the debate must change with it.

Note: Click on any of these charts to download them as .pdf files.

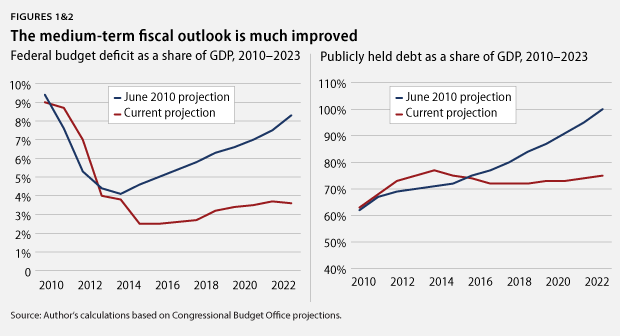

In 2010, the nonpartisan Congressional Budget Office, or CBO, projected exploding annual budget deficits and cumulative national debt. Policymakers on both sides agreed that stabilizing the federal budget had to be a high priority, so Congress enacted legislation that will reduce deficits by about $2.5 trillion over the next 10 years—not including the automatic spending cuts known as the “sequester.” Congress cut spending by $1.5 trillion and raised about $630 billion in new revenues. Taken together, these actions will reduce government spending by an additional $400 billion by reducing interest costs for the national debt. Due in part to these policy changes, annual budget deficits and cumulative national debt are both stable over the medium term.

None of this deficit reduction was painless or easy, and each attempt nearly led to a severe crisis. Congress began to cut spending in its annual appropriations bills for fiscal year 2011. Those cuts were the product of several rounds of difficult negotiations, which nearly shut down the government. Later that year, Congress locked in even deeper cuts for a 10-year period in legislation that raised the debt ceiling just in time to avoid an economic catastrophe. And at the start of 2013, Congress agreed to some tax increases for the wealthiest Americans as part of the “fiscal cliff” agreement.

Over the past several years, health care costs have also grown much more slowly than the CBO expected back in 2010. Lower costs mean less government spending on health care programs such as Medicare and Medicaid. In addition, the Affordable Care Act made important policy changes that substantially reduced cost projections for Medicare.

The long-term budget outlook has also significantly improved, mainly due to two factors. First, of course, is the ripple effect of the medium-term improvements. Second, the budget projection that many were using to analyze long-term trends was based on expectations of future Congresses passing new legislation to increase the deficit, rather than continuing current policies. If one assumes that, 10 years from now, Congress will cut taxes and increase spending, then the debt looks dire. If we project forward and account for policies in place today, the debt looks far more manageable.

Those calling for more austerity policies ignore not only the improved domestic budget outlook, but also the failed austerity policies of other nations. In Greece, the economy has shrunk dramatically each year after deep spending cuts. In the United Kingdom, severe austerity failed to even reduce the national debt, because the resulting economic stagnation damaged that nation’s fiscal health.

Austerity has similarly damaged the U.S. economy. The expiration of job-creation measures, along with trillions of dollars in spending cuts, resulted in the sharpest reduction in federal spending since the end of the Korean War. Important federal investments—such as infrastructure, education, and basic scientific research—will reach historic lows. Independent experts now project slower economic growth than they expected in 2010, before the cuts began.

Because sequestration makes new automatic cuts every year, austerity will only get worse. The sequestration cuts were intentionally designed to be so damaging that Congress would never let them take effect. But sequestration did take effect, and CBO expects that in the next 12 months alone, it will reduce GDP by 0.7 percent and eliminate 900,000 jobs.

And sequestration is certainly not necessary for debt reduction. Even if all the sequestration cuts were repealed without any offsetting deficit reduction, our debt-to-GDP ratio 10 years from now would be the same as it is today.

Because the fiscal picture has improved so much over the past couple years, sequestration is completely unnecessary to stabilize the debt. In fact, the CBO currently projects lower budget deficits without sequestration than it projected two years ago with sequestration.

The Center for American Progress has outlined a plan that repeals sequestration through 2016 and makes new investments in key economic sectors. While new deficit reduction is unnecessary since the medium-term budget is stable even without sequestration, the plan includes smart spending cuts elsewhere in the budget and proposals to make sure that Big Oil companies and the wealthiest Americans pay their fair share.

Finally, even if one does not believe any of these facts about the improving fiscal outlook, then perhaps the free market will convince them. Private investors have decided that the United States is as good an investment as ever. If investors believed the United States was about to go “broke” due to exploding debt, we would see higher interest rates on U.S. Treasury bonds as they became harder for the government to sell; instead, interest rates on Treasury bonds are unusually low.

Instead of working to grow our economy and get unemployed Americans back to work, Congress is approaching another self-created crisis over shutting down the government and defaulting on our financial commitments by failing to raise the debt limit. Not only do these unnecessary partisan battles pull the focus away from creating jobs, but they also risk further damaging our struggling economy.

The fiscal debate is still focused on more austerity—despite an improved budget outlook and mounting evidence of austerity’s failure. It’s time to reset the fiscal debate to focus instead on the economic crisis we have today.

Michael Linden is the Managing Director for Economic Policy at the Center for American Progress. Harry Stein is the Associate Director for Fiscal Policy at the Center.