Strengthening America’s middle class should be elected officials’ top priority. Incomes are either stagnant or falling for the middle class, while the costs of life’s necessities continue to rise. As a result, the risk of the middle class falling behind economically is growing. A weak middle class hurts all of us by stifling our country’s economic growth and undermining our democracy.

Unfortunately, reducing the deficit has distracted our political leaders from this pressing challenge and has made it seem like little can be done, as Congress blocked or failed to act on important legislation to help the middle class. In reality, however, there are many things that the federal government can do to help the middle class.

Rather than make excessive short-term budget cuts as we are currently doing, we can and should make needed investments in the middle class, such as expanding access to preschool and child care, as part of a package that reduces the deficit over the longer term, as CAP has proposed on many occasions. Furthermore, there are a number of things that policymakers can do that won’t require any additional expenditures.

To help remind politicians that they have lots of room to act, we have compiled a list of the top six policies that would help the middle class without costing taxpayers a penny. Together, these policies will boost the incomes of millions of hardworking Americans; put families on a path to a sustainable retirement; ensure that workers don’t have to choose between staying home while sick or losing their job; allow struggling homeowners to stay in their homes; and empower students with valuable information on college quality.

While these policies would not address all of the challenges faced by the middle class, they would make a meaningful difference in the lives of millions of working Americans.

1. Increase the minimum wage

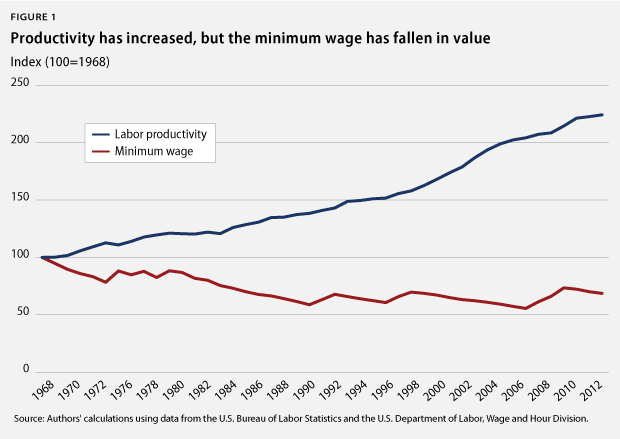

Over the past four decades, workers have become much more productive and our country has become much richer, but the value of the minimum wage has declined significantly. Since 1968 the inflation-adjusted value of the minimum wage has declined by 31 percent.[1] The minimum wage would be more than $10.50 per hour today if it had kept up with inflation. This decrease has occurred even as workers have become more productive. Over the same period of time, productivity—the measure of output per hour of work—increased by 124 percent.[2] (see Figure 1)

Raising the minimum wage would not only help boost incomes for those struggling to reach the middle class, but it would also cause employers to raise wages through “spillover effects” for even those more solidly in the middle class. After increasing wages for low-wage workers, employers feel the need to increase the wages of workers near the minimum wage in order to preserve their relative position. Studies have estimated that this spillover effect can increase the share of the workforce affected by the hike by 5 to 10 percentage points.

Furthermore, raising the minimum wage is good for the economy because it boosts workers’ purchasing power, providing needed demand in the economy.

The minimum wage should also be indexed to prevent congressional inaction from reducing its value. Indexing to inflation is good, but indexing to one-half of the average wage would be better because it would help ensure that workers reap some of the economic gains they help create. It would also raise living standards as the country becomes richer.

2. Make saving for retirement easier, cheaper, and more secure

Social Security provides retirees an essential baseline of income, but middle-class Americans depend upon accumulations in private retirement accounts to maintain their standard of living in retirement. Because of flaws in our private retirement system, however, many Americans do not have enough retirement savings to maintain their current standard of living. Ernst and Young estimates that 59 percent of new middle-class retirees will outlive their retirement savings, while Boston College’s National Retirement Risk Index estimates that 53 percent of all households are at risk of having an insecure retirement. (see Figure 2)

In order to help the middle class retire with dignity, we need to expand retirement coverage and improve the quality of retirement plans available. We can achieve these goals and improve the current retirement system by creating a new hybrid retirement plan type—the Secure, Accessible, Flexible, and Efficient Retirement Plan, or SAFE Retirement Plan, a hybrid between a traditional pension and a 401(k) plan—and opening the federal Thrift Savings Plan, the 401(k) for federal employees, to the public.

Under this proposal, workers would be automatically enrolled in a retirement plan—their choice of the SAFE Retirement Plan, the Thrift Savings Plan, or their current workplace plan, if they have one. Furthermore, both of these new plans, especially the SAFE Retirement plan, would boost retirement savings and security compared to a typical 401(k) plan. The SAFE Retirement Plan is estimated to cost roughly half as much as a 401(k) to provide the same level of benefit, and savers in the plan would be more secure because risk is spread across all workers. The TSP would provide much lower fees and more suitable investment options than a typical 401(k).

These plans wouldn’t cost the government money because they are not government programs but rather sensible retirement plans facilitated by government action.

3. Lower monthly housing costs by providing homeowners with principal forgiveness

Although housing markets are beginning to recover from the collapse of the housing bubble, more than one in five homeowners are still “underwater” on their loans, meaning that they owe more on their mortgages than their loans are worth. (see Figure 3) Not only does this threaten individual homeowners, but the more than $600 billion in negative equity also significantly hampers economic recovery. Barring an ill-advised effort to reinflate the housing bubble, we will likely need to deal with the unique problems of underwater mortgages for some time to come.

Owing more on a home than it is worth is a significant threat to middle-class families that have long relied on homeownership as a means to build wealth. Home equity accounts for 40 percent to 50 percent of total wealth for middle-class families with incomes falling between $30,000 and $70,000.

Providing troubled underwater homeowners with principal forgiveness, which means permanently reducing the outstanding principal balance of an underwater loan to reflect current market value as part of a loan modification, can accomplish three important goals:

- Help ensure the long-term success of mortgage modifications.

- Stabilize the nation’s hardest-hit housing markets.

- Remove a major barrier to consumer confidence and spending.

Some investors are already forgiving principal balances in their modifications, either through the Home Affordable Modification Program, or HAMP, Principal Reduction Alternative or as part of the National Mortgage Settlement. Using HAMP is optional for investors, however, even when reducing principal returns more value than simply forbearing principal. The U.S. Treasury Department should require that HAMP participants reduce principal in those cases.

Moreover, Fannie Mae and Freddie Mac are still barred from participating in the HAMP principal reduction program by their regulator, the Federal Housing Finance Agency, even though the agency’s own analytics demonstrate that allowing principal forgiveness with these incentives would save Fannie Mae and Freddie Mac $3.6 billion in total. Permitting the two mortgage giants to do principal forgiveness would be a significant step toward helping homeowners, the housing market, and the larger economy.

For all investors—including Fannie and Freddie as well as private investors—one option for reducing principal without taking the full loss is to offer “shared appreciation” loan modifications, in which the investor writes down principal in exchange for the borrower pledging to share with the investor a portion of any future appreciation when the home is ultimately sold or refinanced.

4. Let all workers earn paid sick days

Paid sick days should be available to all U.S. workers. Implementing this policy would provide greater job security to millions of Americans, reduce worker turnover, and ultimately strengthen the middle class.

There are currently no federal laws guaranteeing workers the right to earn paid sick days. Nearly 40 percent of workers in middle-income families and more than 55 percent of workers in low-income families do not have access to paid sick days.[3] Twenty-three percent of adults report either being threatened with losing a job or being fired for taking time off when they or a family member have been sick. (see Figure 4)

What’s more, adults that do not have access to paid sick days are 1.5 times more likely to go to work sick with a contagious infection or illness. The cost of “presenteeism,” or the decreased productivity of a worker who works when sick, costs the U.S. economy $160 billion each year, surpassing even the cost of absenteeism, when a worker doesn’t show up at all.

Policymakers should guarantee workers the ability to accrue up to seven job-protected, paid sick days per year to recover from their own short-term illnesses or care for an ill family member. The Healthy Families Act would implement paid sick days.

5. Ensure that workers who want to form a union are able to do so

Unions help strengthen the middle class by enabling workers to negotiate for fair wages and benefits and helping ordinary citizens get involved in the political process.

But as unions became weaker over the past four decades—due in part to an unfair union election process—they became less able to perform these functions. The middle class has withered as a result, with the share of income going to the middle class falling alongside the percentage of workers in unions. (see Figure 5)

Indeed, according to Harvard University’s Bruce Western and the University of Washington’s Jake Rosenfeld, “Union decline explains one-third of the growth in inequality—an effect equal to the growing stratification of earnings by education.” If unionization rates increased by 10 percentage points—to roughly the level that they were in 1980—the typical middle-class household, unionized or not, would earn $1,501 more per year, according to research conducted by the Center for American Progress Action Fund.

Unfortunately, the current union election process is stacked against workers who want to form a union. One study by Stanford University’s John-Paul Ferguson finds that 35 percent of the time that workers file a petition for an election, the election does not happen.

To ensure that workers who want to form a union are able to do so, the following should occur:

- The National Labor Relations Board should help put an end to needless election delays and modernize the union election process.

- Congress should pass comprehensive labor-law reform that establishes a fair process for workers to decide on union representation that expands coverage so that more workers are provided the right to organize; establishes meaningful penalties and remedies for workers who are fired or discriminated against for exercising their right to organize; and includes measures to promote productive bargaining between workers and companies.

- Congress should also make the right to join a union a civil right. This would give workers who are discriminated against in exercising their right to organize a private right to sue, just as workers have a right to sue if they face other forms of workplace discrimination.

6. Require colleges to provide consumer information via college scorecards

Two-thirds of students with four-year bachelor’s degrees finish their studies with student-loan debt, and the average amount of debt per student is nearly $25,000. (see Figure 6) Yet average debt loads at schools can range from $950 or less to $55,250, and graduation rates range from 0 percent to 91 percent. Many students, however, are unaware of these differences.

The federal government should require colleges and universities to do a better job of providing pertinent information to prospective students concerning their likelihood of graduating, finding employment, and paying off student debt. Schools should be required to direct students to this information on all promotional materials to allow students to easily compare schools.

Expanding access to college education is a key mechanism for building a strong middle class. The college wage premium—the percent increase that a college graduate earns compared to a similar worker without a college degree—is approximately 45 percent, according to data from the Economic Policy Institute. Furthermore, the overall middle class has shrunk as the supply of highly skilled workers hasn’t kept up with the demand for those skills. Approximately one-third of the rise in income inequality since the late 1970s is due to the rising college premium.

Despite the increasing return on investment in a college degree, many students still have a difficult time figuring out the costs and benefits of different schools. This is especially difficult for those who are the first college students in their families, as they lack guidance from family members who attended college and went through the process of choosing a school to attend.

The Obama administration has developed an important new tool in helping prospective students and their families access this information: a college scorecard, which provides a standardized, easy to read one-page summary of the cost, debt, and graduation rates of degree-granting colleges in the United States. The scorecard should be improved, however, in order to help more middle-class families access the information that they need to make an informed decision.

The college scorecard, for example, is currently only available on government websites. The federal government should require institutions to include information about the availability of the college scorecard on college websites, enrollment forms, financial-aid paperwork, and other promotional materials in order to make it visible enough to grab the attention of applicants. Moreover, the scorecard should include other important data such as the average earnings for recent graduates. Ideally, some critical data—graduation rates and earnings, for example—should be available at the degree and program level. Finally, comparison tools should be provided that allow for easy comparisons among institutions and, ultimately, degree and program levels.

Conclusion

The American middle class is in trouble. Hard work has less power to lift families into the ranks of the middle class. And even when working families achieve a middle-class lifestyle, unstable work environments, the rising cost of obtaining a college education, and the inability to save for a secure retirement make it difficult to remain in the middle class.

There are many things that the federal government can do to help secure the American promise that hard work can lead to a better future. Some measures will require additional investment in the middle class, and they can be part of a package that reduces the deficit over the longer term. Still other policies that Congress and the Obama administration can adopt would help the middle class without costing taxpayers a penny. The top six policies in this column provide a good place to start.

David Madland is the Director of the American Worker Project at American Progress. Karla Walter is the Associate Director of the American Worker Project.

Endnotes

[1] Authors’ analysis of data from the U.S. Bureau of Labor Statistics and the U.S. Department of Labor, Wage and Hour Division.

[2] Authors’ analysis of data from the U.S. Bureau of Labor Statistics.

[3] The family income categories used in this analysis are based on the categories first laid out in the 2010 Center for American Progress and Center for WorkLife Law report, “The Three Faces of Work-Family Conflict.” They are modified for the data available through the American Time Use Survey. The universe is families with a currently employed worker over the age of 18. Families are divided into three groups:

- Low-income families, who make up approximately the bottom one-third—37.68 percent—of families by income

- Middle-income families, who include those families not falling within the low-income and the professional-class families groups

- Professional families, who make up approximately the top 20 percent of families—24.07 percent—in which the worker has at least a college degree