In recent years we have been repeatedly warned that the federal government is on track to accumulate an unsustainable amount of debt over the next several decades. This debt, we’ve been told, will eventually crush our economy unless we drastically cut entitlement programs such as Medicare, Medicaid, and Social Security.

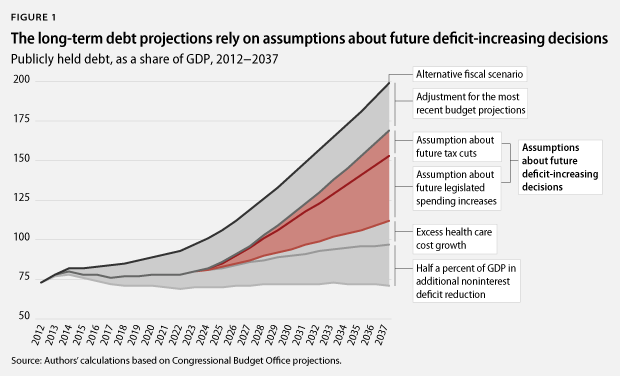

But our long-term fiscal challenges are far less frightening than we have been led to believe. In fact, a huge portion of the Congressional Budget Office’s, or CBO’s, daunting projections of massive debt in 2037 are driven by one key assumption: Starting a decade from now, future Congresses will enact huge new deficit-increasing tax cuts and spending hikes. Without this key assumption, the debt projections fall dramatically. Indeed, after accounting for recently enacted deficit reduction and the recent slowdown in the growth of health care costs, the 25-year debt projections start to look downright manageable.

When you hear dire predictions about our long-term debt, Exhibit A is usually CBO’s most recent long-term budget outlook—released in June 2012—and especially its “Alternative Fiscal Scenario.” Under this scenario, the U.S. debt-to-GDP ratio would reach 199 percent in 2037. That certainly is something to be concerned about. No one knows for sure at what level the debt will start to cause serious economic harm, but the higher it goes, the more likely we are to find out. And that’s something we should surely seek to avoid.

But the Alternative Fiscal Scenario’s long-term debt projection is based on the following important assumptions:

- All of the expiring Bush tax cuts would be extended permanently, and after 2022 revenues would remain the same share of gross domestic product, or GDP, in perpetuity.

- Currently enacted automatic spending cuts such as the sequester would be repealed without being paid for, and current expenditures on “Overseas Military Operations” would also continue indefinitely.

- After 2022 spending on nonentitlement programs—all programs other than Social Security, Medicare, Medicaid, and certain other mandatory health programs—would grow from currently projected levels back to its historical average.

CBO had to make some assumptions to produce its projections, and these were reasonable ones to make. But the good news is that since CBO released its long-term outlook in June 2012, we’ve already made significant progress toward bringing down our deficits. First, contrary to CBO’s assumption, we did not extend all of the Bush tax cuts at the end of 2012. Instead, the American Taxpayer Relief Act allowed approximately $600 billion of the Bush tax cuts to expire as scheduled, thereby raising future revenue projections. Second, the most recent CBO budget outlook, published in early February 2013, shows substantially less spending over the next 10 years than was projected in June’s long-term outlook. Finally, given the scheduled drawdown in Afghanistan, it seems unlikely that we will continue spending more than $100 billion a year—as is currently projected—on foreign wars. Incorporating these changes brings the 2037 debt projection down from 199 percent of GDP to 169 percent.

Although 169 percent is certainly preferable to 199 percent, it’s still far too much debt. But here’s where the other CBO assumptions make a huge difference. Most people probably imagine that all this debt will pile up unless we make major changes to existing federal spending and tax policies. In fact, however, a huge portion of the projected debt comes from the assumption that, instead of simply allowing current policies to continue, future Congresses will affirmatively pass laws that will increase the deficit.

Take CBO’s long-term revenue projection. It assumes that revenue will remain stable at a constant share of GDP every year after 2022. At first glance, that might seem to imply that the tax code will remain fixed over this period. But for the revenue-to-GDP ratio to remain flat, Congress would actually need to repeatedly cut taxes. That’s because under normal circumstances, tax revenues rise faster than economic growth. From 1994 through 2000, for example, revenues rose from 18 percent of GDP to 20.6 percent of GDP even though there were no tax increases. CBO itself acknowledges this fact: Under its standard baseline projection, the revenue-to-GDP ratio continues to grow after 2022. By contrast, the Alternative Fiscal Scenario assumes “unspecified changes in tax law that would keep revenues constant as a share of GDP after 2022.” In other words, the projection that debt will rise to 169 percent of GDP in 2037 partly relies on the assumption that future Congresses will enact deficit-increasing tax cuts after 2022. Take that assumption away, and the debt projection drops from 169 percent of GDP to 153 percent.

On the spending side, CBO assumes that spending on nonentitlement programs will quickly rise after 2022 and won’t be offset by other spending cuts or new revenue. Specifically, CBO projects that after 2022 programmatic spending on everything other than Social Security, Medicare, Medicaid, and certain other mandatory health programs will increase from 7.6 percent of GDP back to its historical average of around 10.7 percent.

That may well happen, given that 7.6 percent of GDP is a very low spending level. But because the vast majority of this nonentitlement spending has to be set annually during the congressional budget process, this jump from 7.6 percent to 10.7 percent assumes that future Congresses will actively vote to increase spending without any offsetting revenues or spending cuts. This assumption accounts for approximately 41 percentage points of debt in 2037. Take it away, and the projected debt level falls from 153 percent of GDP to 112 percent.

It’s not unreasonable to assume that Congress will cut taxes and increase spending in the future, but that is not the same thing as projections based on underlying demographic or economic trends. Guesses about what policymakers will do a decade into the future are just that—guesses. It is just as reasonable to assume that in 2023—when the debt is already 80 percent of GDP—Congress won’t enact massive new tax cuts or spending increases without paying for them.

The problem isn’t CBO’s debt projections per se, but rather how they are invoked in the current debate over the sustainability of Medicare, Medicaid, and Social Security. As we now know, a huge portion of the projected run up in debt has nothing whatsoever to do with automatic growth in entitlement programs. Instead, it’s a direct result of CBO’s assumptions about future deficit-increasing decisions. It’s therefore misleading to cite CBO’s overall debt projections as evidence that our entitlement programs are unsustainable.

This is not to say that current entitlements pose no problem at all. Even if we assume that future Congresses won’t affirmatively act to increase the deficit, the debt is still projected to rise from around 76 percent of GDP today to 112 percent in 2037. That’s far less horrifying than 199 percent, but it’s still nothing to celebrate. And much of that debt increase is attributable to projected increases in federal health care spending.

But there’s also good news on this front. CBO projections of future growth in federal health care spending are driven in part by the assumption that underlying U.S. health care costs will continue to grow much faster than GDP. Specifically, CBO assumes in their long-term budget projection that national health care expenditures will grow 1.6 percent faster than GDP every year—even before accounting for the additional health care spending that will be required because of the aging of the population.

In the past several years, however, the growth of health care costs has actually been far slower than that—even after including the extra health care spending necessitated by the aging of the population. From 2009 through 2012 total U.S. health care expenditures grew just 0.7 percentage points faster than GDP, less than half as fast as CBO’s long-term assumption. And in 2012, the most recent year for which data are available, expenditures grew even slower than that. Although some of the recent slowdown may be attributable to the recent economic downturn, there is reason to believe that structural changes in our health care system may also be playing a role. In fact, the recent trend prompted CBO to reduce its projection of federal health care spending over the next 10 years by $382 billion in its latest February outlook.

What could this new health care cost trend mean for long-term debt projections? If, after adjusting for aging, health care costs grow only as fast as overall economic growth—not faster, as CBO’s current long-term projection assumes—then debt in 2037 would be reduced from 112 percent of GDP to 97 percent.

So to recap: Simply making the adjustments described above reduces the projected debt-to-GDP ratio in 2037 by 102 percentage points—from 199 percent to 97 percent. And to be clear, this reduction owes nothing to future tax increases or spending cuts—aside from the continued drawdown in spending on foreign military operations.

Does this mean our long-term debt problem is solved? No, it doesn’t. Debt at 97 percent of GDP is still a serious challenge. But it’s a much more manageable and less intractable challenge than if the debt was actually on track to hit nearly 200 percent of GDP. With only a little additional deficit reduction, we can stabilize the long-term debt-to-GDP ratio at a reasonable level. Implementing an average of about 0.5 percent of GDP in additional annual programmatic spending cuts or tax increases—or some combination of the two—would keep the debt level essentially stable for the next 25 years, reducing it to about 71 percent of GDP in 2037. This 0.5 percent of GDP would amount to about $1 trillion saved over the next 10 years.

$1 trillion in additional programmatic spending cuts or tax increases is no small task, but it is not impossible. On the spending front, for example, the Center for American Progress has crafted a package of reforms that will reduce federal health care spending by nearly $400 billion over the next 10 years without harming any beneficiaries. We’ve laid out a plan to responsibly reduce defense spending by $100 billion over the next 10 years without harming our national security. We’ve also identified about $1 trillion in tax expenditure reforms. Altogether, that’s more than enough to reduce spending and raise revenues by an average of 0.5 percent of GDP each year. And to be clear, these are the savings that are required assuming the repeal of the sequester.

The conventional wisdom in Washington is that we have a huge long-term debt problem. But we rarely recognize that much of the expected run up in debt is derived not from out-of-control entitlement spending but rather from the assumption that future Congresses will make our budget challenges much worse by enacting new tax cuts and new spending increases without paying for them. Take that assumption away, add in the deficit reduction we’ve already enacted, and factor in the recent slowdown in the growth of health care costs, and the debt projection falls by more than 100 percentage points of GDP. That doesn’t mean the long-term budget picture is suddenly rosy, but it does mean that we may not need to hyperventilate quite so much.

Michael Linden is the Director for Tax and Budget Policy at the Center for American Progress. Sasha Post is the Special Advisor to CAP President and CEO Neera Tanden.