Though conservatives like to point to the “historical average” level of tax revenue as support for their position that further deficit reduction should not include more revenue, the historical data actually prove just the opposite. If we want to reduce our budget deficit, we will need higher revenues than are currently projected.

As Congress and the White House contemplate possible approaches to deficit reduction that would replace the $1.2 trillion sequester that is set to begin in March, the arguments over revenue and spending levels have intensified. Most conservatives in Congress insist that any plan to replace the sequester must be paid for entirely by cutting spending—not by bringing in new revenue. Their position rests on the contention that, “This isn’t a tax problem. It is a spending problem.” And as proof, they often point out that revenues are already projected to rise above the historical average over the next 10 years.

They’re not wrong—at least not about the historical average. Federal receipts, as a percentage of gross domestic product, or GDP, have averaged 17.9 percent over the last 40 years. The Congressional Budget Office projects that—with the fiscal cliff deal in place and assuming that a variety of “temporary” tax breaks will be extended yet again—federal revenues will average 18.5 percent of GDP over the next 10 years. 18.5 percent is certainly bigger than 17.9 percent, so some conservatives say that this proves that we don’t need more revenue.

But what they’re missing is that 17.9 percent of GDP hasn’t been enough revenue for the last 40 years—and it certainly won’t be enough for the next 40 years. Remember, the federal budget was in the red for nearly every one of these last 40 years—and often deeply so. And the deficits were bigger when revenue was lower, smaller when revenue was higher—a fact that should surprise no one.

Take, for example, the last four years. From 2009 to 2012 federal receipts averaged just 15.4 percent of GDP—lower than at any point since 1950. Not surprisingly, record-low revenues translated into record-high deficits.

This basic relationship holds true over the past four decades. In the 40 years since 1973, 11 years saw deficits greater than 4 percent of GDP. In those same 11 years, revenues averaged 16.7 percent of GDP—well below the much-vaunted historical average. Similarly, there were 12 years in which the deficit was smaller than 2 percent of GDP. And in those years, revenue averaged 18.9 percent of GDP—much higher than the average. And, of course, in the four years in which we actually balanced the budget, revenue averaged 20 percent of GDP. (see Figure 1)

But full budget balance isn’t necessarily what we’re aiming for right now, so perhaps revenues don’t need to be increased all the way up to 20 percent of GDP. Indeed, President Obama has called for just enough deficit reduction to prevent the national debt, measured as a share of GDP, from rising. Others have called for somewhat more deficit reduction. Those goals will require deficits in the range of 2.5 percent of GDP or lower. And in the years since 1973—when the deficit was less than or equal to 2.5 percent of GDP—the federal government collected 18.8 percent of GDP on average in revenue.

While the difference between 18.8 percent and the current projection of 18.5 percent may not appear to be substantial, that 0.3 percent increase over the next 10 years equates to about $640 billion in additional revenue. To put that in perspective, the president’s call to replace the sequester half with revenues and half with spending cuts would equate to about $500 billion in new revenue. That would still leave us short of the “historical average” for years with low deficits.

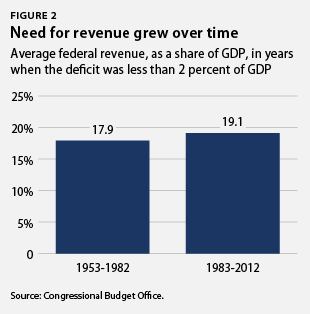

And let’s not forget that what was sufficient in the past may not be sufficient in the future—a point which the historical data itself proves. In the years between 1953 and 1983 in which the deficit was smaller than 2 percent of GDP, revenues averaged 17.9 percent of GDP. But during the following three decades, in the years in which the deficit was smaller than 2 percent of GDP, revenues averaged a much-higher 19.1 percent. Our needs grew over time as our demographic, economic, and security challenges changed, so revenues that were sufficient in one generation became insufficient in the next. (see Figure 2)

This is especially true right now. The anticipated demographic shift as a result of the “baby boom” generation retiring means that there will be a larger proportion of the population relying on Social Security and Medicare in the coming years. Even with significant changes to these programs, this will mean higher costs to the federal government. If we want smaller budget deficits in the future, revenues must be higher than they have been in the past.

Yes, revenues are currently projected to rise above the historical average—but this misleading factoid proves little. Rather than showing why we don’t need more revenue, the historical data actually show clearly why we do. When deficits were small in past years, revenues were higher—higher than the historical average and higher than the current projections. Not only that, but the average revenue in low-deficit years has increased over time.

The lesson is clear and simple: If we want to reduce the deficit, we’re going to need more revenue.

Michael Linden is the Director for Tax and Budget Policy at the Center for American Progress. John Craig is a Research Assistant in the Economic Policy department at the Center.