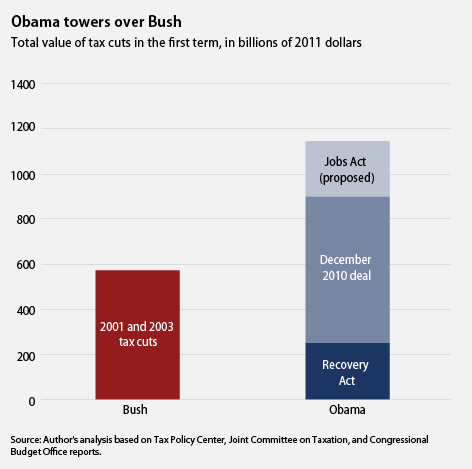

If you had to guess whether President George W. Bush or President Barack Obama cut taxes more in his first term, which one would you choose? Probably President Bush, right? After all, the “the Bush tax cuts” were massive. And President Obama is the one calling for the expiration of some of those tax cuts. He’s also pushing for more revenue as we try to address our long-term fiscal imbalance.

Given all that, you could be forgiven for guessing that President Bush is the bigger tax cutter. But you’d actually be wrong. By the end of his first term, President Obama will have signed into law a series of tax cuts that, taken together, exceed the value of those signed into law by President Bush.

President Obama’s tax cuts versus President Bush’s tax cuts

President Bush enacted his tax cuts in 2001 and 2003, and over their 10-year lifespan, they reduced tax revenues by around $2.4 trillion, with $474 billion of that coming in the first four years. The first-term impact of those tax cuts is equivalent to about $574 billion in today’s dollars, or about 1.1 percent of gross domestic product.

President Obama has also signed two major pieces of tax-cutting legislation into law. The first, the American Recovery and Reinvestment Act, included a variety of tax cuts that benefited nearly every single American household. ARRA contained the Making Work Pay tax credit that directly reduced a family’s income tax bill by up to $800, which, overall, reduced tax revenue by about $116 billion. It included expansions of the child, earned income, American Opportunity, and first-time homebuyer tax credits. ARRA patched up the alternative minimum tax, providing $70 billion in tax cuts, and cut a wide array of business taxes, together totaling another $60 billion.

All told, the Recovery Act included $243 billion worth of tax cuts through 2012.

Nearly two years after signing his first big tax cut bill into law, President Obama completely outdid himself by signing the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, commonly known as the December 2010 tax deal. The biggest element of the December deal was the extension, for two additional years, of all the Bush tax cuts and alternative minimum tax relief, at a two-year combined cost of more than $400 billion.

In addition, the deal extended a variety of business tax cuts and incentives, which reduced revenues by some $150 billion, and it cut the estate tax—a tax paid by only a very few super-wealthy, massive estates—by $65 billion. The December tax bill also cut the payroll tax paid by employees by 2 percentage points, delivering more than $110 billion in tax cuts to working Americans.

Put it all together, and in one fell swoop, President Obama cut taxes by $654 billion in 2011 and 2012 alone. In other words, with this bill President Obama cut taxes by more, in raw dollar amounts, in just half of his term than George W. Bush did over his full first term.

With the huge Recovery Act tax cuts and the enormous December 2010 tax cuts combined, President Obama has already signed into law tax cuts amounting to more than $900 billion from 2009 through 2012. Even after accounting for legislation that the president signed that increased revenue during that period, President Obama has cut taxes by more than $850 billion in his first term, or approximately 1.5 percent of GDP.

Just recently, President Obama proposed another $250 billion in tax cuts designed to spur job creation, mostly in the form of additional cuts to the payroll tax. In fact, as the Citizens for Tax Justice noted, President Obama’s proposed payroll tax cuts are essentially equal in size to the total cost of the extended Bush tax cuts for 2012. If Congress passes this next set of Obama tax cuts, his total will rise to well more than $1.1 trillion, or nearly 2 percent of GDP—close to double the size of the tax cuts in President Bush’s first term.

How the cuts differ

Of course, there are two major differences between President Obama’s tax cuts and President Bush’s.

First, President Obama’s tax cuts are much more targeted at the middle class. The Bush tax cuts were heavily skewed toward the wealthy with more than half of the entire benefit going only to the richest 20 percent. President Obama’s tax cuts, on the other hand, are distributed more evenly. Eighty-five percent of the benefits of the Making Work Pay tax credit, for example, went to the bottom 80 percent of households, and because the very wealthy don’t pay payroll taxes on all of their income, the payroll tax cut, too, benefits the middle class much more than the Bush tax cuts did.

Second, the Obama tax cuts are temporary. All of them, from those in the Recovery Act to the newly proposed ones in the American Jobs Act, either already expired or will expire in the next year. The president has proposed making some of them permanent—lower rates on income under $250,000, and a permanent fix to the AMT, among others—but many will eventually disappear. Because of this, and because the president wants to raise some additional revenue to help close the budget deficit, if you compare the entire 10-year cost of the Bush tax cuts to a similar 10-year period predicted for President Obama’s proposals, President Bush is still the bigger tax cutter.

These two differences reflect the important fact that the philosophy behind the cuts differs dramatically even though both presidents signed big tax cuts into law. While President Bush’s tax cuts primarily benefited the wealthy, President Obama’s tax cuts focus on the middle class. While President Bush believed tax cuts were the cure-all elixir for whatever ailed the economy—a belief that was far-fetched even at the time—President Obama uses targeted breaks to businesses and consumers in a time of profound economic weakness designed to spark job creation. And while President Bush was entirely unconcerned about the long-term costs of tax cuts and the resulting debt pile-up, President Obama has consistently made the case for more revenue, especially from those who can most afford it, to help close the budget gap.

The underlying philosophies are different, as are the long-term consequences. But the fact remains that right now President Obama’s tax cuts exceed those of President Bush. By 2012, bills signed into law by President Obama will have reduced tax revenues by about $900 billion, or 1.5 percent of GDP. And if he gets his way, and Congress passes another $250 billion in cuts, the total of all Obama tax cuts will rise to about 2 percent of GDP. That’s close to twice as big as the tax cut tally at the close of President Bush’s first term.

Michael Linden is the Director of Tax and Budget Policy and Michael Ettlinger is Vice President for Economic Policy at American Progress.