For appendix tables, see the PDF or Scribd versions of this issue brief.

In 1954, the U.S. Supreme Court made clear with its Brown v. Board of Education decision that education “must be made available to all on equal terms.” Sixty years later, that promise remains unfulfilled. Millions of students—largely low-income students and students of color—continue to attend segregated and economically isolated schools. State and district school finance systems perpetuate and compound these inequities by providing less money to students with the greatest need.

Federal law—through Title I, Part A, of the Elementary and Secondary Education Act, or ESEA—attempts to ameliorate these disparities. It requires school districts to provide “comparable” educational services in high-poverty and low-poverty, or non-Title I, schools as a condition of receiving Title I dollars.

But the devil, as always, is in the details. Under current law, districts can compute comparability using average teacher salaries or teacher-to-student ratios instead of actual expenditures on teacher salaries. And because teacher salaries constitute the largest proportion of school budgets and teachers with greater experience earn higher salaries and tend to teach in lower-poverty schools, this compliance method renders it impossible to accurately compare school budgets.

This problem is not an oversight. Federal law explicitly prohibits districts from calculating comparability using actual expenditures. Instead, it chooses to treat teachers as interchangeable widgets. For example, if School A has 10 teachers and School B has 10 teachers, they must be providing a comparable education. It is this loophole in federal law—the “comparability loophole”—that is at the heart of school funding inequities.

But research over the past decade has conclusively shown that all teachers are not equal. Some have a vastly greater impact on student achievement than others. In fact, a recent RAND Corporation report stated, “among school-related factors, teachers matter most.” And while experience is not a perfect proxy for effectiveness, research consistently shows that teachers undergo a steep learning curve during the first three years on the job and then gradually reach a peak in their fifth year. Consequently, it is particularly problematic that schools disproportionately serving low-income students also have more than their fair share of new teachers. Additionally, though individual teacher effectiveness varies, schools with more new teachers are, on average, not comparable to schools with more experienced teachers.

Ensuring that Title I funds provide additional funds for disadvantaged students is not a small issue. Indeed, it goes to the heart of the American promise of equal opportunity: No matter your background or family circumstance, you have a shot at a middle-class life if you work hard and get a good education. While money is not the only driver of a high-quality education, research shows that money really matters for disadvantaged students.

A recent National Bureau of Economic Research study found that:

For poor children, a twenty percent increase in per-pupil spending each year for all 12 years of public school is associated with nearly a full additional year of completed education, 25 percent higher earnings, and a 20 percentage-point reduction in the annual incidence of poverty in adulthood. … The results … highlight how improved access to school resources can profoundly shape the life outcomes of economically disadvantaged children, and thereby significantly reduce the intergenerational transmission of poverty.

The comparability requirement in ESEA is the mechanism through which the federal government can ensure that the public education offered to poor students is at least as well resourced as that offered to their more affluent peers. By allowing districts to use measures of educators instead of expenditures to demonstrate that they are providing comparable educational services, federal law ceases to have teeth. This is commonly referred to as the comparability loophole.

Effects of the comparability loophole

To determine the scope and depth of the funding inequity between higher- and lower-income students, we analyzed the most recent available data from the U.S. Department of Education, or DOE, on how much districts spend on each of their schools. The DOE collected this information on more than 95,000 public schools through its Civil Rights Data Collection during the 2011-12 school year. We compared how districts fund schools that are eligible to receive federal Title I dollars with other schools in their grade span—elementary, middle, or high school grades—and found vast disparities throughout the country in how districts spend state and local dollars on Title I schools. Whenever possible, we compared Title I schools with non-Title I schools in each grade span. In other cases, we compared higher-poverty Title I schools with other Title I schools. We adjusted school spending for differences in cost of living across districts.

Nationally, we found that:

- Due to the loophole in federal law, more than 4.5 million low-income students attend inequitably funded Title I schools. In most states, there are tens of thousands of students from low-income households who attend Title I schools that are not funded equitably relative to other schools in their district. See the appendix for state-by-state results.

- These inequitably funded schools receive around $1,200 less per student than comparison schools in their districts. Overall,these schools receive around $668,900 less per year than comparison schools. In Fort Worth, Texas, for example, inequitably funded Title I schools receive around $2,600 less per student.In some districts, the disparities are even wider. In Santa Fe, New Mexico, inequitably funded Title I schools receive around $4,900 less than other schools. These disparities can add up to millions of dollars at the state level. If these gaps were closed, inequitably funded schools in Texas would receive another $1.6 billion annually, and in New Mexico, they would have an additional $65 million. See the appendix for state-by-state results.

- If the federal loophole were closed, high-poverty schools would receive around $8.5 billion in new funds each year. This estimate is similar to findings reported in a previous study that used 2008-09 school finance data, also based on information collected by DOE. This amount is equivalent to around 1.5 percent of total state and local revenues, which were more than $500 billion in the 2011-12 school year. For inequitably funded Title I schools, these dollars could add real value. See appendix for state-by-state results.

As Congress works to reauthorize the No Child Left Behind Act, improving school funding has been a key focus. Sen. Lamar Alexander (R-TN), chairman of the Senate Health, Education, Labor and Pensions Committee, and Rep. John Kline (R-MN), chairman of the House Education and Workforce Committee, both proposed changing the distribution of Title I funds. This would allow states the option of distributing funds solely on the basis of the number of low-income students, rather than continuing to use the four formulas that target the funds to concentrations of poor students. Moreover, both of their proposals fail to address the comparability loophole and would continue to allow districts to demonstrate comparability in ways that mask real inequities in school resources. Members of the House Education and the Workforce Committee recently approved Rep. Kline’s proposal.

What could $668,900 buy?

Comparability is about a broad range of resources. Title I schools should at least have the same amount of resources—to invest as school leaders see fit—as other schools. They may choose to hire more experienced, and thus more costly, teachers, or they may choose to invest in technology, a new curriculum, an after-school program, or teaching supplies. If shortchanged schools received an additional $668,000, they could do one of the following:

- Purchase new MacBook Pro computers for more than 550 students

- Construct six new libraries

- Implement a new music education program that serves more than 3,500 students

- Institute a new arts program covering more than 190 classrooms

- Hire 12 new guidance counselors with an average salary of nearly $54,000

- Give a $10,000 bonus to more than 60 teachers

This paper is not the first to point out this issue of comparability. The fiscal inequities perpetuated by the comparability loophole are well documented. In a DOE national study of school finance during the 2008-09 school year, the department looked at differences in spending between schools in the same districts and found that about 40 percent of Title I schools were underfunded relative to non-Title I schools. In 2012, the Center for American Progress issued its “Unequal Education” report, which analyzed the first wave of DOE per-school expenditure data that included actual teacher salaries. It found that children of color are routinely being shortchanged. CAP has long argued that the loophole is one of the most significant barriers to educational equity. Other groups such as The Education Trust and the New America Foundation have also analyzed the impact of the loophole and found that districts claiming comparability significantly underfund higher-poverty schools.

It is important to note that districts reported their own financial information for the Civil Rights Data Collection, or CRDC. Districts might have chosen somewhat different approaches to completing the financial survey. The CRDC focuses on expenditures from state and local funds. School-level financial data is already scarce, but this focus on state and local resources makes it difficult to cross-validate these school-level findings even with available state-level school finance results.

Although legally comparable, schools can still have large funding inequities

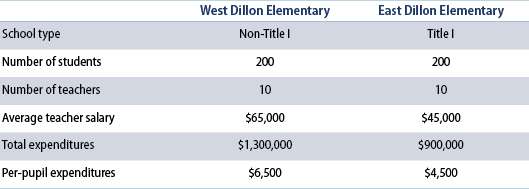

The following is an example of how the comparability loophole permits school funding inequities to persist. The schools are hypothetical, reproduced from a Center for American Progress video released in 2011.

In this scenario, each school serves the same number of students with the same number of teachers. Each teacher is paid according to a district-wide salary schedule. In West Dillon, the average teacher has 20 years of experience, while teachers in East Dillon are much less experienced. According to the law, these schools are comparable. But in actuality, the Title I school receives $400,000 less overall in state and local funds or $2,000 less per pupil.

Recommendations

To ensure that low-income schools are funded at equal levels with their more affluent counterparts, Congress should update the law and close the comparability loophole in the following three ways:

- The comparability calculation must be based on actual expenditures, including actual teacher salaries.

- Districts should be required to achieve comparability between Title I and non-Title I schools only by demonstrating that Title I schools receive state and local funding that is at least equal to the average of the district’s non-Title I schools.

- Districts that serve only Title I schools must show that higher-poverty schools receive no less than the average total of state and local funds for lower-poverty schools.

Under current guidance from the U.S. Department of Education, districts can demonstrate comparability at the 90 percent level. In other words, districts can claim that they spend comparable amounts at Title I schools as long as those schools provide at least 90 percent of services offered in other schools. Districts can interpret that percentage as a ceiling not a floor. The department’s guidance should not allow for this amount of leeway.

Some have argued that the only way for districts to close the comparability gap is to force experienced teachers to transfer to high-poverty schools, which typically employ teachers with fewer years of experience and lower salaries. In fact, states and districts could provide a host of additional resources to the high-poverty schools and leave the staffing distribution as is. By purchasing the kind of enrichment activities listed in the “What could $668,900 buy?” text box above, districts would comply with the requirement.

In addition, districts could change their compensation systems to reward effectiveness instead of seniority or educational degree attainment. In this way, districts can pay highly effective teachers more, particularly those working in schools serving high concentrations of low-income students. With more highly effective teachers clustered in high-poverty schools, these districts could close the comparability gap through supporting highly effective teachers in these schools rather than forcing teachers to move to high-poverty schools.

At the same time, actually achieving comparability given that schools have been inequitably funded throughout history will not be easy. That is why Congress should require meaningful compliance with the comparability provision to be phased in gradually. Priority would first be given to the schools that have been most egregiously shortchanged. Full compliance would be required within five years. The following timetable would serve that end:

- Year one: All districts must publicly report all expenditures by school level. These facts must be made available in an easy-to-read format that is available to the public. The report must also include the percentage of students eligible to receive free and reduced-price lunches. In each subsequent year, the district continues to report this data.

- Year two: States and districts begin to fill in funding gaps. States would rank their Title I schools by per-pupil expenditures and ensure that the lowest-spending 25 percent of schools are funded to at least 100 percent of the average level of their districts’ comparison schools. These gaps could be closed through state or local actions or a combination of both.

- Year three: States ensure that the lowest-spending 50 percent of Title I schools are funded to at least 100 percent of the average level of their districts’ comparison schools.

- Year four: States ensure that the lowest-spending 75 percent of Title I schools are funded to at least 100 percent of the average level of their districts’ comparison schools.

- Year five: States ensure that all Title I schools are funded at least to the level of the average of their districts’ comparison schools.

Under current law, districts already risk losing their Title I dollars if they fail to comply with comparability requirements. Congress should expand this provision to hold states accountable for the gaps outlined above as well. Here, the guiding principle is that states hold the ultimate responsibility for operating inequitable funding systems. Specifically, states should risk losing their full allocation of Title I dollars each year that they fail to keep on track with the above timeline. This arrangement would be a strong deterrent to states and districts that wish to continue their current approaches to funding their most disadvantaged schools. Nationally, this amounts to a reasonable trade-off. For example, we found that in the second year—the first year of narrowing comparability gaps—states and districts would be responsible for closing gaps by around $2.3 billion in exchange for receiving more than $14.6 billion in federal Title I funds.

Conclusion

Students from economically disadvantaged backgrounds deserve the same opportunities at their peers from higher-income families. Notwithstanding the fact that comparability is the law of the land, the way districts comply with the provision undermines its true intent. Under the current fiscal policy, districts can spend less of their own state and local dollars on the schools with the highest needs, and most do spend millions of dollars less in these schools. Therefore, Congress should close the comparability loophole by requiring that districts fund their Title I schools at the same level as or higher than—based on actual spending—their other schools.

To truly address the problem of fiscal inequity, Congress must seize this opportunity to close the comparability loophole. An improved comparability provision could go a long way toward ensuring that all low-income students get their fair share of state and local funding.

Robert Hanna is a Senior Policy Analyst, Max Marchitello is a Policy Analyst, and Catherine Brown is Vice President of Education Policy at the Center for American Progress.