After a few uncertain months, April marked a return to normal economic news. Fears of a recession in early 2019 appear to have subsided, though there is significant uncertainty about the path of the economy for the rest of the year.

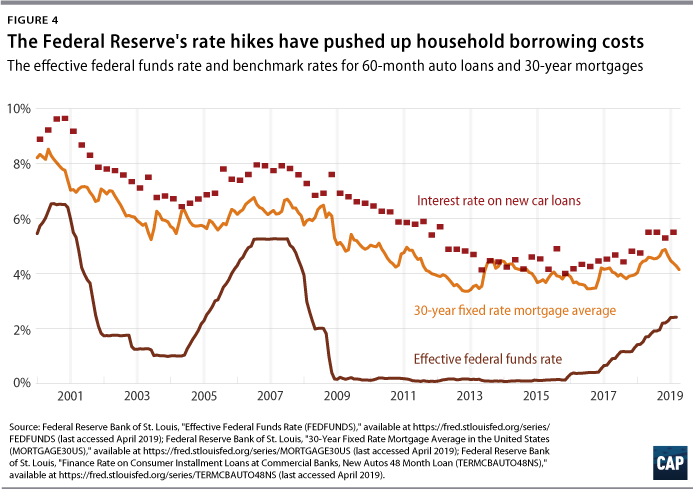

After its third meeting in 2019, the Federal Reserve seems set to let the economy run hotter after keeping a tight leash in the wake of the 2017 tax cuts. The major source of uncertainty in the labor market remains the question of how much longer the economy can keep adding jobs and growing wages without triggering higher inflation rates.

The U.S. Bureau of Labor Statistics will release its monthly report with April’s jobs numbers on Friday, and all indications are that the steady job gains that the United States has seen since 2011 will continue for yet another month.

Low, stable unemployment but wealth gaps remain

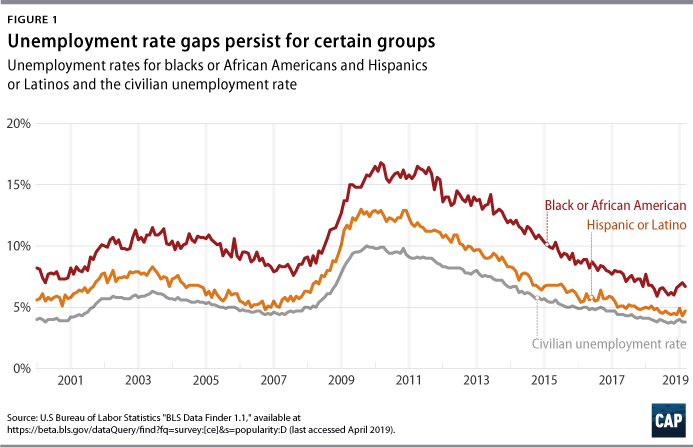

For the past year, the unemployment rate has stayed in the range of 3.7 percent to 4 percent. This is a solid performance after the steady decline in unemployment rates observed since 2009. (see Figure 1) The employment rate has also continued to inch up to almost pre-recession levels, with workers continuing to move from the sidelines into jobs at higher numbers than some predicted for yet another year.

Yet despite a more attractive labor market for some workers, unemployment rates remain disproportionately high for certain groups, particularly black and African American and Hispanic/Latinx people, who face other hurdles in the economy such as prominent wealth gaps. These gaps exist despite the fact that overall, these communities are seeing similar levels of educational attainment and are working more than their white counterparts. Moreover, although some people may have an easier time finding a job than in previous years, wider economic pressures have sparked reason for worry.

Emergency expenses, stagnant wages, and the need for economic security

Despite the possibility of last-minute spending, 40 percent of Americans are unable to afford a $400 emergency, while wages remain close to stagnant for most people, even as those at the top continue to see gains. Recent analysis from the Economic Policy Institute shows that labor income for the bottom 90 percent has shrunk by more than 10 percent since 1979—translating to about $10,800 of lost pay per household. With little sign of bipartisan cooperation on pro-worker policies, a tight labor market is the primary force that most workers can expect to reverse this trend in the coming year.

Meanwhile, wages for production and nonsupervisory workers have remained virtually stagnant for decades, increasing just $2.71 since the beginning of 2000. (see Figure 2) All the while, costs of living—including child care and education, just to name a few—have continued to rise, outpacing wage growth for most Americans.

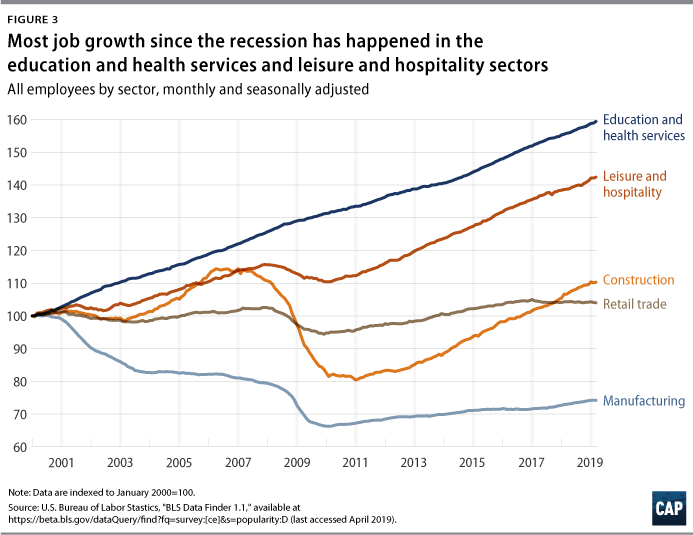

Broader economic trends that put pressure on American workers, in conjunction with the disconcerting priorities of the Trump administration, hurt working families. They also put into focus the need to highlight the true conditions and lived experiences of people across the economy. Job growth has been uneven across all sectors of employment since the Great Recession, with many only now returning to their pre-recession employment levels. A closer look at the sectors that have seen the largest growth since the recession shows that the food service and health care sectors have seen the most job growth. (see Figure 3)

Although overall inflation has remained moderate, the sectors where costs have grown rapidly are largely those where the Fed’s decision to raise interest rates is making big-ticket purchases less affordable. Since the Fed started hiking rates two years ago, monthly payments on mortgages and car loans have increased considerably, putting pressure on households, homebuilders, and an automobile industry that began April with “near-record inventories” that include 4.2 million unsold vehicles.

Conclusion

Despite overall low unemployment rates and a welcomed continuation of normal growth in gross domestic product, the reality behind wages—as well as the disproportionate hurdles that certain groups face in the labor market—suggest that workers may not be seeing the gains and opportunities of an economy that appears healthy from the headlines. There is still room for the economy to grow—and when considering economic priorities, it is essential that analysts and policymakers take a variety of indicators into account, instead of overstating the economic prosperity of the past few years.

Galen Hendricks and Daniella Zessoules are special assistants for Economic Policy at the Center for American Progress. Michael Madowitz is an economist at the Center.