As Americans across the country filed their tax returns over the past few months, two competing approaches to improving our federal tax code have emerged. One approach is to offer specific proposals to reform, eliminate, or otherwise cut back on the unfair and inefficient tax breaks—known as tax expenditures—that clutter the current code. The other approach is to offer specific proposals to cut tax rates, promise to pay for them with tax-expenditure reforms, but stay silent on exactly how to do that.

Tax expenditures are spending programs hidden in the tax code that allow individuals and corporations to reduce their tax bill through deductions and exemptions, credits, or preferential rates for certain types of income. They include broadly utilized tax breaks such as charitable gift deductions and state and local tax deductions, and lower capital-gains tax rates, but they also include obscure and narrowly defined tax breaks such as those that benefit only hedge-fund managers, oil companies, or corporate-jet owners.

Both President Barack Obama and House Budget Committee Chairman Paul Ryan (R-WI) agree on the need to reform these tax expenditures. But that is about all they agree on.

President Obama’s budget for fiscal year 2014 identified the specific tax preferences he wishes to reform and detailed proposals to do so. Rep. Ryan’s tax-expenditure reform proposals, however, must be deduced from his larger tax proposals and targeted revenue level. He is specific about tax cuts, and he is specific about how much overall revenue he wants to raise, but he fails to offer any details whatsoever on the exact tax-expenditure reforms he would prefer.

Comparing these two plans for tax reform side by side, it is apparent which approach is more realistic and more committed to actual reform. Where the president offers a well-defined path forward that eliminates unfair or unnecessary tax expenditures to generate a modest amount of new revenue, Rep. Ryan’s approach depends on unrealistic levels of new revenue from tax-expenditure reforms that he declines to identify. In fact, any plan to actually meet Rep. Ryan’s tax rates and tax-revenue specifications would inevitably entail a large tax increase for the middle class and lower-income households, while bestowing a large tax cut on those earners at the top.

In this issue brief we describe the details provided by President Obama and Rep. Ryan on tax reform generally and on tax expenditures specifically; evaluate whether the policy targets of each are realistic; and then analyze the effect these competing reforms would have on middle-class taxpayers.

What reforms to taxes and tax expenditures does each budget call for, and are the targets realistic?

In his 2014 budget President Obama calls for the elimination or reform of a variety of tax expenditures. These include proposals that put a large dent in yearly deficits as well as proposals that would eliminate much smaller loopholes that, nevertheless, are simply unfair. Some of the president’s proposed reforms would:

- Limit itemized deductions taken by high-income earners to 28 percent tax credits ($529 billion)

- Enact the Buffett Rule, which would ensure that millionaires pay at least 30 percent of their income in taxes after charitable contributions ($53 billion with other reforms, $99 billion alone)

- Place a ceiling on the total amount that can be accrued in tax-preferred retirement accounts ($9 billion)

- Eliminate the unfair tax classification that allows hedge-fund managers to pay tax rates lower than middle-class Americans ($15.9 billion)

- End the special depreciation allowance given to corporate jets beyond what is given to an identical commercial airliner ($2.7 billion)

These changes, along with several others in his budget, offer a complete picture of the president’s tax-expenditure reform. The president’s changes could pay for lowering corporate tax rates, new job incentives, and increased investment in American infrastructure. What’s more, even after carrying out all of those options, there would still be enough revenue left to reduce deficits by an estimated $583 billion over 10 years.

The House budget takes an entirely different approach. Though it is vague in many areas, especially regarding tax-expenditure reforms, Rep. Ryan’s main tax proposals are very clear and provide context for what his tax-expenditure reform must do. He aims to drastically lower marginal rates for both corporations and individuals, seeking a historically low top rate of 25 percent, and a full repeal of the alternative minimum tax, or AMT, a tax aimed at preventing wealthy taxpayers from paying extraordinarily low rates. Further, by repealing the Affordable Care Act, the Ryan budget also eliminates the modest revenue obtained from high-income taxpayers through a Medicare and investment income tax.

These changes to the tax code would reduce federal revenues enormously. The nonpartisan Tax Policy Center estimates that the cost of these changes to the federal government would be more than $5.7 trillion over the next 10 years. But despite calling for massive tax cuts, the Ryan budget sets a 10-year revenue level equal to the same $40.24 trillion under the current tax code. This means Rep. Ryan will need to find roughly $5.7 trillion through tax-expenditure reforms to pay for his tax-rate cuts. The House budget is silent on how it would achieve these tax-expenditure savings, and just as he did with his FY 2013 budget last year, Rep. Ryan passes the buck to the House Ways and Means Committee Chairman Rep. Dave Camp (R-MI) to identify the reforms that can raise $5.7 trillion. Although the Center for American Progress has found $1 trillion in savings from expenditure reforms, finding the next $4.7 trillion is another thing entirely.

In order for the Ryan budget to raise $40.24 trillion over the next 10 years, Rep. Camp and Rep. Ryan must find an average of $570 billion a year in tax expenditures to reform or eliminate. But the nonpartisan Congressional Research Service has found that eliminating more than $150 billion in individual tax expenditures per year would be both politically and technically difficult, leaving at least a $420 billion gap in the Ryan budget.

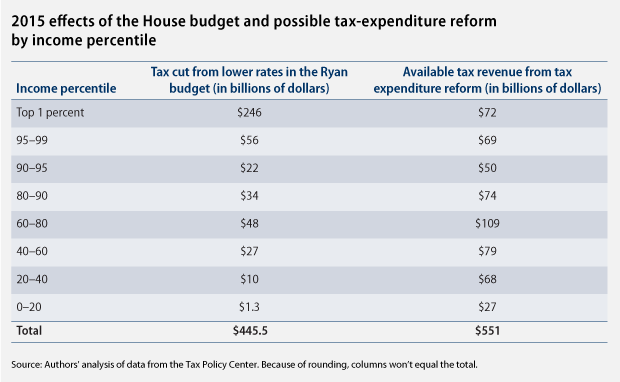

Filling this gap becomes an even more difficult task if the House budget tries to find this revenue without raising taxes on the middle class. In 2015 alone the House budget gives $246 billion of the $445.5 billion tax-rate cut to the top 1 percent of earners. If Rep. Ryan wants to pay for his tax-rate cuts and insulate the middle class from a tax hike, he would need to eliminate $246 billion in tax expenditures used only by the top 1 percent of income earners.

Given the technical complexity involved with eliminating some of these provisions and Rep. Ryan’s continued defense of those provisions that promote savings and investment, it seems unlikely that his overhaul of tax expenditures can raise this much from top income earners. This isn’t just rhetoric: The math clearly shows that the policies outlined in the Ryan budget offer a great deal for the wealthy—at the expense of middle-class Americans or future deficits.

The impact of the tax proposals in the Obama and Ryan budgets on the middle class

The tax cuts, as laid out in the House budget plan, would benefit mostly upper-income taxpayers, with more than 80 percent of Rep. Ryan’s cuts, roughly $4.5 trillion, going toward the highest 20 percent of income earners and 55 percent going solely to the highest 1 percent. To put this number in perspective, all of the austere spending cuts included in the House budget total “only” $4.63 trillion. In other words, the cost of the proposed tax cuts going to the richest fifth of Americans in the Ryan budget almost equals the money saved through his painful spending cuts.

The specified tax changes in the Ryan budget give the top 1 percent a $246 billion tax cut in 2015. But remember, Rep. Ryan claims that revenue in 2015—and every year of his 10-year budget—will be the same as it would be if no tax changes were made at all. This means that Rep. Ryan intends to make up that $246 billion in lost revenue. To do that without raising taxes on the middle class, he would need to get all $246 billion back from that same top 1 percent. Is that even possible?

According to several estimates, all of the individual-income tax expenditures in 2015 will total approximately $1.3 trillion. But there are several reasons why that total dramatically overstates how much is actually available to Reps. Ryan and Camp.

First, this total must be reduced to reflect the effect that the lower tax rates in Rep. Ryan’s plan have on potential revenues gained through tax-expenditure reform. To understand why lower tax rates reduce the potential savings from tax-expenditure reforms, imagine the following: A wealthy taxpayer deducts $1,000 from his taxable income. At the current 39.6 percent marginal tax rate, this deduction saves him or her $396 of tax liability, while at a 25 percent marginal tax rate, this same $1,000 deduction saves only $250 of tax liability. Once rates are lowered, eliminating or reducing this deduction will raise less money than it would have at the higher rates. This helps to explain why President Obama’s tax expenditure reform is more attainable as well; besides needing to raise less revenue from tax expenditure reform, the higher tax rates offer more savings from the elimination and reform of tax preferences.

There are also certain tax expenditures that could not realistically be cut under a conservative base-broadening reform. These include income exclusions that are technically too difficult to tax, such as “imputed rent on owner-occupied housing,” and expenditures that are politically off-limits, such as taxing veterans’ benefits and combat pay. What’s more, many tax expenditures are directed toward encouraging savings and investment, such as the lower tax rate on capital gains and dividends. While Rep. Ryan does not directly defend these provisions in his 2014 budget and could even eliminate them, his 2013 budget made the case for protecting them. And given that Rep. Ryan has supported eliminating these taxes altogether in the past, it is unlikely that he now supports raising them.

After these adjustments, the Tax Policy Center found only $551 billion left for possible revenue increasing tax expenditure reform. Obviously, $551 billion is more than the $246 billion that Rep. Ryan needs to make his plan add up. But not all of that $551 billion goes to the top 1 percent. Of the $551 billion available, only $72 billion can be raised from that group in 2015 through eliminating individual tax expenditures, according to our analysis below. The remaining $174 billion in cuts for the wealthy can only be paid for by cutting corporate tax expenditures or by raising taxes on the middle class.

Paying for some of the remaining $174 billion in cuts for the wealthy could certainly come from closing corporate tax loopholes, but not nearly enough is available to prevent a tax increase on the middle class. First, the Office of Management and Budget projects that in 2015 all corporate income tax expenditures will total approximately $159 billion. Second, there is ample evidence that conservatives are not interested in eliminating the largest corporate tax preferences.

One of the largest corporate tax expenditures is the accelerated depreciation of machinery and equipment, which is estimated to cost $43 billion in 2015. Accelerated depreciation is a set of provisions in the tax code that allow businesses to deduct the cost of equipment before its useful life has run out. Rather than seeking to eliminate accelerated depreciation, Rep. Camp actually supports permanently extending an expensing provision that would increase the cost of accelerated depreciation.

Another equally large corporate tax expenditure is the deferral of taxes paid on the foreign earnings of American companies, which is estimated to cost $43 billion in 2015. Both Reps. Ryan and Camp have expressed support for moving the United States to a territorial tax system. This change would allow foreign-earned profits of American companies to be repatriated to the United States with either no tax or a small tax paid to the federal government.

By expanding depreciation and moving the United States to a territorial tax system, there simply is not enough revenue to be gained from corporate tax reform to prevent a middle-class tax hike on the individual side of the code. Those two provisions are the largest in the corporate tax code and after sparing them, only $73 billion is left to cut through corporate expenditures—about $100 billion less than the $174 billion needed to prevent a middle-class tax hike. This shortfall can only be expected to grow as more details are sketched out, particularly with other expenditures such as the exclusion of municipal bond interest and the expensing of research activities likely to be saved.

Simply put, there aren’t enough tax breaks for the top 1 percent and for corporations to offset their massive tax cut. And it’s not even close. Though Rep. Camp recently asserted that his tax reform will not result in a middle-class tax hike, Rep. Ryan has also declared that his tax cuts will not increase deficits. One of these two men is wrong.

This is in contrast to President Obama’s tax-expenditure reforms, which clearly identify who will pay higher taxes. Taxing the income of hedge-fund managers the same way as other Americans will not raise your taxes if you are not a hedge-fund manager. Likewise, if you do not own a corporate jet, lengthening corporate-jet-depreciation schedules to the same depreciation timeline that commercial airlines use will not raise your taxes. And limiting itemized deductions for the top 3 percent of income earners and tax-preferred retirement accounts for Americans with more than $3 million in those funds, only affects the people who can most afford to pay for deficit reduction.

President Obama’s budget is stronger on tax-expenditure reform and better for the middle class

Both President Obama and Rep. Ryan agree that we should reform the dense thicket of tax breaks that has grown wild and unchecked in the tax code. But their approaches to clearing out this underbrush differ dramatically. The president prefers an approach that targets the provisions that are demonstrably unfair as well as a few used by Americans most able to pay. By reforming the tax code in this manner, President Obama can contribute $583 billion to deficit reduction over the next 10 years without overburdening the middle class with higher taxes.

Rep. Ryan works backward in his budget, starting with the huge revenue levels that must be raised and then searching for the tax-expenditure reforms to get there. But by so generously cutting taxes for the wealthy in step one of his process, Rep. Ryan is left with a situation where he must either raise taxes on the middle class or fail to reach his revenue target.

John Craig is a Research Assistant in the Economic Policy department at the Center for American Progress. Michael Linden is the Managing Director for Economic Policy at the Center.