Introduction and summary

Turkey needs to transition its energy system rapidly in order to reduce its reliance on imports, which account for 3 out of 4 units of Turkey’s total primary energy supply. With a growing population and economy, the country’s imported energy costs have reached alarming levels, driving a significant share of Turkey’s current account deficit. Turkey’s population grew from 70 million only a decade ago to 81 million people in 2017—the equivalent of adding a metropolitan region the size of the Rhine-Ruhr in Germany or Chicago in the United States.1 Alongside this population growth, the economy has seen gross domestic product (GDP) per capita growth averaging 3 percent per year, with growth exceeding 7 percent in 2010 and 2017 and 9 percent in 2011.2

This increasing demand has driven rapid growth of the country’s energy system, including in conventional fossil fuels and renewable energy. Fortunately, Turkey is endowed with significant renewable energy resources, a flexible financial sector, an entrepreneurial business approach, and a large manufacturing and engineering base. Turkey’s auction scheme for tenders—or awarding the rights to undertake renewable energy projects—means that much of the installed renewable energy equipment will also be locally produced, a product of government efforts to position the country for the wider, global energy transition as part of its ambitious plan for the 2023 centenary of the Republic.3

Turkey’s energy transition is a largely positive story that has not received enough attention by country analysts. By the end of 2017, renewable energy accounted for nearly 30 percent of all Turkey’s electricity generation.4 Still, the country needs to do more to transition its energy system to a more secure, affordable, clean, and sustainable model, as well as attempt to meet its ambitious energy and climate goals.

This report first explains the need for energy transition in Turkey, considering the following three issue areas: energy security and the balance of trade; job creation and economic activity; and environmental effects. The report then explores the current standing and future opportunities of Turkey’s energy system. After providing an overview of existing national energy and climate strategy and policies, it discusses the crucial role of the electricity generation sector and the need for adaptation in end-use sectors to improve efficiency and incorporate variable renewable energy generation. The report also highlights useful lessons that can be learned from the United States and Germany. It concludes with recommendations for how Turkey can sustain its progress and advance a smart energy transition.

The need for energy transition in Turkey

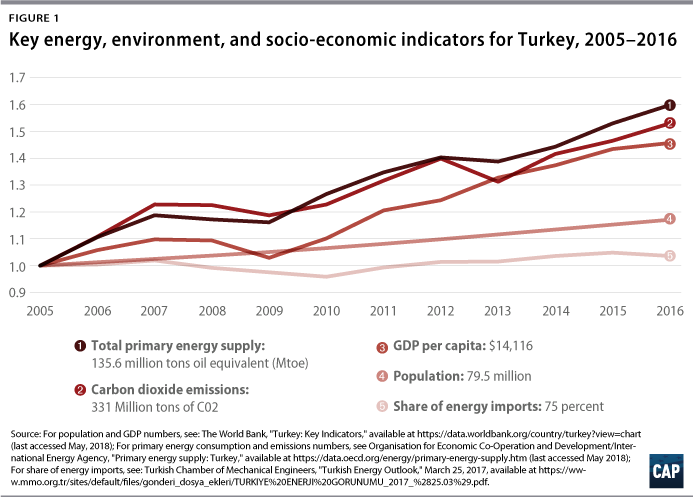

Unquestionably, Turkey’s top policy priority is to secure its energy supply and keep up with the demand to sustain its economic growth as its population increases. (see Figure 1) In addition to meeting growing demand, Turkey’s specific economic priorities are shaping its energy transition. These priorities include reducing the adverse environmental and economic impacts of increasing fossil fuel use, making markets more competitive, giving consumers more energy choices, and rapidly increasing renewable energy investments in both large and distributed generation assets.5

Government incentives for and investments in renewable energy technology and production stand to pay big dividends for Turkey. These efforts will help strengthen energy security and the country’s bargaining position with suppliers; reduce the current accounts deficit and ease inflationary pressures; grow the high-technology industry; and create economic activity and jobs. They will also reduce carbon emissions and improve the environment.

Energy security and balance of trade

In 2016, Turkey’s total primary energy supply reached 135 million tons of oil equivalent (Mtoe) per year—up from around 100 Mtoe in 2007. Although Turkey’s total energy demand trails that of other countries in the Organization for Economic Cooperation and Development (OECD) and the Group of 20 (G-20), it is the country with the fastest-growing market by demand.6 Electricity demand grew by 7 percent per year in the 2000s and has continued to grow by 4–5 percent per year.7 Total electricity demand is projected to reach between 440 terawatt hours (TWh) and 550 TWh per year by 2030.8 The higher end of this range would be equivalent to just less than double the current levels—295 TWh in 2017—over the period. Around three-quarters of Turkey’s overall supply is imported, including almost all gas and crude oil and two-thirds of coal.9

Demand for natural gas represents roughly 30 percent of the country’s total primary energy supply. In 2015, Turkey used nearly 45 billion cubic meters (bcm) of gas per year; this amount nearly doubled over the past decade.10 Russia accounts for more than half of all supply of natural gas to Turkey, with Iran, Azerbaijan, Algeria, and Nigeria making up the majority of the remainder.11 Likewise, oil accounts for more than 20 percent of Turkey’s total primary energy supply,12 with 92 percent of crude oil imported largely from Iraq, Russia, and Iran.13 Of course, Turkey’s ties with Russia and Iran bring with them fraught political considerations and a degree of political vulnerability—concerns that are also shared by the member states of the North Atlantic Treaty Organization and the European Union (EU). Turkey’s strong energy and trade relationships with its powerful neighbors rely on relative political stability on all sides.14 Turkey also remains reliant on coal for about 27 percent of its total primary energy supply,15 and imports of hard coal have doubled over the past decade.16 Coal is the only fossil fuel of which Turkey has a meaningful supply, with some hard coal reserves in Zonguldak Province and significant lignite spread across the country.17

Import dependency across these fossil fuel markets has important economic implications, leaving Turkey’s economy vulnerable to volatile global energy prices and substantially contributing to the current account deficit. When energy prices peaked in 2014, for example, Turkey’s energy import costs reached US$53 billion. In 2017, import costs declined to US$36 billion following the decline in global energy prices.18 In view of recent developments, as well as forecasts for the remainder of 2018 and growing energy demand in Turkey and globally, the import bill is likely to remain high given the volatility in energy prices.19 The latest Central Bank of the Republic of Turkey data show that the current account deficit reached US$53.4 billion between February 2017 and February 2018, with energy imports comprising the largest part of that shortfall.20

Driving the transition away from imported fossil fuels and toward domestically produced renewable energy is therefore a crucial priority for Turkey. Prioritizing the use of domestic renewable energy will reduce Turkey’s political reliance on energy exporters such as Iran or Russia as well as insulate Turkey against price shocks and fluctuating energy prices. In 2017, for example, Turkey generated around 7 percent of all its electricity from wind and solar, amounting to 18.8 TWh per year.21 If Turkey were able to triple this generation to replace electricity generated from imported fossil fuels, it would save more than US$1 billion per year in energy imports, equivalent to the annual electricity expenditure of a medium-sized Turkish city.

Turkey’s account deficit is also deepened by its current dependence on imported energy-related equipment and machinery. Despite Turkey’s otherwise strong manufacturing sector, the country’s net imports related to energy supply equipment amounted to US$2.8 billion in 2015, equivalent to 1 percent of overall net trade imports. This is driven in part by rising imports of renewable energy equipment, which have grown recently by 5 percent per year. China, Germany, and Italy represent half of all imports. Turkey is, however, a net exporter of wind equipment, with a total volume of US$1.1 billion per year, but this was outweighed by net solar and coal equipment imports with a total volume of US$4.2 billion per year in 2015.22

Jobs and economic activity

The energy transition will bring benefits and opportunities beyond saved import costs and an improved balance of trade; it could also drive badly needed value-added manufacturing and employment. Turkey’s auction system for energy tenders aimed to reverse the trade imbalance—particularly in electricity generation equipment—and foster broader domestic economic development.

Under the new system, bidders that win auctions to develop solar or wind fields are required to manufacture and use equipment that is at least two-thirds locally produced. This aims to drive economic activity and incentivize Turkey’s local production capacity. This sort of higher value-added equipment manufacturing is essential to Turkey’s broader economic agenda as well as to its efforts to create jobs and avoid the middle-income trap.23 It is also important that Turkey develop a strategy that offers a long-term view of the gigawatt-size market while creating investor confidence.

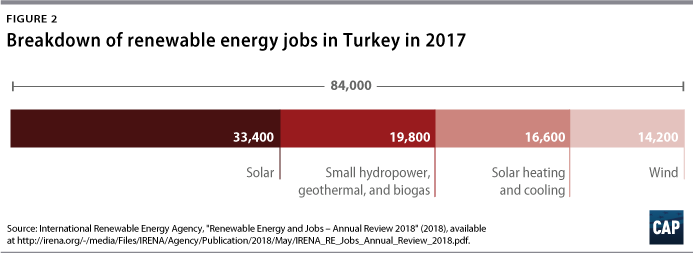

By the end of 2017, about 84,000 people were already employed in Turkey’s renewable energy sector, primarily in the solar industry.24 (see Figure 2) By comparison, the entire legacy electricity and gas sector employs a total of 819,000 people—and only directly employs one-third of that number.25 Indeed, local content requirements will drive up economic activity and create new jobs, but one should also consider the upfront costs and time needed to create a domestic manufacturing base. Turkish stakeholders should factor in these considerations when planning for the country’s energy transition in order to avoid both delays and increases in the current account deficit.

Environment

Finally, the energy transition could have dramatic positive impacts on the environment and human health. These positive results would stem from avoiding emissions of carbon dioxide (CO2) and air pollutants that are released during the conversion of fossil fuels into final energy products such as gasoline, diesel, or electricity, as well as the consumption of these products in power plants, transport, and heating or cooking.

Local air pollution is a growing concern in Turkey: 97 percent of the country’s urban population is exposed to particulate matter emissions higher than the EU and World Health Organization limits. In 2010, an estimated 29,000 premature deaths in Turkey were attributed to exposure to particulate matter and ozone emissions.26 A recent study shows that just 6 out of 81 surveyed cities meet the air pollution standards for sulfur dioxide and particulate matter.27

Perhaps more profound in the long run are the effects Turkey’s energy transition could have on global climate change, which stands to upend modern life and reshape economies and societies wholesale in the coming century. Turkey’s energy-related CO2 emissions reached 317 million tons (Mt) in 2015. Emissions from coal—by far the most emission-intensive fuel—used for electricity generation represented more than 40 percent of this total. In 2015, the sectoral breakdown of the country’s total emissions was as follows: 40 percent for electricity generation; 23 percent for transport; 14 percent for manufacturing, industry, and construction; 9 percent for residential buildings; and 14 percent for commercial buildings and smaller sectors such as agriculture and forestry.28 When non-CO2 greenhouse gases (GHG) are included, Turkey is the world’s 20th-largest emitter of GHG and ranks first in terms of GHG emissions growth among Annex I countries since 2006 given its rapidly growing energy demand and population.29 If its emission growth rate continues to increase at its current pace, Turkey could become one of the world’s largest emitters by 2030, making it a crucial crossroads country for global mitigation efforts.30 The advancement of Turkey’s energy transition will therefore contribute to improved health and well-being in the country and make a meaningful contribution to the global effort to mitigate climate change.

The current standing and future opportunities of Turkey’s energy system

The economic, strategic, environmental, and health factors outlined above all point to the potential benefits of a well-planned energy transition. This section offers an overview of the Turkish government’s current strategies and action plans to drive the country’s energy transition. Many of these plans have a target date of 2023, the centenary of the Turkish Republic.

While the ambitious goals set out in these planning documents are welcome, the planning process would benefit from a more extended timeline, deconfliction between strategic plans, and inclusion of lessons learned from other countries.

Overview of existing national energy and climate strategy and policies

Turkey has signed but not yet ratified the Paris climate agreement.31 Its Intended Nationally Determined Contribution (INDC) under the agreement projects that, according to its business-as-usual scenario, Turkey’s GHG emissions will grow 2.5 times between 2015—when it stood at 415 Mt CO2 equivalent—and 2030.32 The mitigation scenario Turkey introduced to meet its obligations proposes a 21 percent reduction by 2030. Turkey’s INDC relies on the rapid deployment of renewables, mainly in the power sector, and improved energy efficiency across the entire energy system.

However, Turkey is in an unusual position with respect to its climate policy. Turkey is a founding member of the OECD grouping of developed economies and is therefore often treated as a developed country; but in the climate context, Turkey regards itself outside of this definition. There are no established criteria to define countries as developed or developing, and Turkey falls somewhere in between depending on the context.33 Indeed, Turkey has thus far been a low emitter of CO2 and a small consumer of energy per capita, yet the country aspires to become one of the largest world economies and is on the path to becoming one of the largest CO2-emitting countries in the world. This future would leave Turkey with a “critically insufficient” INDC pledge.34 Turkey has delayed ratifying the Paris climate agreement, hoping for differentiation from the developed industrial Annex I countries that would allow Turkey access to international climate finance.

The Turkish government has put forward a number of plans outlining how it intends to transform the energy sector. Measures to improve energy efficiency form the core of these strategies, as efficiency improvements cut across all sectors that must contribute to Turkey’s long-term targets. Most recently, in January 2018, the government released a National Energy Efficiency Action Plan (NEEAP) that outlines 55 detailed actions in all six energy sectors—industry, transport, buildings, agriculture, energy generation, and cross-cutting issues—that would reduce Turkey’s primary energy demand by 14 percent by 2023. In fulfilling this target, the government estimates the actions will attract a US$10.9 billion investment over this period.35

Alongside these efficiency guidelines, the government has laid out a vision for the expansion of the renewable energy sector. The 2014 National Renewable Energy Action Plan provides overall renewable energy deployment targets through 2023 by energy sector and technology.36 These targets match those of the Electricity Energy Market and Security of Supply Strategy, calling for 34 gigawatts (GW) installed capacity of hydropower, 20 GW of wind, 5 GW of solar, 1 GW of geothermal, and 1 GW of biomass by 2023.37

Taken together, these various strategies to 2023 cover Turkey’s approach to energy efficiency, renewable energy, and climate change in great detail. Several issues, however, warrant further attention from policymakers. Turkey’s energy and climate strategies focus on 2023—the centenary of the Republic. Numerous country examples demonstrate the need for longer-term policies to allow market certainty for the private sector. Currently, much of Turkey’s policy focus is on the next five years. The power sector’s role is undoubtedly crucial for energy transition, but the focus must be broadened to include renewable energy’s roles in buildings, industry, and transport with a long-term focus and to accelerate the uptake of all low-carbon technologies in these sectors.

In view of the rapid technological and market changes, targets need to be updated continuously. This will help provide certainty for investors. While existing technologies can and will drive much of Turkey’s energy transition system, in order to achieve significant reductions in GHG emissions, further innovation, research, and development will be necessary for the deployment of new low-carbon technologies. In some of these burgeoning technological fields, Turkey may be able to carve out a competitive market position.

The key to these strategies will be implementation: Achieving an effective energy transition will require new regulations, policy instruments, financing, and business models. Turkey has prioritized its energy regulatory framework in recent years, for example, by raising building energy efficiency regulations and making them compatible with the EU Energy Efficiency Directive.38 It also released two action plans on renewables and efficiency that align with EU requirements. To ensure a cost-competitive transition to a low-carbon economy, financing must be ensured, and related mechanisms and business models need to be in place to drive investments and the overhaul of the energy sector.

International finance institutions and programs such as the World Bank, the Global Environment Facility, and the EU’s Instrument for Pre-accession Assistance (IPA) have supported Turkey’s energy efficiency implementation through loans—often on favorable financial terms—and technical assistance. The European Bank for Reconstruction and Development also has a portfolio of around €1 billion in the Turkish energy sector, mainly directed toward renewable energy capacity.39 Similarly, the European Investment Bank sets aside large sums of money out of its €500 million portfolio of loans across various sectors.40

The crucial role of the electricity generation sector

Turkey’s energy system has seen a considerable transformation over the past decade. In an effort to liberalize the power market, incentivize investments, and improve the efficiency of the system, the government has privatized large shares of the legacy thermal power fleet and built new gas- and coal-fired power and wind plants. Parallel to these efforts, a wholesale market was introduced, the distribution system was privatized, and the Turkish power system was connected synchronously to the European Network of Transmission System Operators.41

Indeed, developments in 2017 were unprecedented, as economic arguments started to work in favor of disruptive solar and wind development. The latest solar tender in Karapınar was finalized at US$0.0699 per kilowatt hour (kWh), and wind was finalized at US$0.0348 per kWh. By comparison, the recent lignite coal tender in Çayırhan resulted in a power purchase agreement at US$0.0604 per kWh, and the nuclear power plant under construction in Akkuyu has a guaranteed electricity sales price of US$0.125 per kWh.42

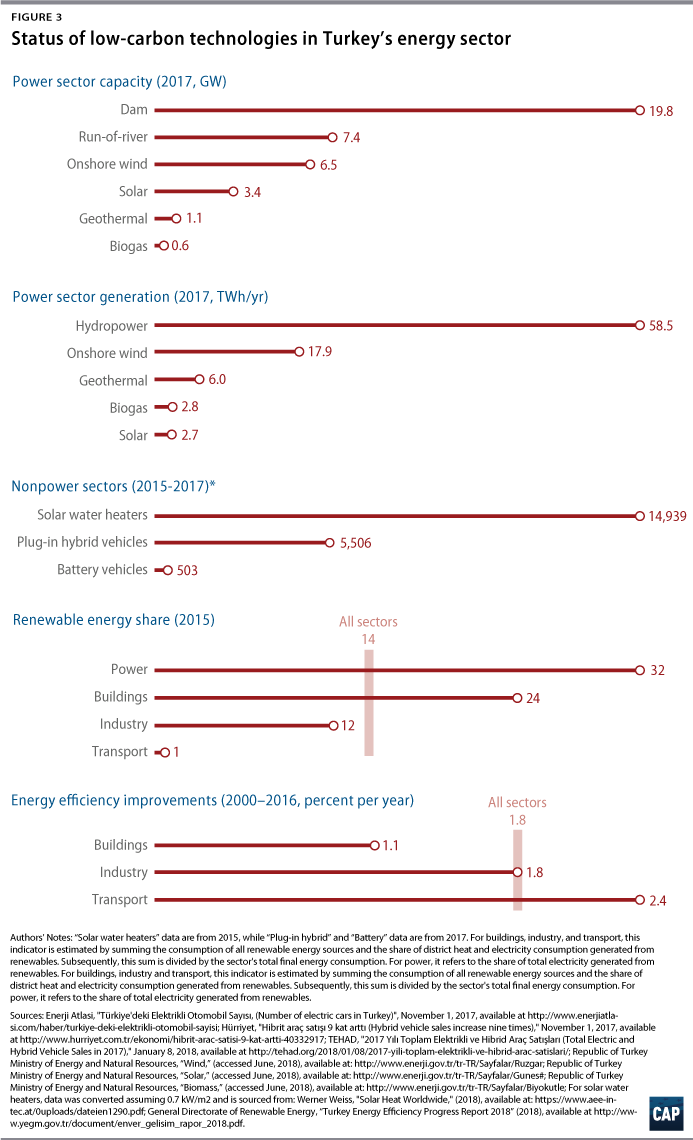

Beyond the favorable auction results, two-thirds of the net capacity additions came from renewable energy sources, of which solar and wind represented three-quarters. Despite the need to increase domestic production, planned electricity generation capacity continues to focus more on conventional power-generation technologies than on renewables. For example, Turkey has roughly 25 GW of coal-fired generation capacity in the permitting process.43 Compare that with the recently unveiled plans to include a 1 GW tender for an offshore wind park as part of the plan to build an additional 10 GW of renewable generation over the next 10 years. (Note that this plan is not necessarily a part of Turkey’s current targets to reach 25 GW installed wind and solar capacity by 2023).44 Taken together, these developments mean that renewable energy accounted for 28.5 percent of all electricity generation by the end of 2017. The share of solar and wind power was at 7.1 percent from a total generation of 18.8 TWh and a total installed capacity of 6.5 GW of wind and 3.4 GW of solar. Turkey also ranks fourth in the world in geothermal power use, with its total installed generation capacity exceeding 1 GW.45

There are also vast opportunities in building-integrated rooftop photovoltaics (PV) which convert sunlight into usable electricity. Nearly 500 million square meters across residential, commercial, and public buildings hold a market potential for up to 4 GW of installed capacity to be reached by 2026. This is a conservative estimate that considers grid capacity, growth in sales of rooftop systems, income levels, and creditworthiness. The technical potential reaches 47 GW, of which half is in residential buildings.46 With regulations now in place to govern the use of rooftop systems, investments are expected to accelerate, offering to those with capital a cost-competitive alternative to household electricity prices. The challenge remains to widen access to financing for rooftop solar projects with payback periods that can easily reach up to 10 years, even in regions with frequent sunshine. To address this challenge, several options are worth consideration, including self-consumption, net metering, and net billing models. The rollout of business models such as peer-to-peer trade systems will also be important.

As renewable energy generation increases, the question of how to integrate fluctuating, distributed power generation while ensuring secure and reliable operation of the grid is paramount. As part of its 10-year network development plan, transmission system operator Türkiye Elektrik İletim Anonim Şirketi (TEİAŞ) plans for about 20 GW solar and wind capacity by 2026 (14 GW wind and 6 GW solar). It anticipates that these sources will cover 11 percent of total output by that year. This likely underestimates the share of renewable energy in the system, considering recent market developments and government announcements; TEİAŞ and other energy planners should prepare for a more rapid change.47

Such changes need not be expensive infrastructure updates. A recent SHURA Energy Transition Center study—based on an hourly power market and network model—found that Turkey could double its planned solar and wind capacity to 40 GW by 2026 with no major changes in its grid operations and transmission grid investments.48 Moreover, up to 60 GW solar and wind capacity could be integrated with an additional investment of 10 percent compared with TEİAŞ’s plans, provided that new renewable energy capacity is placed close to demand centers and where the transmission grid is stronger and system flexibility is improved.49 Recognizing the importance of providing low-cost grid flexibility, the Republic of Turkey Energy Market Authority (EPDK) released a smart grid road map in April 2018, laying out a technological strategy for the energy transition through 2025.50 Turkey’s Ministry of Energy and Natural Resources has also agreed with Electricity of France (EDF) to work on a battery storage to help insulate the grid against variations in its renewable energy production road map.51

Despite these promising developments, several issues require more attention if Turkey is to achieve higher shares of renewable energy generation. Currently, the majority of installed solar PV capacity falls under unlicensed capacity from smaller-scale plants.52 When solar power emerged, the focus was on licensed capacity, but investors have now shifted to unlicensed capacity for technical and economic reasons and, in 2017, to installations with 1 GW capacity.53 However, the regulatory framework should allow small-scale investors to continue investing profitably in new projects.54 Otherwise, it is likely that smaller investors could shift to markets outside of Turkey which potentially benefit from high feed-in tariffs or do not constrain smaller entrants. A second issue is the Energy Market Regulatory Authority’s (EMRA) decision to postpone 2 GW license applications for wind until 2020—this delay in preliminary license applications comes at a crucial time in the competitive development of the field and should be revisited. Questions also remain about how future auctions will be designed—whether average plant sizes will be smaller or even whether smaller-scale parcel-based designs will be preferred. Identifying the locations will also be essential, considering that the SHURA analysis results show that plants are most beneficial to the power system when electricity is generated close to where it is consumed.55

Finally, early 2018 has seen the introduction of two mechanisms that will artificially protect coal- and gas-based capacity even against less expensive renewables: purchase guarantees for generators using domestic coal and a mix of domestic and imported coal; and the capacity market mechanisms to help ensure the security and reliability of the electricity markets through payments.56 Capacity market mechanisms are common in many countries but can lead to high electricity costs for consumers if they are not well-designed, while suppliers can fail to provide the required security if compliance is not monitored. There is little reason to protect or incentivize these legacy systems, especially since alternative instruments exist that can provide the same services to secure supply.57

The need for efficiency and adaptation in end-use sectors

Turkey’s total final energy demand can be broken down between residential and commercial buildings that represent the largest share at around 35 percent, followed by industry with a 28 percent share, and transport with a 26 percent share. The remaining 11 percent is used in other, smaller sectors. Turkey’s energy efficiency improved on average by 1.8 percent per year in the period between 2000 and 2016.58 Buildings, the largest energy-consuming sector, has improved its energy efficiency less than in all other sectors.59

Buildings and industry

Half of all electricity is used in buildings, with much of the remainder used in industry. Buildings are the largest consumer of renewable energy, making up 30 percent of total primary renewable energy supply.60 The majority of this energy, however, is consumed through inefficient traditional combustion techniques—for example, by burning biomass such as wood. Turkey is among the leading countries for solar water heater installations, but technology and infrastructure quality needs to improve significantly, and there is a gap between countries with similar resource availability or advanced policies, such as Austria, China, Cyprus, and Israel.61

A large share of energy is used in buildings and offers untapped potential for other renewables such as direct geothermal and heat pump applications. Furthermore, as variable renewable energy comprises a larger share of generation in the coming years, smart home systems and demand response will be key to providing badly needed grid flexibility. Turkey has gradually improved its energy efficiency policy for buildings, for example, by updating the 2008 regulation regarding buildings’ energy performance in 2013 to provide new energy performance standards for new and renovated buildings.62 Although Turkey still lags behind EU standards, efforts are underway to align with these and other international policy benchmarks. The dramatic urban transformation of Turkey’s major cities offers significant opportunities to invest in energy efficient equipment and building design.

There are thousands of industrial production facilities scattered across Turkey, including several energy-intensive industrial sectors such as iron and steel, cement, ceramics, and glass production. Unlike the building sector, however, the manufacturing sector is defined by the drive for competitiveness. This is essential to the Turkish government’s efforts to escape the middle-income trap.63 Hence efficiency investments usually only take place when payback periods are short—unless government policy incentivizes or pushes a faster transition. Overall, Turkey’s industrial sector offers untapped potential for renewable energy and energy efficiency, but it must contend with the challenge of scattered geography and strong competitive pressures. Industrial plants are spread across Turkey and consume energy at different levels, requiring tailored made solutions to supply low-carbon energy solutions. And Turkish industry faces strong pressure to remain cost-competitive globally, leaving little room for experimentation.64

Transport

Transport is the largest user of all fuels—both fossil and renewables—in Turkey, representing more than 40 percent of all fuel demand, excluding the demand of the electricity sector.65 Oil and its products, as well as a very small share for gas, are predominantly used to cover transport energy demand. Only 500 electric vehicles were in use by the end of 2017 out of a total of 11.5 million vehicles in the country. Hybrid cars have fared slightly better, with more than 4,000 sold by the end of 2017 thanks to tax reduction support and the introduction of newer models.66 The EMRA is also planning to release new licensing guidelines to encourage investments in charging infrastructure in the hopes of incentivizing electric vehicle sales in the coming years.67

Despite these developments, Turkey’s end-use sectors are lagging behind the progress made in the use of renewable energy technologies in the power sector. In addition, energy efficiency improvements in both electricity and heating demand need to be accelerated significantly in order to ensure that Turkey achieves a complete transition of its energy system.

In sum, Turkey’s policy priority is to minimize energy imports by utilizing local resources of energy efficiency, renewable energy, and others with the aim of reducing its current account deficit. As Turkey strives to achieve this, it continues to invest in coal-fired generation despite cost-competitiveness of renewable energy such as wind and solar PV in recent tenders. Turkey’s renewable energy and climate plans are ambitious; however, overlapping strategies and a singular focus on 2023 hold back efforts to outline a long-term vision. Finally, progress in renewable energy electricity generation has not yet been accompanied by large-scale efforts to deploy low-carbon technologies for transport, heating, and cooling.

Lessons from the United States and Germany

The global energy sector has entered a new period of energy transition driven by the progress in technology, markets, and policies. Solar PV costs have declined by 80 percent since 2009, and the trend is continuing; wind turbine costs were halved in the same period, though costs still vary between countries. In 2017, the cost of electricity generation from wind averaged US$0.06 per kWh worldwide. Several solar projects have also been offered at US$0.03 per kWh.68 As a result, the power generation sector has seen substantial renewable energy capacity additions in the past five years.69 For instance, renewables represented nearly 90 percent of new capacity additions in the EU in 2016. Rapid progress has led countries to raise their ambitions for renewable capacity, and the EU has recently agreed on a renewable energy target of 32 percent by 2030.70 India is likely to exceed its 175 GW renewable power target for 2022, set just two years ago. Globally, 167 GW of renewable power were commissioned in 2017, up more than 8 percent from 2016 and far outpacing the 70 GW of net fossil fuel generating capacity added in the same year.71

Fortunately, Turkey confronts the challenges discussed above at a time of rapid change in energy markets and tremendous opportunities for countries committed to reshaping their energy production and consumption. Turkey can draw on several examples of how to drive the transition to a sustainable energy system, particularly because its energy transition is not taking place in a vacuum. There are substantial lessons to be drawn from the experiences of the United States and Germany—two countries that have pioneered different areas of the wider global energy transition and uncovered hurdles of which Turkish policymakers and entrepreneurs should be wary.

The United States

In the United States, the rapid rise of domestic natural gas production and a concerted policy effort—including tax incentives for wind and solar—drove a profound transformation across the energy sector. The rapid progress in the fields of renewable energy and energy efficiency benefited from thorough grid analysis, strong innovation, research, and development; the fields were also subsequently bolstered by developments in electric vehicles and battery storage.72 Together, these technological and market developments drove economic growth alongside emissions reductions and environmental improvements. Indeed, from 2000 to 2014, the U.S. economy grew by 28 percent, while GHG emissions declined by 6 percent.73

The U.S. case also demonstrates the employment benefits that Turkey could realize from embracing renewables and energy efficiency. In the first quarter of 2016, 2.2 million Americans worked in energy efficiency jobs, an increase of 7 percent from the previous year. Solar electric generation accounted for 374,000 employees in 2016, a 24.5 percent increase from the previous year,74 while solar industry employment increased by 20 percent per year from 2015 to 2017.75 More recently, however, policy uncertainty has contributed to the first job losses in the solar industry since 2010.76 Wind power, meanwhile, employed 77,000 workers in 2015 and nearly 102,000 workers in 2016—a 32 percent increase.77

This long-term employment growth is driven in large part by the rapid expansion of both utility-scale and distributed renewable power. Utility-scale solar electric generation expanded 40 times over since 2008—from 0.86 TWh to 36.8 TWh, or from 0.02 percent to 0.9 percent of total generation.78 Costs have declined rapidly as the industry has scaled up, with residential solar PV costs falling from US$0.42 to US$0.18 per kWh of electricity generated, spurring further growth in distributed solar PV installation. In the Los Angeles area, the median generation cost of systems with size less than 20 kW was nearly halved between 2010 and 2016, from US$0.50 to US$0.28 per kWh. Costs of all systems ranged between US$0.1 and US$0.4 per kWh in 2016, with many systems reaching grid parity compared with the average electricity prices of US$0.1 to US$0.25 per kWh.79 Utility-scale solar PV costs fell from US$0.27 to US$0.07 per kWh between 2010 and 2016.

The U.S. Department of Energy helped finance the first five large solar PV plants through loan guarantees.80 This financing mechanism and subsequent due diligence helped prove the technology’s viability at scale and led the private sector to build 45 large solar projects—projects with greater than 100 MW in power. Turkey would benefit from the work done in other countries to demonstrate the success of large-scale clean energy technology. Distributed solar generation has also grown rapidly from 11.2 million megawatt hours (MWh) in 2014 to about 19.5 million MWh in 2016, a 70 percent increase.81 Distributed solar generation has gained significant market share in recent years, with residential and nonresidential rooftop systems driving rapid growth.82

Wind power has also grown rapidly, with generation quadrupling from 55.4 TWh to 226.9 TWh between 2008 and 2016, or 1.3 percent to 5.6 percent of total electricity generation.83 While significant hurdles to expanded wind power remain—related to project finance, transmission access, zoning, and particularly the massive offshore wind potential of the United States—efforts are moving forward at the state level despite a recalcitrant federal government.84

The growth of these renewable sources, energy efficiency, and, most importantly, domestic natural gas has massively reduced the importance of coal in U.S. electricity generation and provided huge environmental benefits. Coal’s share of electricity generation fell from 48 percent of overall supply across all sectors in 2008 to just 30 percent in 2016.85 While it would be unrealistic for Turkey to recreate the U.S. shale boom that drove much of this decline by undercutting coal on price, effective government policy can also play a role.86

More than regulating legacy power production, however, the United States has had success with incentives such as the investment tax credit for solar power and the production tax credit for wind and other renewables. By extending to the nascent renewable energy sector, the favorable tax treatment long-enjoyed by the fossil fuel industry in its exploratory and development phases, the incentives leveled the playing field and helped encourage the scaling-up of renewable investments, which have in turn made new wind and solar projects cost-competitive in many areas.87 Having largely achieved the goal of standing up a competitive wind power industry, the production tax credit is now in the process of being phased out.88

The United States’ strides in energy efficiency, once again prodded by proactive government action, could hold lessons for Turkey. The United States’ most dramatic step was the 2012 emissions and fuel economy standards for cars and light trucks, which required new vehicles to average more than 50 miles per gallon by 2025.89 While the standards are now the subject of prolonged legal disputes, the announcement prompted a meaningful course adjustment from American auto manufacturers, who have already shifted development plans to meet the higher expectations.90 At the state level, California has led the way in driving the adoption of hybrid, electric, and other zero-emission vehicles through sales quotas, tax rebates, and perks that include access to high-occupancy vehicle lanes. The steps have worked. According to The New York Times, there are now 370,000 such cars on the road in California, and electric vehicles comprised nearly 5 percent of the state’s car sales in 2017.91

California’s success in cutting emissions from transport points to a key advantage of the United States—its innovative capacity and emphasis on technological development. The American clean energy market was early in recognizing that renewable energy generation held even greater potential if it could be effectively paired with electric vehicles, seizing an early market leadership role in the space.92 American companies have likewise invested heavily in distributed storage and battery technology, adding behind-the-meter storage capacity to provide backup power and stockpile solar energy from rooftop panels for cloudy periods. These technological developments are often, in part, spurred by federal or state research grants or pilot programs. Pilot microgrid programs in California, Michigan, New York, and Oregon now seek to network these residential and commercial systems to boost the resilience and flexibility for the wider grid.93

Other forms of energy efficiency—for example, in heating, cooling, insulating, and lighting buildings—have also played a major role in reducing U.S. emissions and forming new markets. The use of light-emitting diode (LED) light bulbs has taken off in the past decade, from just 400,000 installed nationwide in 2009 to more than 400 million installed in 2016; each LED bulb uses about 75 percent less energy than a conventional incandescent bulb.94 Efficiency improvements brought meaningful declines in energy intensity by end use per floor area in U.S. residences between 2000 and 2015, with the biggest efficiency gains made in space heating, lighting, and water heating.95 Similar to electricity generation, embracing energy efficiency has been a job creator for the United States. For example, one-fifth of the 6.5 million construction workers in the United States work to support the installation of energy-efficient technologies.96

While the private sector has usually taken the lead in scaling these technological developments, it has had help and direction from the federal government. Public investment from the U.S. Department of Energy through universities and national laboratories has been crucial to driving basic and applied research; the department increased its annual spending on renewable energy research and development from US$1.2 billion to US$2.1 billion a year from 2008 to 2016. Research and development for solar and wind increased from US$215 million to US$337 million over the same period, with spending on research into energy efficiency in vehicles, buildings, and manufacturing rising from US$379 million to US$739 million.97

Germany

Germany has engineered a profound transformation of its energy markets through a long-term process of policy interventions, market design, and citizen participation. This profound transformation has been labeled the so-called Energiewende.

The Energiewende offers an example of how to transition an energy system steadily through long-term planning and policy stability. In 2017, renewable electricity generation hit a new record high at 218 TWh—up from 38 TWh in 2000.98 This increase was due to the rapid expansion of wind farms and solar PV in the past 15 years. Renewables now cover 36 percent of the country’s total electricity demand—an impressive achievement in the world’s fourth-largest economy. This expansion continues to successfully drive a large manufacturing industry sector—and is more than what was achieved in other large renewable energy-producing countries.99

Germany’s power system operators have been able to integrate more than 22 percent of fluctuating solar and wind generation while maintaining security of supply at world-record levels.100 They achieved this through a combination of high-quality grid infrastructure and strong interconnections with neighboring countries, more flexible thermal power plants, and a pioneering approach to develop specific grid code requirements for variable renewable energy units. In view of Germany’s ambitions to increase this share further, its energy policy now focuses on enabling flexibility measures such as smart grids and metering—combining electricity, heating, and transport sectors locally—and continuing to improve cross-border exchange and balancing of supply and demand.101

The example of Germany—not to mention Denmark, another pioneering country when it comes to wind power integration102—underlines the critical role governments play in creating the secure, long-term policy frameworks necessary for the private sector and civil society to engage productively.

Since the 1990s, the expansion of renewable energy in Germany has been promoted with various regulatory tools—most notably the Renewable Energy Act (EEG) introduced in 2000. The EEG guarantees reliable investment conditions to producers of renewable electricity. Over the years, EEG has been continuously modified, with each new set of rules stimulating innovation to speed up technological development and cost digression as well as to improve the integration of electricity from renewables into grid and market.103 With new EEG rules, the mid- and long-term targets have been raised, most recently to cover 65 percent of power demand by 2030.104

Over this same period of time, a national consensus around both energy efficiency and renewable energy was built based on the philosophy of enabling small and medium enterprises (SMEs) and citizens to take ownership of the energy transition. The feed-in tariffs for renewable producers large and small have driven investment, with more than 1.5 million solar installations and 30,000 wind turbines operating country-wide, many of them solar PV rooftop installations or wind farms developed and owned by local cooperatives.105

This reliable policy framework, which focused on stripping off-take risks from investors by guaranteeing grid connection, priority grid access, and feed-in premiums, has been instrumental in reducing the cost of wind and solar power by between 50 percent and 90 percent in just a decade. The cost is now as low as US$0.04–US$0.05 per kWh, and today, wind and solar are the cheapest choices for new electricity generation.106

The Energiewende has driven an investment program, encouraging growth and innovation in new low-carbon sectors—such as renewable energy, energy efficiency, new energy services, and alternative transportation. Total investment in renewable energy across all sectors from 2000 to 2015 was €235 billion, corresponding to an annual average of €16 billion.107 These investments have contributed to Germany’s competitiveness in low-carbon technologies while also supporting economic growth. The Energiewende has also had an important impact on the employment structure of the energy sector. In 2017, the renewable industry alone accounted for approximately 332,000 jobs—twice as many as in 2004.108

As for its positive outcomes, the challenges of the Energiewende are equally helpful for Turkey in formulating its renewable energy policies. These include the relatively high cost burden of inflexible feed-in tariffs on consumers in the past; the shortcomings of CO2 pricing policies, an issue that was present in other EU countries; insufficient grid capacity to transmit wind produced in the north to the consumers in the south; and the difficulties in implementing renewables and energy efficiency measures in sectors outside of electricity generation such as transport and buildings.

The feed-in tariffs, which are financed through consumer electrical bills, have put an extra burden on households. Electricity bills in Germany are almost twice as high as those in France and 40 percent higher than the EU average.109 Germany began developing renewables when they were still more expensive than their conventional counterpart. More importantly, tariffs were not adjusted quickly enough when costs decreased, allowing investors to build GW-size solar generation at high feed-in tariffs, creating windfall profits. Meanwhile, wholesale electricity prices for the manufacturing industry are among the lowest in the EU due to exemptions for certain industries. After years of increases, electricity prices for German households have been relatively stable since 2013. The underlying reason for this is that new renewable power plants have costs comparable to those of new conventional power plants, and power purchase agreements for renewables follow real costs more closely.110

The rapid transformation of the sector has also brought major transmission and distribution integration challenges, scrambling the traditional grid designed to carry power from large stations to industries and consumers. This change was boosted by hundreds of thousands of small so-called prosumers emerging in the market that both consume and feed electricity into grid.111 Updating the system to cope with these new dynamics requires investment in smart meters and local substations as well as better grid management software—a challenge that Turkey should anticipate and for which it should plan.112 Germany also has far more favorable wind energy conditions in the north and that is the region in which renewable generation has grown the fastest. The challenge of strengthening transmission capacities from the north to centers of industry and population in the west and south has tested the political and technical capacity of German federal and state governments, as transmission system operators faced resistance from local communities in densely populated central Germany.113 Ensuring that build-ups of renewables and grid capacity are coordinated well is a key issue.

The rapid transformation of Germany’s electricity generation sector has moved beyond its strides in other fields as well. With uneven distribution of taxes, surcharges, and levies, emissions from transportation have increased with a growing economy.114 Moving forward, the new governing coalition has committed to phasing out coal power and meeting emissions reduction goals in line with the Paris climate agreement, which was ratified by Germany in 2016.115 It has also pledged action on the transport and heating sectors.116 In this next phase of the energy transition, therefore, attention is to be focused on integrating sectoral policies to develop a consistent strategy to decarbonize the power, transport, and heating sectors efficiently and to overcome the mismatch of sectoral incentives currently in place.117

The United States and Germany offer useful lessons for Turkey as it continues its energy transition. The American and German examples highlight the importance of grid planning and flexibility; the need for government incentives and direct investments in research and development, technology, and pilot programs; the predictable and in many ways positive challenges brought by rapid growth of distributed generation; and the crucial importance of improving energy efficiency and the use of renewables in sectors beyond the power sector.

Conclusion: Next steps in Turkey’s energy transition

Turkey has joined the global trend to transition its energy system. Wind is already competitive, and new solar PV plants are nearing cost parity with fossil fuel generation. Turkey has seen promising recent developments in the two pillars of overall energy transition: energy efficiency and renewable energy production. Further development of secure, affordable, and sustainable energy supplies in Turkey will require action across the energy sector—including in the fields of technology, policy, finance, and business. Experiences from across the globe can help Turkey accelerate its progress and close the gap to become a leading player in the global energy transition.

The following five suggestions deserve the consideration of Turkey’s policymakers, investors, technology developers, financiers, and other stakeholders.

Set long-term goals for the energy transition

Credible and attainable long-term energy and climate goals—and the development of strategies to support those goals—have been essential to many countries’ successful energy transitions. These goals help create a predictable and favorable policy environment for investors. As Turkey pursues its 2023 targets, it should start by defining its post-2023 objectives and working backwards to set achievable milestones, as it will take years to formulate the supporting policies and mechanisms.

Plan for power system transformation

As solar and wind power add larger shares to Turkey’s electricity mix, grid management and planning will become more important than ever. Demand is clustered mainly in the west, so balancing variable generation from different sources across Turkey will be challenging. Ensuring the flexibility of the system and building a system that takes resource availability, demand patterns, and grid infrastructure into account will be key to meeting this challenge. SHURA’s recently released grid integration study offers concrete steps to help achieve these goals.

Combine the benefits of large- and small-scale investments

The share of distributed generation is growing in all countries. Distributed generation brings multiple benefits to the system when electricity is consumed where it is produced, such as better load management and system reliability, improved power quality, and decreased need for costly grid investments. Distributed assets also help diversify ownership and create opportunities for local actors to participate in the market. Utility-scale power plants, meanwhile, bring benefits from economies of scale. By smartly combining distributed and utility generation in its new policy mechanisms, Turkey can enjoy the benefits of both approaches as it enlarges its renewable energy markets.

Drive innovation in technology and enabling systems

Renewable costs have declined significantly in recent decades due in large part to technologies and strategies to integrate renewables into the energy system.118 This technological innovation has played a key role in early stages of the global energy transition and will continue to be essential to improving the efficiency of existing technologies, further driving down costs, and developing breakthroughs such as digitalization and energy storage. Turkey stands to benefit tremendously if it can develop a strong technology base that favors local development. Doing so, however, will require the cooperation of both the public and private sectors. And this innovation, research, and development cannot be limited to the technical side. It will also need to expand across financing, market design, and business models as Turkey’s energy transition enters its next stages.

Utilize the potential of renewables and energy efficiency in the transport, heating, and cooling sectors

A comprehensive transition of the energy system will require the deployment of both energy efficiency and renewable energy technologies across all sectors of the energy system. This includes the power sector and those sectors consuming energy—namely transport, production of bulk materials such as steel and cement, and buildings. In this regard, Turkey’s recently released NEEAP is an important step forward. Efforts should go beyond the current plans, however, while also meeting Turkey’s rapidly growing energy demand in a secure, affordable, and sustainable way.

About the authors

Deger Saygin is the director of the SHURA Energy Transition Center in Istanbul, Turkey. He has previously worked at the International Renewable Energy Agency (IRENA), where he developed and led the global renewable energy road map program from 2013 to 2017. Prior to joining IRENA, Deger was a researcher at Utrecht University focusing on sustainable energy and manufacturing projects for intergovernmental organizations, governments, and the private sector. He received his Ph.D. from Utrecht University and his undergraduate degree in environmental engineering from the Middle East Technical University in Ankara, Turkey.

Max Hoffman is the associate director for National Security and International Policy at the Center for American Progress, focusing on Turkey and the Kurdish regions; U.S. defense policy; and the intersection of climate change, human migration, and security concerns. Hoffman previously worked on disarmament and security issues for the United Nations and the U.S. House of Representatives Armed Services Committee. Hoffman received his M.A. in history from the University of Edinburgh in Scotland.

Philipp Godron is a senior associate for Global Energy Transition at the Agora Energiewende, where he is responsible for international energy policies, seeking to provide lessons learned to outside stakeholders from Germany’s energy transition. Before joining Agora, Philipp worked for Desertec Industrial Initiative, advised the government of Jordan on incentivizing renewables development, and worked for the German utility E.ON. Philipp has a master’s degree in European studies from Humboldt University in Berlin and studied political sciences, history, and philosophy in Cologne, Germany, and Bologna, Italy.

Acknowledgments

The authors would like to thank their colleagues who took the time to review draft versions of this report and provide feedback and significant improvements, including Selahattin Hakman and Ceren Ayas, both members of the SHURA Steering Committee, as well as Gwynne Taraska, formerly of the Center for American Progress, and Alison Cassady and Luke Bassett of CAP. The authors would also like to thank United Minds for Progress for its generous support of this research.