Dealing with banks is becoming ever more complicated for customers. Banks already have the upper hand in dealing with their customers because the hassle factor of switching accounts often keeps customers locked in at their bank even when the bank hikes fees or provides inadequate service. Banks tip the scale in their favor even further when they rely on confusing fees and other noninterest charges, such as overdraft and low-balance fees, for their income.

This complexity gives banks power in dealing with their customers, who are often not fully aware of the impact these fees and charges have on their finances. Only the newly created Consumer Financial Protection Bureau, or CFPB, will be able to balance the scale and give customers much needed financial protections in dealing with banks, but Senate Republicans have stalled the confirmation of the CFPB’s designated director, former Ohio Attorney General Richard Cordray, thus limiting the CFPB’s effectiveness.

The CFPB makes sure that somebody is watching out for consumers. This is a substantial improvement over the previous approach of playing “whack-a-mole” with bank fees, whereby Congress outlaws one type of bad practice just to see another, similar one pop up under a different name.

The CFPB will provide consumers with more power in dealing with banks through a number of channels. It will help improve the financial information that consumers receive, such as by increasing the clarity of information on mortgage interest rates and bank fees; enforcing existing disclosure rules on interest rates, fees, and other bank charges; and policing antidiscrimination rules. More and better information will empower consumers to make more informed decisions, and the enforcement of existing rules and laws and supervision of new products and financial institutions will ensure consumers get a fair shake when dealing with powerful banks.

Banks have become accustomed to living more and more on fees and noninterest charges and less and less on interest earnings from their traditional business of making loans. Fees are not automatically harmful to consumers but fees and charges come in many different varieties, often under different names, making it hard for customers to know what the financial impact of fees and charges on their finances is and to comparison shop between banks that charge different fees for different services. The growth of fees and charges highlights the growing challenge for consumers when dealing with banks and highlights the need for greater transparency and consumer protection offered through the CFPB. Just look at the numbers.

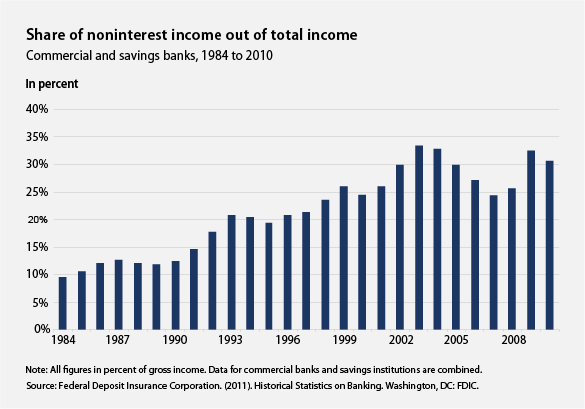

Data from the Federal Deposit Insurance Corporation show that the share of income of commercial banks and savings institutions that they earned from fees rose to a record high of 33.4 percent in 2003 from 9.6 percent in 1984,[1] with the fee share of bank income bouncing between 24.3 percent and 32.8 percent since then. (see Figure 1) The rest of bank income comes from interest income—money made on loans to consumers and businesses. The share of interest income out of total bank income consequently trended downward over the past 28 years as noninterest income from fees and other charges has trended upward.

The data also show that banks put greater emphasis on noninterest income after experiencing declines in their net income—income minus expenses—in a crisis and a recession. Bank net income fell from 1985 to 1989, for instance,[2] sparking banks to quickly increase the share of total noninterest income from 11.8 percent in 1989 to 26 percent in 1999—even as total net income and overall (gross) income rose again.[3]

Then, bank net income fell again in 2000, and the share of gross income from fees and other charges rose from 24.4 percent in 2000 to 27.2 percent in 2006, before net bank income started to decline again. Bank net income fell to its most recent low point in 2009. But banks started to increase the share of noninterest income amid the decline in net income, starting in 2007. The share of noninterest income rose from 24.3 percent in 2007 to a high of 32.5 percent in 2009. As bank net income turned from a negative $10.6 billion in 2009, its first negative net income since 1987, to a plus of $87.5 billion, the share of noninterest income—fees and other charges— remained high at 30.6 percent.

In short, fees and other noninterest charges played a substantial role in the recovery of bank incomes after the Great Recession.

It is worth pointing out that the growth of the share of noninterest income out of total bank income results from banks finding new ways to charge fees to consumers and not because banks no longer make money on their loans. Total interest income grew by an inflation-adjusted 14 percent between 1984, the first year of available data, and 2007, the last year before the financial crisis—even though interest rates fell sharply in this period. And net interest income of interest expenses rose by an inflation-adjusted 110.4 percent over this same period, suggesting that banks still know how to make money on their loans.[4]

But the business of charging fees to their customers is a lot more lucrative. Inflation-adjusted noninterest income rose by 246.1 percent from 1984 to 2007. And these comparisons do not depend on the dates chosen for comparison, suggesting that the growth of noninterest income is not only a deliberate business choice by banks but also a long-term, sustained trend.

Bank income from fees and other charges will likely continue to stay high and possibly increase. Banks continue to feel the fallout of the 2007-2008 financial crisis and the Great Recession. Mortgage delinquencies and foreclosures, for instance, remain near record highs with one in eight mortgages either delinquent or in foreclosure in the second quarter of 2011,[5] and many of these bad loans are not yet fully written off by banks. And credit card default rates, albeit down from their record highs of last year, remain large by historical standards, with 5.6 percent of all credit card debt being written off the books of banks in the second quarter of 2011.[6]

U.S. banks may face further losses from their exposure to European financial institutions and companies that are undergoing their own debt crisis.[7] But these additional costs of banking go along with the potential for lower revenue opportunities in banks’ traditional credit markets, as interest rates have been declining for most of 2011. Mortgage interest rates averaged 4.7 percent in 2010 but have fallen to less than 4.3 percent in the past three months, from August to October 2011.[8] Banks may still generate higher net interest income—the difference between loan interest earned and deposit interest paid—but banks are already paying close to zero on their customers’ deposits, leaving little room for net interest income to grow. The combination of comparatively high actual and potential losses and low interest rates will send banks looking for alternative sources of income, mainly in the form of fees and other charges.

The search for new revenue will only be limited by banks’ creativity and customers’ willingness to pay for more charges, many of which will be obscured. This process is inherently skewed in favor of large banks, which have the incentive and resources to find new ways to retain more of their customers’ money, and against customers with small savings accounts and large credit needs. Congress created the CFPB under the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 exactly because middle-class customers need some way to balance the scale in the financial world in their favor.[9]

Sadly, Senate Republicans’ unwillingness to allow the confirmation of the designated director to move forward helps maintain an unhealthy power balance in financial markets at a time when banks are poised to find new ways to derive additional revenue from their customers’ money.

Christian E. Weller is a Senior Fellow at the Center for American Progress and associate professor at the Department of Public Policy and Public Affairs, University of Massachusetts Boston.

Endnotes

[1] The de-composition reports shares of gross income—not adjusting for expenses—to highlight changes in the sources of bank income, rather than shares of net income, which can be heavily influenced by short-term changes in different expenses.

[2] Drops of net income—income minus expenses—reflect economic crises and recessions. The discussion thus uses changes in net income as a marker for large-scale economic changes but discusses the changing composition in gross income shares after a crisis to highlight compositional changes in the sources of bank incomes.

[3] Gross income fell through 1993. Banks maintained a high share of noninterest income out of total income, even as gross income rose again after 1993. This suggests that the change in the composition of bank income was a deliberate bank policy change and not just a result of falling interest income in the wake of lower interest rates. Author’s calculations based on Federal Deposit Insurance Corporation, “Historical Statistics on Banking” (2011).

[4] Data are inflation adjusted using a gross domestic product deflator from: Bureau of Economic Analysis, “National Income and Product Accounts” (2011).

[5] Data from the Mortgage Bankers Association, “National Delinquency Survey” (2011).

[6] Data from the Board of Governors, Federal Reserve, “Charge-off and Delinquency Rates of Loans and Leases at Commercial Banks” (2011).

[7] For details on the link between the U.S. economy and the European debt crisis, see: Sabina Dewan and Christian Weller, “When Europe’s Sovereign Debt Crisis Hits Home: How the European Crisis Will Affect the United States” (Washington: Center for American Progress, 2011), available at http://americanprogress.org/issues/2011/09/europe_debt.html.

[8] Data from the Board of Governors, Federal Reserve, “Release H.15 Selected Interest Rates” (2011).

[9] The idea for such a consumer protection agency goes back to an idea by Harvard Law School professor Elizabeth Warren, who was also charged with building up the infrastructure for the new CFPB before returning to Cambridge in the fall of 2011. See: Elizabeth Warren, “Unsafe at Any Rate," Democracy: A Journal of Ideas (5) (2007): 8–19.