“Countries like China and Germany are going all in in the race for clean energy. I believe Americans build things better than anybody else. I want America to win that race, but we can’t win it if we’re not in it.”

—President Barack Obama

Georgetown University

June 25, 2013

The United States has long been a top destination for clean energy investment, which has helped it to capture many of the near-term economic, energy security, and environmental benefits that stem from expanded domestic clean energy generation. Since 2004, in fact, clean energy investment in the United States increased nearly 250 percent and reached $36.7 billion in 2013.

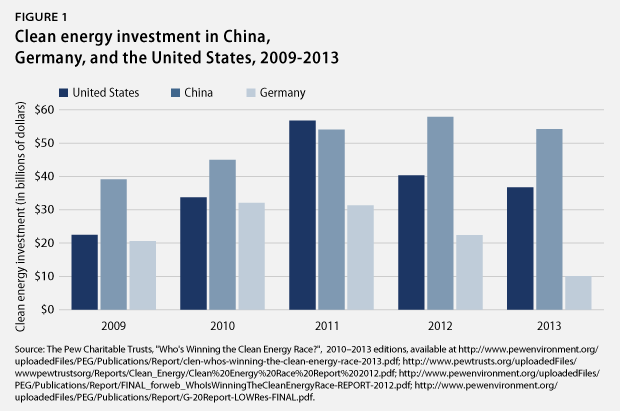

However, America will need to do more to continue to compete successfully in the burgeoning clean energy economy. After leading the global clean energy investment race until 2008, the United States has fallen behind China in four of the past five years.

The countries that lead in clean energy investment can increase clean energy manufacturing capacity; secure greater global market share for their clean energy products; create jobs at home; and help build strong economies fueled by energy and technologies that hedge against energy price volatility and future carbon pricing. To maintain its competitiveness, the United States will need to take bold new steps that build on what has been accomplished over the past five years and fill the voids left by the winding down of many of the important clean energy and energy-efficiency programs and investments made through the American Recovery and Reinvestment Act of 2009, or ARRA.

Filling those voids, however, will be challenging. The ARRA enabled investors to finance clean energy projects during a time of capital scarcity and to keep our clean energy sector competitive during a global recession. It did this by providing more than $90 billion in clean energy investments through loans and loan guarantees to capital-intensive projects, tax credits to lower project costs for companies, upfront grants to help businesses that are unable to benefit from tax credits get started, and more. Thanks to these and other federal- and state-level investments and policies over the past five years, the U.S. clean energy sector has emerged as a powerful economic force that can drive innovation, create jobs, and expand manufacturing.

In 2013, for example, the United States added more than 4.7 gigawatts of solar photovoltaic capacity, which was a 41 percent increase over 2012 installations and nearly 10 times the capacity added in 2009. During that same time frame, cumulative wind capacity in the United States has gone up 74 percent and despite limited deployment in 2013, it still saw more than 12 gigawatts of capacity under construction at the end of the year. In the past five years, wind and solar power use has more than doubled; they are now 4.4 percent of the U.S. electricity generation mix combined, up from just 1.9 percent in 2009. U.S. wind turbine manufacturing has also expanded, with domestic manufacturers supplying nearly 70 percent of the value of U.S.-deployed turbines compared to less than 25 percent prior to 2005.

Other nations have also redoubled their commitments to developing their clean energy sector through clean energy targets and programs over the past few years. In fact, 102 other countries currently have national renewable energy standards.

One of the global clean energy leaders, Germany, has created a world-class solar market by incentivizing deployment through feed-in tariffs, which are payments to clean energy generators to offset the difference in costs between renewable and conventional energy generation. China, the current leader in clean energy investment, has claimed this title through a set of ambitious goals to scale up domestic investment in clean energy. Both countries understand the importance of the race for clean energy investments and the opportunities that come with an attractive clean energy market. Since 2009, China has attracted $60.3 billion more in clean energy investments than the United States, amassing a cumulative total of $250.3 billion over the five-year period. (see Figure 1)

On one level, the growth of clean energy markets—whether in China or elsewhere—is a good thing, and we should welcome the fact that countries around the world are ramping up their efforts in this industry. But it also means that the United States must enhance its competitiveness and attractiveness as a place to invest in clean energy or risk losing its share of the growing clean energy market. Unfortunately, Congress has thus far failed to pass many of the laws needed to allow the United States to take full advantage of this growing market. Therefore, we propose action and leadership by the Obama administration that will help to drive continued investment in the clean energy sector. Specifically, we recommend the following:

- Use forthcoming power plant standards to drive clean energy investment.

- Attract foreign direct investment, or FDI, in new projects in the clean energy sector.

- Expand the use of existing financial instruments.

- Increase clean energy worker-training programs.

Use forthcoming power plant standards to drive clean energy investment

The Obama administration should create a stable, predictable regulatory framework that provides incentives for states to maximize clean energy and energy-efficiency deployment. By June 1, 2014, the Environmental Protection Agency, or EPA, is expected to propose standards for existing power plants with the finalization of those standards slated for June 1, 2015. States will then have until June 1, 2016, to submit their state implementation plans to the EPA to demonstrate how they will meet the new standards. When fully implemented, these standards, if properly designed, could stimulate significant clean energy deployment and investment. The EPA should allow states to use existing programs, such as clean energy targets and interstate or other carbon trading schemes, to meet the standards for existing sources through a systems-based emissions reduction approach, rather than just reducing emissions at each power plant. This will give states the flexibility to determine the most cost-effective methods to meet the new requirements while spurring clean energy demand and investment.

Attract FDI in new projects in the clean energy sector

Maximizing foreign direct investment provides an important and insufficiently tapped opportunity for increasing clean energy investment in the United States. By attracting greater foreign investment in new, or so-called “greenfield,” clean energy businesses, projects, and manufacturing facilities, the United States will accelerate clean energy deployment and overall investment. FDI is little discussed in the clean energy context, aside from the occasional news about a clean tech company being acquired by a foreign company. Yet America leads the world in overall inward FDI with foreign investments in U.S. markets totaling more than $1.5 trillion since 2006. The United States is developing the necessary tools to attract even greater amounts of FDI, but more targeted efforts will be required to increase clean energy investments, especially in greenfield projects. An estimated 20 percent of inward FDI goes currently toward greenfield investments, while 50 percent to 60 percent of FDI in China supports greenfield projects and investments. To drive FDI in greenfield clean energy projects, the Obama administration should take the following steps.

Create a clean energy investment track

The Department of Commerce should create a clean energy investment track within the SelectUSA program that would highlight greenfield clean energy projects and financing opportunities. Currently, investors have to navigate federal, state, and local government incentives, regulations, and potential locations to determine the best places and opportunities for investment in the United States. Partly to address this stumbling block to investment, President Barack Obama established the SelectUSA initiative in 2011, a federal program designed to attract investment in U.S. businesses from both domestic and foreign firms. With new databases that capture the widespread opportunities in solar, wind, and other clean energy technologies, as well as the national, state, and local incentives, SelectUSA could become the go-to source for investors interested in clean energy and help to streamline the investment process.

Housed within the U.S. Department of Commerce, SelectUSA can become an important resource for foreign and domestic investors with the proper funding. SelectUSA should tailor its work to ensure that the myriad of investment opportunities in the clean energy sector are showcased.

Congress appropriated $7 million for SelectUSA for fiscal year 2014, about a third of what the administration requested to carry out its mission. In the 2015 appropriations bill, Congress should fund the program at its requested level to give it the resources it needs to develop effective tools to attract investors. If adequately funded, the SelectUSA program would be able to more effectively act as the first point of contact for prospective investors, build comprehensive databases on investment opportunities and incentives available in the United States, and work with state and local economic development organizations across the nation to help them compete for foreign investment.

Train American officials in the Commercial Service to attract clean energy investment

The Department of Commerce should increase the training that Foreign Service officers in the U.S. Commercial Service receive to promote clean energy investment. Foreign Service officers, or FSOs, in the Commercial Service are stationed overseas in order to encourage the export of U.S. goods and services, as well as to attract foreign investment to the United States. However, exports have historically taken priority over inward FDI within the Commercial Service. Going forward, the Department of Commerce should increase training to ensure that FSOs have the capacity to encourage foreign companies to invest in the U.S. clean energy sector.

With U.S. embassies and consulates in more than 75 countries, the ability of FSOs to attract clean energy investment in the United States is significant. FSOs should urge foreign firms to establish operations in the United States not only as a way to reach the American consumer base, but also as an opportunity to export their clean energy goods or services to growing markets in Latin America and Canada. By developing manufacturing centers in the United States, foreign companies could limit the substantial shipping costs associated with exporting goods to North and South America from overseas markets.

Form a presidential Investment Advisory Council

President Obama should form an Investment Advisory Council, or IAC, to advise him and future presidents on strategies to attract investment in domestic industries. The IAC must have a strong clean energy investment component and bring together experts who can identify best practices, propose new approaches, and make sound recommendations. Importantly, the council should seek to engage foreign investors to get their perspective on the opportunities and obstacles of doing business in the United States—a view that is too often inadequately understood.

Build strong relationships with foreign investors

The Obama administration should develop a stronger and more transparent relationship with targeted foreign investors interested in the American clean energy market. China, for instance, has become a leader in global renewable energy investments, specifically in solar and wind energy markets. In fact, China has been increasing its overseas investments in renewable energy, investing in at least 124 projects cumulatively worth at least $37.5 billion in 33 countries over the past 10 years. As recommended by CAP Senior Policy Analyst Melanie Hart in a recent report, “Increasing Opportunities for Chinese Direct Investment in U.S. Clean Energy,” the United States should work to identify projects that carry little risk of triggering national security reviews, which have impeded Chinese foreign investment in the United States in the past.

Expand the use of existing financial instruments

The United States needs to ensure that it offers the appropriate financial instruments to capture every possible source of capital. To that end, the Obama administration should work to expand the use of existing financial instruments through the following actions.

High-level financing task force

The Departments of Commerce and Treasury should create a high-level task force to promote awareness and the utilization of promising financing mechanisms, such as securitization and investment yield vehicles, called yield cos, to the renewable industry and investors to ensure that these tools are fully utilized. Further, this task force would be charged with developing and making available additional appropriate new financing tools.

Within the past few years, there have been important developments in clean energy financing. Financial tools new to the clean energy sector have started cropping up around the country and are changing the way clean energy is financed. However, some of these new financing mechanisms are not available everywhere, and some have not yet reached all potential investors. These tools include securitization and investment yield vehicles. As the clean energy technologies mature, it is critical that these emerging clean energy-financing options grow to reach more investors.

Securitization and investment yield vehicles are financial instruments that are just starting to be used for clean energy technologies and hold enormous potential within the industry. Securitization is the long-used financial practice of pooling debt and issuing tradable securities to investors. In November 2013, solar leasing company SolarCity completed the solar industry’s first securitization by pooling solar contracts from more than 5,000 residential and commercial solar installations, selling $54 million in bundled cash payments. New research from the Michigan Technological University found that securitization can be an important tool to make project financing for solar photovoltaic technology more affordable.

Yield cos are corporate investment structures that are created by bundling together operating projects with stable, reliable cash flows that are then offered as shares to the general public that are low risk and earn high rates of return. In 2013, NRG Energy launched its NRG Yield, a yield co with a 1.3-gigawatt portfolio of energy generation assets, which included solar and wind resources, as well as natural gas. Clean energy investors are starting to take note of the promise of yield cos. SunEdison, for example, is a leading solar technology manufacturer that recently launched its own yield co, and the SunPower Corporation, a maker of photovoltaic cells and solar panels, just started exploring the option as well.

To further promote both securitization and yield cos, the Departments of Commerce and Treasury should create a task force of investors, clean energy finance experts, and leaders in the clean energy sector to determine any additional actions that could be taken to facilitate utilization of these financial instruments, as well as to develop or make available new ones. For instance, the task force could consider developing a database that would provide information on investment opportunities in the clean energy sector to investors.

Another financial instrument that would help to unlock investment are clean energy bonds, which are bonds issued by public entities to finance clean energy projects. Under the Energy Policy Act of 2005, the federal government established Clean Renewable Energy Bonds, or CREBs, that electric cooperatives, states, cities, and other public entities used. However, the federal government is no longer accepting applications for CREB funding since no funds have been allocated for the program since 2008.

Real estate investment trusts

The Obama administration should request that the Internal Revenue Service issue a revenue ruling to allow real estate investment trusts to invest in clean energy assets. Real estate investment trusts, or REITs, are widely used in the real estate and fossil energy industries but are not currently available to the clean energy sector. A REIT is an investment portfolio that real estate companies use to bundle together income-producing real estate assets, including properties and mortgages, and sell shares off to investors similar to a stock on the major exchanges.

REITs are appealing to investors because they offer single taxation of profits, rather than being subject to both corporate and income taxes, which reduces the cost of raising capital. Currently, offering clean energy REITs requires an IRS ruling on a case-by-case basis. In 2013, clean energy financier Hannon Armstrong Sustainable Infrastructure secured a private letter ruling from the IRS on its request to form a REIT with its clean energy assets—the first favorable ruling for these types of assets. However, approval for other clean energy REITs is not a guarantee since the sources of income associated with clean energy projects function according to the energy demands of a property rather than the properties themselves.

Expand clean energy worker-training programs

In order to meet the skills gap of the emerging clean energy economy, the United States must expand worker-training programs for clean energy employment. According to a national survey of the energy industry conducted in 2013, 60 percent of energy professionals reported that there would be a shortage of qualified workers in the clean energy field within the next five years. To continue to monitor the needs of the industry and help to develop a stronger workforce, the Obama administration should do the following.

Create targeted business survey

The Bureau of Labor Statistics, or BLS, should initiate a targeted business survey to improve understanding of the current and future labor needs of the clean energy industry. The federal government can also play a role in identifying current and future employment needs within the clean energy sector. BLS conducted a survey, which included clean energy jobs, based on a sample of 120,000 business establishments to determine the number of jobs related to the production of green goods and services in 2010 and 2011. The survey is no longer being conducted, due to funding constraints, but the BLS should initiate a new survey that captures the current and future labor needs of the clean energy industry to make sure that American businesses can find the workers they need to compete in this sector of the economy. The BLS should prioritize funding for a new clean energy survey, which would be extremely valuable in determining the workforce training needed to transition to a clean energy economy.

Convene stakeholder meetings

The Department of Labor should convene stakeholder meetings in key regions of the United States to help expand the development of clean energy workforce training programs. In addition to providing funding and informational resources, the federal government can help bring together stakeholders in key regions of the country to ensure the successful development and implementation of clean energy worker-training programs. Coordinated efforts among stakeholders within a state or region can add to the effectiveness of clean energy workforce training through the standardization of curricula, identification of gaps in training across the region, and private sector participation and funding. Depending on the region, these stakeholders can include community colleges, workforce investment boards, labor unions, employers, state energy offices, and nonprofit and community-based organizations. These stakeholders should consider labor needs in their regions and design programs to train new workers, Armed Services veterans, and those individuals switching careers. The Department of Labor should act as a convener to bring these stakeholders together in regions across the country to facilitate the expansion of the clean energy workforce in the United States.

Conclusion

The United States is still a global leader in clean energy investment, but over the past five years, other countries have started to increase their market share, with China overtaking the lead in annual clean energy investment in four out of the past five years. Congress, meanwhile, is not doing all that it should to help keep America competitive. Faced with this challenge, the Obama administration should seek to deploy all of the tools as its disposal to help the United States to capture the full benefits of the emerging clean energy economy for decades to come.

Pete Ogden is a Senior Fellow and the Director of International Energy and Climate Policy at the Center for American Progress. Mari Hernandez is a Research Associate at the Center. Ben Bovarnick is a Special Assistant at the Center.