If you wanted to design a budget plan that would help accelerate the economic recovery, promote job creation, lay the foundations for future growth, and set federal finances on a sustainable course for the foreseeable future, what would it look like? First and foremost, you’d probably want to make sure not to do anything that would actually hamper the economy—or in medical parlance: First, do no harm. So that should rule out immediate massive cuts. Second, you’d want to protect—and probably even enhance—critical investments in things such as infrastructure, science, and education. Third, you’d want to pursue modest, responsible changes in future fiscal policies so that the national debt doesn’t rise faster than economic growth. And you’d certainly want to accomplish the latter without unduly burdening the middle class—and without making it harder for people in poverty to reach the middle class.

In other words, if you wanted to design a pro-growth budget, it would look absolutely nothing like the budget that was released earlier this week by Rep. Paul Ryan (R-WI). It might, however, look much more akin to the one released yesterday by Sen. Patty Murray (D-WA).

Sen. Murray’s budget has a lot to recommend it when it comes to growth and fiscal responsibility, taking a nearly opposite approach to the one taken by Rep. Ryan’s on essentially every key economic question. Whereas the Ryan budget includes more than $500 billion in spending cuts over the next two years, Sen. Murray’s budget repeals the sequester and delays all of its proposed spending cuts until 2015. At a moment when the economy finally seems to be on the verge of a robust recovery—with unemployment at its lowest level in four years, new jobless claims down to their lowest levels in five years, and housing and consumer spending all appearing to growing at a healthy clip—it would be pure folly to drop the anchor by cutting back enormously on government consumption and investment.

In addition to making rapid and immediate cuts that are sure to hamper the recovery right away, the Ryan budget also includes absolutely enormous cuts to long-term investments in our economic future in areas such as education, infrastructure, and scientific research. The Murray budget, on the other hand, understands that cuts in these areas are going to be counterproductive, reducing growth, reducing jobs, and therefore making it difficult—if not impossible—to improve our fiscal situation over the long run. Instead of making enormous cuts in productive economic investments, the Murray budget protects these areas and even includes room for a $100 billion boost in the near term. In education, for example, the Murray budget allocates approximately $200 billion more over the 10-year period than does the Ryan budget, including boosted investments in early childhood education. Sen. Murray allocates about $150 billion more than Rep. Ryan to transportation infrastructure. And scientific research receives about $20 billion more in Sen. Murray’s budget. Although these areas deserve significantly more attention and resources than this, relative to Rep. Ryan’s, Sen. Murray’s budget is much more likely to produce faster growth, more jobs, and therefore more deficit reduction.

But even without accounting for the relative effects on economic growth, Sen. Murray’s approach to deficit reduction is by far the more responsible—not to mention moral—one. Rep. Ryan asks absolutely nothing of the wealthiest and most powerful people and corporations in the country; in fact, his budget includes a call to dramatically reduce their tax bill. Conversely, Sen. Murray seeks more than $900 billion in new tax revenue, accomplished by reforming tax expenditures and closing tax loopholes that benefit the rich and powerful. This is an eminently reasonable goal. The Center for American Progress has previously identified more than $1 trillion in savings from cutting tax expenditures, so Sen. Murray’s target is easily within reach. And note that the revenue levels in the Murray budget are still well below those proposed by former Sen. Alan Simpson (R-WY) and former White House Chief of Staff Erskine Bowles in their plan developed as part of the president’s 2010 fiscal commission.

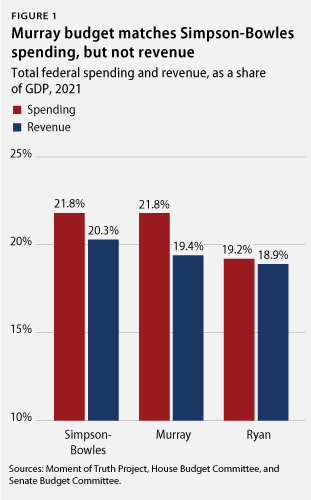

When it comes to spending, the Murray budget is almost precisely in line with the original Simpson-Bowles plan, whereas Rep. Ryan’s budget calls for draconian and unrealistic cuts. Both Sen. Murray and Simpson-Bowles envision government spending totaling 21.8 percent of gross domestic product, or GDP, in 2021. By contrast, Ryan’s budget calls for spending at just 19.2 percent. How does Rep. Ryan accomplish this remarkably low level of spending? By imposing enormous cuts to Medicaid, stripping health insurance from more than 30 million people, and sending nondefense discretionary spending down to a level one-third below its lowest levels in modern history. Sen. Murray’s budget does include spending cuts, but it doesn’t rely exclusively on taking away protections from the middle class and assistance to those in poverty—as Ryan’s budget does. Instead, it spreads the cuts much more evenly, asking the military, Medicare providers, the wealthy, and corporations to contribute to deficit reduction as well.

Both the Ryan budget and the Murray budget should properly be seen as guidelines, as statements of priorities, and as indications of general approaches to budgeting. Certainly, both budgets have holes and areas where more details would be appreciated—though not in equal measure. Nevertheless, it is clear that one budget plan—Rep. Ryan’s—would set back the recovery, undermine future growth, and further skew the economy toward the rich at the expense of the middle class, while the other budget plan—Sen. Murray’s—would promote immediate job creation, lay the foundations for future broad-based growth, and responsibly pursue deficit reduction.

Michael Linden is the Director for Tax and Budget Policy at the Center for American Progress.