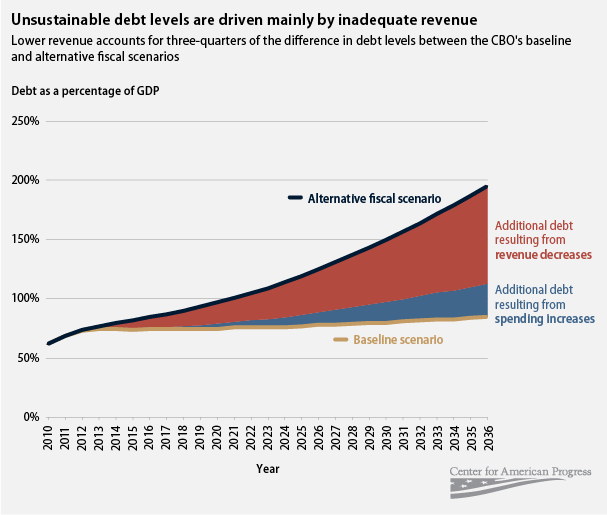

We have a serious revenue problem. And the recent Congressional Budget Office report on the country’s long-term fiscal outlook makes this crystal clear. If we continue our current policies, debt will soar, approaching 200 percent of gross domestic product by 2036. On the other hand, if we follow current law, debt will never crack 90 percent. And the biggest difference by far between these two alternatives is revenue. In fact, reduced revenue is responsible for fully three-quarters of the higher debt level in the current policy scenario compared to just one-quarter from increased spending.

The CBO makes its budget projections under two different sets of assumptions. In the first—the “baseline” scenario—the CBO assumes that future budgets will follow current law, meaning the Bush tax cuts expire as scheduled, the alternative minimum tax grows, the new health care law is implemented, and payments to Medicare doctors are cut.

In this future our debt burden is very manageable. It rises from just under 70 percent of GDP this year to 85 percent by 2036 and 87 percent by 2040. But from there it stabilizes and actually begins to decline.

But under the other set of assumptions—the “alternative” scenario—the debt quickly explodes into disastrous levels. The alternative scenario roughly mirrors current policies, rather than current law. This scenario assumes that the Bush tax cuts are extended, the AMT is indexed to inflation, the formula requiring big cuts to Medicare doctors is overridden, and the reforms of the Affordable Care Act aren’t implemented. These assumptions mean that this scenario has both more spending and less revenue than the baseline.

The result is much larger deficits and much more debt. By 2036, debt under the alternative scenario would be 195 percent of GDP. The CBO doesn’t even project the debt past that year because it would exceed 200 percent.

So which one is right? That depends on what you think will happen with those key policies. Most budget and political analysts focus their attention and worry on the alternative scenario. After all, they point out, the Bush tax cuts were set to expire last year, and Congress extended them for two more years. Won’t they do the same in 2012? And Congress has always been diligent about making sure that Medicare doctors don’t suffer huge pay cuts. Why would the future be any different from the past?

These are good points, and it is certainly true that we cannot afford to continue current policies. But by comparing the differences between the baseline scenario—in which debt is manageable—and the more realistic alternative scenario—in which debt is out of control—we can see exactly which side of the ledger is really driving the high debt.

It turns out that the alternative scenario’s much lower levels of revenue are the main problem. In the alternative scenario, debt as a share of GDP in 2036 is 110 points above the debt level in the baseline scenario. That’s about $52 trillion in additional debt. Of that amount, nearly 75 percent—or $39 trillion—is the direct result of lower levels of revenue. Higher spending is responsible for the other quarter.

These two scenarios highlight the fact that, under current policies, we do have a serious revenue problem. The huge debt levels embedded in the alternative fiscal scenario are mainly the result of dramatically reduced revenue. The baseline, on the other hand, has much more stable levels of debt because of its higher levels of revenue. Of course, few think the baseline scenario is likely, and the alternative is much more frightening. But it’s important to understand that the reason that scenario is so dire is because of a serious lack of adequate revenue, not huge spending hikes.

Michael Linden is the Associate Director for Tax and Budget Policy at American Progress.